Addressing High Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

BofA's Assessment of Current Market Conditions

BofA Securities, a leading financial institution, regularly assesses market conditions. Their analysis often considers factors like price-to-earnings (P/E) ratios, the cyclically adjusted price-to-earnings ratio (Shiller PE), and other valuation metrics to gauge whether current market prices are justified. While specific reports change frequently, a common theme is often a cautious outlook when stock market valuations are significantly elevated. BofA typically highlights the potential risks associated with overvalued assets.

-

Key Findings on Valuation Metrics: BofA's recent analyses often reveal that certain valuation metrics, such as the Shiller PE ratio, are trading at levels historically associated with higher risk. This means that while earnings are growing, the price increases have outpaced earnings growth, leading to higher valuations. They may also point out discrepancies between different sectors, with some appearing significantly overvalued compared to others.

-

Overvalued and Undervalued Sectors: Past BofA reports have often identified specific sectors, such as technology or certain growth stocks, as potentially overvalued based on their current valuations relative to historical averages and projected future earnings. Conversely, more value-oriented sectors might be flagged as relatively undervalued.

-

Influence of Economic Indicators: Inflation, interest rates, and economic growth forecasts significantly influence BofA's overall assessment. Rising interest rates, for example, typically put downward pressure on stock valuations, as they increase the attractiveness of fixed-income investments. High inflation erodes purchasing power and can lead to investor uncertainty.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current environment of high stock market valuations. Understanding these factors is crucial for informed investment decisions.

-

Low Interest Rates: Prolonged periods of low interest rates, often a result of central bank monetary policies, incentivize investors to seek higher returns in the stock market, driving up prices. This can lead to asset bubbles, increasing the risk of market corrections.

-

Quantitative Easing (QE) and Monetary Policies: Central bank policies, such as QE, inject liquidity into the financial system, lowering borrowing costs and stimulating investment. While beneficial for economic growth, excessive liquidity can inflate asset prices, further contributing to elevated valuations.

-

Corporate Earnings Growth (or Lack Thereof): While strong corporate earnings growth can justify higher valuations, a mismatch between earnings growth and stock price increases can lead to overvaluation. BofA's analysis often considers the sustainability of corporate earnings.

-

Technological Innovation and Growth Stocks: The rapid growth of technology companies and the allure of disruptive innovations often attract significant investment, driving up valuations within this sector. However, this growth is not always sustainable and may contribute to overall market overvaluation.

-

Geopolitical Factors: Global events and geopolitical uncertainty can impact investor sentiment, sometimes leading to increased risk aversion and capital flight into perceived safe havens, or conversely, driving investors to equities for higher returns.

Strategies for Investors Facing High Stock Market Valuations

Navigating high stock market valuations requires a proactive approach to risk management and portfolio diversification.

-

Diversification: Diversification is crucial to mitigate risk. This includes diversifying across asset classes (stocks, bonds, real estate), geographies, and sectors. Reducing concentration risk is critical in a potentially volatile market.

-

Value Investing: Value investing focuses on identifying undervalued companies with strong fundamentals. This approach can be attractive in a high-valuation environment, allowing investors to seek out companies trading below their intrinsic value.

-

Defensive Investment Strategies: Defensive strategies emphasize preservation of capital and income generation, rather than aggressive growth. This often includes investing in lower-risk assets, such as high-quality dividend-paying stocks or government bonds.

-

Portfolio Rebalancing: Regularly rebalancing your portfolio ensures your asset allocation remains aligned with your risk tolerance and financial goals. This involves selling some overperforming assets and buying underperforming ones to maintain your target allocation.

-

Alternative Investments: Consider alternative investments like real estate or infrastructure, which might offer diversification benefits and potentially less correlation with traditional stock market movements.

The Role of Risk Management in a High-Valuation Environment

In a market characterized by high stock market valuations, robust risk management is paramount.

-

Understanding Risk Tolerance: Knowing your risk tolerance – your capacity to withstand potential losses – is fundamental. Avoid taking on more risk than you're comfortable with.

-

Reducing Portfolio Volatility: Employ strategies to reduce your portfolio’s volatility. Diversification, defensive asset allocation, and hedging strategies are important tools.

-

Stop-Loss Orders and Risk Mitigation Techniques: Utilize stop-loss orders to automatically sell an asset if it falls below a certain price, limiting potential losses. Other techniques include position sizing and diversification.

Conclusion

BofA's analysis consistently highlights the potential risks associated with high stock market valuations. The factors driving these elevated valuations, including low interest rates, monetary policies, and sector-specific growth, need careful consideration. Investors can employ strategies such as diversification, value investing, and defensive approaches to manage risk effectively. Thorough risk management, including understanding your risk tolerance and using tools like stop-loss orders, is crucial in this environment. Understanding and addressing high stock market valuations is crucial for successful investing. Consult with a financial advisor to develop a personalized investment strategy tailored to your risk tolerance and financial goals. Learn more about mitigating the risks associated with high stock market valuations by exploring additional resources and conducting thorough research.

Featured Posts

-

Where To Watch England Vs Spain Womens Match Tv Channel And Kick Off Time

May 02, 2025

Where To Watch England Vs Spain Womens Match Tv Channel And Kick Off Time

May 02, 2025 -

Todays Lotto Lotto Plus 1 And Lotto Plus 2 Winning Numbers

May 02, 2025

Todays Lotto Lotto Plus 1 And Lotto Plus 2 Winning Numbers

May 02, 2025 -

125 Murid Asnaf Sibu Terima Bantuan Kembali Ke Sekolah Tabung Baitulmal Sarawak 2025

May 02, 2025

125 Murid Asnaf Sibu Terima Bantuan Kembali Ke Sekolah Tabung Baitulmal Sarawak 2025

May 02, 2025 -

Breaking The Silence Dr Shradha Maliks Perspective On Mental Health And Its Importance

May 02, 2025

Breaking The Silence Dr Shradha Maliks Perspective On Mental Health And Its Importance

May 02, 2025 -

Rust Review Alec Baldwin And The Films Troubled Production

May 02, 2025

Rust Review Alec Baldwin And The Films Troubled Production

May 02, 2025

Latest Posts

-

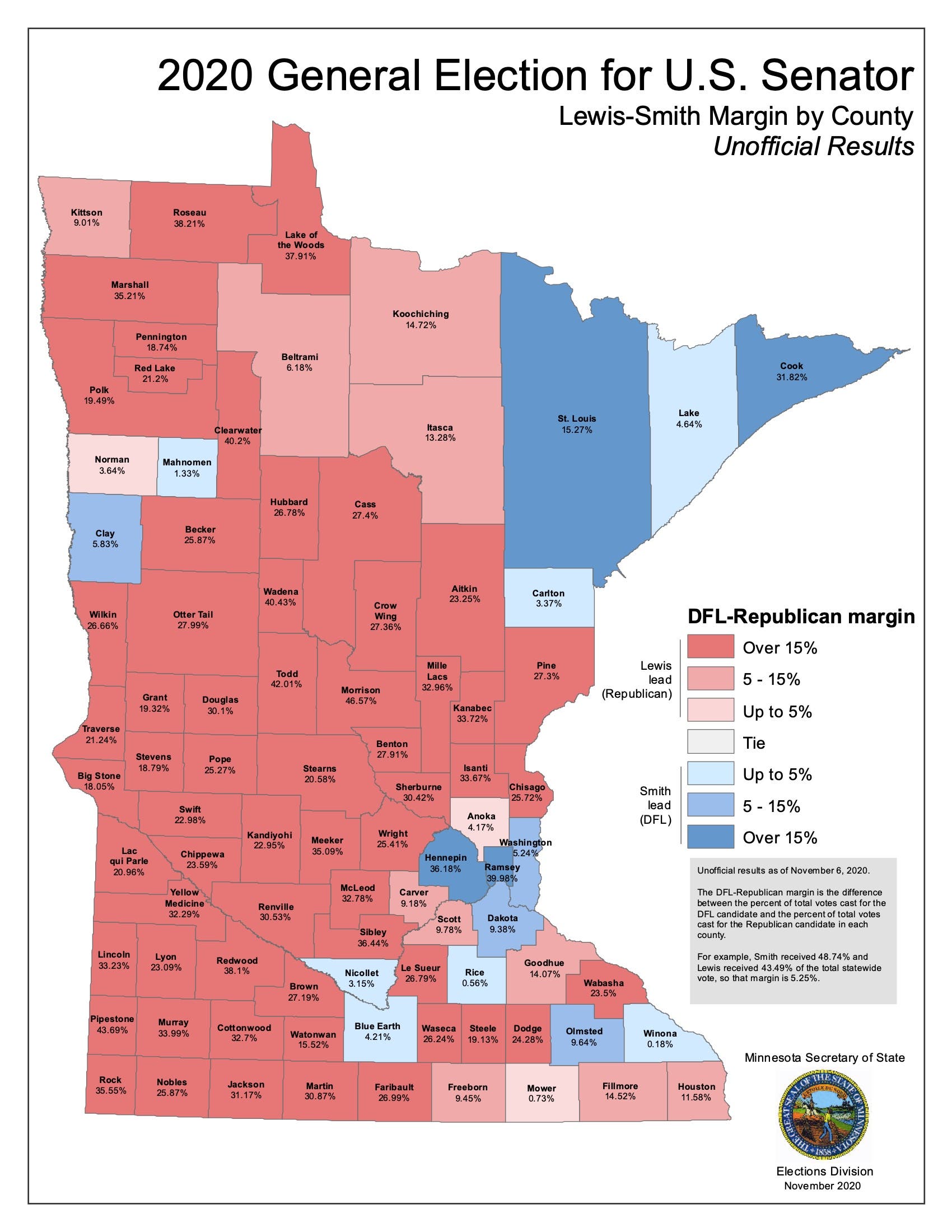

Analyzing Ap Decision Notes Implications For The Minnesota House Race

May 02, 2025

Analyzing Ap Decision Notes Implications For The Minnesota House Race

May 02, 2025 -

Ap Decision Notes Your Guide To The Minnesota Special House Election

May 02, 2025

Ap Decision Notes Your Guide To The Minnesota Special House Election

May 02, 2025 -

South Carolina Voters Express Confidence In Election Processes 93 Approval

May 02, 2025

South Carolina Voters Express Confidence In Election Processes 93 Approval

May 02, 2025 -

High Public Trust In South Carolina Elections A Recent Survey

May 02, 2025

High Public Trust In South Carolina Elections A Recent Survey

May 02, 2025 -

Ap Decision Notes And The Minnesota Special State House Election A Comprehensive Overview

May 02, 2025

Ap Decision Notes And The Minnesota Special State House Election A Comprehensive Overview

May 02, 2025