Addressing High Stock Market Valuations: A BofA Perspective

Table of Contents

Understanding Current Market Conditions and High Valuations

High stock market valuations are a significant concern for investors. Understanding the underlying factors is crucial for making informed decisions.

Factors Contributing to High Stock Prices

Several factors have contributed to the current environment of high stock market valuations:

-

Low interest rates: Historically low interest rates make bonds less attractive, pushing investors towards higher-yielding assets like stocks. This increased demand fuels price appreciation, leading to higher valuations. This effect is amplified by the Federal Reserve's monetary policies designed to stimulate economic growth.

-

Quantitative easing (QE): QE programs inject liquidity into the financial system, increasing the money supply and potentially inflating asset prices, including stocks. While intended to boost economic activity, the unintended consequence can be inflated stock valuations.

-

Strong corporate earnings: Robust corporate earnings reports, particularly in specific sectors, can support high stock prices, even if valuations appear elevated based on traditional metrics. This highlights the importance of analyzing individual company performance alongside broader market trends.

-

Investor sentiment and speculation: Optimistic investor sentiment and speculation can drive up stock prices beyond what might be justified by fundamentals. Market exuberance can lead to "bubble" formations, where prices detach from underlying value.

-

Global economic growth (or lack thereof in certain sectors): Uneven global growth significantly impacts market valuations. Strong growth in certain regions or sectors can drive overall market valuations higher, while lagging sectors might experience lower valuations, creating pockets of opportunity for discerning investors. For example, technological advancements often drive growth in specific tech sectors leading to high valuations within that space.

Metrics for Assessing Valuation

Several metrics help assess stock valuations, each with its strengths and weaknesses:

-

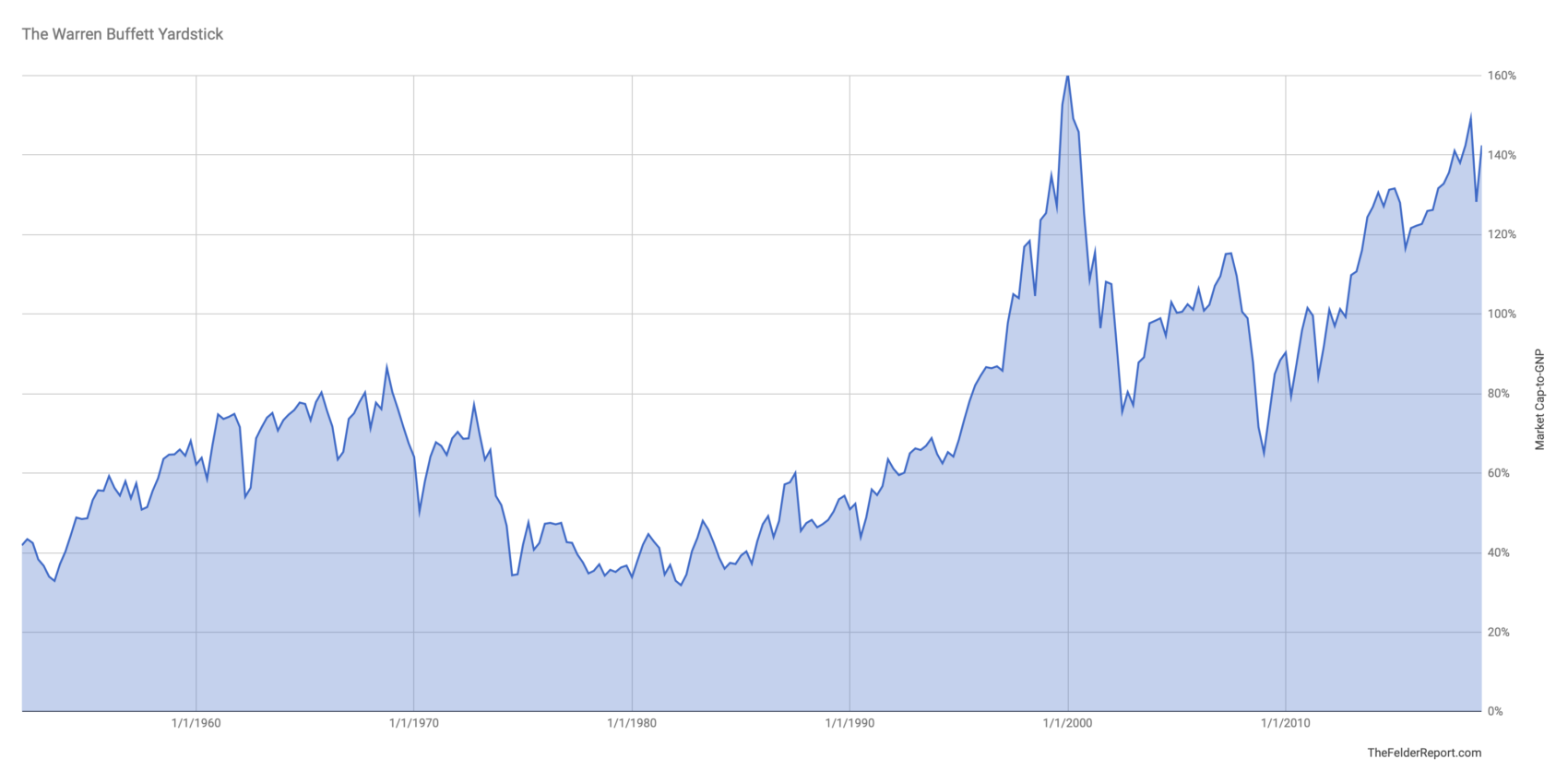

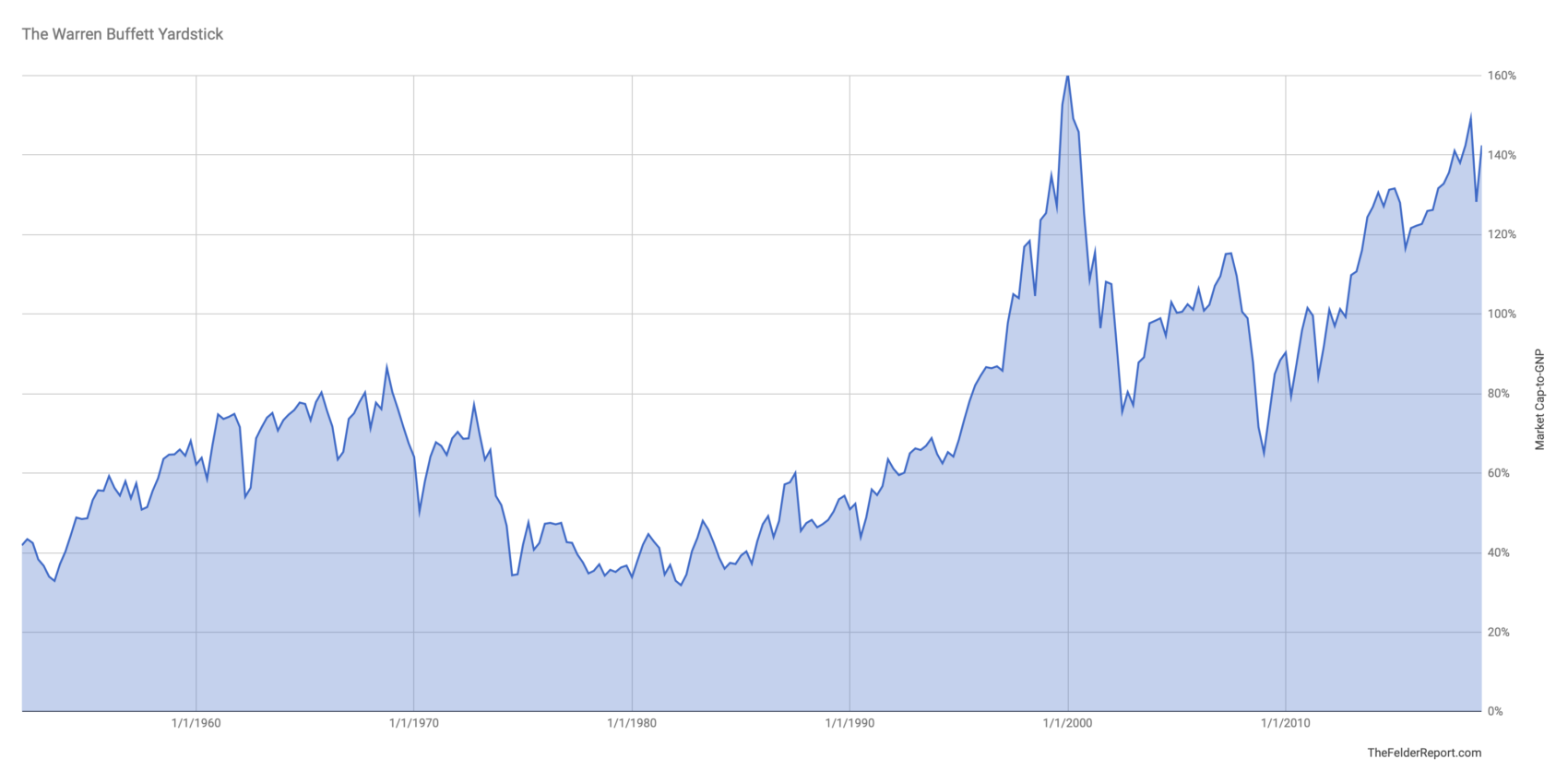

Price-to-earnings ratio (P/E): The P/E ratio compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating a high valuation. However, it's crucial to compare P/E ratios across similar companies and consider industry-specific factors.

-

Price-to-sales ratio (P/S): The P/S ratio is useful for evaluating companies with negative earnings. It compares a company's stock price to its revenue per share. A high P/S ratio might signal high expectations for future earnings growth.

-

Shiller PE ratio (CAPE): The cyclically adjusted price-to-earnings ratio (CAPE) smooths earnings over a ten-year period, providing a longer-term perspective on valuation. It's less susceptible to short-term earnings fluctuations, offering a more stable measure of valuation.

-

Other relevant valuation metrics: Other metrics, such as dividend yield, can also be valuable, particularly in the context of high stock market valuations. Dividend yield provides insights into the income potential of an investment, providing a different lens to assess valuation compared to P/E or P/S ratios.

BofA's Perspective on High Stock Market Valuations

Understanding BofA's perspective is crucial for navigating the current market.

BofA's Current Market Outlook

BofA's current market outlook (Note: This section needs to be updated with the most current BofA reports and statements. Replace the following with actual data and analysis from BofA.) Generally speaking, BofA analysts often provide a balanced view, acknowledging the high valuations but also considering factors such as potential earnings growth and economic forecasts. They might highlight specific sectors or asset classes that they believe offer better value or present less risk in this environment.

BofA's Recommended Investment Strategies

BofA typically advises a diversified approach to manage risk associated with high stock market valuations:

-

Diversification across asset classes: Diversification is key to mitigating risk. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces exposure to any single market's volatility.

-

Focus on undervalued sectors: BofA may identify sectors believed to be currently undervalued, presenting potential opportunities for investors. These might be sectors that are temporarily out of favor or haven't fully reflected positive future growth prospects.

-

Defensive investment strategies: Defensive strategies, such as focusing on dividend-paying stocks or investing in less volatile asset classes, are often recommended during periods of high valuations to preserve capital.

Managing Risk in a High-Valuation Environment

Minimizing risk is paramount when dealing with high stock market valuations.

Risk Mitigation Strategies

Several strategies can help mitigate risk:

-

Portfolio rebalancing: Regularly rebalancing your portfolio to maintain your target asset allocation can help manage risk by selling some overvalued assets and buying undervalued ones.

-

Value investing: Focusing on undervalued companies with strong fundamentals can provide a buffer against market corrections. Value investing involves identifying companies whose stock prices are below their intrinsic value.

-

Hedging strategies: Hedging techniques, such as options or short selling (with careful consideration and understanding of their risks), can help protect against potential losses. Note that hedging strategies are complex and carry significant risks, so it's important to fully understand them before implementing them.

-

Stress testing your portfolio: Stress testing assesses your portfolio's resilience to various market scenarios, including a sharp market correction. This proactive approach helps you better understand potential risks and adjust your strategy accordingly.

Conclusion

Addressing high stock market valuations requires a cautious yet strategic approach. BofA's perspective, as outlined above, emphasizes the importance of diversification, risk management, and potentially focusing on undervalued sectors. By understanding the factors driving current valuations and employing appropriate strategies, investors can navigate this challenging market environment more effectively. Remember to conduct thorough research and consider seeking professional financial advice before making any investment decisions related to high stock market valuations or any investment strategy.

Featured Posts

-

12 Solutions Pour Economiser Sur Votre Budget

May 11, 2025

12 Solutions Pour Economiser Sur Votre Budget

May 11, 2025 -

Measles Outbreak In North Dakota Schoolchildren Quarantined

May 11, 2025

Measles Outbreak In North Dakota Schoolchildren Quarantined

May 11, 2025 -

Tom Cruise And Suri Cruise A Fathers Post Birth Action

May 11, 2025

Tom Cruise And Suri Cruise A Fathers Post Birth Action

May 11, 2025 -

Increased Q1 Profits And Dividend For Telus

May 11, 2025

Increased Q1 Profits And Dividend For Telus

May 11, 2025 -

Pope Leo Addresses The Growing Threat Of De Facto Atheism

May 11, 2025

Pope Leo Addresses The Growing Threat Of De Facto Atheism

May 11, 2025