Addressing High Stock Market Valuations: BofA's Analysis

Table of Contents

BofA's Key Findings on High Stock Market Valuations

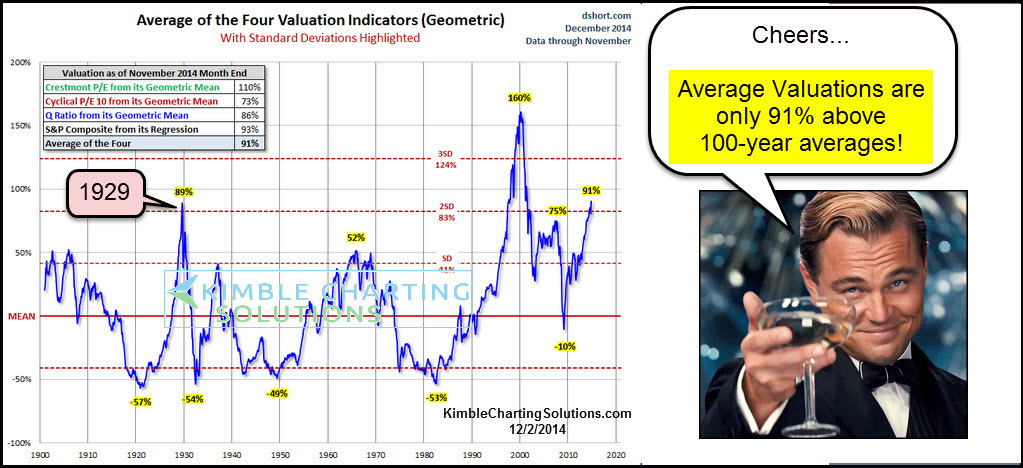

BofA's analysis of high stock market valuations centers on the argument that current prices, relative to historical data and projected earnings, are unsustainable in the long term. They employ various valuation metrics, including the widely used Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE), which considers inflation-adjusted earnings over a longer period.

-

BofA's Valuation Models and Conclusions: BofA's models, incorporating various economic indicators and historical data, suggest that many sectors are trading at premiums compared to their intrinsic value. Their analysis points towards a potential correction in the future, although the timing and magnitude remain uncertain.

-

Overvalued and Undervalued Sectors: According to BofA's research, certain technology sectors and growth stocks show signs of overvaluation, while some value sectors and cyclical industries might be comparatively undervalued. Specific sectors mentioned often vary depending on the report's release date, so consulting the most recent BofA report is crucial.

-

BofA's Market Performance Forecast: BofA's forecast generally anticipates slower growth in the near term, reflecting the inherent risks associated with high stock market valuations. They caution against expecting the same rapid returns witnessed in previous periods of inflated valuations.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current elevated stock market valuations. These factors are interconnected and reinforce each other, creating a complex environment.

-

Low Interest Rates: Historically low interest rates, implemented by central banks globally, make bonds less attractive compared to stocks. This drives investors towards equities, increasing demand and pushing prices upward.

-

Quantitative Easing (QE): QE programs, involving central bank purchases of government bonds and other assets, inject liquidity into the financial system. This increased liquidity can fuel asset price inflation, including stocks.

-

Corporate Earnings: While corporate earnings have been strong in some sectors, the sustainability of this growth is a key question influencing stock valuations. BofA's analysis likely assesses the relationship between current earnings and future projections.

-

Investor Sentiment: Positive investor sentiment, fueled by low interest rates and expectations of continued economic growth, can create a feedback loop, driving further price increases. Conversely, shifts in sentiment can trigger rapid market corrections.

-

Technological Advancements: Innovation and technological advancements, particularly in the tech sector, contribute significantly to high valuations. Investors often place high premiums on companies with disruptive technologies and strong growth potential.

Potential Risks Associated with High Stock Market Valuations

High stock market valuations inherently increase the risks faced by investors. A thorough understanding of these potential downsides is essential for responsible portfolio management.

-

Market Corrections and Crashes: Elevated valuations make the market more vulnerable to corrections or even crashes. A relatively small negative shock could trigger a significant price drop.

-

Reduced Future Returns: High starting valuations imply lower potential returns in the future. Investors who buy at inflated prices may see slower growth compared to those entering at lower levels.

-

Inflationary Pressures: Rising inflation erodes the real value of investments. High inflation could lead to higher interest rates, impacting both company profits and investor sentiment, potentially negatively affecting stock prices.

-

Geopolitical Risks: Uncertain geopolitical events, such as trade wars or international conflicts, can significantly impact market sentiment and trigger volatility, impacting valuations.

Investment Strategies in a High-Valuation Market

Navigating a market with high stock market valuations requires a cautious and strategic approach. While predicting market movements is impossible, adopting prudent strategies can mitigate risks.

-

Diversification: Diversifying across asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to reduce portfolio risk. Avoid over-concentration in any single sector, especially those identified as overvalued.

-

Undervalued Sectors and Companies: Focus on identifying undervalued sectors or companies that may offer better risk-adjusted returns compared to their overvalued counterparts. This requires thorough fundamental analysis.

-

Long-Term Investment Horizon: High valuations are often temporary. Maintaining a long-term investment horizon can help weather short-term market fluctuations and benefit from eventual price corrections.

-

Defensive Investment Strategies: Defensive strategies, such as investing in high-quality dividend-paying stocks or defensive sectors, can help cushion against market downturns.

-

Options Strategies: Sophisticated investors may use options strategies to hedge against risk and potentially profit from market volatility. However, options trading carries considerable risk and requires expertise.

Conclusion

BofA's analysis offers valuable insights into the complexities of current high stock market valuations. Understanding the factors driving these valuations and the associated risks is critical for investors. By carefully analyzing BofA's findings and implementing appropriate investment strategies, investors can better navigate this challenging market environment. Remember to conduct thorough research and, if needed, seek advice from a qualified financial advisor before making any investment decisions related to stock market valuations. Responsible management of your portfolio is key to mitigating the risks associated with these high stock market valuations.

Featured Posts

-

Uk Eurovision Entry 2025 Controversy And Past Scandals

May 18, 2025

Uk Eurovision Entry 2025 Controversy And Past Scandals

May 18, 2025 -

Kanye West And Bianca Censori A Spanish Restaurant Reunion

May 18, 2025

Kanye West And Bianca Censori A Spanish Restaurant Reunion

May 18, 2025 -

Damiano David Embarks On Solo Musical Journey

May 18, 2025

Damiano David Embarks On Solo Musical Journey

May 18, 2025 -

Is Reddit Down Right Now Current Status And Outage Map

May 18, 2025

Is Reddit Down Right Now Current Status And Outage Map

May 18, 2025 -

Trumps Middle East Policy A Shift In Power Dynamics Between Arab States And Israel

May 18, 2025

Trumps Middle East Policy A Shift In Power Dynamics Between Arab States And Israel

May 18, 2025

Latest Posts

-

Amanda Bynes Classmate Claims Tragic School Ritual

May 18, 2025

Amanda Bynes Classmate Claims Tragic School Ritual

May 18, 2025 -

Amanda Bynes And Taran Killam A Look Back At Their Relationship

May 18, 2025

Amanda Bynes And Taran Killam A Look Back At Their Relationship

May 18, 2025 -

Amanda Bynes Only Fans Debut A Major Caveat Explained

May 18, 2025

Amanda Bynes Only Fans Debut A Major Caveat Explained

May 18, 2025 -

Drake Bells Controversial Comparison Amanda Bynes And Friends Rachel

May 18, 2025

Drake Bells Controversial Comparison Amanda Bynes And Friends Rachel

May 18, 2025 -

Michael Confortos Path To Redemption Overcoming Early Spring Slump

May 18, 2025

Michael Confortos Path To Redemption Overcoming Early Spring Slump

May 18, 2025