Addressing High Stock Market Valuations: Insights From BofA For Investors

Table of Contents

BofA's Assessment of Current Market Valuations

BofA regularly publishes reports analyzing stock market valuations, employing various metrics to gauge market health. These reports often highlight key indicators and offer a perspective on potential future market movements. While specific data points fluctuate, a general theme consistently emerges from their analyses.

-

Summary of BofA's valuation metrics: BofA frequently uses metrics such as Price-to-Earnings (P/E) ratios and Price-to-Sales (P/S) ratios to assess market valuations across different sectors. They also consider other factors, such as interest rates and economic growth forecasts, to paint a complete picture.

-

Comparison to historical valuations: BofA's analysis often compares current valuation metrics to historical averages. This comparison helps determine whether the market is currently trading at a premium or a discount relative to its past performance, providing context for the current high valuations.

-

Identification of overvalued and undervalued sectors: Based on their comprehensive analysis, BofA typically identifies sectors that appear overvalued and those that might be undervalued relative to their growth potential and risk profiles. This sector-specific analysis provides investors with targeted insights for portfolio adjustments.

-

Discussion of potential market corrections: Given the current high stock market valuations, BofA's reports often discuss the potential for market corrections. They may highlight potential catalysts for a correction, emphasizing the importance of risk management within investment portfolios. This analysis incorporates their view on market volatility and its potential impact.

Strategies for Navigating High Valuations

Navigating high stock market valuations requires a strategic approach. BofA's analysis implicitly and explicitly suggests several strategies to mitigate risk and potentially capitalize on opportunities within this environment.

-

Diversification strategies to mitigate risk: BofA consistently emphasizes the importance of diversification. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces reliance on any single investment's performance, helping to cushion against market downturns.

-

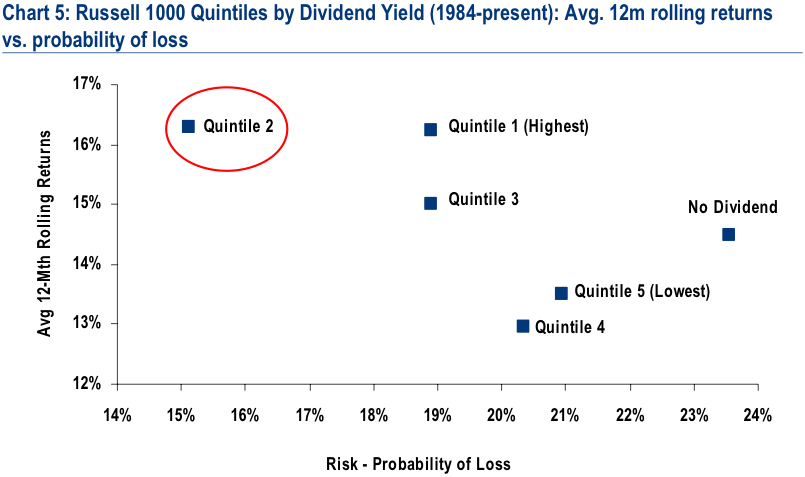

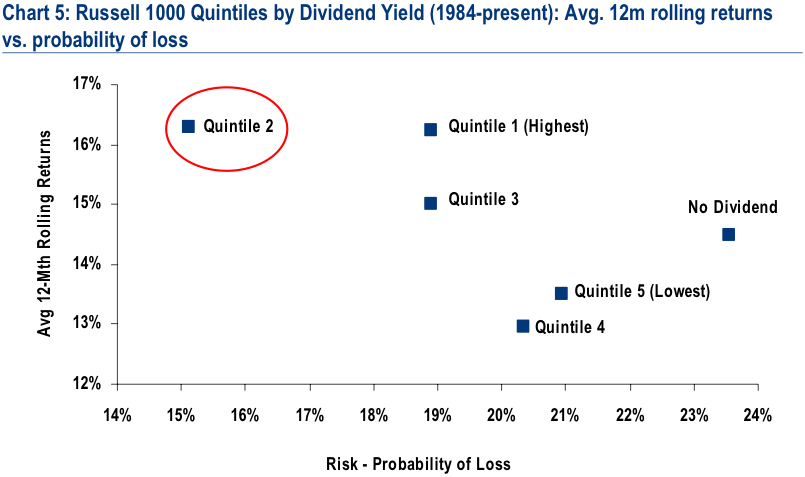

Defensive investing approaches: In periods of high valuations, BofA might suggest shifting towards more defensive investment strategies. This could involve increasing exposure to lower-risk, income-generating assets, such as high-quality bonds or dividend-paying stocks.

-

Sector-specific opportunities identified by BofA: BofA's research often highlights specific sectors that might offer better value or growth potential despite overall high market valuations. Identifying these opportunities requires careful scrutiny of their reports and understanding their underlying rationale.

-

Importance of long-term investment horizons: BofA generally advocates for a long-term investment approach. Short-term market fluctuations are less relevant for long-term investors, allowing them to ride out volatility and benefit from long-term growth.

-

Considering alternative asset classes: Depending on market conditions, BofA might suggest exploring alternative investments, such as commodities or private equity, to diversify a portfolio beyond traditional stocks and bonds and to potentially find better returns given current stock market valuations.

Understanding the Risks and Rewards

High stock market valuations present both significant risks and potential rewards. It's crucial to understand both sides before making investment decisions. BofA's insights help illuminate these factors.

-

Risks associated with high valuations: High valuations increase the potential for a market correction, meaning prices could fall significantly. This leads to the risk of lower returns or even losses for investors.

-

Potential for further growth: Despite the risks, the market could continue to rise, driven by factors such as strong corporate earnings, low interest rates, or continued economic expansion. BofA's analysis would typically highlight the key factors influencing this potential for growth.

-

Importance of risk tolerance in investment decisions: Investors need to carefully assess their own risk tolerance. Those with a lower risk tolerance should prioritize capital preservation and potentially shift towards more conservative investment strategies in this environment, while those with higher risk tolerance might have more leeway to consider riskier, growth-oriented options.

BofA's Predictions and Outlook

BofA's market predictions and outlook are subject to change and should be viewed as a dynamic assessment rather than definitive forecasts. They typically offer both short-term and long-term perspectives, considering numerous factors like economic growth, interest rate changes, and geopolitical events. Their predictions often influence various asset classes and will impact investment strategies.

Conclusion

High stock market valuations present both opportunities and challenges for investors. BofA's analysis provides valuable insights into navigating this complex landscape. By understanding the current valuations, employing appropriate diversification strategies, and considering the risks and rewards, investors can make more informed decisions.

Call to Action: Stay informed about BofA's ongoing market analysis to effectively address high stock market valuations and optimize your investment strategy. Regularly review your portfolio and adapt your approach based on market conditions and BofA's expert insights. Understanding how to address high stock market valuations is an ongoing process requiring continuous monitoring and adjustment of your investment approach.

Featured Posts

-

Reaction To Ddgs Dont Take My Son Diss Track Aimed At Halle Bailey

May 06, 2025

Reaction To Ddgs Dont Take My Son Diss Track Aimed At Halle Bailey

May 06, 2025 -

Novak Speaks Out The Truth Behind His Relationship With Mindy Kaling And Delaney Rowe Speculation

May 06, 2025

Novak Speaks Out The Truth Behind His Relationship With Mindy Kaling And Delaney Rowe Speculation

May 06, 2025 -

Carney And Trump A Decisive Meeting For The Cusma Agreement

May 06, 2025

Carney And Trump A Decisive Meeting For The Cusma Agreement

May 06, 2025 -

Mindy Kalings Weight Loss A New Look At The Premiere

May 06, 2025

Mindy Kalings Weight Loss A New Look At The Premiere

May 06, 2025 -

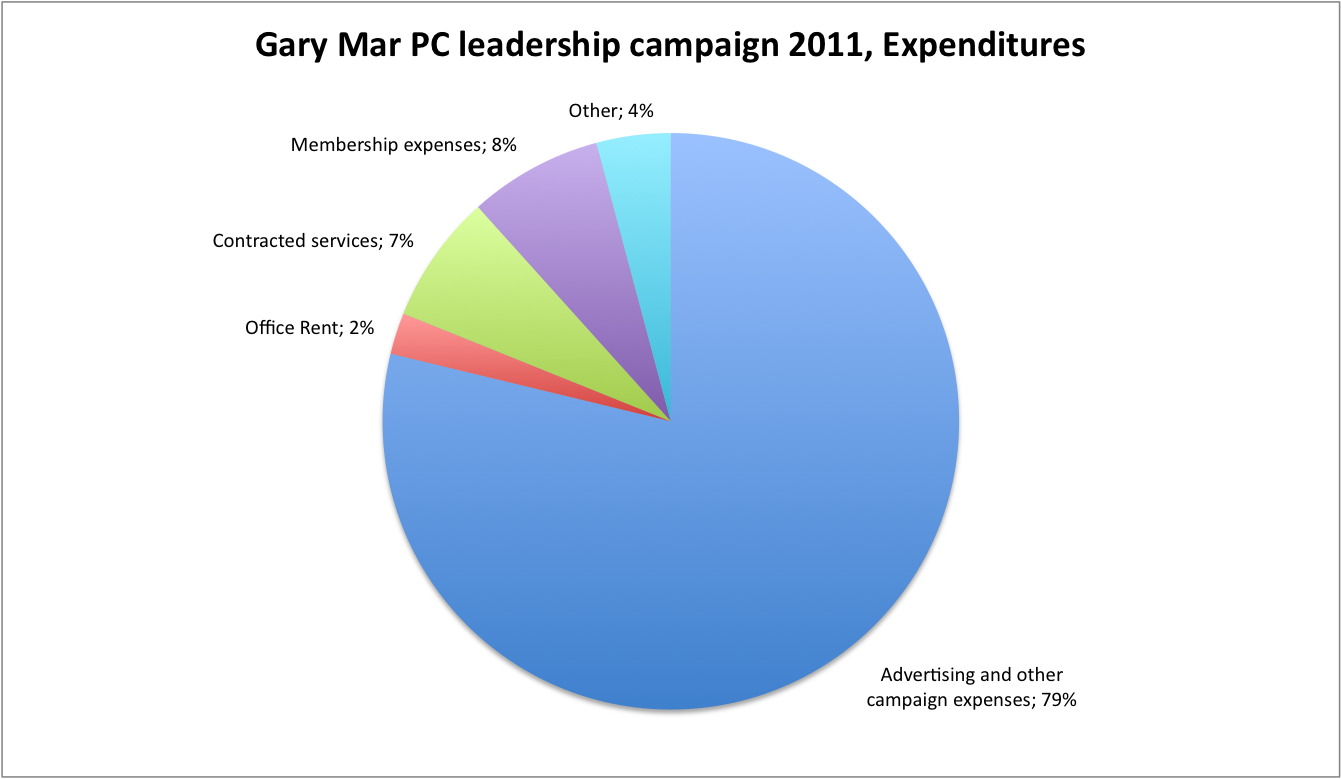

Western Canadas Economic Potential A Call To Action From Gary Mar

May 06, 2025

Western Canadas Economic Potential A Call To Action From Gary Mar

May 06, 2025

Latest Posts

-

Ddg Fires Shots At Halle Bailey In New Song Dont Take My Son

May 06, 2025

Ddg Fires Shots At Halle Bailey In New Song Dont Take My Son

May 06, 2025 -

Planning The Perfect Independence Day Tips Recipes And Party Ideas

May 06, 2025

Planning The Perfect Independence Day Tips Recipes And Party Ideas

May 06, 2025 -

Getting To Know Emilie Livingston Jeff Goldblums Wife And Family

May 06, 2025

Getting To Know Emilie Livingston Jeff Goldblums Wife And Family

May 06, 2025 -

Independence Day History Origins Evolution And Modern Celebrations

May 06, 2025

Independence Day History Origins Evolution And Modern Celebrations

May 06, 2025 -

Ariana Grande And Jeff Goldblum Release I Dont Know Why

May 06, 2025

Ariana Grande And Jeff Goldblum Release I Dont Know Why

May 06, 2025