Addressing Investor Anxiety: BofA's View On High Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's BofA Market Analysis frequently incorporates a nuanced view of the market, acknowledging the complexities of assessing stock market overvaluation. While they might not explicitly declare a blanket "overvalued" judgment, their analyses often highlight specific areas of concern. Their assessments consider various factors including:

-

Key Findings on Stock Market Valuations: BofA's reports usually detail their findings on valuation metrics like Price-to-Earnings (P/E) ratios and other key indicators, comparing them to historical averages and considering sector-specific variations. They often caution about specific sectors appearing richly valued relative to their growth prospects.

-

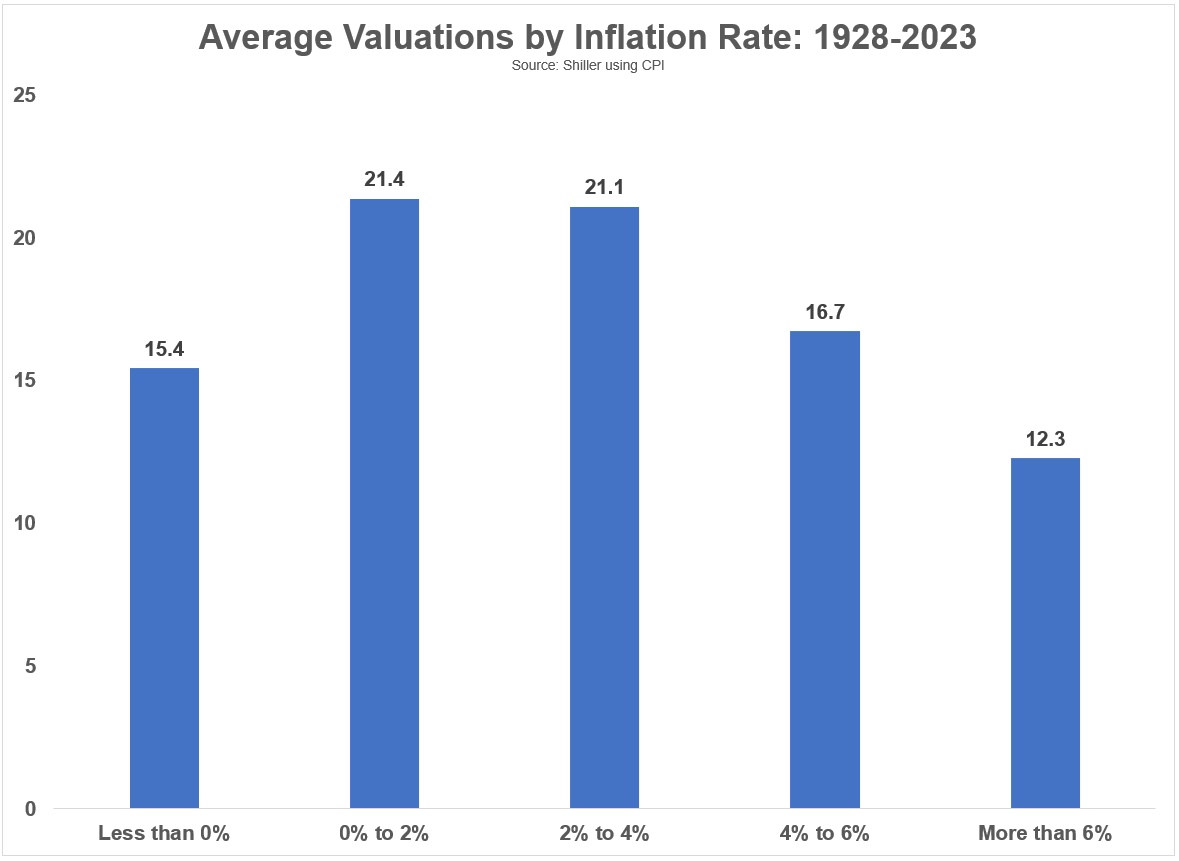

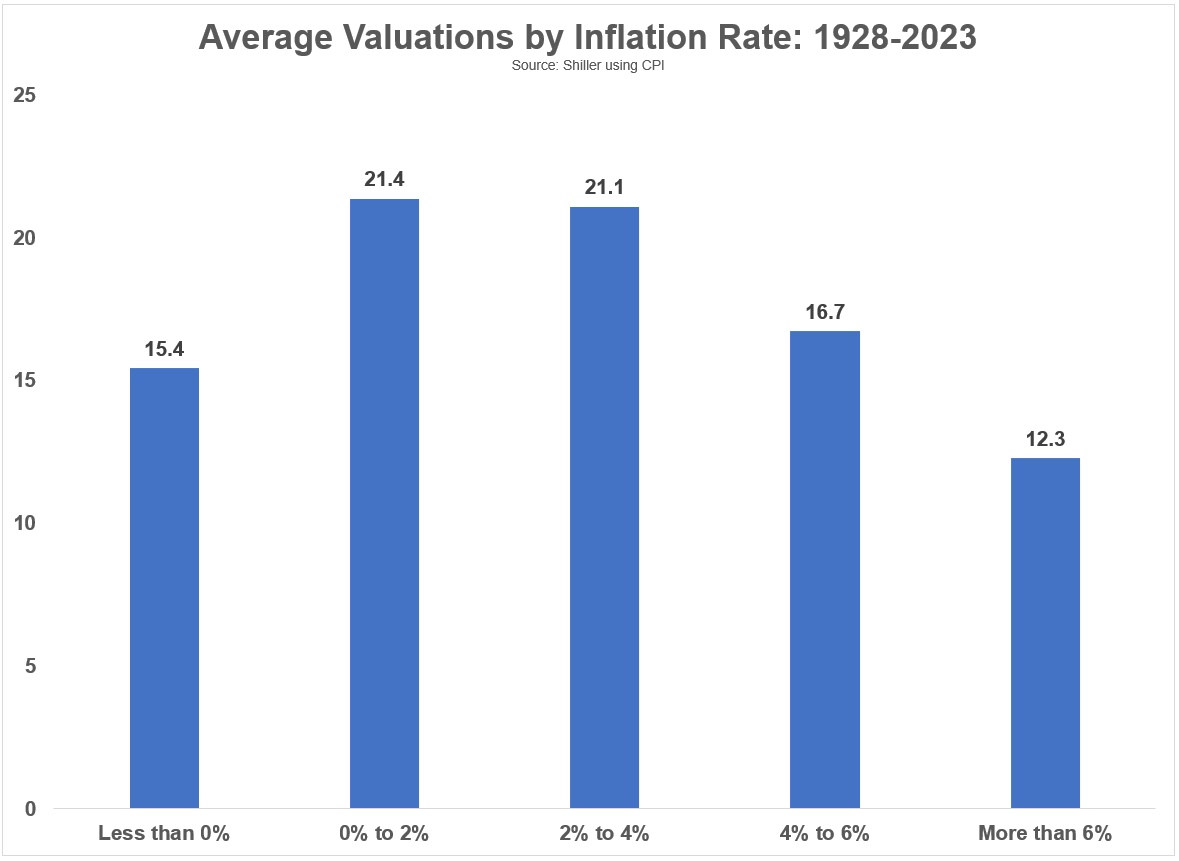

Economic Indicators: BofA's analysts carefully examine key economic indicators such as inflation rates, interest rates, and GDP growth. These indicators significantly influence market valuations and investor sentiment. High inflation, for example, can lead to increased interest rates, potentially dampening stock prices.

-

Market Sentiment and Investor Behavior: BofA regularly assesses market sentiment, identifying whether investors are exhibiting excessive optimism or pessimism. Understanding investor behavior is crucial for anticipating market shifts. Periods of irrational exuberance or fear can significantly impact valuations, independent of fundamental economic factors.

-

Vulnerable and Resilient Sectors: BofA's analyses often highlight specific sectors or asset classes they believe are particularly vulnerable (e.g., those heavily reliant on cheap borrowing) or resilient (e.g., those demonstrating consistent earnings growth regardless of economic conditions). This granular approach helps investors understand where risks and opportunities may lie.

Understanding the Drivers of High Valuations

According to BofA's analysis, several factors contribute to the current high stock market valuations. These include:

-

Low Interest Rate Environment: Historically low interest rates have made borrowing cheaper for companies, fueling investment and potentially driving up stock prices. This environment encourages investors to seek higher returns in the equity market.

-

Strong Corporate Earnings Growth: In many sectors, particularly technology, consistent earnings growth has supported higher valuations. However, BofA's analysts likely caution about the sustainability of these growth rates in the long term.

-

Technological Advancements: Innovation and technological advancements often lead to higher valuations for companies in the tech sector and related industries. However, the competitive landscape within these sectors is intense, influencing the longer-term sustainability of high valuations.

-

Valuation Metrics: BofA uses a variety of stock valuation models, including P/E ratios, Price-to-Sales ratios, and discounted cash flow analysis, to assess whether stocks are fairly valued, undervalued, or overvalued. Their interpretations of these metrics inform their overall market outlook.

-

Monetary Policy and Interest Rates: The actions of central banks, particularly monetary policy decisions influencing interest rates, significantly impact stock valuations. Tightening monetary policy generally leads to higher interest rates, making bonds more attractive and potentially lowering stock prices. Conversely, loose monetary policy can stimulate stock market growth.

-

Risk Appetite: Investor risk appetite plays a significant role in driving valuations. Periods of higher risk tolerance often lead to higher stock valuations, while increased risk aversion can result in lower valuations.

BofA's Recommendations for Investors

BofA's advice to investors facing high stock market valuations and resulting investor anxiety typically emphasizes:

-

Portfolio Diversification: BofA likely recommends diversifying portfolios across various asset classes, reducing reliance on any single sector or market. This approach mitigates risk by spreading investments across different areas, mitigating losses if one area underperforms.

-

Defensive Investing: Increasing exposure to defensive assets, such as high-quality bonds or dividend-paying stocks, can provide a degree of stability during periods of market uncertainty. These assets tend to be less volatile than growth stocks.

-

Risk Management: Re-evaluating risk tolerance and adjusting asset allocation accordingly are crucial. Investors should ensure their portfolio aligns with their risk profile and long-term financial goals.

-

Asset Allocation Strategies: BofA's recommendations on asset allocation likely involve adjusting the mix of stocks, bonds, and other assets in an investor's portfolio to reflect their risk tolerance and market outlook.

-

Specific Investment Vehicles: BofA might suggest specific investment vehicles such as government bonds, corporate bonds, real estate investment trusts (REITs), or alternative investments to balance risk and potential returns in their portfolios.

-

Actionable Steps: Investors can take concrete steps, like regularly rebalancing their portfolios, setting stop-loss orders, and sticking to their long-term investment strategy to manage anxieties.

The Importance of Long-Term Investing

Navigating periods of high stock market valuations requires a long-term investment strategy.

-

Long-Term Perspective: Focusing on long-term goals, rather than short-term market fluctuations, is paramount. Market corrections are a natural part of the market cycle.

-

Patience and Discipline: Patience and discipline are essential for successful long-term investing. Avoid making impulsive decisions based on short-term market volatility.

-

Historical Market Corrections: Examining historical data shows that market corrections, even significant ones, have been followed by periods of strong growth.

-

Financial Planning: A well-defined financial plan that considers retirement planning and other long-term goals provides a framework for making informed investment decisions.

Conclusion

BofA's insights on high stock market valuations highlight the complexities of assessing market conditions. While they may not offer definitive pronouncements on overvaluation, their analysis considers various economic indicators, investor sentiment, and valuation metrics. Their recommendations emphasize the importance of diversification, risk management, and a long-term perspective. Addressing investor anxiety requires proactive strategies, including carefully considering your risk tolerance and seeking professional advice.

Call to Action: Stay informed about market developments and consult with a financial advisor to create a personalized investment strategy that addresses your individual concerns regarding high stock market valuations. Develop a robust plan to manage your anxieties surrounding high stock market valuations and ensure a secure financial future. Remember, a long-term, well-diversified approach, informed by professional guidance, is key to navigating the challenges presented by high valuations.

Featured Posts

-

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 24, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 24, 2025 -

The Post Roe Reality The Significance Of Over The Counter Birth Control

May 24, 2025

The Post Roe Reality The Significance Of Over The Counter Birth Control

May 24, 2025 -

Intikami Hemen Alan Burclar Ihanet Edildiginde Ne Yapiyorlar

May 24, 2025

Intikami Hemen Alan Burclar Ihanet Edildiginde Ne Yapiyorlar

May 24, 2025 -

Glastonbury 2024 Unofficial Lineup Leak Points To Us Band

May 24, 2025

Glastonbury 2024 Unofficial Lineup Leak Points To Us Band

May 24, 2025 -

Corporate Espionage Office365 Data Breach Results In Multi Million Dollar Loss

May 24, 2025

Corporate Espionage Office365 Data Breach Results In Multi Million Dollar Loss

May 24, 2025

Latest Posts

-

Andreescu Defeats Rybakina Advances To Italian Open Fourth Round

May 24, 2025

Andreescu Defeats Rybakina Advances To Italian Open Fourth Round

May 24, 2025 -

Anchors Long Absence From Today Co Hosts Share Heartfelt Message

May 24, 2025

Anchors Long Absence From Today Co Hosts Share Heartfelt Message

May 24, 2025 -

Explanation For Anchors Prolonged Absence From Today Show

May 24, 2025

Explanation For Anchors Prolonged Absence From Today Show

May 24, 2025 -

Today Show Anchors Absence Explained Co Hosts Share Update

May 24, 2025

Today Show Anchors Absence Explained Co Hosts Share Update

May 24, 2025 -

Co Hosts Comment On Anchors Extended Absence We Were Praying For Her

May 24, 2025

Co Hosts Comment On Anchors Extended Absence We Were Praying For Her

May 24, 2025