Addressing Investor Concerns: BofA On Elevated Stock Market Valuations

Table of Contents

BofA's Analysis of Current Market Valuations

BofA employs a multifaceted approach to assess stock market valuations, utilizing a combination of quantitative and qualitative methods. Their methodology typically involves:

- Price-to-Earnings (P/E) Ratios: Comparing current stock prices to company earnings to gauge relative valuation across sectors and individual companies.

- Discounted Cash Flow (DCF) Models: Projecting future cash flows and discounting them back to their present value to determine intrinsic value and compare it to market prices.

- Comparative Company Analysis: Benchmarking against similar companies to identify relative overvaluation or undervaluation.

BofA's recent findings suggest a mixed picture. While certain sectors, fueled by technological advancements and strong earnings growth, appear justified in their current valuations, others show signs of being overvalued. For example:

- Overvalued Sectors (according to BofA's analysis): Technology (certain segments), Consumer Discretionary (specific sub-sectors).

- Undervalued Sectors (according to BofA's analysis): Energy (depending on oil price forecasts), select segments within the Financials sector.

- Key Metrics Used: P/E ratios, Price-to-Sales (P/S) ratios, Return on Equity (ROE), and forward earnings estimates.

BofA identifies several potential risks associated with these elevated valuations, including:

- Interest Rate Hikes: Rising interest rates increase borrowing costs for companies, potentially impacting profitability and reducing future cash flows.

- Inflationary Pressures: Persistent inflation erodes purchasing power and can lead to decreased consumer spending and corporate earnings.

- Geopolitical Uncertainty: Global instability can create volatility in the market, impacting investor sentiment and leading to market corrections.

Addressing Investor Concerns about Potential Market Corrections

BofA acknowledges the possibility of a market correction, but its perspective on the likelihood and severity is nuanced. They do not predict an imminent crash but emphasize the importance of preparedness. Their predictions are influenced by:

- Economic Indicators: GDP growth, unemployment rates, inflation figures, consumer confidence indices – all play a role in their assessment.

- Investor Behavior: BofA monitors indicators of speculative behavior, such as high levels of margin debt and increased retail investor participation, to gauge potential vulnerabilities.

- Market Volatility: Increased market volatility (measured through indices like the VIX) can signal heightened risk and potential for a correction. BofA's assessment of current investor sentiment is currently cautious, with a recognition of the elevated valuations.

To mitigate potential risks, BofA suggests these strategies:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) to reduce exposure to any single sector or market downturn.

- Defensive Positioning: Shifting towards more defensive sectors (utilities, consumer staples) that are less sensitive to economic cycles.

- Value Investing: Focusing on undervalued companies with strong fundamentals, offering potentially higher returns with lower risk compared to growth stocks.

BofA's Recommendations for Investors

Based on their analysis, BofA recommends a cautious yet opportunistic approach:

- Specific Investment Strategies: Diversification, value investing, hedging strategies against potential market downturns.

- Asset Allocation Suggestions: Adjusting the allocation of assets based on individual risk tolerance and investment timelines. A more conservative allocation might be suggested for investors nearing retirement.

BofA sees opportunities even within this high-valuation environment: companies with strong earnings growth and competitive advantages may still provide attractive returns. However, thorough due diligence is crucial. Long-term investment strategies remain paramount; focusing on the long-term prospects of companies, rather than short-term market fluctuations, is emphasized.

Considering Alternative Investment Strategies

Alternative investments like bonds, real estate, and commodities can play a crucial role in mitigating risk in a high-valuation stock market. Bonds offer stability and income, acting as a counterbalance to the volatility of stocks. Real estate provides diversification and potential for long-term appreciation. Commodities can serve as an inflation hedge. These strategies complement a stock portfolio by reducing overall portfolio volatility and potentially enhancing risk-adjusted returns.

Conclusion: Understanding and Navigating Elevated Stock Market Valuations with BofA's Insights

BofA's analysis reveals a complex picture of elevated stock market valuations, highlighting both potential risks and opportunities. Their findings emphasize the need for a cautious and well-diversified approach, incorporating value investing strategies and potentially incorporating alternative assets. They reiterate the importance of aligning investment strategies with individual risk tolerance and long-term financial goals.

To stay informed about fluctuating stock market valuations, explore BofA's comprehensive analysis and resources [link to BofA resources if available]. Remember, seeking professional financial advice is crucial before making any investment decisions. Understanding and proactively managing elevated stock market valuations is key to achieving long-term investment success.

Featured Posts

-

Is Stefano Domenicali The Key To Formula 1s Explosive Growth

May 05, 2025

Is Stefano Domenicali The Key To Formula 1s Explosive Growth

May 05, 2025 -

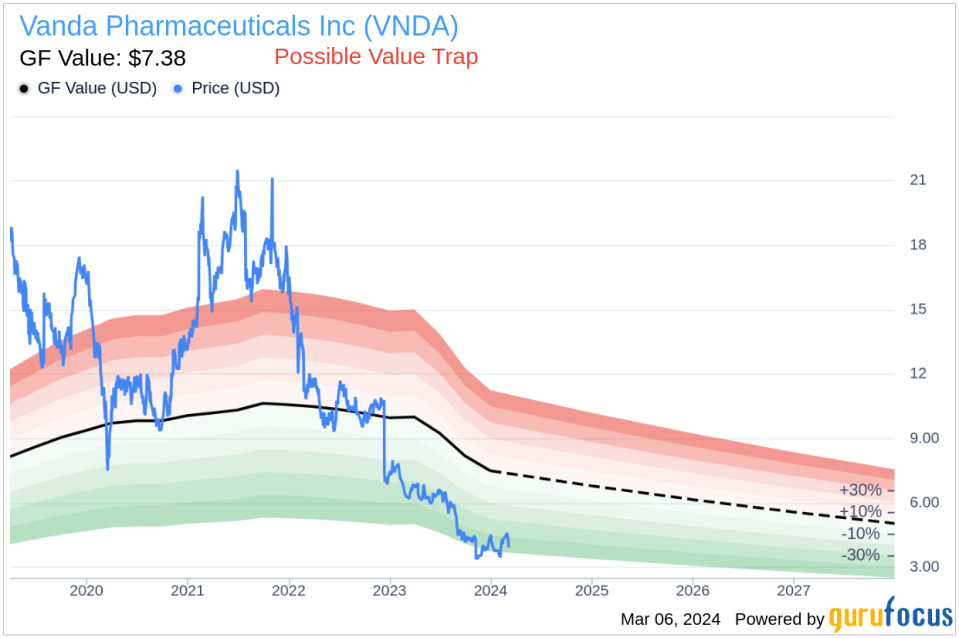

Vanda Pharmaceuticals Partners With Capitals For 2025 Playoffs Initiatives

May 05, 2025

Vanda Pharmaceuticals Partners With Capitals For 2025 Playoffs Initiatives

May 05, 2025 -

Chainalysis Expands With Ai Agent Startup Acquisition Alterya Deal Details

May 05, 2025

Chainalysis Expands With Ai Agent Startup Acquisition Alterya Deal Details

May 05, 2025 -

Ufc 314 Fight Card Main Event And Preliminary Bout Order Revealed

May 05, 2025

Ufc 314 Fight Card Main Event And Preliminary Bout Order Revealed

May 05, 2025 -

Analyzing The Grand Theft Auto Vi Trailer New Discoveries

May 05, 2025

Analyzing The Grand Theft Auto Vi Trailer New Discoveries

May 05, 2025

Latest Posts

-

Pimblett Raises Concerns About Chandlers Conduct Before Ufc 314 Clash

May 05, 2025

Pimblett Raises Concerns About Chandlers Conduct Before Ufc 314 Clash

May 05, 2025 -

Ufc 314 Pimbletts Pre Fight Concerns Regarding Chandlers Fighting Style

May 05, 2025

Ufc 314 Pimbletts Pre Fight Concerns Regarding Chandlers Fighting Style

May 05, 2025 -

Paddy Pimbletts Plea To Referee Concerns Over Michael Chandlers Tactics At Ufc 314

May 05, 2025

Paddy Pimbletts Plea To Referee Concerns Over Michael Chandlers Tactics At Ufc 314

May 05, 2025 -

Ufc 314 Revised Fight Card Following Prates Neal Bout Cancellation

May 05, 2025

Ufc 314 Revised Fight Card Following Prates Neal Bout Cancellation

May 05, 2025 -

Prates Vs Neal Cancellation Impacts Ufc 314 Ppv Lineup

May 05, 2025

Prates Vs Neal Cancellation Impacts Ufc 314 Ppv Lineup

May 05, 2025