Addressing Investor Concerns: BofA On High Stock Market Valuations

Table of Contents

BofA's Stance on Current Stock Market Valuations

BofA's assessment of current stock market valuations is nuanced. While acknowledging the elevated levels compared to historical averages, they haven't outright declared a market bubble. Their analysis often considers a range of factors beyond simple price-to-earnings (P/E) ratios, incorporating macroeconomic indicators and corporate performance data. Recent reports suggest that while some sectors appear overvalued, the overall market is considered to be fairly valued, with a caveat dependent on sustained economic growth and corporate earnings.

-

Specific Indices: BofA's analysis frequently references the S&P 500 and Nasdaq Composite, key indicators of US equity market performance. Their valuation assessments often incorporate both broad market indices and sector-specific analyses, identifying overvalued and undervalued sectors within the overall market.

-

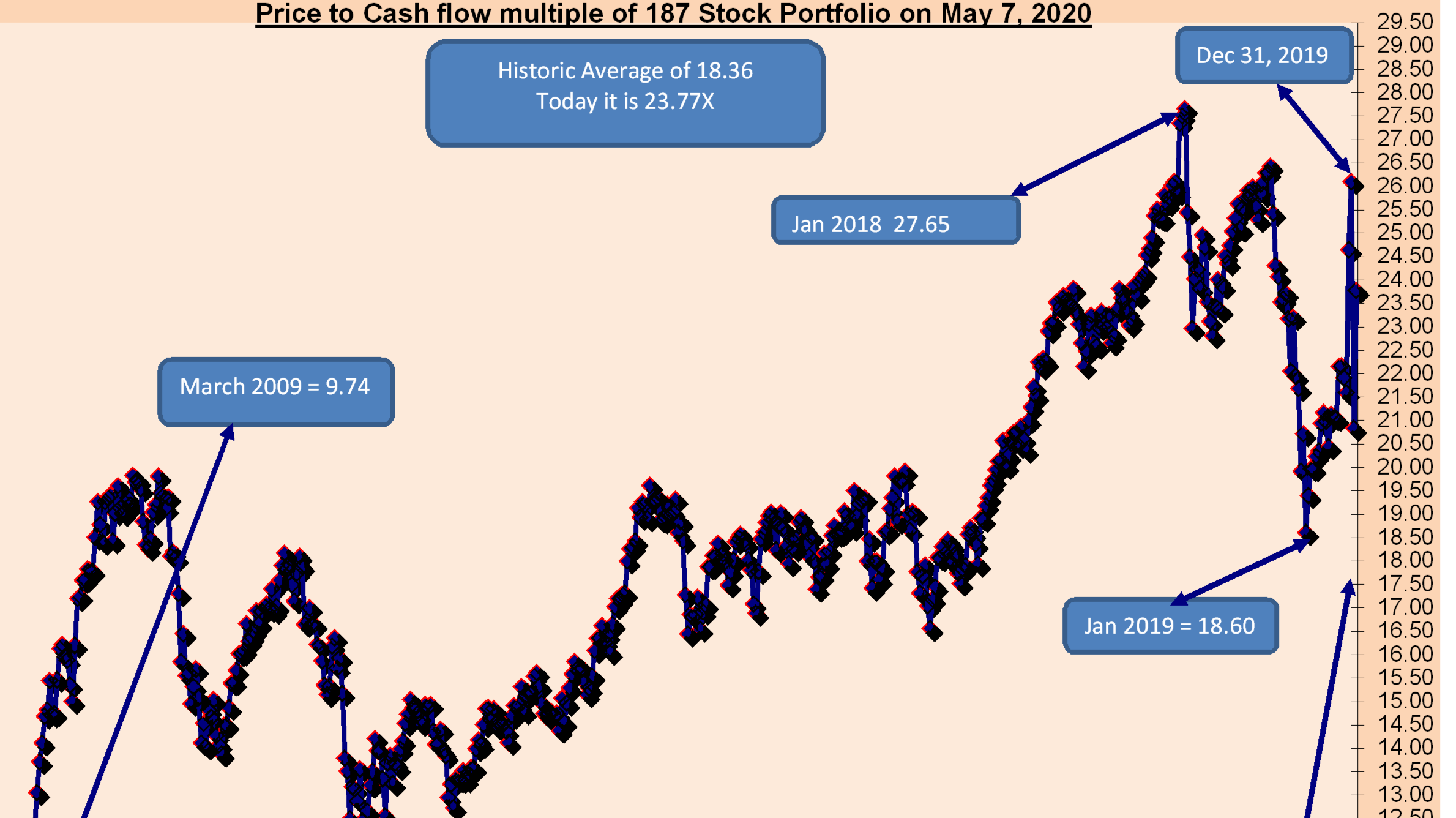

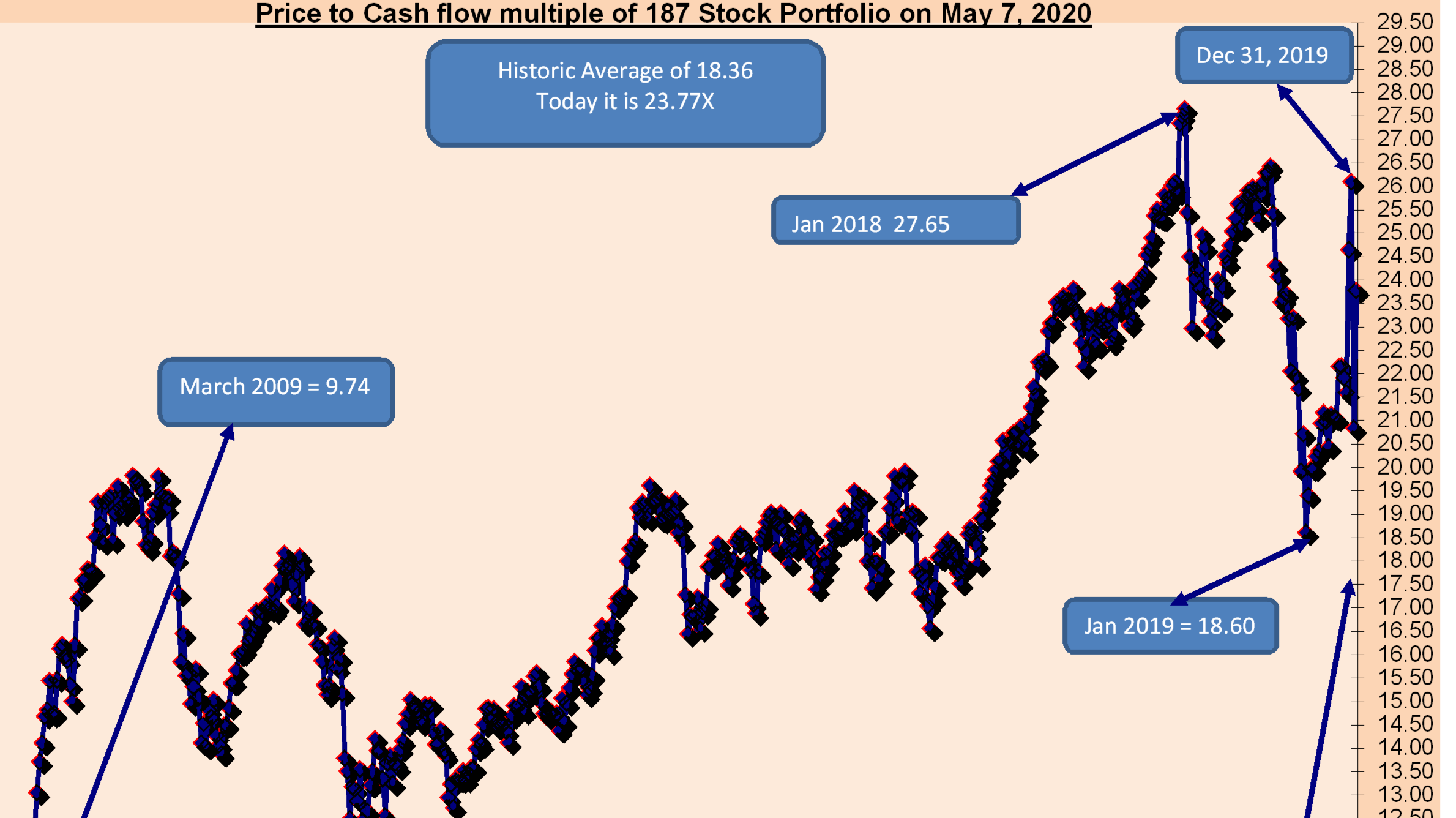

Key Metrics: Beyond P/E ratios, BofA utilizes metrics like the market-cap-to-GDP ratio and forward-looking earnings estimates to assess valuations. These provide a broader perspective than relying solely on historical data, allowing for projections about future market performance.

-

Caveats: BofA consistently emphasizes the inherent uncertainty in market forecasting. Their valuation assessments are contingent on several factors, including sustained economic growth, inflation control, and geopolitical stability. Changes in any of these could significantly impact their assessment of whether current valuations are sustainable.

Factors Contributing to High Stock Market Valuations

Several intertwined economic and market forces have contributed to the current high stock market valuations. Understanding these factors is crucial for investors seeking to make informed decisions.

-

Low Interest Rates: Historically low interest rates have encouraged investors to seek higher returns in the stock market, driving up demand and prices. This has been particularly true for growth stocks, which are more sensitive to changes in interest rates.

-

Strong Corporate Earnings (or Expectations Thereof): Robust corporate earnings, or the expectation of strong future earnings, have supported higher stock prices. Companies demonstrating consistent growth and profitability attract investment, increasing their valuations.

-

Inflationary Pressures: While inflation can negatively impact valuations, in certain instances, it can also drive asset prices higher as investors seek to protect their purchasing power. This effect is often seen in commodities and other inflation-hedged assets.

-

Government Stimulus Packages: Government stimulus measures, aimed at mitigating economic downturns, have injected significant liquidity into the market, fueling demand for stocks and other assets.

-

Technological Advancements: The rapid pace of technological advancements has created significant growth opportunities, attracting significant investment in technology and related sectors, contributing to their elevated valuations.

BofA's Recommendations for Investors

Given the current valuation environment, BofA generally recommends a cautious yet strategic approach for investors.

-

Diversification: Diversifying across different sectors and asset classes is crucial to mitigate risk. This might involve reducing exposure to potentially overvalued sectors and increasing exposure to sectors considered relatively undervalued.

-

Risk Management: Implementing risk management techniques such as stop-loss orders and hedging strategies can help limit potential losses during market corrections.

-

Investment Style: BofA may suggest a balanced approach, incorporating elements of both value and growth investing. This involves identifying undervalued companies with strong fundamentals alongside promising growth stocks.

-

Investment Horizon: Maintaining a long-term investment horizon is critical. Short-term market fluctuations should not dictate long-term investment strategies.

-

Attractive Sectors: BofA's recommendations regarding specific attractive sectors vary over time, dependent on market conditions and economic outlook. Their research reports provide detailed insights into sector performance and potential.

Addressing Specific Investor Concerns Regarding High Valuations

High stock market valuations inevitably raise concerns about potential market corrections and losses. Addressing these anxieties is paramount for investor confidence.

-

Potential Risks: High valuations inherently increase the risk of a market correction. A sharp downturn could lead to significant losses for investors holding overvalued assets.

-

Risk Mitigation: Diversification, risk management strategies, and a long-term perspective are vital for mitigating these risks. Careful monitoring of market trends and economic indicators is also essential.

-

Historical Context: While current valuations are high, it’s important to remember that markets have seen periods of high valuations in the past, followed by periods of growth or correction. Historical data provides context but doesn't predict future performance.

-

Long-Term Strategy: BofA consistently emphasizes the importance of adopting and adhering to a well-defined long-term investment strategy. This minimizes the impact of short-term market volatility.

Conclusion

BofA's analysis suggests that while current stock market valuations are elevated, the market isn't necessarily overvalued in its entirety. Their assessment takes into account a wide range of factors and acknowledges the uncertainties inherent in market forecasting. The key takeaways are the importance of diversification, risk management, and a long-term perspective. Investors concerned about high stock market valuations should carefully consider BofA's insights and adapt their investment strategies accordingly. Thorough research and professional financial advice are crucial for navigating this complex market environment. Stay informed on market trends and seek expert guidance to effectively manage your portfolio in the face of high stock market valuations.

Featured Posts

-

Virginia Giuffre Epstein Accuser Passes Away

Apr 28, 2025

Virginia Giuffre Epstein Accuser Passes Away

Apr 28, 2025 -

Bof As View Addressing Investor Concerns About Stretched Stock Market Valuations

Apr 28, 2025

Bof As View Addressing Investor Concerns About Stretched Stock Market Valuations

Apr 28, 2025 -

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Acquisition

Apr 28, 2025

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Acquisition

Apr 28, 2025 -

The Impact Of Wildfire Betting On Los Angeles And Beyond

Apr 28, 2025

The Impact Of Wildfire Betting On Los Angeles And Beyond

Apr 28, 2025 -

Nintendos Action Ryujinx Switch Emulator Development Ends

Apr 28, 2025

Nintendos Action Ryujinx Switch Emulator Development Ends

Apr 28, 2025

Latest Posts

-

E Ink Spectra

Apr 28, 2025

E Ink Spectra

Apr 28, 2025 -

75

Apr 28, 2025

75

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Coras Subtle Red Sox Lineup Changes For Doubleheader

Apr 28, 2025

Coras Subtle Red Sox Lineup Changes For Doubleheader

Apr 28, 2025 -

Could Espns Red Sox Outfield Prediction For 2025 Come True

Apr 28, 2025

Could Espns Red Sox Outfield Prediction For 2025 Come True

Apr 28, 2025