Addressing Investor Concerns: BofA's Take On Stretched Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Valuations

BofA generally holds a cautious view on current market valuations, suggesting that certain segments are overvalued. Their analysis points to a potential disconnect between current stock prices and underlying fundamentals, raising concerns about future returns for investors. This isn't a blanket statement of impending doom, but rather a call for careful consideration and strategic adjustments.

-

Metrics Used: BofA employs various metrics to assess valuations, including the widely used Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio). These ratios compare a company's stock price to its earnings, providing insights into whether a stock is relatively expensive or cheap compared to its historical performance and industry peers. They also consider other valuation metrics, such as price-to-sales and price-to-book ratios, to get a more comprehensive picture.

-

Overvalued Sectors/Stocks: While BofA's specific recommendations often change based on updated market data and analysis, their reports often point out certain sectors, such as some technology and consumer discretionary stocks, as being particularly vulnerable to corrections due to high valuations. It's crucial to remember that specific stock recommendations should be taken only from official BofA reports and professional financial advice, never from generalized articles.

-

BofA Reports: BofA regularly publishes research reports and market commentaries offering detailed analysis of their valuation assessments. These reports often outline their methodology and provide supporting data for their conclusions. Accessing these resources directly provides the most up-to-date and comprehensive insights.

-

Implications of High Valuations: High valuations generally imply higher risk. While potential for growth exists, the likelihood of significant price corrections becomes more pronounced if underlying fundamentals don't support current prices. This suggests a need for more cautious investment strategies, diversification, and a thorough risk assessment.

Factors Contributing to Stretched Valuations

BofA's analysis points to several interconnected factors driving these high valuations:

-

Low Interest Rates: Historically low interest rates have made equities more attractive relative to bonds, driving up demand and pushing valuations higher. This makes borrowing cheaper, potentially fueling company growth but simultaneously increasing market risk.

-

Quantitative Easing (QE): Past instances of QE, designed to stimulate economic growth, have increased market liquidity, further contributing to higher asset prices, including stocks. This increased liquidity can inflate asset bubbles if not managed properly.

-

Investor Sentiment: Positive investor sentiment, driven by factors like technological advancements and expectations of continued economic growth, has played a significant role in inflating stock prices. This exuberance can be a double-edged sword, leading to irrational exuberance and subsequent corrections.

-

Technological Advancements: Technological breakthroughs and the growth of innovative sectors have fueled optimism about future earnings growth, justifying, in part, higher valuations for certain companies and sectors. However, this growth needs to be sustainable to support high valuations.

-

Geopolitical Factors: Geopolitical uncertainties can either positively or negatively impact valuations. Periods of relative stability can boost investor confidence, while geopolitical tensions can increase risk aversion and trigger market volatility.

BofA's Recommendations for Investors

Given the current valuation environment, BofA generally advises a cautious approach. Their recommendations often emphasize risk management and diversification.

-

Diversification: Diversifying investments across different asset classes (equities, bonds, real estate, etc.) and sectors helps to mitigate risk. This limits the impact of any single investment performing poorly.

-

Sector/Stock Selection: Focusing on undervalued or fundamentally strong companies, even within sectors that might seem expensive at first glance, can improve the risk/reward profile of a portfolio. Always check independent verification of valuation from multiple sources.

-

Asset Allocation: The optimal asset allocation will depend on individual risk tolerance and investment goals. However, a balanced approach, carefully considering the high valuations of some asset classes, is often recommended. This might mean reducing exposure to sectors perceived to be overvalued.

-

Hedging Strategies: Implementing hedging strategies, such as using options or other derivatives, can offer protection against potential market downturns. This is a more advanced strategy and requires a good understanding of derivative instruments.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon can help to weather short-term market volatility and benefit from the long-term growth potential of equities. This is crucial in managing the risk associated with high valuations.

Managing Risk in a High-Valuation Market

Navigating a market with stretched stock market valuations requires a proactive and disciplined approach:

-

Due Diligence: Thorough due diligence is paramount. Analyze financial statements, understand business models, and assess management quality before investing in any company.

-

Undervalued Opportunities: Actively search for undervalued opportunities – companies whose stock prices might not fully reflect their intrinsic value. This requires careful analysis and a contrarian mindset.

-

Active vs. Passive Investing: The choice between active and passive investing strategies depends on individual expertise and resources. Active management might be more suitable for navigating complex market conditions.

-

Portfolio Review and Rebalancing: Regularly review and rebalance your portfolio to ensure it aligns with your risk tolerance and investment goals. This helps to manage risk and capture potential opportunities.

Conclusion

BofA's analysis highlights the concerns surrounding stretched stock market valuations, emphasizing the need for investors to proceed cautiously. Several factors, including low interest rates, QE, investor sentiment, and technological advancements, have contributed to the current environment. BofA's recommendations stress the importance of diversification, careful sector and stock selection, appropriate asset allocation, and a long-term investment horizon. Proactive risk management is crucial in this market. Stay informed about the evolving market landscape by regularly reviewing BofA's research and other reputable financial sources. Proactive management of your investment portfolio, considering BofA's insights on stretched stock market valuations, is crucial for long-term success. Don't wait; take control of your financial future by understanding the implications of these high valuations and adapting your investment strategy accordingly.

Featured Posts

-

M Net Firmenlauf Augsburg Rueckblick Ergebnisse Und Fotos Vom Heutigen Lauf

May 30, 2025

M Net Firmenlauf Augsburg Rueckblick Ergebnisse Und Fotos Vom Heutigen Lauf

May 30, 2025 -

Nuevos Detalles Sobre El Precio De Las Entradas De Ticketmaster

May 30, 2025

Nuevos Detalles Sobre El Precio De Las Entradas De Ticketmaster

May 30, 2025 -

Elon Musk And Bill Gates A Heated Exchange Over Child Poverty

May 30, 2025

Elon Musk And Bill Gates A Heated Exchange Over Child Poverty

May 30, 2025 -

Kramarics Penalty Earns Hoffenheim A Point Against Augsburg

May 30, 2025

Kramarics Penalty Earns Hoffenheim A Point Against Augsburg

May 30, 2025 -

Spesifikasi Dan Harga Kawasaki Versys X 250 2025 Warna Terbaru

May 30, 2025

Spesifikasi Dan Harga Kawasaki Versys X 250 2025 Warna Terbaru

May 30, 2025

Latest Posts

-

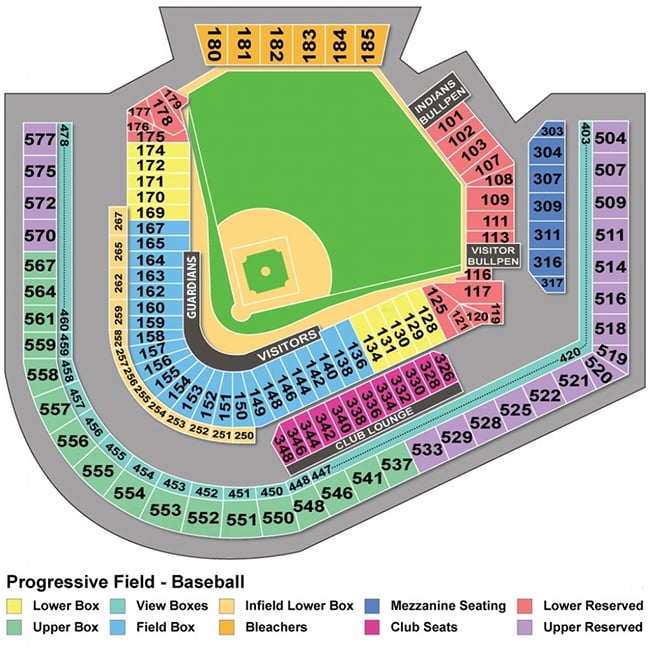

Historical Weather Patterns For Guardians Opening Day Games

May 31, 2025

Historical Weather Patterns For Guardians Opening Day Games

May 31, 2025 -

Cleveland Browns No 2 Draft Pick Mel Kiper Jr S Analysis

May 31, 2025

Cleveland Browns No 2 Draft Pick Mel Kiper Jr S Analysis

May 31, 2025 -

Cleveland Guardians Opening Day Weather Is It Typically This Cold

May 31, 2025

Cleveland Guardians Opening Day Weather Is It Typically This Cold

May 31, 2025 -

Nfl Draft Mel Kiper Jr S Pick For The Cleveland Browns At No 2

May 31, 2025

Nfl Draft Mel Kiper Jr S Pick For The Cleveland Browns At No 2

May 31, 2025 -

Guardians Opening Day Weather History A Chilly Look Back

May 31, 2025

Guardians Opening Day Weather History A Chilly Look Back

May 31, 2025