Affirm Holdings (AFRM) And The Trump Tariff's Chill On Fintech IPOs

Table of Contents

The Trump administration's tariffs, implemented starting in 2018, sent shockwaves through the global economy. While their impact was widespread, one sector felt the chill particularly acutely: Fintech. The initial public offering (IPO) market for financial technology companies, already a volatile landscape, faced added headwinds. This article will examine the relationship between the Trump tariffs, the resulting economic uncertainty, and the impact on Fintech IPOs, using Affirm Holdings (AFRM) as a compelling case study. We'll analyze how these trade policies affected investor sentiment, IPO valuations, and the broader Fintech investment landscape.

The Trump Tariffs and Their Economic Impact

Disruption to Global Supply Chains

The Trump tariffs significantly disrupted global supply chains. Increased import duties led to higher costs for businesses across various sectors. This directly impacted profitability, forcing companies to absorb increased costs or raise prices, impacting consumer demand and overall economic growth.

- Increased material costs: Businesses relying on imported components or raw materials saw their production costs rise dramatically.

- Reduced international trade: The tariffs discouraged international trade, limiting access to certain markets and hindering the growth of global businesses.

- Challenges in forecasting: The unpredictable nature of the tariff implementations made it extremely difficult for businesses to accurately forecast their future costs and plan accordingly.

Investor Uncertainty and Risk Aversion

The uncertainty surrounding the tariffs created a climate of risk aversion among investors. The unpredictability made it difficult to assess the long-term viability of businesses, particularly those heavily reliant on international trade. This risk aversion directly impacted investment in IPOs, especially in sectors like Fintech, known for their relatively high growth potential and inherent volatility.

- Reduced IPO valuations: Companies going public faced lower valuations due to investor hesitation.

- Postponement of IPOs: Many companies delayed their IPOs, hoping for a clearer economic outlook.

- Decreased investment capital available: Overall investment capital available for IPOs dwindled as investors adopted a more cautious approach.

Affirm Holdings (AFRM) IPO: A Case Study

Timing and Market Conditions

Affirm Holdings (AFRM) launched its IPO in January 2021, after the initial wave of Trump-era tariffs had subsided. However, the lingering economic uncertainty and the impact of the pandemic still affected market sentiment. While the IPO was successful, it's reasonable to speculate that a more favorable economic climate might have resulted in a higher valuation.

- IPO valuation: While successful, the valuation might have been higher in a less volatile market.

- Investor response: The response was positive, but potentially less enthusiastic than it would have been without the prior economic uncertainty.

- Stock performance post-IPO: Post-IPO performance reflected broader market trends and not solely the lingering effects of the tariffs.

Affirm's Business Model and Tariff Vulnerability

Affirm's business model, focusing on buy-now-pay-later services, wasn’t directly impacted by tariffs in the same way a manufacturing company might be. It didn't rely heavily on imported goods or services. However, the broader economic slowdown caused by the tariffs indirectly affected consumer spending, potentially impacting Affirm's transaction volumes.

- Supply chain analysis: Affirm's operations were largely unaffected by direct tariff impacts.

- International expansion plans: While not directly impacted by tariffs on goods, the broader economic uncertainty could have affected its international expansion strategies.

- Impact on operational costs: The indirect economic consequences had a minor influence on operational costs, largely related to general market conditions.

The Broader Impact on Fintech IPOs

Decreased Fintech Investment

The Trump tariffs contributed to a decrease in overall Fintech investment and a slowdown in the number of Fintech IPOs. The uncertainty created by the tariffs made investors hesitant to commit capital to companies with inherently high growth potential but also higher risk profiles.

- Statistics on the number of Fintech IPOs: A clear comparison of the pre- and post-tariff periods reveals a notable decrease in IPO activity within the Fintech sector.

- Comparison of pre- and post-tariff periods: Analysis of IPO activity and valuations shows a clear downward trend during the period of tariff implementation.

- Average valuation changes: The average valuation of Fintech IPOs experienced a decrease, reflecting the overall investor sentiment and risk aversion.

Alternative Funding Sources for Fintech

Facing difficulties in securing funding through traditional IPO routes, many Fintech companies turned to alternative funding sources. This helped them navigate the challenges created by the less favorable IPO market during the tariff period.

- Private equity investments: Private equity firms provided crucial funding for many Fintech companies.

- Venture capital: Venture capital investments remained a significant funding source, providing capital for growth and development.

- Debt financing: Many Fintech companies also explored debt financing options to supplement their funding needs.

Conclusion: Assessing the Long-Term Effects of Tariffs on Fintech IPOs like Affirm Holdings (AFRM)

The Trump tariffs created a challenging environment for Fintech IPOs. While Affirm Holdings (AFRM) successfully navigated the market conditions, the overall impact on the Fintech sector was undeniable, leading to decreased IPO activity and lower valuations. Investor uncertainty, directly influenced by the unpredictability of trade policy, played a significant role. Fintech companies increasingly turned to alternative funding sources to mitigate the effects of this less favorable IPO market. Understanding the relationship between global trade policies, investor sentiment, and the success of IPOs remains crucial for both investors and companies navigating the financial technology landscape. Learn more about the impact of trade policy on Fintech IPOs like Affirm Holdings (AFRM) and the long-term consequences of such policies on the financial technology sector. Understanding the complexities of these intertwined factors is crucial for future investment strategies within the dynamic Fintech market.

Featured Posts

-

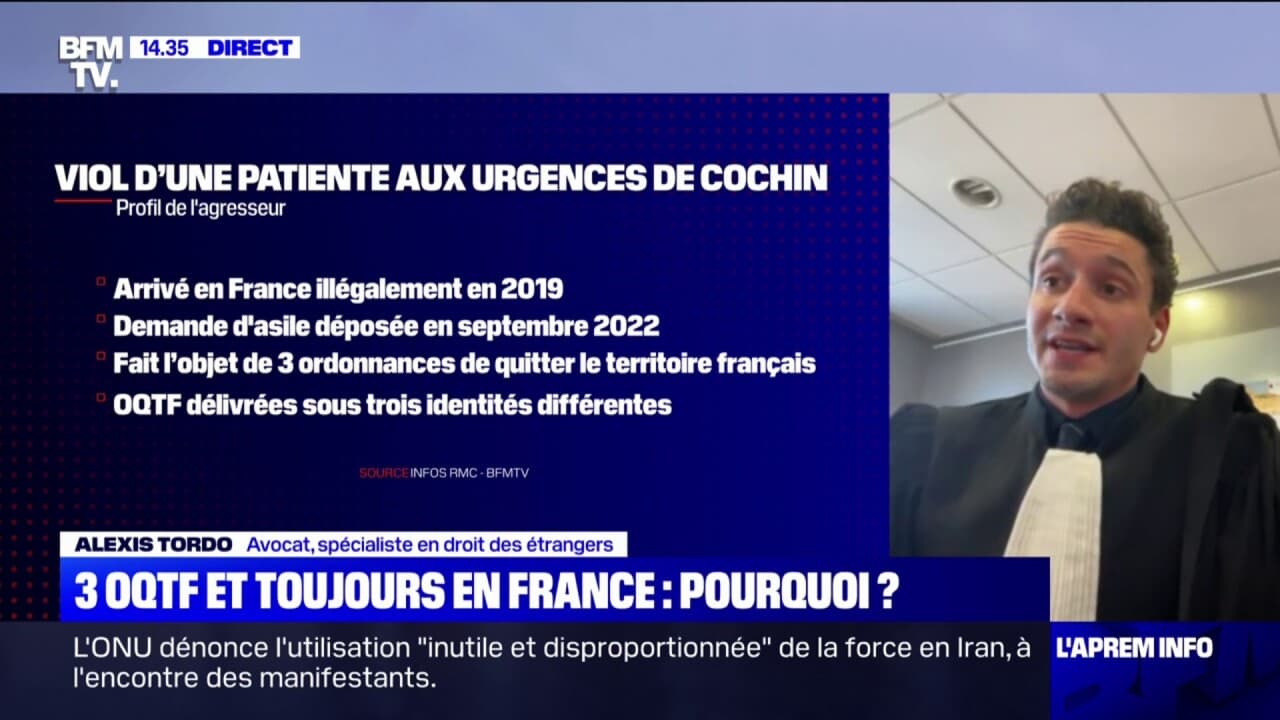

Migrant Libyen Sous Oqtf Interpelle Apres Viol A Paris

May 14, 2025

Migrant Libyen Sous Oqtf Interpelle Apres Viol A Paris

May 14, 2025 -

Snow Whites Box Office Disappointment A Turning Point For Disney Live Action Remakes

May 14, 2025

Snow Whites Box Office Disappointment A Turning Point For Disney Live Action Remakes

May 14, 2025 -

Gk Barry Opens Up About Loose Women Challenges And A Surprising Ally

May 14, 2025

Gk Barry Opens Up About Loose Women Challenges And A Surprising Ally

May 14, 2025 -

Aina Awoniyi Spearhead Forests Dominant 9 0 Victory Over City

May 14, 2025

Aina Awoniyi Spearhead Forests Dominant 9 0 Victory Over City

May 14, 2025 -

Las Otras Presentaciones De Joaquin Caparros Un Repaso A Su Trayectoria Sevillista

May 14, 2025

Las Otras Presentaciones De Joaquin Caparros Un Repaso A Su Trayectoria Sevillista

May 14, 2025