AI And Blockchain Converge: Chainalysis' Strategic Acquisition Of Alterya

Table of Contents

Enhanced Blockchain Analytics Capabilities

Alterya's acquisition significantly bolsters Chainalysis' existing capabilities in blockchain investigation. Alterya brings advanced AI-powered data analysis tools to the table, creating a synergy that promises to redefine the landscape of blockchain analytics. This integration enhances Chainalysis' platform in several key ways:

- Improved speed and accuracy of transaction tracing: The combined technology allows for faster and more precise tracking of cryptocurrency transactions, even across multiple blockchains and mixers. This enhanced speed is crucial in quickly identifying and responding to illicit activities.

- Enhanced identification of illicit activities like money laundering and terrorist financing: Alterya's AI algorithms excel at identifying complex patterns and anomalies indicative of money laundering, terrorist financing, and other financial crimes. This improves the effectiveness of investigations and helps law enforcement disrupt criminal networks.

- More effective risk assessment for cryptocurrency exchanges and financial institutions: The combined platform offers more sophisticated risk scoring and assessment tools, enabling exchanges and financial institutions to better manage their compliance obligations and mitigate risks associated with cryptocurrency transactions.

- Advanced pattern recognition to detect sophisticated fraud schemes: By leveraging AI's pattern recognition capabilities, the combined entity can detect even the most sophisticated fraud schemes, including those using complex mixing services or decentralized exchanges. This proactive approach helps prevent significant financial losses.

Synergies and Competitive Advantages

The Chainalysis Alterya acquisition provides Chainalysis with a considerable competitive advantage in the rapidly growing blockchain analytics market. This strategic move yields several key benefits:

- Expanded market share through access to Alterya's customer base and technology: Chainalysis gains immediate access to Alterya's existing client base, expanding its reach and market penetration. The integration of Alterya's technology further broadens its product offerings.

- Enhanced product offerings with a more comprehensive and powerful suite of tools: The combination of Chainalysis' investigative expertise and Alterya's AI-driven analytics creates a significantly more robust and comprehensive suite of tools for blockchain analysis.

- Attracting top talent in both AI and blockchain fields: The acquisition brings together leading experts in both AI and blockchain, fostering innovation and accelerating the development of cutting-edge solutions.

- Strengthened position to address evolving regulatory challenges in the crypto space: With increasingly stringent regulatory scrutiny of the cryptocurrency industry, the combined entity is better positioned to help companies navigate compliance requirements and address evolving regulatory challenges.

Impact on Cryptocurrency Regulation

The merger of Chainalysis and Alterya is expected to have a profound impact on the regulatory landscape of cryptocurrencies. The enhanced analytical capabilities will likely lead to:

- Improved compliance tools for regulated entities: Cryptocurrency exchanges and other regulated entities will benefit from more sophisticated compliance tools to help them meet regulatory requirements and prevent illicit activities.

- More efficient investigations for law enforcement agencies: Law enforcement agencies will have access to more powerful tools to investigate financial crimes involving cryptocurrencies, leading to more effective prosecutions.

- Potentially influencing the development of stricter regulatory frameworks: The improved transparency and accountability provided by the combined entity may influence regulators to develop more comprehensive and potentially stricter regulatory frameworks for cryptocurrencies.

- Increased transparency and accountability within the cryptocurrency industry: The enhanced analytics capabilities will promote greater transparency and accountability within the cryptocurrency ecosystem, ultimately fostering greater trust and confidence.

Future Implications for the Cryptocurrency Ecosystem

The long-term effects of the Chainalysis Alterya acquisition on the cryptocurrency market are significant and far-reaching. We can anticipate:

- Increased adoption of cryptocurrencies through improved security and transparency: The enhanced security and transparency provided by improved blockchain analytics could lead to increased adoption of cryptocurrencies by both individuals and institutions.

- Greater trust and confidence in the ecosystem: By combating illicit activities and promoting greater transparency, the merger helps build trust and confidence in the cryptocurrency ecosystem.

- Potential for further innovation in blockchain technology and AI: The collaboration of these two powerful entities could accelerate innovation in both blockchain technology and AI, leading to further advancements in the field.

- Development of more robust anti-money laundering (AML) and know-your-customer (KYC) solutions: The combined entity is well-positioned to develop more robust AML and KYC solutions, helping to address critical compliance challenges in the cryptocurrency industry.

Conclusion

The Chainalysis Alterya acquisition represents a pivotal moment in the development of blockchain analytics. By combining Chainalysis' expertise in blockchain investigation with Alterya's cutting-edge AI capabilities, this merger promises significant advancements in combating financial crime, enhancing regulatory compliance, and fostering greater trust within the cryptocurrency ecosystem. The combined power of AI and blockchain, showcased by this strategic move, is poised to shape the future of the digital asset landscape.

Call to Action: Stay informed about the evolving landscape of blockchain analytics and the impact of the Chainalysis Alterya acquisition. Learn more about how AI and blockchain are converging to create a more secure and transparent future for cryptocurrencies. Follow the developments in the Chainalysis Alterya acquisition for further insights into this transformative merger.

Featured Posts

-

Ofilis 100 000 Grand Slam Debut A Promising Third Place

May 12, 2025

Ofilis 100 000 Grand Slam Debut A Promising Third Place

May 12, 2025 -

Feds Charge Crook With Millions In Office365 Executive Account Breaches

May 12, 2025

Feds Charge Crook With Millions In Office365 Executive Account Breaches

May 12, 2025 -

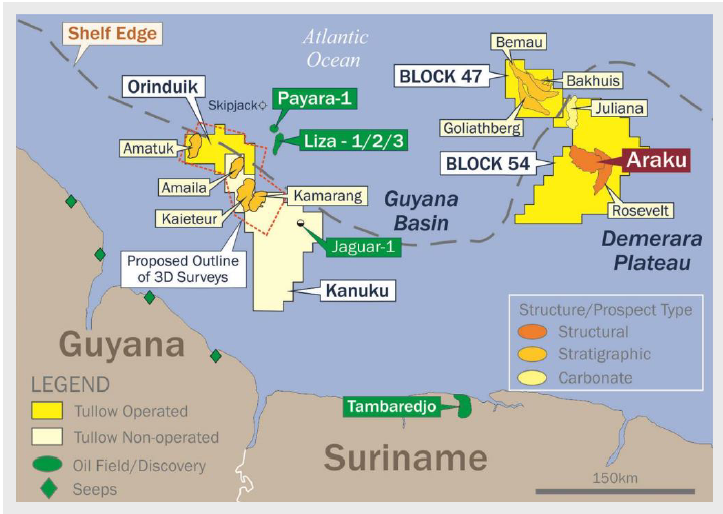

Is Black Gold Within Reach Uruguays Focus On Offshore Drilling

May 12, 2025

Is Black Gold Within Reach Uruguays Focus On Offshore Drilling

May 12, 2025 -

Pope Francis Successor A Conclave Of Nine

May 12, 2025

Pope Francis Successor A Conclave Of Nine

May 12, 2025 -

Va Hero Payton Pritchards Sixth Man Award Win

May 12, 2025

Va Hero Payton Pritchards Sixth Man Award Win

May 12, 2025

Latest Posts

-

Dodgers Shutout Cubs 3 0 Yamamotos Gem And Edmans Blast

May 13, 2025

Dodgers Shutout Cubs 3 0 Yamamotos Gem And Edmans Blast

May 13, 2025 -

Mlb 2 1 6

May 13, 2025

Mlb 2 1 6

May 13, 2025 -

Dodgers Shutout Cubs 3 0 Yamamotos Gem Edmans Blast

May 13, 2025

Dodgers Shutout Cubs 3 0 Yamamotos Gem Edmans Blast

May 13, 2025 -

Dodgers Fall To Cubs As Ian Happ Hits Walk Off Homer

May 13, 2025

Dodgers Fall To Cubs As Ian Happ Hits Walk Off Homer

May 13, 2025 -

Chicago Cubs Secure Win Against Dodgers Thanks To Ian Happs Walk Off

May 13, 2025

Chicago Cubs Secure Win Against Dodgers Thanks To Ian Happs Walk Off

May 13, 2025