Airbus: US Airlines Responsible For Tariff Payments

Table of Contents

The Origin and Impact of the Airbus Tariffs

The imposition of tariffs on Airbus aircraft imported into the US stems from a protracted World Trade Organization (WTO) dispute. Both the US and the EU accused each other of providing illegal subsidies to their respective aircraft manufacturers, Boeing and Airbus. The WTO ultimately ruled that both sides had engaged in unlawful subsidies, leading to the authorization of retaliatory tariffs.

These tariffs significantly increase the cost of purchasing and operating Airbus planes for US airlines. The specific tariff rates vary depending on the aircraft model, adding millions of dollars to the acquisition and operational costs.

- Timeline: The dispute began in 2004, with key rulings and retaliatory measures unfolding over the following years. The current tariffs are a result of these ongoing legal battles.

- Tariff Percentages: Tariffs range from 10% to 25% on various Airbus models, representing a substantial increase in the already significant investment airlines make in their fleets.

- Quantifiable Impact: The increased costs translate directly into higher operational expenses, reduced profitability, and potentially constrained growth for airlines relying heavily on Airbus aircraft. This financial strain impacts everything from route expansion to investment in new technologies and employee compensation.

Which US Airlines are Affected and How?

Several major US airlines rely significantly on Airbus aircraft for their fleets. These airlines are directly absorbing the cost of the tariffs, impacting their financial performance and strategic planning. They are forced to find ways to offset these additional expenses.

- Affected Airlines & Fleet Size: American Airlines, Delta Air Lines, and United Airlines, among others, operate substantial numbers of Airbus aircraft, making them particularly vulnerable to the tariff's impact. Precise figures on fleet size vary and can be found through publicly available airline financial reports.

- Financial Impact Analysis: The financial impact on each airline varies depending on its fleet composition and the proportion of Airbus planes in operation. Financial analysts often release reports detailing the estimated effect of the tariffs on the profits and stock prices of the affected companies.

- Mitigation Strategies: Airlines are employing various strategies to mitigate the impact, such as negotiating with Airbus, seeking government assistance, and potentially adjusting pricing strategies to offset the increased costs. These strategies are constantly evolving as the trade dispute continues.

The Broader Economic Consequences of the Airbus Tariffs on the US Airline Industry

The consequences of these Airbus tariffs extend far beyond the airlines directly impacted. The increased costs ripple throughout the US airline industry and the broader economy.

- Job Losses & Reduced Hiring: Reduced profitability due to higher operational costs may lead to decreased investment in growth, potential job cuts, or reduced hiring, impacting the entire workforce associated with the airline industry.

- Airfare Prices and Consumer Impact: Airlines may pass some of the increased costs on to consumers through higher airfare prices, potentially impacting travel demand and affordability.

- Retaliatory Tariffs: The ongoing trade dispute raises the risk of further retaliatory tariffs from the EU, potentially creating a broader and more damaging trade war. This scenario would escalate the problems currently faced by the US airline industry.

Potential Solutions and Future Outlook

Resolving the trade dispute and lifting the tariffs on Airbus aircraft is crucial for the US airline industry. Various paths to resolving the conflict need to be explored.

- Negotiation Strategies: Negotiations between the US and EU governments are key to finding a mutually agreeable solution that eliminates or reduces the tariffs.

- Likelihood of Tariff Removal: The likelihood of tariff removal in the near future remains uncertain and depends heavily on the outcome of ongoing negotiations and political factors.

- Alternative Aircraft Manufacturers: US airlines may explore diversifying their aircraft purchases by considering alternative manufacturers, like Boeing, although this may present its own set of challenges and may not completely solve the problem.

Conclusion: Airbus Tariffs: A Continuing Challenge for US Airlines

The tariffs imposed on Airbus aircraft represent a significant financial burden for US airlines. This burden affects not only the airlines themselves but also has broader economic consequences for the US airline industry, including potential job losses and increased airfare prices. The ongoing nature of this trade dispute underscores the need for continued vigilance and proactive solutions. Stay updated on the developments in the Airbus tariff dispute to understand its continuing impact on US airlines and the future of air travel. Contact your representatives to voice your concerns about the tariffs and urge them to seek a resolution to this damaging trade dispute.

Featured Posts

-

Lotto 6aus49 Vom 19 April 2025 Ueberpruefung Ihrer Zahlen

May 02, 2025

Lotto 6aus49 Vom 19 April 2025 Ueberpruefung Ihrer Zahlen

May 02, 2025 -

Find The Winning Numbers For Lotto Lotto Plus 1 And Lotto Plus 2

May 02, 2025

Find The Winning Numbers For Lotto Lotto Plus 1 And Lotto Plus 2

May 02, 2025 -

Remembering A Bright Light A Community Mourns 10 Year Old Rugby Player

May 02, 2025

Remembering A Bright Light A Community Mourns 10 Year Old Rugby Player

May 02, 2025 -

Did Christina Aguilera Go Too Far With Photoshopping Fans Weigh In

May 02, 2025

Did Christina Aguilera Go Too Far With Photoshopping Fans Weigh In

May 02, 2025 -

England Vs France Six Nations Dalys Late Show Decides Tight Contest

May 02, 2025

England Vs France Six Nations Dalys Late Show Decides Tight Contest

May 02, 2025

Latest Posts

-

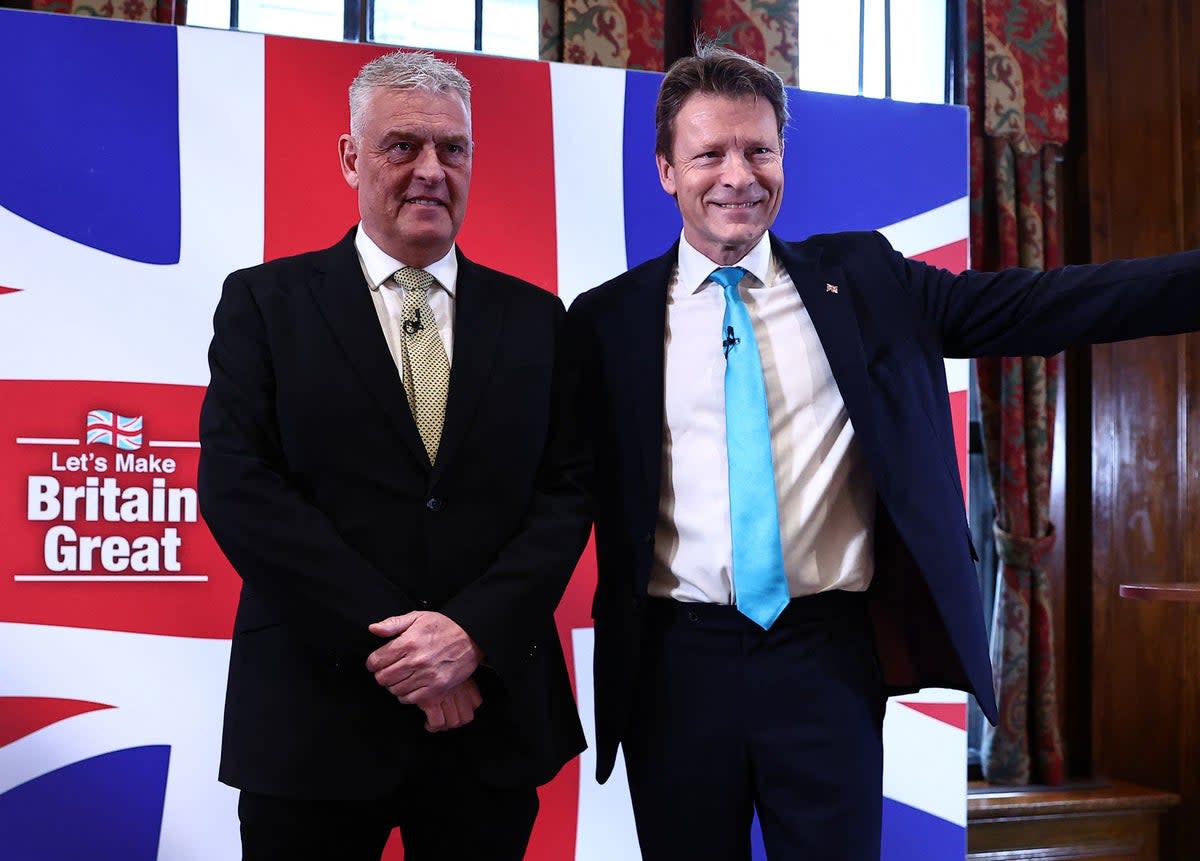

Lee Anderson Celebrates Major Political Win With Councillor Defection

May 03, 2025

Lee Anderson Celebrates Major Political Win With Councillor Defection

May 03, 2025 -

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025 -

Lee Anderson Welcomes Councillors Defection To Reform

May 03, 2025

Lee Anderson Welcomes Councillors Defection To Reform

May 03, 2025 -

Drone Attack On Ship Carrying Aid To Gaza Ngo Statement

May 03, 2025

Drone Attack On Ship Carrying Aid To Gaza Ngo Statement

May 03, 2025 -

Activist Aid Ship To Gaza Hit By Drone Strikes Ngo

May 03, 2025

Activist Aid Ship To Gaza Hit By Drone Strikes Ngo

May 03, 2025