Altcoin's 5880% Price Surge: Is This The New XRP?

Table of Contents

Analyzing the 5880% Price Surge: What Drove This Growth?

The astronomical rise of ASTA demands a thorough investigation into the contributing factors. Several interconnected elements likely fueled this rapid appreciation.

Market Sentiment and Speculation: The Hype Machine

The sudden surge in ASTA's price is largely attributable to a confluence of positive market sentiment and intense speculation.

- Increased media coverage and social media buzz: Several prominent cryptocurrency news outlets covered ASTA's price action, generating significant online discussion and fueling further interest. Social media platforms like Twitter and Telegram became hubs for ASTA-related conversations, with many users expressing excitement and sharing price predictions. This created a significant FOMO (fear of missing out) effect.

- Influencer endorsements or community excitement: While not yet confirmed, there are rumors of prominent cryptocurrency influencers endorsing ASTA, further driving up demand. Strong community engagement and positive sentiment within ASTA's online forums have also significantly contributed to the hype.

- Potential partnerships or technological advancements: While details are scarce at this stage, unconfirmed reports of a significant partnership or a breakthrough technological advancement within the ASTA project could have triggered the price explosion. Further investigation into these rumors is required. This highlights the importance of keeping abreast of cryptocurrency news to understand such market shifts.

Technical Analysis: Charting the Course of ASTA

Examining ASTA's price chart reveals several interesting patterns and indicators. The rapid price increase is clearly visible, and while we are not providing financial advice, observing technical indicators is a common practice among crypto investors.

- Technical indicators: While past performance is not indicative of future results, indicators like the Relative Strength Index (RSI) likely showed overbought conditions during the price surge, suggesting potential for a correction. The Moving Average Convergence Divergence (MACD) might have indicated a strong bullish trend. However, this requires detailed chart analysis.

- Support and resistance levels: Identifying support and resistance levels on the chart is crucial to understanding potential price movements. A strong break above a resistance level can often lead to further price increases. A chart would illustrate this more clearly.

- Trading volume: The significant price increase was accompanied by a considerable rise in trading volume, reflecting high levels of market activity and interest in ASTA.

Fundamental Analysis: Digging Deeper into ASTA

To gain a comprehensive understanding of ASTA's potential, we must analyze its underlying fundamentals.

- Blockchain technology: ASTA's whitepaper details its innovative use of blockchain technology, outlining its advantages over existing solutions. Understanding the underlying technology is crucial for assessing long-term viability.

- Use case: The project's intended use case needs careful consideration. A well-defined and valuable use case can significantly impact the token's long-term value.

- Team expertise: The experience and credibility of the development team behind ASTA are essential factors. A strong team with a proven track record increases investor confidence.

- Project roadmap: A well-defined roadmap outlining short-term and long-term goals provides transparency and helps assess the project's potential for future growth.

- Tokenomics: Understanding the token's supply, distribution, and utility is critical for evaluating its long-term value and potential for appreciation.

Comparing ASTA to XRP: Similarities and Differences

The comparison between ASTA and XRP reveals both similarities and significant differences.

Similarities: Echoes of Early Success?

- Scalability: Both projects aim for high transaction scalability, although XRP has a clear head start in this area.

- Transaction speed: Both aim for faster transaction speeds compared to some other cryptocurrencies.

- Cross-border payments: XRP initially focused on facilitating cross-border payments, and ASTA's potential use cases might intersect with this area.

- Decentralized finance (DeFi): The potential for both coins to integrate with DeFi platforms could influence their future growth.

Differences: Divergent Paths

Several key distinctions could prevent ASTA from replicating XRP's success.

- Market capitalization: ASTA's market capitalization is significantly smaller than XRP's, indicating a much higher risk profile.

- Regulatory compliance: The regulatory landscape for cryptocurrencies is complex and evolving, and ASTA's compliance status needs to be closely monitored.

- Competition: The cryptocurrency market is highly competitive, and ASTA faces competition from numerous established and emerging altcoins.

- Technological innovation: While ASTA boasts innovative technology, it must continually innovate to stay ahead in the rapidly evolving crypto space.

Investment Risks and Considerations: Is it Worth the Investment?

Investing in ASTA, or any altcoin for that matter, involves considerable risk.

Volatility and Uncertainty: Navigating the Rollercoaster

The cryptocurrency market is notoriously volatile, and ASTA's recent price surge underscores this fact.

- Significant price drops: The possibility of substantial price drops is very real, and investors could experience significant losses.

- Thorough research: Investors should conduct extensive due diligence and understand the risks before committing any capital.

- Risk management: A well-defined investment strategy with appropriate risk management techniques is vital.

Regulatory Scrutiny: Potential Hurdles

Regulatory uncertainty poses a significant threat to the cryptocurrency market.

- SEC regulations: The SEC and other regulatory bodies worldwide are actively monitoring the cryptocurrency market, and potential regulatory actions could significantly impact ASTA's price and future.

- Compliance: ASTA's compliance with existing and future regulations will be crucial for its long-term viability.

Conclusion: The Future of ASTA: A Potential XRP Competitor?

ASTA's recent 5880% price surge is remarkable, but it's crucial to approach such dramatic gains with caution. While the project shows potential, its relatively small market capitalization and the inherent volatility of the cryptocurrency market highlight substantial risks. The comparison with XRP reveals similarities in intended functionality but also significant differences in maturity, market position, and regulatory scrutiny. While ASTA's future remains uncertain, its ability to maintain its momentum and overcome considerable challenges remains to be seen.

While ASTA's recent performance is remarkable, remember that investing in cryptocurrencies, including altcoins like this one, carries significant risks. Conduct thorough due diligence before making any investment decisions, and stay informed about the latest developments in the dynamic world of altcoins. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

A Szineszno Aki Inspiralta Jenna Ortegat

May 07, 2025

A Szineszno Aki Inspiralta Jenna Ortegat

May 07, 2025 -

Multiple Teams Eyeing Pittsburgh Steelers Star Wide Receiver

May 07, 2025

Multiple Teams Eyeing Pittsburgh Steelers Star Wide Receiver

May 07, 2025 -

Steelers Face Potential Loss Of George Pickens Ahead Of 2026

May 07, 2025

Steelers Face Potential Loss Of George Pickens Ahead Of 2026

May 07, 2025 -

Will Chris Finchs Coaching Decisions Determine The Timberwolves Success

May 07, 2025

Will Chris Finchs Coaching Decisions Determine The Timberwolves Success

May 07, 2025 -

Rihanna In Savage X Fenty The Ultimate Wedding Night Look

May 07, 2025

Rihanna In Savage X Fenty The Ultimate Wedding Night Look

May 07, 2025

Latest Posts

-

Xrp On The Rise Three Reasons Why Xrp Could Experience A Parabolic Move

May 08, 2025

Xrp On The Rise Three Reasons Why Xrp Could Experience A Parabolic Move

May 08, 2025 -

3 Key Indicators Suggesting A Significant Xrp Price Rally Is Imminent

May 08, 2025

3 Key Indicators Suggesting A Significant Xrp Price Rally Is Imminent

May 08, 2025 -

Xrp Price Prediction 3 Factors Pointing To A Potential Parabolic Move For Xrp

May 08, 2025

Xrp Price Prediction 3 Factors Pointing To A Potential Parabolic Move For Xrp

May 08, 2025 -

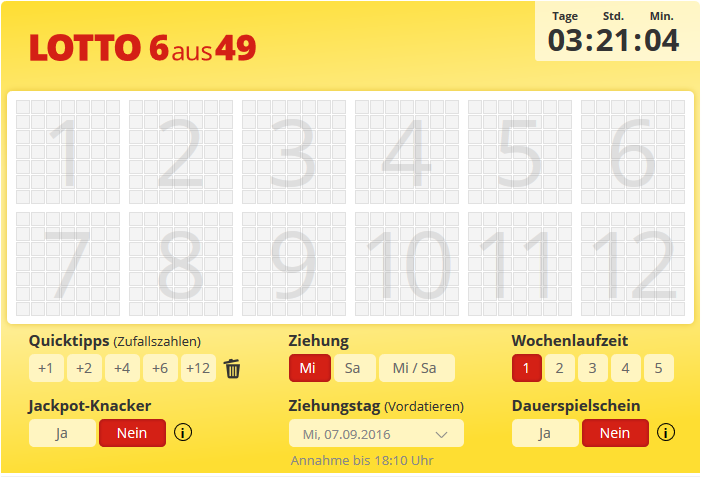

Lotto 6aus49 Ziehung Mittwoch 9 April 2025 Ergebnisse

May 08, 2025

Lotto 6aus49 Ziehung Mittwoch 9 April 2025 Ergebnisse

May 08, 2025 -

Die Lotto 6aus49 Ergebnisse Des 19 April 2025

May 08, 2025

Die Lotto 6aus49 Ergebnisse Des 19 April 2025

May 08, 2025