American Battleground: Challenging The World's Richest

Table of Contents

The Growing Gap in Wealth Inequality

The widening chasm of wealth inequality in America is a defining characteristic of our current economic landscape. This disparity represents a significant threat to social cohesion and economic stability.

Statistics and Trends

The statistics paint a stark picture. The top 1% of Americans hold a disproportionately large share of the nation's wealth, a figure that has steadily increased over the past few decades. Meanwhile, the bottom 50% struggles to maintain economic stability, facing increasing challenges in accessing crucial resources like healthcare, education, and housing. The concentration of wealth is not merely a matter of income; it reflects the accumulation of assets, including real estate, stocks, and other investments, further exacerbating the wealth gap.

- Rising income inequality over the past few decades: Data consistently shows a widening gap between the earnings of high-income earners and the rest of the population.

- The concentration of wealth among a small elite: A small percentage of the population controls a significant portion of the nation's assets, creating an uneven playing field.

- The impact of inheritance and generational wealth: Inherited wealth contributes significantly to the perpetuation of wealth inequality, creating advantages for some while hindering others.

- The role of globalization and technological advancements: While globalization and technological progress have boosted overall economic growth, they have also contributed to the concentration of wealth in the hands of a few, often leaving behind those whose skills are less in demand in the new economy.

Tax Policies and Their Impact

Tax policies play a pivotal role in shaping wealth distribution. The debate surrounding progressive versus regressive taxation lies at the heart of the American battleground over wealth inequality.

Progressive vs. Regressive Taxation

Progressive taxation systems, where higher earners pay a larger percentage of their income in taxes, are often advocated for as a means of redistributing wealth and funding social programs. Regressive systems, conversely, disproportionately burden lower-income individuals.

- Analysis of current US tax laws and their impact on the wealthy: Current tax laws have been criticized for containing loopholes that allow high-net-worth individuals and corporations to significantly reduce their tax burdens.

- Arguments for and against progressive taxation: Proponents argue that progressive taxation is essential for fairness and social equity, while opponents raise concerns about its potential impact on economic growth and investment.

- The debate surrounding tax loopholes and avoidance strategies: Tax avoidance strategies employed by the wealthy often involve complex financial instruments and offshore accounts, making it challenging to enforce tax laws effectively.

- The effectiveness of wealth taxes in other countries: Several European countries have implemented wealth taxes with varying degrees of success, offering examples for debate and analysis in the context of the American discussion.

The Role of Political Power and Lobbying

The influence of wealthy donors and powerful lobbying groups significantly shapes the political landscape, impacting policy decisions related to taxation, regulation, and social programs. This influence further exacerbates the American battleground over wealth inequality.

Influence of Wealthy Donors and Super PACs

Super PACs and wealthy donors exert considerable influence on political campaigns and legislative agendas. Their contributions often tilt the playing field in favor of policies that benefit their interests, sometimes at the expense of broader societal well-being.

- The impact of campaign finance laws: Campaign finance laws, while intended to regulate political spending, are often criticized for their loopholes and inefficiencies.

- The role of lobbying groups representing the interests of the wealthy: Powerful lobbying groups representing corporate interests and wealthy individuals actively shape legislation impacting tax policies, regulations, and social programs.

- Examples of policies influenced by wealthy donors: Numerous examples exist of policies that appear to favor the interests of wealthy donors and corporations, at the potential cost of public welfare.

- The impact on social programs and public services: Funding cuts to social programs and public services often result from policy decisions influenced by lobbying efforts from wealthy interests.

Social and Economic Consequences

The consequences of wealth inequality extend far beyond economic disparities, impacting social mobility, access to essential resources, and even social stability.

Impact on Social Mobility and Opportunity

The widening wealth gap significantly hinders social mobility, making it increasingly difficult for lower-income individuals to improve their economic standing.

- The difficulty of upward mobility for lower-income individuals: The lack of access to quality education, healthcare, and affordable housing creates significant barriers to upward mobility for those from lower socioeconomic backgrounds.

- The impact on education, healthcare, and housing: Wealth inequality directly impacts access to quality education, healthcare, and affordable housing, creating significant disparities in life outcomes.

- The correlation between wealth inequality and social unrest: Studies have shown a correlation between high levels of wealth inequality and social unrest, as widening disparities can lead to frustration and discontent among marginalized populations.

- Potential solutions to promote greater social mobility: Potential solutions include investments in education and affordable housing, as well as policies aimed at reducing income inequality, such as progressive taxation and stronger social safety nets.

Conclusion

The American battleground over wealth inequality is a complex and multifaceted issue with profound social and economic consequences. The widening wealth gap, fueled by regressive tax policies and the undue influence of wealthy donors, hinders social mobility and threatens social stability. Understanding the dynamics of this struggle—from the statistics on wealth concentration to the influence of lobbying and political power—is crucial for addressing this critical challenge.

Join the conversation and help us level the playing field in this crucial American battleground against wealth inequality. Research the issue further, participate in political discussions, and support policies that aim to create a more equitable society where opportunity is truly available to all, not just the wealthiest. Let's work together to build a more just and prosperous future for everyone.

Featured Posts

-

Mission Impossible Dead Reckonings Omission Of Two Sequels

Apr 26, 2025

Mission Impossible Dead Reckonings Omission Of Two Sequels

Apr 26, 2025 -

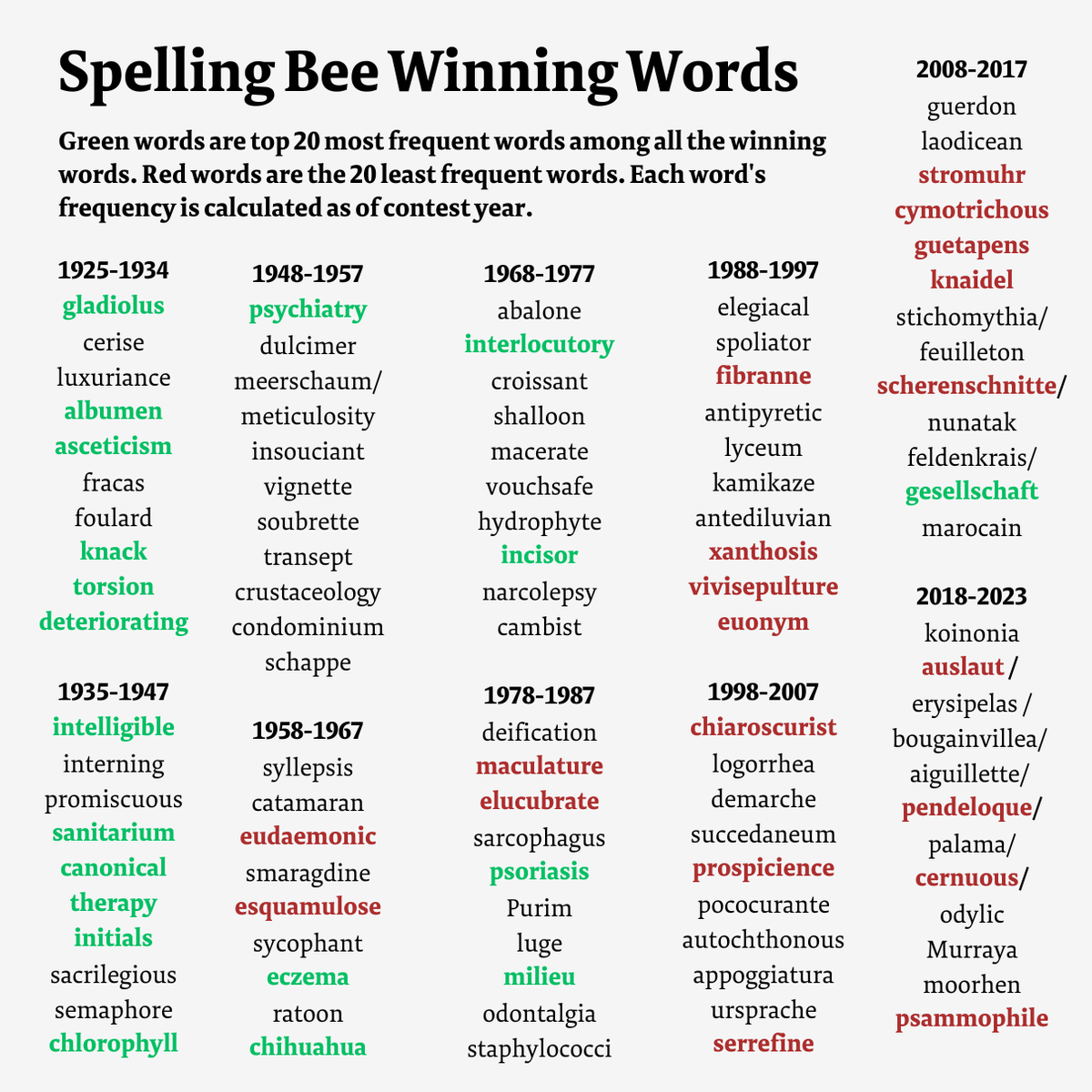

Solve Todays Nyt Spelling Bee February 5th 339 Hints And Complete Answers

Apr 26, 2025

Solve Todays Nyt Spelling Bee February 5th 339 Hints And Complete Answers

Apr 26, 2025 -

New Hanoi To Hai Phong Luxury Train Launching This May

Apr 26, 2025

New Hanoi To Hai Phong Luxury Train Launching This May

Apr 26, 2025 -

A Kings Birthday Party Plans Unveiled Ahead Of Schedule

Apr 26, 2025

A Kings Birthday Party Plans Unveiled Ahead Of Schedule

Apr 26, 2025 -

Saint Laurents Milan Design Week 2025 Tribute To Charlotte Perriand

Apr 26, 2025

Saint Laurents Milan Design Week 2025 Tribute To Charlotte Perriand

Apr 26, 2025