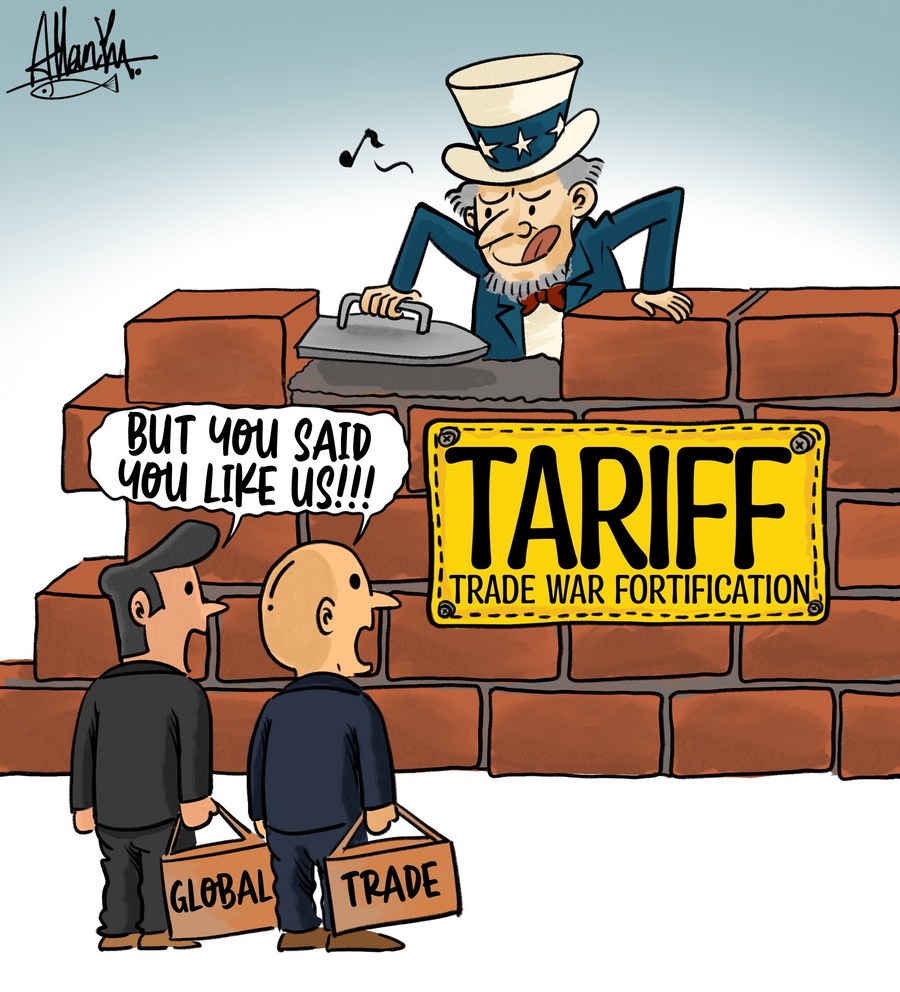

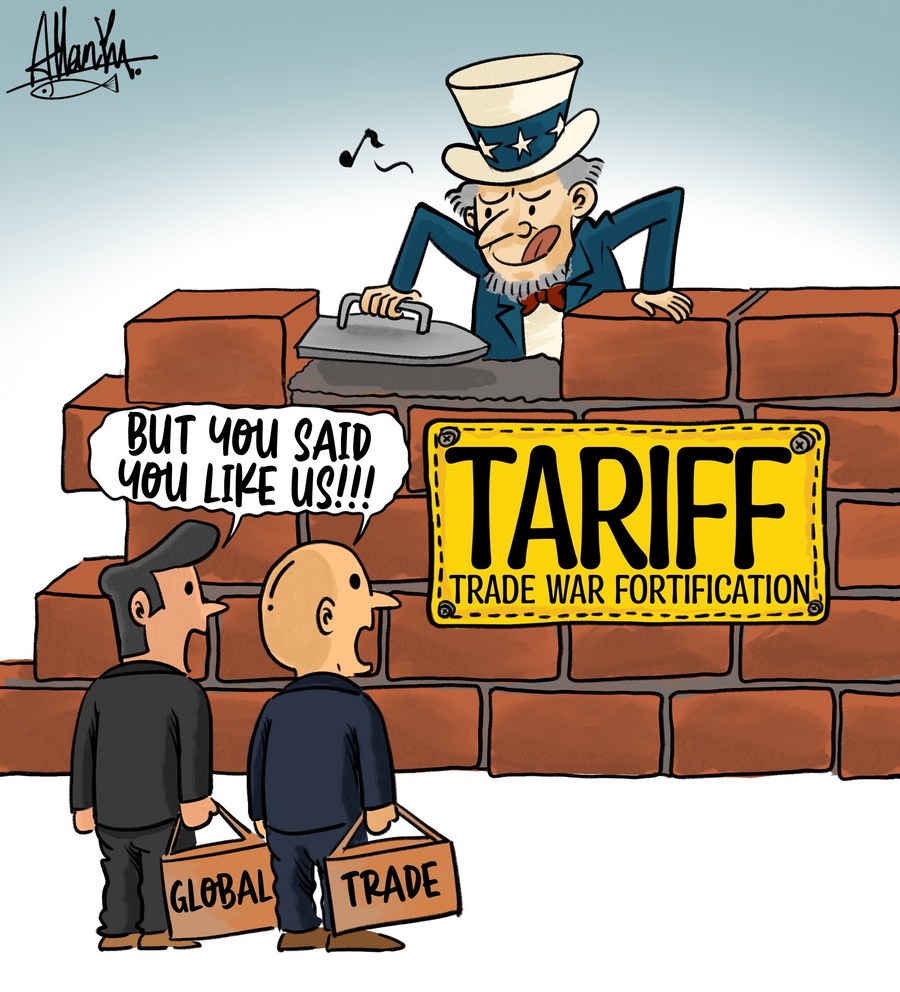

Amsterdam Exchange Down 2%: Impact Of Trump's Latest Tariff Increase

Table of Contents

Direct Impact of Tariffs on Dutch Businesses

The newly implemented Trump tariffs have directly impacted several key sectors of the Dutch economy, causing ripples throughout the Amsterdam Exchange.

Affected Sectors

Dutch businesses heavily reliant on trade with the US are feeling the brunt of these tariffs. Key sectors include:

- Agriculture: Dutch agricultural exports, particularly dairy products, flowers, and certain fruits, face increased import duties in the US, leading to reduced demand and lower prices for Dutch farmers. For example, exports of Gouda cheese to the US have already seen a noticeable decline.

- Manufacturing: Dutch manufacturers exporting machinery, electronics, and chemicals to the US are also experiencing a slowdown. Increased costs associated with tariffs make their products less competitive compared to those originating from countries not subject to the same levies.

- Food Processing: Companies processing agricultural products for export to the US are also affected by decreased demand and increased input costs.

The impact extends beyond reduced export orders. Supply chain disruptions are also becoming increasingly prevalent. Increased production costs, stemming from higher import duties on raw materials and components sourced from the US, further erode profit margins. Statistics from the Netherlands Bureau for Economic Policy Analysis (CPB) show a projected X% decrease in Dutch exports to the US in the next quarter, directly impacting the performance of the Amsterdam Exchange.

Decreased Export Demand

The rise in tariffs has undeniably decreased the demand for Dutch exports to the US. We've seen:

- Reduced Orders: Multiple Dutch businesses have reported significant reductions in orders from US clients, citing the higher costs associated with the tariffs as the primary reason.

- Business Losses: Some smaller businesses specializing in exports to the US are facing severe financial difficulties, with some already announcing layoffs or production cutbacks.

- Competitive Disadvantage: Dutch businesses now face a competitive disadvantage against businesses in other countries not affected by the same tariffs. This loss of market share directly translates into lower revenues and profits, impacting the overall performance of the Amsterdam Exchange.

The following chart illustrates the dramatic drop in export volumes to the US since the tariff announcement: (Insert relevant chart/graph here)

Investor Sentiment and Market Volatility

The announcement of further tariffs fueled uncertainty and risk aversion, significantly impacting the Amsterdam Exchange.

Fear and Uncertainty

The abrupt tariff increase injected a significant dose of fear and uncertainty into the market, leading to:

- Sell-off: Investors reacted swiftly, triggering a significant sell-off on the Amsterdam Exchange as they sought to reduce exposure to risk.

- Eroded Confidence: Investor confidence in the future performance of Dutch companies and the overall European economy has been severely eroded.

- Investment Hesitation: This uncertainty is likely to dampen future investment decisions, leading to slower economic growth.

Financial analysts have expressed serious concerns. "[Quote from a financial analyst about the market reaction]," stated [Analyst's Name], [Analyst's Title] at [Financial Institution].

Flight to Safety

Market instability prompted a "flight to safety," with investors moving capital towards safer assets:

- Government Bonds: Demand for government bonds, considered low-risk investments, increased dramatically.

- Impact on Amsterdam Exchange: This capital flight further depressed the Amsterdam Exchange, as funds were withdrawn from riskier equities.

- Interest Rates and Liquidity: The increased demand for government bonds could potentially lead to lower interest rates, but also impact overall market liquidity.

Wider Implications for the European Economy

The downturn in the Amsterdam Exchange is not an isolated incident; its implications extend to the broader European economy.

Contagion Effect

The interconnectedness of European markets means the Amsterdam Exchange's decline could trigger a wider contagion effect:

- Spread to Other Exchanges: The negative sentiment could easily spread to other European stock exchanges, impacting overall market performance.

- Economic Growth: The decreased investor confidence and potential decline in trade could negatively impact European economic growth.

- Impact on the Euro: The continued uncertainty could put downward pressure on the Euro, further exacerbating the economic challenges.

Geopolitical Considerations

The escalating trade war between the US and other countries carries significant geopolitical implications:

- Retaliatory Measures: The EU may implement retaliatory measures against the US, further escalating the conflict and harming both economies.

- International Relations: The trade war is straining international relations and undermining the stability of global trade agreements.

Conclusion

The 2% drop in the Amsterdam Exchange is a stark demonstration of the significant impact of President Trump's latest tariff increase. The direct effects on Dutch businesses, particularly in agriculture and manufacturing, combined with decreased export demand and investor uncertainty, have created a volatile market environment. The potential for a contagion effect across European markets and the broader geopolitical implications underscore the severity of this situation. The link between Trump’s tariffs and the downturn on the Amsterdam Exchange is undeniable.

Call to Action: Stay informed about the ongoing impact of these Trump tariffs on the Amsterdam Exchange and global markets. Regularly check reputable financial news sources for updates and consider diversifying your investment portfolio to mitigate risk in this volatile market environment. Understanding the fluctuations of the Amsterdam Exchange and other global markets is crucial for successful investing during these uncertain times.

Featured Posts

-

Skolko Let Geroyam Filma O Bednom Gusare Zamolvite Slovo Vozrast Personazhey Kultovoy Kinolenty

May 25, 2025

Skolko Let Geroyam Filma O Bednom Gusare Zamolvite Slovo Vozrast Personazhey Kultovoy Kinolenty

May 25, 2025 -

New Music Joy Crookes Shares Carmen

May 25, 2025

New Music Joy Crookes Shares Carmen

May 25, 2025 -

Emergency Services Respond To M56 Overturn Motorway Closed Casualty Care

May 25, 2025

Emergency Services Respond To M56 Overturn Motorway Closed Casualty Care

May 25, 2025 -

Actress Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 25, 2025

Actress Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 25, 2025 -

Dopady Hospodarskeho Poklesu H Nonline Sk O Prepustani V Nemecku

May 25, 2025

Dopady Hospodarskeho Poklesu H Nonline Sk O Prepustani V Nemecku

May 25, 2025

Latest Posts

-

The Rise Of Disaster Betting The Case Of The Los Angeles Wildfires

May 25, 2025

The Rise Of Disaster Betting The Case Of The Los Angeles Wildfires

May 25, 2025 -

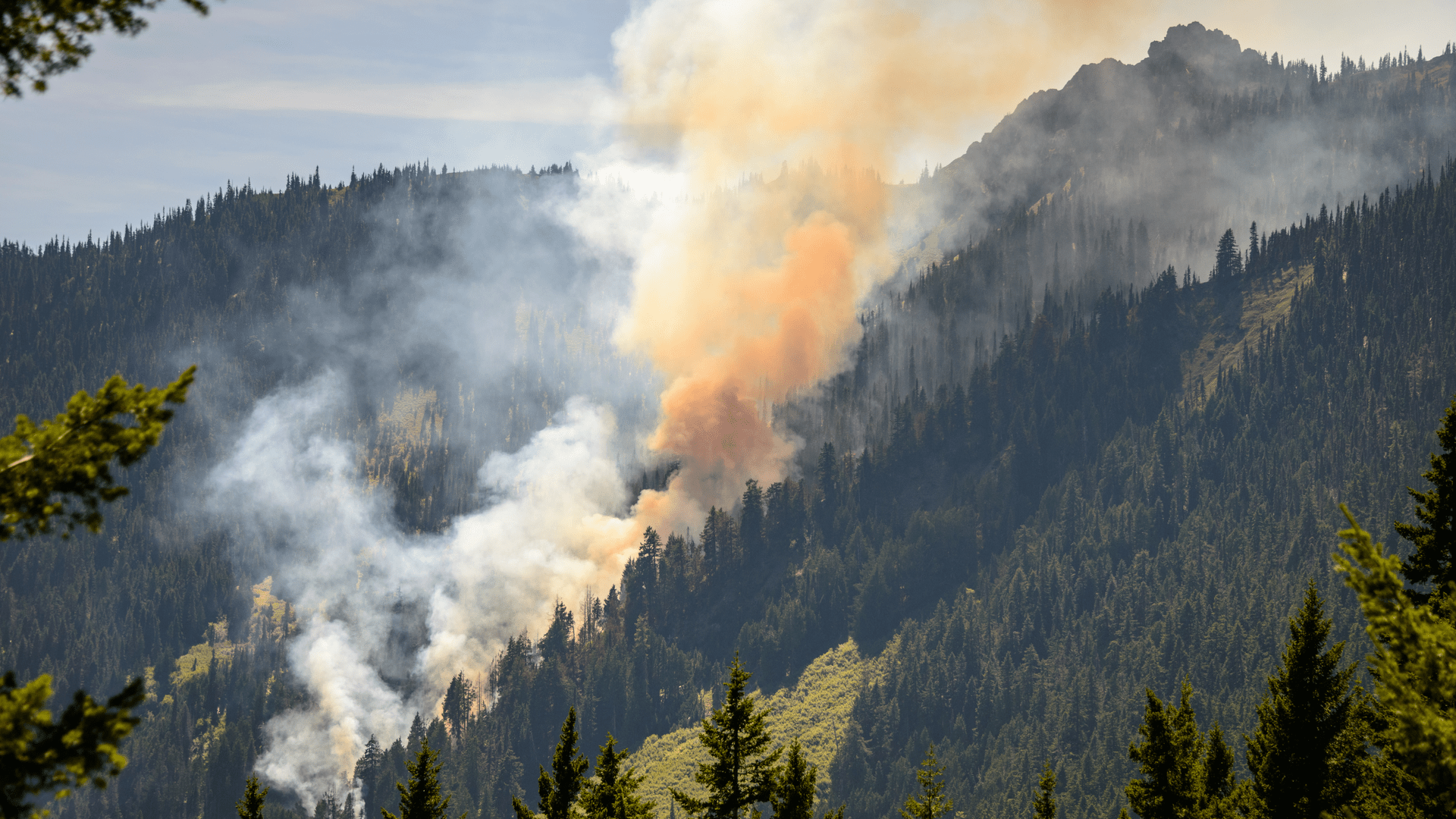

Global Forest Loss Reaches Record High Wildfires Fuel Destruction

May 25, 2025

Global Forest Loss Reaches Record High Wildfires Fuel Destruction

May 25, 2025 -

Los Angeles Wildfires Exploring The Market For Disaster Related Betting

May 25, 2025

Los Angeles Wildfires Exploring The Market For Disaster Related Betting

May 25, 2025 -

Us China Trade Surge Deadline Fuels Export Rush

May 25, 2025

Us China Trade Surge Deadline Fuels Export Rush

May 25, 2025 -

The Ethics Of Betting On Natural Disasters The Los Angeles Wildfires Example

May 25, 2025

The Ethics Of Betting On Natural Disasters The Los Angeles Wildfires Example

May 25, 2025