Amsterdam Stock Exchange Plunges: Three Days Of Losses, Down 11%

Table of Contents

Causes of the Amsterdam Stock Exchange Plunge

The recent Amsterdam Stock Exchange plunge can be attributed to a confluence of factors, both global and specific to the Dutch market.

Global Market Uncertainty

Global market uncertainty played a significant role in the AEX's decline. Rising inflation, aggressive interest rate hikes by central banks worldwide, and persistent geopolitical instability created a climate of fear and uncertainty, prompting investors to seek safer havens.

- The War in Ukraine: The ongoing conflict continues to disrupt global supply chains and energy markets, fueling inflation and increasing economic uncertainty.

- Energy Crisis: Soaring energy prices, driven by the war and reduced Russian gas supplies, are impacting businesses and consumers across Europe, including the Netherlands.

- Potential Recession: Concerns about a looming global recession are further dampening investor sentiment and driving down stock prices.

Statistics from the International Monetary Fund (IMF) show a projected slowdown in global GDP growth for 2023, contributing to the negative market sentiment. This global backdrop significantly impacted the AEX, exacerbating existing vulnerabilities.

Sector-Specific Downturns

The Amsterdam Stock Exchange plunge wasn't uniform across all sectors. Certain sectors were disproportionately affected, experiencing steeper declines than others.

- Technology Sector: The technology sector, sensitive to interest rate changes, saw a significant downturn as higher borrowing costs make growth-focused tech companies less attractive to investors.

- Energy Sector: While energy prices remain high, uncertainty about future demand and regulatory changes contributed to volatility within the energy sector, impacting AEX-listed companies.

(Insert chart/graph here visually representing the performance of different sectors during the three-day period. Label axes clearly and include a concise title like "AEX Sector Performance During Recent Plunge.")

Investor Sentiment and Confidence

Decreased investor confidence played a crucial role in the sell-off. Negative news and pessimistic forecasts from financial analysts fueled a wave of selling pressure, accelerating the downward spiral.

- "The current market volatility reflects a broader lack of confidence in the global economy," stated [Name of Financial Analyst], a leading expert at [Financial Institution].

- Many analysts point to the combined effect of global inflation and rising interest rates as major contributors to the pessimistic outlook.

Impact of the Amsterdam Stock Exchange Decline

The Amsterdam Stock Exchange decline has far-reaching consequences, impacting Dutch companies, the broader Dutch economy, and international markets.

Consequences for Dutch Companies

Listed Dutch companies experienced significant losses in market capitalization, impacting their revenue, profitability, and future investment plans.

- Several major Dutch companies saw their share prices plummet, impacting their ability to secure funding and potentially hindering future growth.

- [Example Company A] reported a [Percentage]% decrease in its share price, leading to [Specific Consequence, e.g., delayed expansion plans].

- (Include a case study detailing the impact on a specific Dutch company.)

Ripple Effects on the Dutch Economy

The stock market plunge has broader implications for the Dutch economy. Decreased investor confidence can lead to reduced consumer spending and potentially higher unemployment.

- A decline in the AEX can negatively impact GDP growth, as stock market performance often correlates with overall economic health.

- The potential for job losses is a significant concern, particularly in sectors heavily represented on the AEX.

- The Dutch government may need to implement fiscal measures to mitigate the economic impact of this downturn. (Refer to relevant economic indicators, like consumer confidence indices and unemployment rates, to substantiate your points.)

International Market Reactions

The AEX decline also reverberated through international markets, although the correlation wasn't uniform across all indices.

- While other European indices (like the DAX and CAC 40) also experienced declines, the magnitude of the AEX's fall was notably significant.

- (Include a comparative data table showing the performance of the AEX against other major indices during the same period.)

- The impact on global markets highlights the interconnectedness of the world's financial systems.

Potential Recovery Strategies and Outlook for the Amsterdam Stock Exchange

Navigating the current market volatility requires a multifaceted approach involving government intervention, informed investor strategies, and realistic future predictions.

Government Intervention

The Dutch government may consider implementing measures to stabilize the market and boost investor confidence.

- Fiscal stimulus packages could inject capital into the economy and encourage spending.

- Regulatory changes could aim to increase market transparency and reduce volatility.

Investor Strategies

Investors need to adopt prudent strategies to navigate this volatile market.

- Diversification is crucial to mitigate risk across different asset classes.

- Risk management strategies, such as stop-loss orders, should be employed.

- A long-term investment approach, rather than short-term speculation, is advisable.

Future Predictions

The outlook for the AEX remains uncertain. A combination of factors will determine the speed and extent of any recovery.

- A sustained period of global economic stability would be beneficial.

- Effective government policies could also help boost market confidence.

- However, persistent geopolitical uncertainty and high inflation pose significant challenges.

Conclusion: Navigating the Amsterdam Stock Exchange's Volatility

The three-day Amsterdam Stock Exchange plunge represents a significant event with broad implications for Dutch companies, the Dutch economy, and global markets. The causes are multifaceted, encompassing global market uncertainty, sector-specific downturns, and decreased investor confidence. The impact extends to reduced profitability for listed companies, potential ripple effects on the Dutch economy, and international market reactions. While potential recovery strategies exist, involving government intervention and informed investor choices, the outlook remains uncertain. Stay updated on the evolving situation of the Amsterdam Stock Exchange, monitor the AEX for potential recovery signs, and understand the impact of the Amsterdam Stock Exchange plunges on your investment strategy. Careful analysis and a long-term perspective are crucial for navigating the volatility of the Amsterdam Stock Exchange.

Featured Posts

-

Trumps Tariffs Trigger 2 Drop In Amsterdam Stock Exchange

May 25, 2025

Trumps Tariffs Trigger 2 Drop In Amsterdam Stock Exchange

May 25, 2025 -

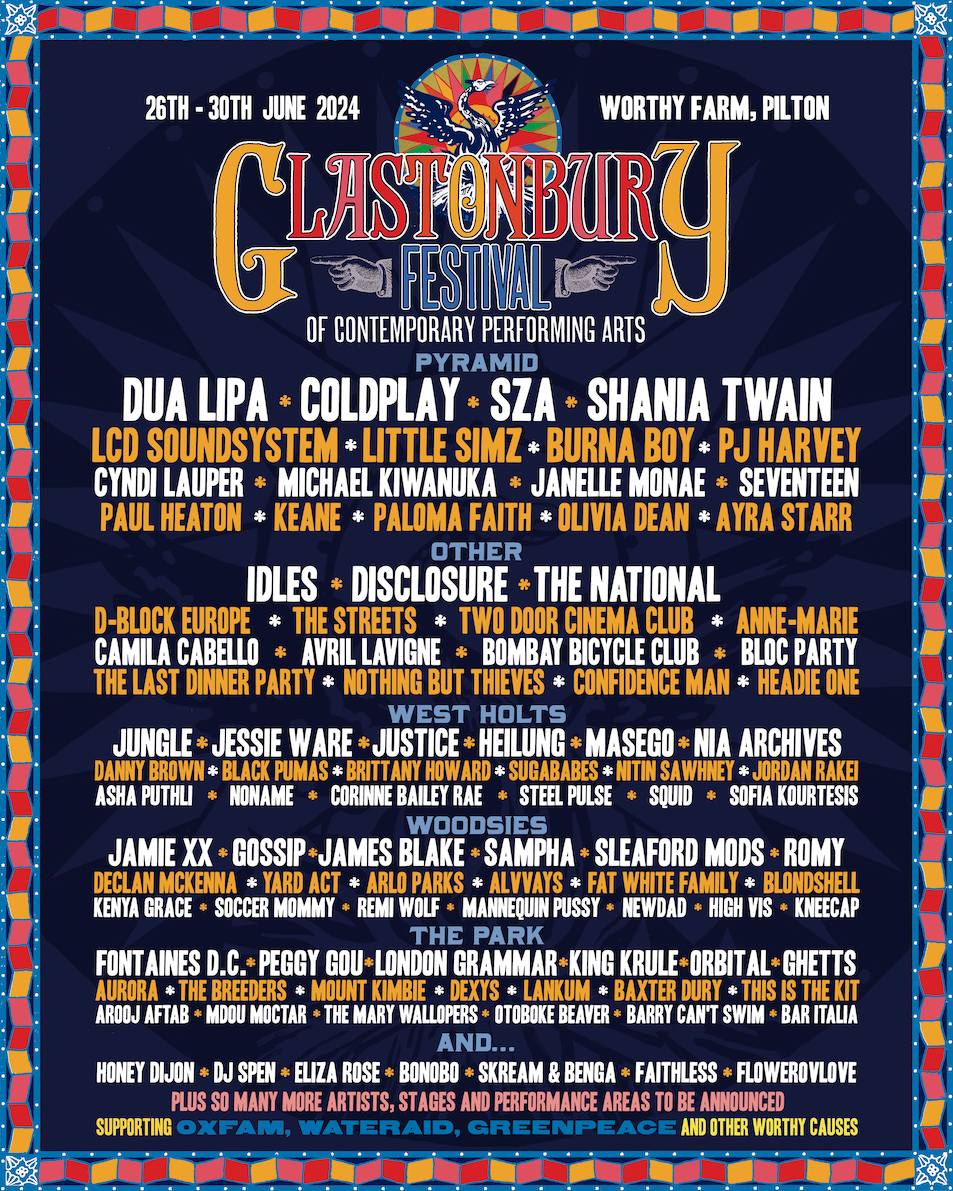

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025 -

Dazi Trump Al 20 L Effetto Domino Su Nike Lululemon E Altri Brand

May 25, 2025

Dazi Trump Al 20 L Effetto Domino Su Nike Lululemon E Altri Brand

May 25, 2025 -

Mia Farrows Career Revival Is Ronan Farrow The Key

May 25, 2025

Mia Farrows Career Revival Is Ronan Farrow The Key

May 25, 2025 -

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 25, 2025

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025