Amsterdam Stock Exchange: Three Consecutive Days Of Heavy Losses

Table of Contents

Causes of the Amsterdam Stock Exchange's Decline

The sharp decline in the AEX index wasn't a singular event but rather a confluence of factors, both global and domestic.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty, directly impacting the Amsterdam Stock Exchange. High inflation, rising interest rates implemented by central banks worldwide to combat inflation, and persistent geopolitical instability have all contributed to a risk-averse market environment. This translates to decreased investor confidence and a sell-off in various asset classes, including those listed on the AEX.

- Increased energy prices: The ongoing energy crisis has significantly increased production costs for many businesses, impacting profitability and investor sentiment.

- Supply chain disruptions: Lingering supply chain issues, exacerbated by geopolitical events, continue to constrain economic growth and contribute to uncertainty.

- The war in Ukraine: The ongoing conflict has created significant geopolitical instability, impacting global markets and increasing investor anxieties.

- Fear of recession: Growing concerns about a potential global recession further fueled the sell-off, as investors sought to protect their capital.

These global headwinds have resulted in a significant drop in various global indices, with the AEX mirroring this trend, experiencing a [Insert Percentage]% decline over the three-day period.

Sector-Specific Weakness

The losses on the Amsterdam Stock Exchange weren't evenly distributed across all sectors. Certain sectors, particularly technology and energy, experienced disproportionately large drops.

- Technology sector: High-growth technology companies, often valued on future expectations, are particularly vulnerable during periods of rising interest rates, as their future earnings are discounted more heavily. Companies like [Insert Example Company Name] experienced a [Insert Percentage]% drop in their share price.

- Energy sector: Fluctuations in global energy prices and concerns about the future of fossil fuels have significantly impacted energy companies listed on the AEX. [Insert Example Company Name] saw a [Insert Percentage]% decrease in its share price.

The underperformance of these key sectors significantly contributed to the overall decline of the AEX index. Analyzing the financial reports of these companies reveals underlying vulnerabilities contributing to their share price drops.

Investor Sentiment and Market Psychology

Fear and panic selling played a significant role in amplifying the losses on the Amsterdam Stock Exchange. Negative news cycles, combined with the general global uncertainty, triggered a wave of sell-offs.

- High trading volume: The increased trading volume during the three-day period indicates a significant level of panic selling.

- Market sentiment indicators: Various market sentiment indicators, such as the VIX (volatility index), showed a sharp increase, reflecting heightened investor anxiety.

The snowball effect of negative news and investor fear created a self-fulfilling prophecy, exacerbating the market decline.

Consequences of the Amsterdam Stock Exchange Losses

The three-day plunge in the AEX has significant consequences, impacting various aspects of the Dutch economy and its citizens.

Impact on Dutch Businesses

The decline in the AEX has directly impacted companies listed on the exchange.

- Reduced investment opportunities: Companies find it more challenging to secure funding and investment as investor confidence wanes.

- Difficulty in raising capital: The reduced investor appetite for risk makes it harder for businesses to raise capital through initial public offerings (IPOs) or other funding rounds.

- Potential job losses: In a struggling market, some companies may resort to cost-cutting measures, potentially leading to job losses.

This, in turn, has a knock-on effect on smaller businesses reliant on the larger listed companies for contracts and partnerships.

Implications for Pension Funds and Individual Investors

The market downturn has resulted in substantial losses for both pension funds and individual investors.

- Potential impact on retirement savings: Pension funds, which often invest in the stock market, have experienced significant losses, potentially impacting future retirement payouts.

- Reduced disposable income: Individual investors have also seen a decrease in their investment portfolios, leading to reduced disposable income and potentially affecting consumer spending.

- Psychological impact: Significant investment losses can have a considerable psychological toll on investors, impacting their financial planning and confidence.

Broader Economic Ramifications

The decline of the AEX carries broader economic ramifications for the Netherlands.

- Decreased consumer confidence: Market volatility can lead to decreased consumer confidence, impacting spending and economic growth.

- Impact on GDP growth: The overall economic performance, as measured by GDP growth, could be negatively affected by the decreased investor confidence and business activity.

- Potential need for government intervention: The Dutch government might need to intervene through economic stimulus packages or other measures to mitigate the impact of the market downturn.

Potential Recovery and Future Outlook for the Amsterdam Stock Exchange

The path to recovery for the Amsterdam Stock Exchange depends on various factors, including government intervention and overall global economic trends.

Government and Central Bank Response

The Dutch government and the central bank may implement measures to support the market and boost investor confidence.

- Potential economic stimulus packages: Government intervention through fiscal policy, such as tax breaks or infrastructure spending, can stimulate economic activity.

- Monetary policy adjustments: The central bank may adjust its monetary policy, potentially lowering interest rates to encourage borrowing and investment.

The effectiveness of these responses will depend on the severity and duration of the global economic headwinds.

Long-Term Investment Strategies

For investors, a long-term perspective and prudent strategies are crucial for navigating market volatility.

- Diversification of investment portfolios: Spreading investments across various asset classes reduces overall risk and protects against sector-specific downturns.

- Risk management strategies: Employing risk management strategies, such as stop-loss orders, can limit potential losses during market corrections.

Adopting a long-term approach, rather than reacting to short-term market fluctuations, is essential for sustainable investment growth.

Indicators for Future Market Performance

Several key economic indicators will help predict future market trends for the Amsterdam Stock Exchange.

- Inflation rates: A decline in inflation rates could ease pressure on central banks to raise interest rates, potentially boosting investor sentiment.

- Interest rates: Interest rate movements significantly influence investment decisions and market valuations.

- Employment data: Strong employment data suggests economic resilience and can improve investor confidence.

Monitoring these indicators will provide insights into potential market rebounds and help inform investment strategies.

Conclusion

The three consecutive days of heavy losses on the Amsterdam Stock Exchange are a significant setback for the Dutch economy. The causes are complex, encompassing global economic uncertainties, sector-specific weaknesses, and volatile market sentiment. The consequences are wide-ranging, impacting businesses, pension funds, and individual investors. While the future remains uncertain, proactive government responses, coupled with prudent investor strategies, are crucial for navigating this turbulent period and fostering the eventual recovery of the Amsterdam Stock Exchange.

Call to Action: Stay informed about the latest developments affecting the Amsterdam Stock Exchange and its constituent companies. Regularly monitor the AEX index and other key economic indicators. Consult a financial advisor to tailor your investment strategy to these market conditions and understand how these fluctuations might impact your personal portfolio. Don't hesitate to adjust your investment strategy in the Amsterdam Stock Exchange based on the evolving economic landscape.

Featured Posts

-

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025 -

Analysis G 7s Consideration Of Reduced Tariffs For Chinese Products

May 24, 2025

Analysis G 7s Consideration Of Reduced Tariffs For Chinese Products

May 24, 2025 -

M56 Motorway Closure Serious Crash Causes Major Delays Live Updates

May 24, 2025

M56 Motorway Closure Serious Crash Causes Major Delays Live Updates

May 24, 2025 -

Prognoz Konchiti Vurst Na Peremozhtsiv Yevrobachennya 2025 Chotiri Potentsiyni Triumfatori

May 24, 2025

Prognoz Konchiti Vurst Na Peremozhtsiv Yevrobachennya 2025 Chotiri Potentsiyni Triumfatori

May 24, 2025 -

Porsche Indonesia Classic Art Week 2025 Perpaduan Seni Rupa Dan Mobil Klasik

May 24, 2025

Porsche Indonesia Classic Art Week 2025 Perpaduan Seni Rupa Dan Mobil Klasik

May 24, 2025

Latest Posts

-

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025 -

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025 -

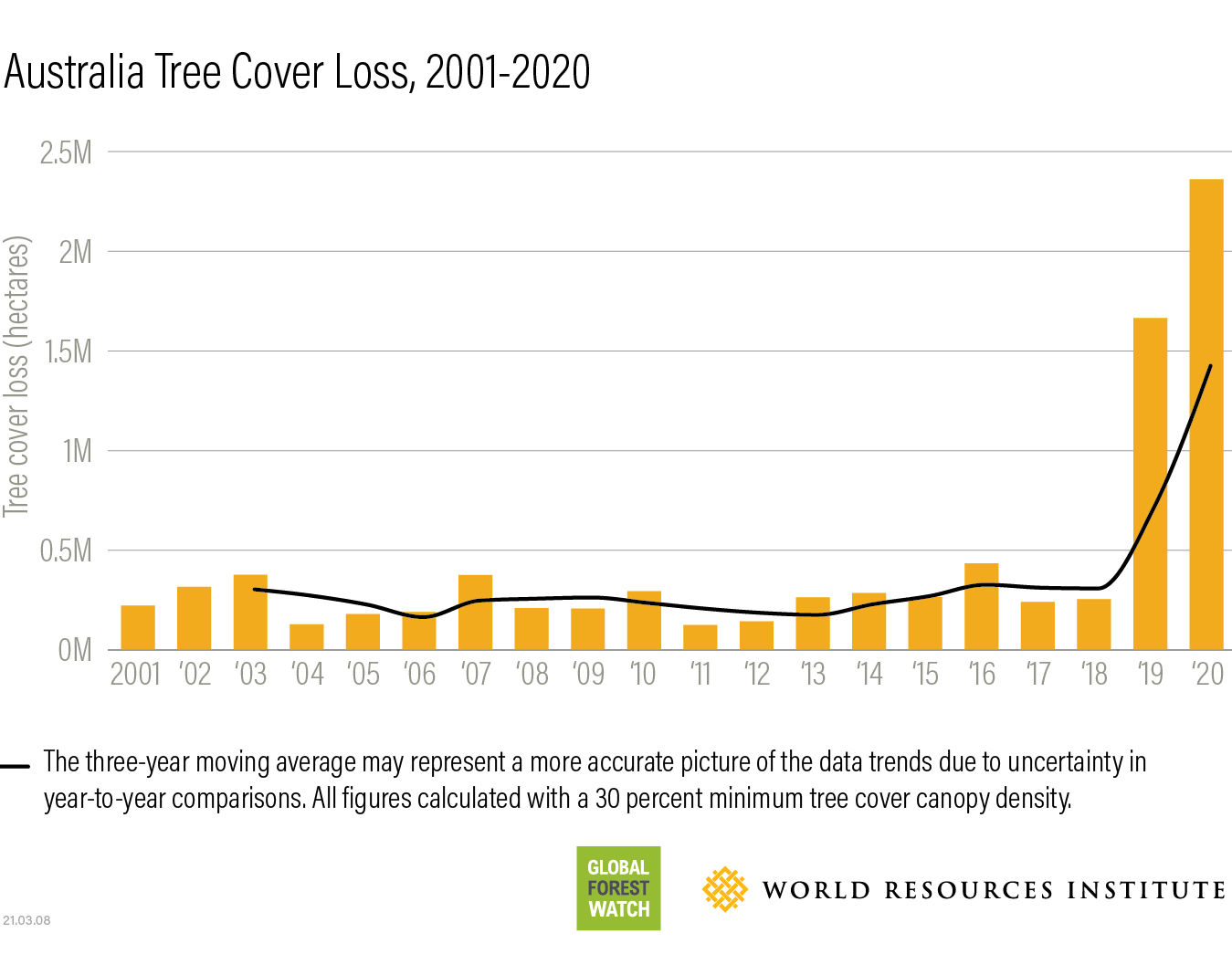

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025