Amsterdam Stock Market Opens Down 7% On Intensifying Trade War Concerns

Table of Contents

Impact of Intensifying Trade War on the AEX Index

The AEX Index, a key indicator of the Amsterdam Stock Exchange's performance, suffered a heavy blow, mirroring the broader global market reaction to the escalating trade conflict. The uncertainty created by rising tariffs and trade restrictions has significantly impacted investor confidence and market sentiment. Sectors heavily reliant on exports, such as technology and manufacturing, experienced the most substantial losses. The impact extends beyond these sectors, however, as the ripple effects of reduced trade are felt throughout the Dutch economy.

- Significant decrease in the value of major AEX listed companies: Several prominent companies saw double-digit percentage drops in their share prices, reflecting the severity of the market downturn.

- Increased market volatility and uncertainty: The AEX Index experienced sharp fluctuations throughout the day, indicating significant uncertainty and nervousness among traders.

- Negative investor sentiment impacting trading volume: Trading volume decreased considerably, suggesting many investors are adopting a wait-and-see approach or moving their investments to safer havens.

- Analysis of specific company share price drops and their relation to the trade war: Companies heavily involved in international trade, particularly those exporting to countries affected by the trade war, experienced disproportionately large drops.

Concerns about Dutch Exports and Global Supply Chains

The Netherlands, a significant player in global trade, is acutely susceptible to disruptions in global supply chains. The intensifying trade war poses a serious threat to Dutch exports, potentially leading to decreased economic growth and increased unemployment. The country's reliance on international trade makes it particularly vulnerable to trade restrictions and tariffs.

- Impact on key export sectors (e.g., agriculture, technology, logistics): Dutch agricultural exports, for example, face potential tariffs in key markets, impacting both farmers and related businesses. The technology and logistics sectors are also vulnerable due to their interconnectedness with global supply chains.

- Potential for increased import costs: Tariffs and trade barriers can lead to higher import costs for Dutch businesses, impacting production costs and potentially reducing competitiveness in the global market.

- Disruption of established trade routes and partnerships: The trade war disrupts established trade routes and partnerships, forcing Dutch companies to seek alternative markets and suppliers, incurring additional costs and complexities.

- Analysis of the potential long-term effects on Dutch economic growth: The long-term effects of the trade war on the Netherlands could include slower economic growth, reduced investment, and increased unemployment if the situation persists.

Investor Reaction and Market Predictions

The market crash has sparked a strong negative investor reaction. Many investors are moving towards safer assets, such as government bonds, reducing their exposure to riskier equities. Financial analysts offer varied predictions for the future, with some suggesting a short-term recovery, while others anticipate further declines.

- Analysis of investor flight to safer assets: A significant outflow of capital from the stock market is observed, as investors seek safety and stability in less volatile investments.

- Predictions for short-term and long-term market recovery: Short-term predictions are largely pessimistic, with analysts citing the ongoing trade tensions and global economic uncertainty as reasons for caution. Long-term predictions vary, depending on the resolution of the trade war and broader geopolitical factors.

- Expert opinions on the potential for further market decline: Some experts warn of further potential declines if the trade war escalates further or if other unforeseen global events occur.

- Strategies investors are employing to mitigate risk: Investors are adopting diverse strategies to mitigate risk, including diversification, hedging, and reducing their overall market exposure.

The Role of Geopolitical Uncertainty

The Amsterdam stock market crash isn't solely driven by the trade war. Broader geopolitical uncertainty, including political instability in various regions and rising global tensions, contributes to the negative market sentiment and increased volatility. This global uncertainty makes accurate market predictions even more challenging.

Conclusion

The 7% drop in the Amsterdam Stock Market reflects a serious response to escalating trade war concerns and broader geopolitical uncertainty. The impact on Dutch exports and investor confidence is significant, highlighting the interconnected nature of the global economy and the vulnerability of even strong economies to international trade tensions. The AEX Index serves as a key barometer of this volatility.

Call to Action: Stay informed about the evolving situation in the Amsterdam Stock Market and the impacts of the intensifying trade war. Monitor the AEX Index and other key indicators to understand the ongoing effects on the Netherlands' economy and make informed investment decisions regarding the Amsterdam Stock Market. Understanding the intricacies of the Amsterdam Stock Market’s reaction to global events is crucial for navigating these turbulent times.

Featured Posts

-

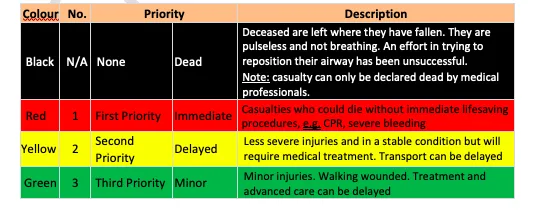

M56 Motorway Incident Car Rollover Casualty Receives Treatment

May 25, 2025

M56 Motorway Incident Car Rollover Casualty Receives Treatment

May 25, 2025 -

Lauryn Goodmans Shocking Move To Italy A New Chapter After Walker Transfer Rumors

May 25, 2025

Lauryn Goodmans Shocking Move To Italy A New Chapter After Walker Transfer Rumors

May 25, 2025 -

Konchita Vurst O Evrovidenii 2025 Ee Predskazanie Chetyrekh Pobediteley

May 25, 2025

Konchita Vurst O Evrovidenii 2025 Ee Predskazanie Chetyrekh Pobediteley

May 25, 2025 -

The National Rallys Sunday Demonstration A Lower Than Anticipated Turnout For Le Pen

May 25, 2025

The National Rallys Sunday Demonstration A Lower Than Anticipated Turnout For Le Pen

May 25, 2025 -

F1 Motorral Hajtott Porsche Teljesitmeny Es Luxus Az Utakon

May 25, 2025

F1 Motorral Hajtott Porsche Teljesitmeny Es Luxus Az Utakon

May 25, 2025

Latest Posts

-

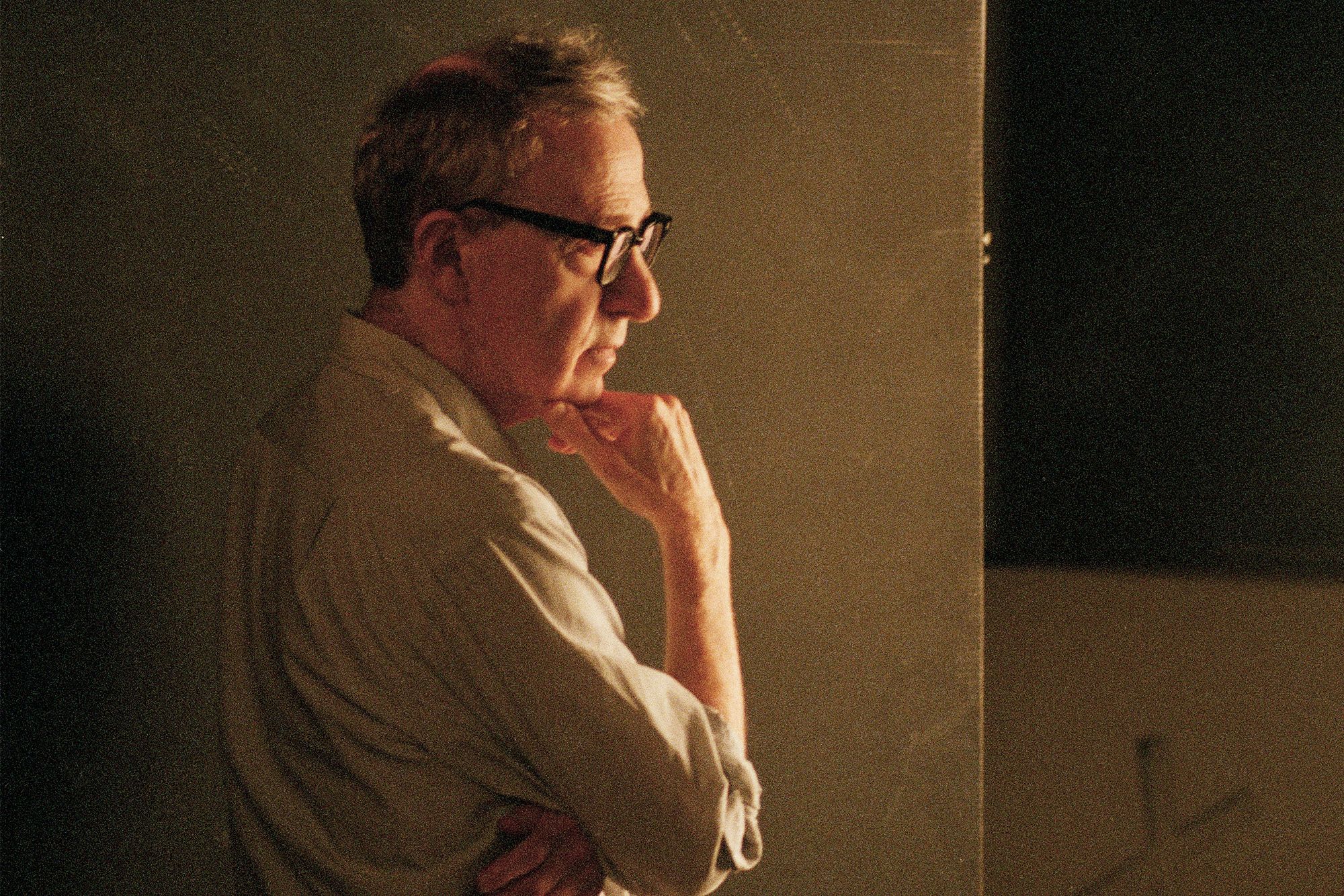

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

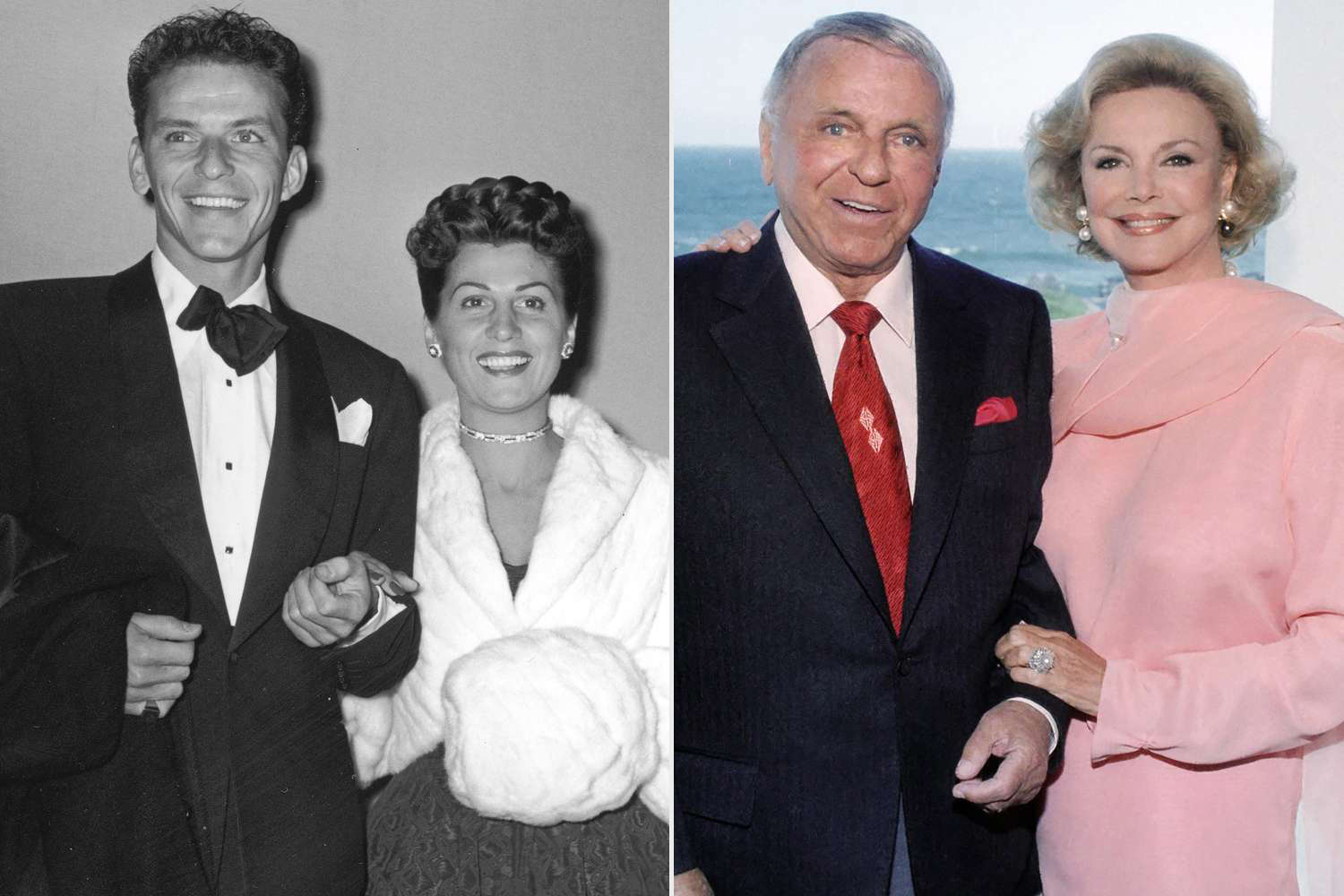

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025