Amsterdam Stock Market Reeling: 2% Drop Attributed To Trump Tariffs

Table of Contents

The Impact of Trump Tariffs on the Amsterdam Stock Market

The newly enforced tariffs on European goods are directly impacting Dutch exports, leading to decreased profitability and widespread uncertainty among investors. This uncertainty is a primary driver of the Amsterdam Stock Market's sharp decline. The ripple effect is substantial, extending beyond initial projections.

-

Specific sectors heavily impacted: The agricultural sector, a cornerstone of the Dutch economy, is experiencing significant hardship. Dairy farmers and flower exporters are particularly vulnerable, facing reduced demand and lower prices in key export markets. The manufacturing sector, another crucial component of the Dutch economy, is also feeling the pinch, with decreased orders and rising production costs. Companies reliant on exporting to the US are facing the most severe challenges.

-

Examples of companies experiencing significant stock price drops: Several prominent Dutch companies heavily involved in exporting to the US have seen their stock prices fall considerably. For instance, [Insert example of a real or hypothetical company and the percentage drop], highlighting the direct impact of the tariffs. Further analysis is required to fully assess the scope of the damage.

-

Analysis of the tariff's impact on specific Dutch industries: The impact varies considerably across different sectors. While some industries are better equipped to adapt, others are facing a direct threat to their viability. This requires a nuanced understanding of individual industry responses to effectively gauge the overall impact on the Amsterdam Stock Market.

-

Comparison to other European markets' reactions to the tariffs: While the Amsterdam Stock Market experienced a significant drop, similar downturns have been observed across other European markets. This indicates a broader concern about the implications of the Trump tariffs on the European Union's economy as a whole. However, the severity of the impact varies depending on each nation’s export profile to the United States.

Investor Sentiment and Market Volatility

Investor confidence in the Amsterdam Stock Market has taken a significant hit following the tariff announcement. The resulting volatility is considerable, with many investors adopting a cautious "wait-and-see" approach. This uncertainty is characterized by decreased trading activity in some sectors and increased volatility in others.

-

Analysis of trading volume and its correlation with the market drop: A noticeable decrease in trading volume in certain sectors indicates a reluctance among investors to commit to further investments until the situation becomes clearer. Conversely, increased trading activity in other sectors, such as defensive stocks, reflects the shift in investor priorities.

-

Expert opinions from financial analysts on the current market sentiment: Financial analysts are expressing significant concerns about the future trajectory of the Amsterdam Stock Market. Many believe that a further correction may be imminent, highlighting the fragile state of investor confidence. Specific quotes from reputable financial analysts can add significant weight to this point.

-

Discussion of potential short-term and long-term market corrections: Short-term market corrections are highly likely as investors grapple with the uncertainty created by the tariffs. Long-term implications depend largely on the duration and intensity of the trade dispute and the response of both the EU and the Dutch government.

-

Mention of investor strategies in response to the volatility (e.g., hedging, diversification): Investors are employing various strategies to mitigate the risk. Hedging against potential losses and diversifying portfolios are becoming increasingly popular approaches to navigate this period of market instability.

Potential Economic Consequences for the Netherlands

The decline in the Amsterdam Stock Market is a reflection of broader concerns about the potential negative consequences for the Dutch economy. The impact on key sectors could trigger a domino effect across the national economy.

-

Potential impact on GDP growth: The tariffs pose a significant threat to GDP growth, potentially leading to a slowdown or even a contraction depending on the duration and severity of the trade war.

-

Possible effects on employment rates: Sectors heavily impacted by the tariffs might be forced to reduce their workforce, leading to an increase in unemployment rates.

-

Government responses and potential mitigating strategies: The Dutch government is likely to implement measures to mitigate the negative impacts, potentially through financial aid to affected industries or initiatives to stimulate domestic demand.

-

Long-term economic outlook given the current market conditions: The long-term economic outlook remains uncertain, contingent on the resolution of the trade dispute and the effectiveness of governmental intervention.

International Reactions and Global Market Impact

The Amsterdam Stock Market's decline isn't isolated; it mirrors a broader global reaction to the Trump tariffs. The interconnectedness of global markets means that the impact extends far beyond national borders.

-

Comparison with other major stock markets’ responses: Similar downturns have been observed in other major European stock markets, reflecting a shared concern regarding the implications of the trade war.

-

Analysis of international trade relations in the context of the tariffs: The tariffs represent a significant escalation of tensions in international trade relations, raising questions about the future of globalization and the stability of global supply chains.

-

Discussions of potential retaliatory measures from the EU: The EU is considering retaliatory measures, which could further exacerbate the situation and increase market volatility.

Conclusion

The 2% drop in the Amsterdam Stock Market highlights the significant impact of the Trump tariffs on European economies. Investor sentiment remains fragile, and the potential economic consequences for the Netherlands are considerable. This situation demands close monitoring and careful consideration from investors, businesses, and policymakers alike. The interconnected nature of the global economy means that the implications extend far beyond the Netherlands.

Call to Action: Stay informed about the evolving situation of the Amsterdam Stock Market and its response to global trade policies. Regularly consult reputable financial news sources for the latest updates on the AEX and other relevant market indicators. Understanding the dynamics of the Amsterdam Stock Market is crucial for navigating these challenging times and making informed investment decisions.

Featured Posts

-

Court Rejects Trumps Case Against Elite Legal Representatives

May 25, 2025

Court Rejects Trumps Case Against Elite Legal Representatives

May 25, 2025 -

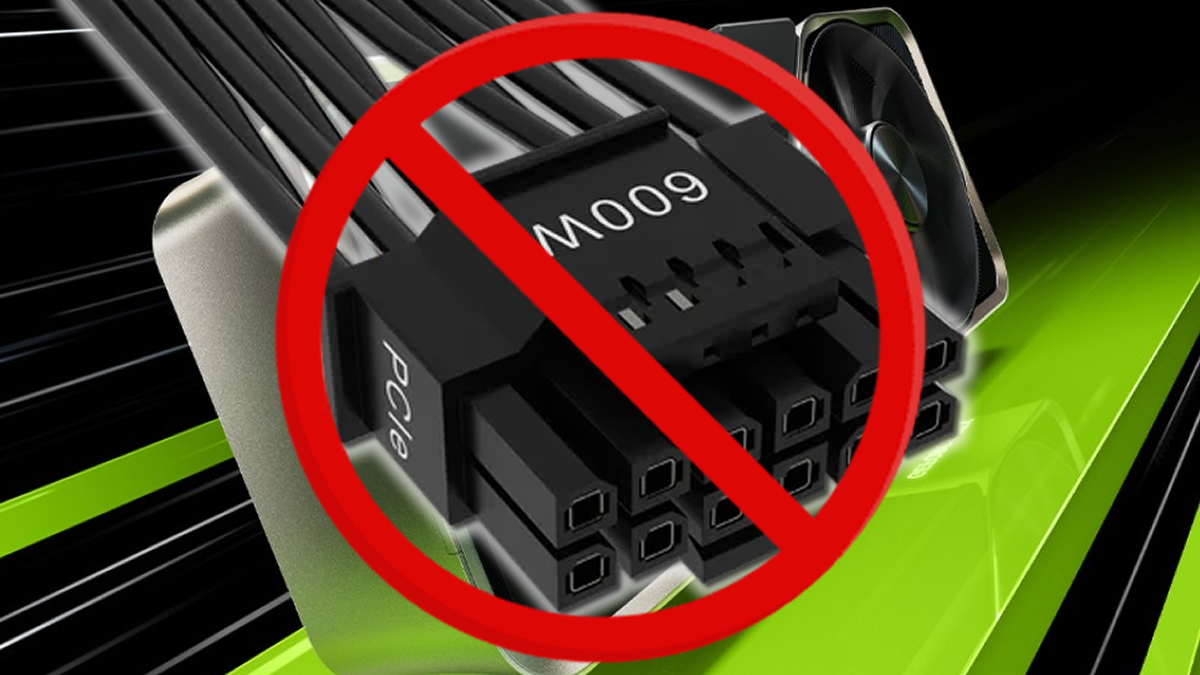

Nvidia Rtx 5060 Review Controversy A Warning For Gamers And Tech Reviewers

May 25, 2025

Nvidia Rtx 5060 Review Controversy A Warning For Gamers And Tech Reviewers

May 25, 2025 -

Rtx 5060 Review Debacle Examining The Issues And Future Expectations

May 25, 2025

Rtx 5060 Review Debacle Examining The Issues And Future Expectations

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 25, 2025

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 25, 2025

Latest Posts

-

Rtx 5060 Review Debacle Examining The Issues And Future Expectations

May 25, 2025

Rtx 5060 Review Debacle Examining The Issues And Future Expectations

May 25, 2025 -

The Rtx 5060 Launch Lessons Learned From A Disappointing Release

May 25, 2025

The Rtx 5060 Launch Lessons Learned From A Disappointing Release

May 25, 2025 -

Nvidias Rtx 5060 A Critical Analysis Of The Launch And Its Implications

May 25, 2025

Nvidias Rtx 5060 A Critical Analysis Of The Launch And Its Implications

May 25, 2025 -

The Republican Party And Trumps Strategy For A Deal

May 25, 2025

The Republican Party And Trumps Strategy For A Deal

May 25, 2025 -

Nvidia Rtx 5060 Review Controversy A Warning For Gamers And Tech Reviewers

May 25, 2025

Nvidia Rtx 5060 Review Controversy A Warning For Gamers And Tech Reviewers

May 25, 2025