Amsterdam Stock Market Slumps: AEX Index Down Over 4%

Table of Contents

Key Factors Contributing to the AEX Index Decline

Several interconnected factors have contributed to the dramatic fall in the AEX Index, impacting the Netherlands stock market and investor confidence.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty. Rising inflation, particularly in the Eurozone, is eroding consumer spending power and dampening business confidence. The threat of a recession looms large, with many economists predicting slower economic growth in the coming months. Geopolitical instability, including the ongoing conflict in Ukraine, further exacerbates the situation, disrupting supply chains and increasing energy prices. The energy crisis in Europe, driven by reduced Russian gas supplies, adds another layer of complexity, impacting businesses across various sectors.

- Rising inflation: Inflation in the Eurozone reached 9.1% in August 2022, impacting consumer spending and business confidence. (Source: Eurostat)

- Potential recession: Leading economic indicators suggest a significant risk of recession in several major European economies, impacting investor sentiment.

- Geopolitical instability: The war in Ukraine continues to disrupt global supply chains and fuel energy price volatility.

- Energy crisis: High energy prices are increasing production costs for businesses and reducing consumer disposable income.

Sector-Specific Performance

The AEX Index decline isn't uniform across all sectors. Certain sectors have been hit harder than others. The technology sector, often sensitive to interest rate hikes and economic downturns, has experienced significant losses. Energy companies, while benefiting from high energy prices in the short term, also face challenges related to supply chain disruptions and regulatory changes. Financial institutions are grappling with the implications of rising interest rates and potential loan defaults.

- Technology: ASML Holding, a major player in the semiconductor industry, saw its share price fall by X%, reflecting broader concerns about slowing tech growth.

- Energy: Shell and other energy companies experienced price drops despite high energy prices, indicating investor concerns about future demand and regulations.

- Financials: ING Groep and other financial institutions have seen their share prices decline due to concerns about rising interest rates and potential loan defaults.

Impact of Interest Rate Hikes

The European Central Bank (ECB) has recently implemented several interest rate hikes to combat inflation. These hikes increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting stock valuations. Higher interest rates make borrowing more expensive, reducing business investment and potentially leading to slower economic expansion. This impacts corporate profitability, and investors react by reducing their stock valuations.

- Increased borrowing costs: Higher interest rates make it more expensive for businesses to borrow money, potentially hindering expansion and investment.

- Reduced business investment: Businesses may postpone investment plans due to the increased cost of borrowing.

- ECB announcements: The ECB's communication regarding future interest rate hikes is carefully scrutinized by investors, influencing market sentiment. (Link to relevant ECB announcement)

Analyzing the AEX Index's Future Trajectory

Predicting the future trajectory of the AEX Index is challenging, but analyzing both short-term and long-term perspectives is crucial.

Short-Term Outlook

The short-term outlook for the AEX Index remains uncertain. Further declines are possible, depending on the evolution of global economic conditions and any further negative news impacting specific companies or sectors. However, a short-term rebound is also possible if positive economic news emerges, such as easing inflation or improved geopolitical stability. Analyst predictions vary widely; some predict further declines, while others anticipate a stabilization or even a modest recovery in the near term.

- Analyst predictions: A range of predictions exist, highlighting the uncertainty in the market. (Mention specific analyst predictions and sources).

- Potential triggers for recovery: Positive economic data, easing inflation, or positive news from major companies could trigger a market rebound.

Long-Term Implications

The long-term implications of this slump on the Dutch economy and the AEX Index will depend on several factors, including the effectiveness of government policies, the resilience of the Dutch economy, and global economic developments. The Dutch government might intervene with fiscal or monetary policies to support the economy and boost investor confidence. Historically, the AEX Index has recovered from similar downturns, but the duration of the recovery can vary significantly depending on the underlying economic circumstances.

- Government interventions: The Dutch government's response to the economic downturn will play a crucial role in shaping the long-term outlook.

- Market adjustments: The market will likely adjust to the new economic reality, leading to shifts in investment strategies and sector performance.

- Historical performance: Analyzing the AEX Index's performance after previous downturns can provide insights into potential recovery paths.

Strategies for Investors in the Current Market

Navigating the current volatile market requires a cautious and strategic approach.

Risk Management Strategies

In a volatile market, risk management is paramount. Investors should prioritize diversification to spread their investments across various asset classes and sectors, reducing their exposure to any single risk. Hedging strategies can help mitigate losses, while setting stop-loss orders can protect against significant declines. Regularly reviewing and adjusting your portfolio is crucial to adapt to changing market conditions.

- Diversification: Spread investments across different asset classes (stocks, bonds, real estate) and sectors.

- Hedging strategies: Employ strategies like options trading to limit potential losses.

- Stop-loss orders: Set automatic sell orders to limit potential losses on individual investments.

Opportunities Amidst the Decline

While the current market presents challenges, it also creates opportunities for astute investors. Value investing, focusing on identifying undervalued stocks with strong fundamentals, can be particularly effective during market downturns. Thorough research and due diligence are critical to identifying companies with long-term growth potential that are currently trading at discounted prices.

- Value investing: Focus on identifying undervalued companies with strong fundamentals.

- Undervalued stocks: Look for companies whose share prices have fallen disproportionately compared to their intrinsic value.

- Due diligence: Conduct thorough research before making any investment decisions.

Conclusion

The slump in the Amsterdam Stock Market, marked by the AEX Index plummeting over 4%, is a result of a confluence of factors, including global economic uncertainty, sector-specific challenges, and the impact of interest rate hikes. The short-term outlook remains uncertain, but the long-term implications depend on various factors including government interventions and market adjustments. Investors should prioritize risk management, employing strategies like diversification and hedging, while also seeking opportunities created by the market decline through careful research and due diligence. Stay informed about the Amsterdam Stock Market and the AEX Index fluctuations. Monitor market news, consult financial advisors, and make informed investment decisions based on your risk tolerance. Regularly check for updates on the AEX index and its performance to navigate the current market volatility effectively.

Featured Posts

-

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf An Investors Guide

May 25, 2025

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf An Investors Guide

May 25, 2025 -

Amsterdam Markets React To Trade War 7 Initial Plunge

May 25, 2025

Amsterdam Markets React To Trade War 7 Initial Plunge

May 25, 2025 -

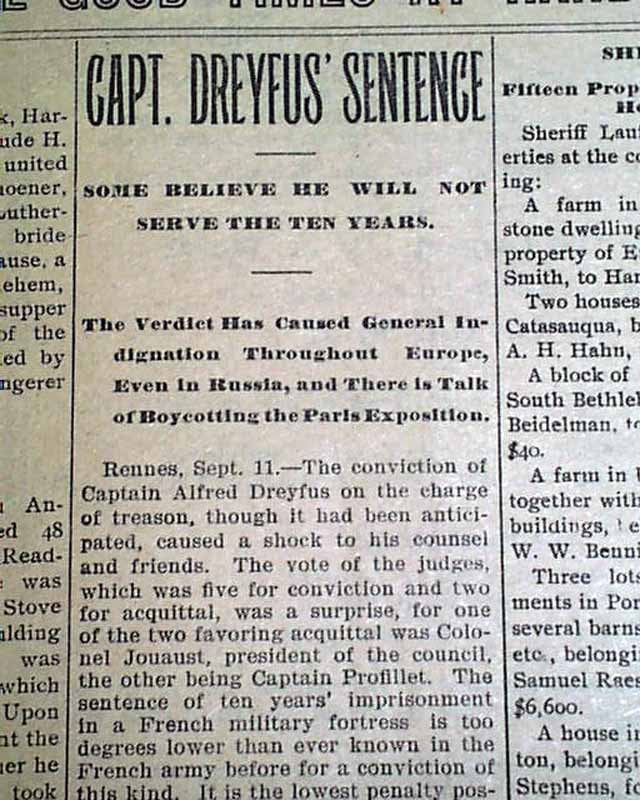

French Lawmakers Push For Dreyfus Promotion 130 Years On

May 25, 2025

French Lawmakers Push For Dreyfus Promotion 130 Years On

May 25, 2025 -

Mia Farrow And Christina Ricci At The Florida Film Festival

May 25, 2025

Mia Farrow And Christina Ricci At The Florida Film Festival

May 25, 2025 -

80 Millio Forintos Extrakkal Felszerelt Porsche 911

May 25, 2025

80 Millio Forintos Extrakkal Felszerelt Porsche 911

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025