Amsterdam Stock Market Suffers Significant Losses: Index Falls Below Key Level

Table of Contents

Key Index Performance and Percentage Drop

The AEX index, a key indicator of the Amsterdam Stock Market's performance, suffered a substantial blow today, plummeting by 4.2%. This represents a significant drop from yesterday's closing price and places the index at its lowest point in the last three months. Compared to the year's high reached in April, the AEX is down a concerning 12%. The accompanying chart visually demonstrates this sharp decline. The AMX index, which tracks mid-cap companies, also experienced a decline, falling by 3.8%.

- AEX Index Decrease: 4.2%

- AEX Index Compared to Previous Day: Down 4.2%

- AEX Index Year-to-Date Performance: Down 12% from the year's high

- AMX Index Decrease: 3.8%

[Insert chart/graph showing AEX and AMX index performance]

Underlying Causes of the Market Decline

Several factors contributed to today's sharp decline in the Amsterdam Stock Market. Global economic headwinds played a significant role, with rising inflation and increasing interest rates dampening investor sentiment across major global markets, including the Amsterdam Stock Exchange. Geopolitical instability, particularly the ongoing situation in Eastern Europe, continues to fuel uncertainty and risk aversion.

- Global Inflation: Persistently high inflation rates globally are eroding purchasing power and impacting corporate profits, leading to investor caution.

- Rising Interest Rates: Central banks' efforts to combat inflation through interest rate hikes increase borrowing costs for businesses, impacting investment and growth.

- Geopolitical Instability: The ongoing conflict in Eastern Europe and related energy price volatility contribute to market uncertainty and risk aversion.

- Sector-Specific Performance: The energy sector, while initially benefiting from high prices, is now showing signs of slowing growth, impacting the overall Amsterdam Stock Market performance. The technology sector also experienced a significant decline.

Impact on Individual Stocks

The downturn significantly impacted several individual companies listed on the Amsterdam Stock Market. For instance, ASML Holding, a major player in the semiconductor industry, saw its share price drop by 5%, while Unilever experienced a 3% decline. These drops reflect broader concerns about global economic growth and industry-specific challenges.

- ASML Holding: 5% drop, reflecting concerns about slowing semiconductor demand.

- Unilever: 3% drop, partly attributed to concerns about consumer spending.

- Sector-Specific Impacts: The energy and technology sectors were particularly hard hit, reflecting global trends and investor sentiment.

Investor Sentiment and Future Outlook

Investor sentiment towards the Amsterdam Stock Market is currently cautious. Many analysts are closely monitoring global economic indicators and geopolitical developments for clues about the market's potential recovery. While the short-term outlook remains uncertain, several analysts predict a gradual recovery in the coming months, contingent on easing inflation and improved geopolitical stability. However, some suggest a period of volatility may persist.

- Analyst Quotes: "The current market downturn reflects global anxieties," stated Jan de Vries, a senior analyst at ABN AMRO. "However, we anticipate a gradual recovery based on our economic forecasts."

- Short-Term Outlook: Analysts predict continued volatility in the short term, with potential for further minor corrections.

- Long-Term Outlook: The long-term outlook is more optimistic, contingent on positive economic data and a resolution to geopolitical tensions.

- Investor Strategies: Diversification and a long-term investment approach are recommended strategies for navigating the current market uncertainty.

Conclusion

Today's significant drop in the Amsterdam Stock Market, with the AEX index falling by 4.2%, highlights the impact of global economic challenges and geopolitical uncertainty. The decline affected various sectors and individual stocks, reflecting a broader investor concern. While the short-term outlook remains uncertain, analysts predict a gradual recovery contingent on improved economic and geopolitical conditions.

Call to Action: Stay informed about the evolving situation in the Amsterdam Stock Market. Monitor key indices like the AEX and AMX, and individual stock performance closely. Regularly consult reputable financial news sources for updated analysis and insights on the Amsterdam Stock Market's recovery and future trajectory. Consider seeking professional financial advice before making any investment decisions related to the Amsterdam Stock Market or Dutch equities.

Featured Posts

-

The Nfls War On Butts A Look At The Tush Push Controversy And Its Resolution

May 24, 2025

The Nfls War On Butts A Look At The Tush Push Controversy And Its Resolution

May 24, 2025 -

Gryozy Lyubvi Ili Ilicha Podrobniy Razbor Publikatsii V Gazete Trud

May 24, 2025

Gryozy Lyubvi Ili Ilicha Podrobniy Razbor Publikatsii V Gazete Trud

May 24, 2025 -

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025 -

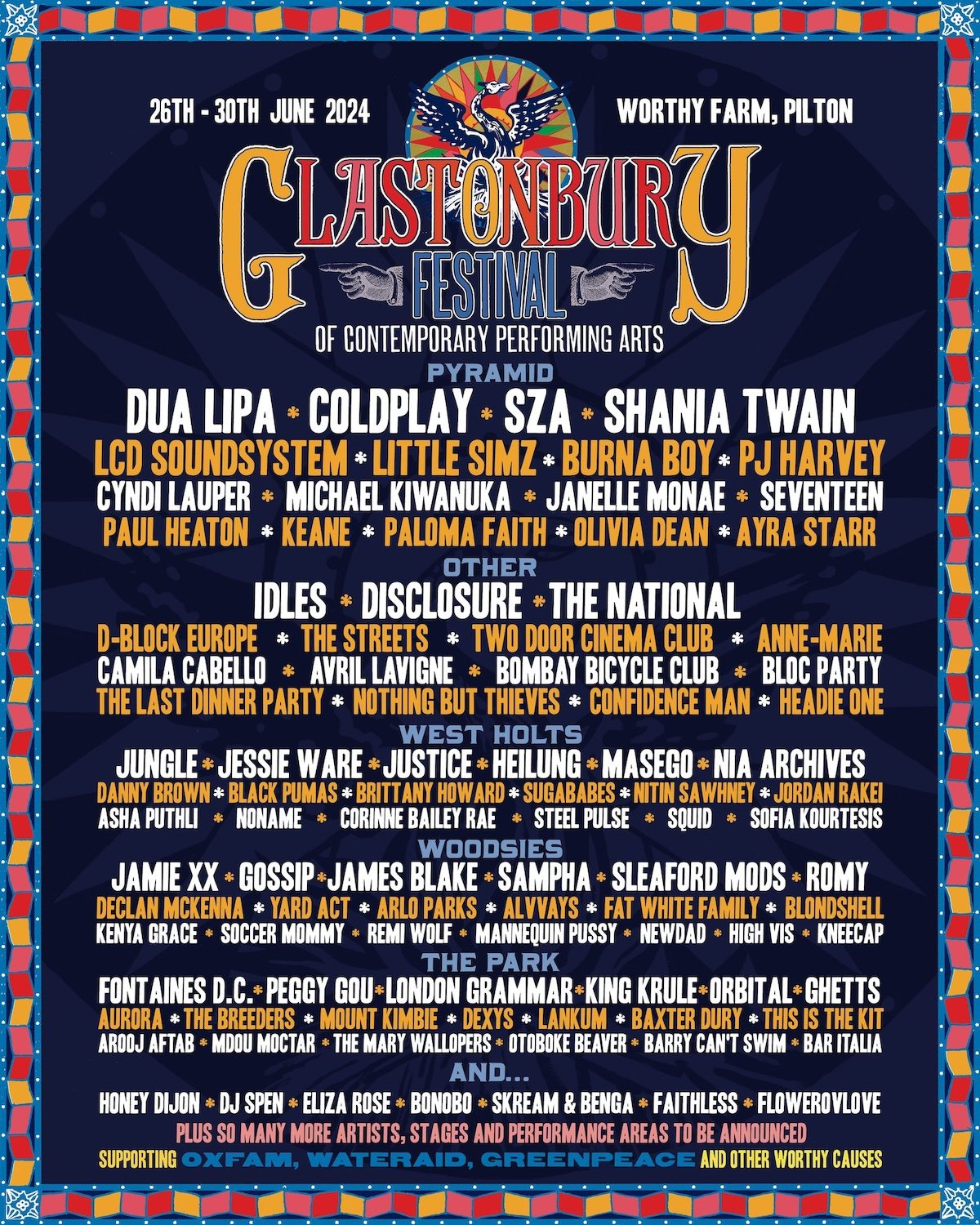

Glastonbury 2024 Unannounced Us Band Performance Confirmed

May 24, 2025

Glastonbury 2024 Unannounced Us Band Performance Confirmed

May 24, 2025 -

Unfall In Stemwede Details Zum Zusammenstoss Eines Autos Mit Einem Baum

May 24, 2025

Unfall In Stemwede Details Zum Zusammenstoss Eines Autos Mit Einem Baum

May 24, 2025

Latest Posts

-

Essen Shajee Traders Wegen Hygienemaengeln Geschlossen

May 24, 2025

Essen Shajee Traders Wegen Hygienemaengeln Geschlossen

May 24, 2025 -

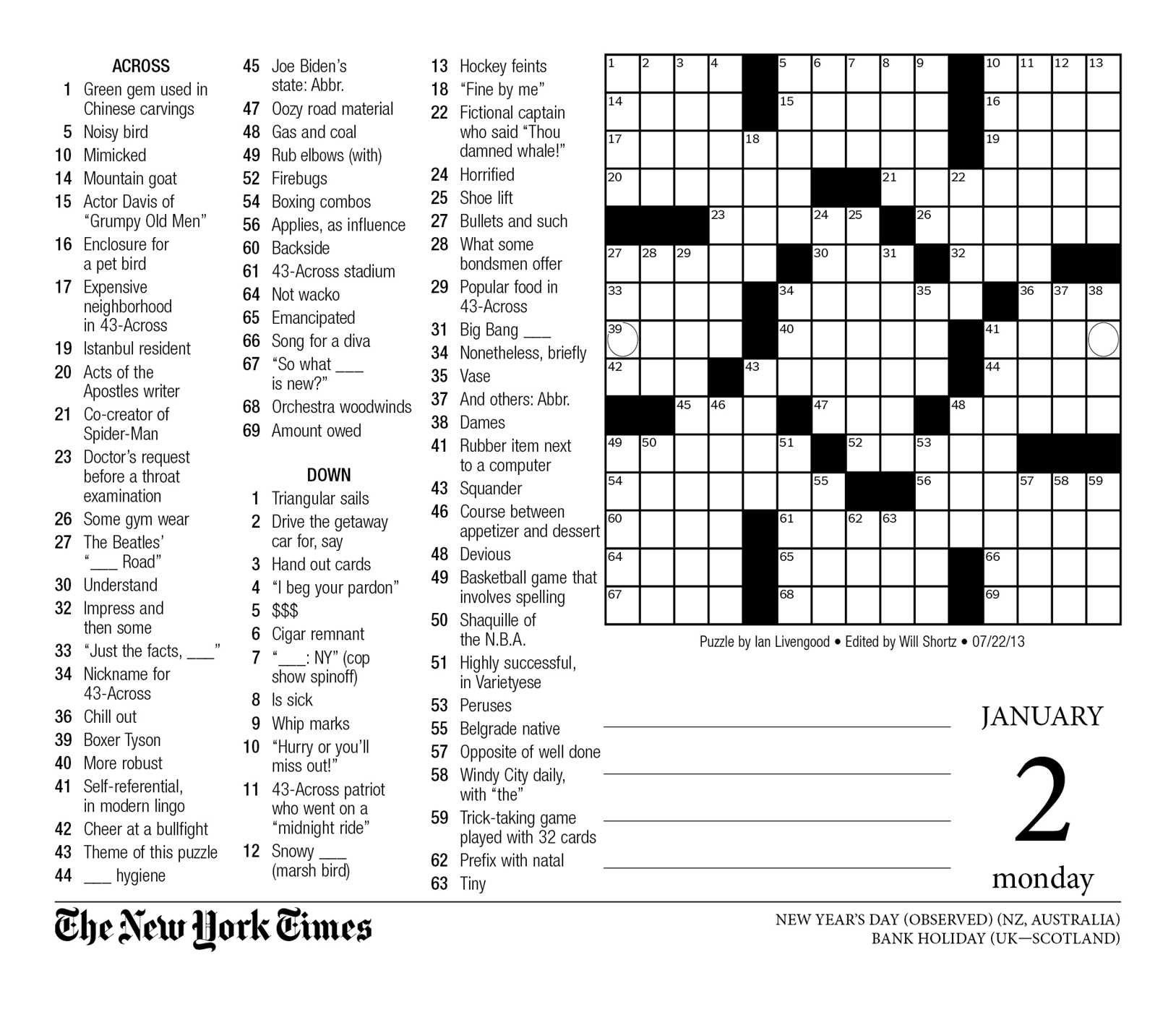

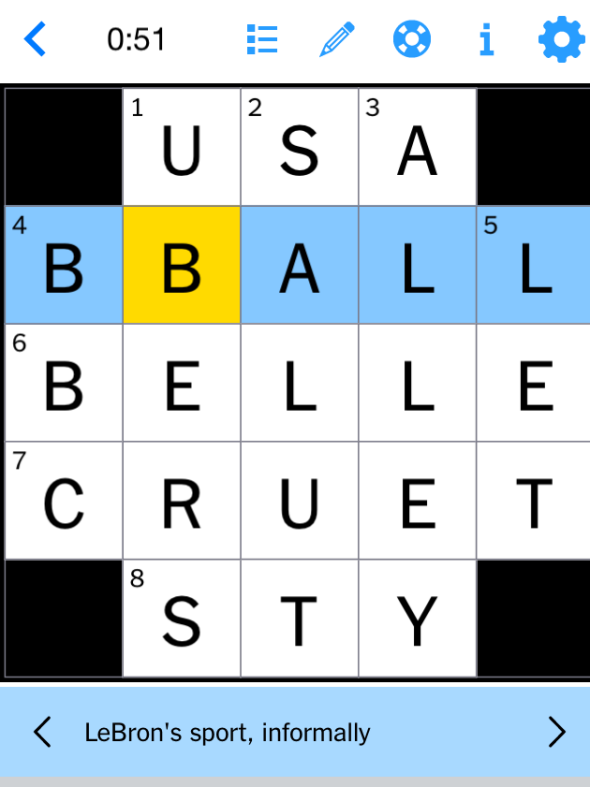

Solve The Nyt Mini Crossword April 8 2025 Tuesday Answers And Clues

May 24, 2025

Solve The Nyt Mini Crossword April 8 2025 Tuesday Answers And Clues

May 24, 2025 -

Nyt Mini Crossword Puzzle Solutions March 3 2025

May 24, 2025

Nyt Mini Crossword Puzzle Solutions March 3 2025

May 24, 2025 -

March 3 2025 Nyt Mini Crossword Find The Answers Here

May 24, 2025

March 3 2025 Nyt Mini Crossword Find The Answers Here

May 24, 2025 -

May 1st Nyt Mini Crossword Answer The Marvel Avengers Clue

May 24, 2025

May 1st Nyt Mini Crossword Answer The Marvel Avengers Clue

May 24, 2025