Amundi DJIA UCITS ETF: A Detailed Look At Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

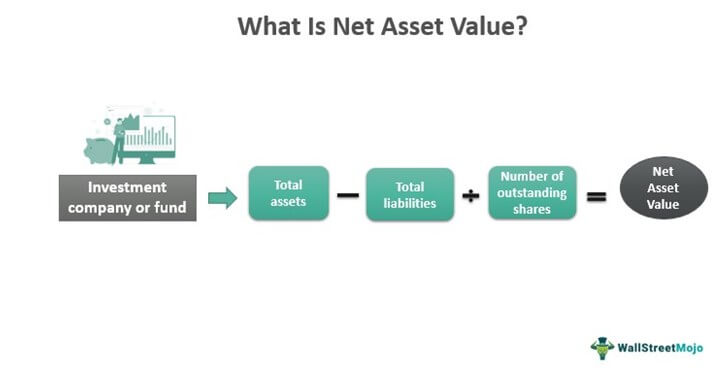

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. In simpler terms, it's the current market value of everything the ETF owns, less any debts, divided by the number of outstanding shares. For the Amundi DJIA UCITS ETF, this means the NAV reflects the collective value of the underlying Dow Jones Industrial Average components held within the ETF.

Understanding the NAV is paramount for several reasons:

- NAV reflects the ETF's underlying asset value: It provides a true picture of the intrinsic worth of your investment, independent of market fluctuations in the ETF's trading price.

- Daily NAV fluctuations show ETF performance: Tracking daily NAV changes allows you to monitor the ETF's performance against the DJIA.

- NAV is crucial for comparing ETF prices with intrinsic value: By comparing the ETF's market price to its NAV, you can identify potential arbitrage opportunities or signs of market mispricing.

- Understanding NAV helps assess investment performance accurately: NAV provides a consistent measure of your investment's growth, unaffected by short-term market volatility.

- NAV transparency builds investor confidence in Amundi DJIA UCITS ETF: The readily available NAV data demonstrates the ETF's transparency and accountability.

How is the NAV of the Amundi DJIA UCITS ETF Calculated?

The NAV of the Amundi DJIA UCITS ETF is calculated daily, typically at the close of the market. The process involves:

- Daily calculation based on closing prices of the DJIA components: The fund manager aggregates the closing prices of all 30 companies comprising the DJIA, weighted according to their representation in the index.

- Consideration of currency exchange rates if applicable: If the ETF holds any assets denominated in currencies other than the base currency of the ETF, appropriate exchange rates are applied.

- Accounting for management fees and expenses: The total value of assets is reduced by the fund's management fees and other operating expenses.

- Transparency in methodology provided by Amundi: Amundi, the fund manager, publicly discloses its NAV calculation methodology, ensuring transparency and investor confidence.

- Availability of daily NAV data on Amundi's website and financial platforms: The daily NAV is readily accessible through Amundi's official website and major financial data providers.

Factors Affecting the Amundi DJIA UCITS ETF's NAV

Several factors influence the Amundi DJIA UCITS ETF's NAV, impacting the overall value of your investment. These include:

- Market sentiment and investor confidence: Broad market trends and investor sentiment significantly affect the DJIA and, consequently, the ETF's NAV. Positive market sentiment generally leads to higher NAVs.

- Global economic news and events: Major economic announcements, geopolitical events, and unexpected news can cause significant fluctuations in the DJIA and the ETF's NAV.

- Performance of individual DJIA companies (e.g., Apple, Microsoft): The performance of individual companies within the DJIA directly impacts the overall index value and, therefore, the ETF's NAV. Strong performance by major components like Apple or Microsoft can boost the NAV.

- Currency fluctuations (if the ETF holds international assets): While the DJIA is a US-dollar denominated index, currency fluctuations can indirectly influence the NAV if the ETF holds international assets or its investors are from different regions.

- Unexpected events impacting specific DJIA companies: Unexpected corporate news, such as earnings surprises, product recalls, or lawsuits, can significantly affect individual company valuations and, by extension, the ETF's NAV.

Using NAV to Make Informed Investment Decisions in the Amundi DJIA UCITS ETF

Utilizing NAV data is key to making informed investment decisions with the Amundi DJIA UCITS ETF:

- Track NAV changes to monitor investment growth: Regularly monitoring NAV fluctuations allows you to assess your investment's performance over time.

- Compare NAV with market price to identify potential arbitrage opportunities: If the ETF's market price deviates significantly from its NAV, it may present an arbitrage opportunity.

- Analyze NAV trends to understand long-term performance: Analyzing NAV trends over longer periods can reveal underlying patterns and help in predicting future performance.

- Use NAV data to manage risk and adjust investment strategies: Understanding NAV helps in assessing risk and making adjustments to your investment strategy based on market conditions.

- Consider using stop-loss orders based on NAV movements: Stop-loss orders based on NAV can help limit potential losses during market downturns.

Conclusion

Understanding the Net Asset Value (NAV) is fundamental for any investor in the Amundi DJIA UCITS ETF. By carefully analyzing NAV data and considering the factors that influence it, you can gain valuable insights into the ETF’s performance and make more informed investment decisions. Regularly monitoring the Amundi DJIA UCITS ETF's NAV, combined with a broader investment strategy, can contribute to long-term success. Learn more about Amundi DJIA UCITS ETF NAV and other key metrics to optimize your investment strategy today!

Featured Posts

-

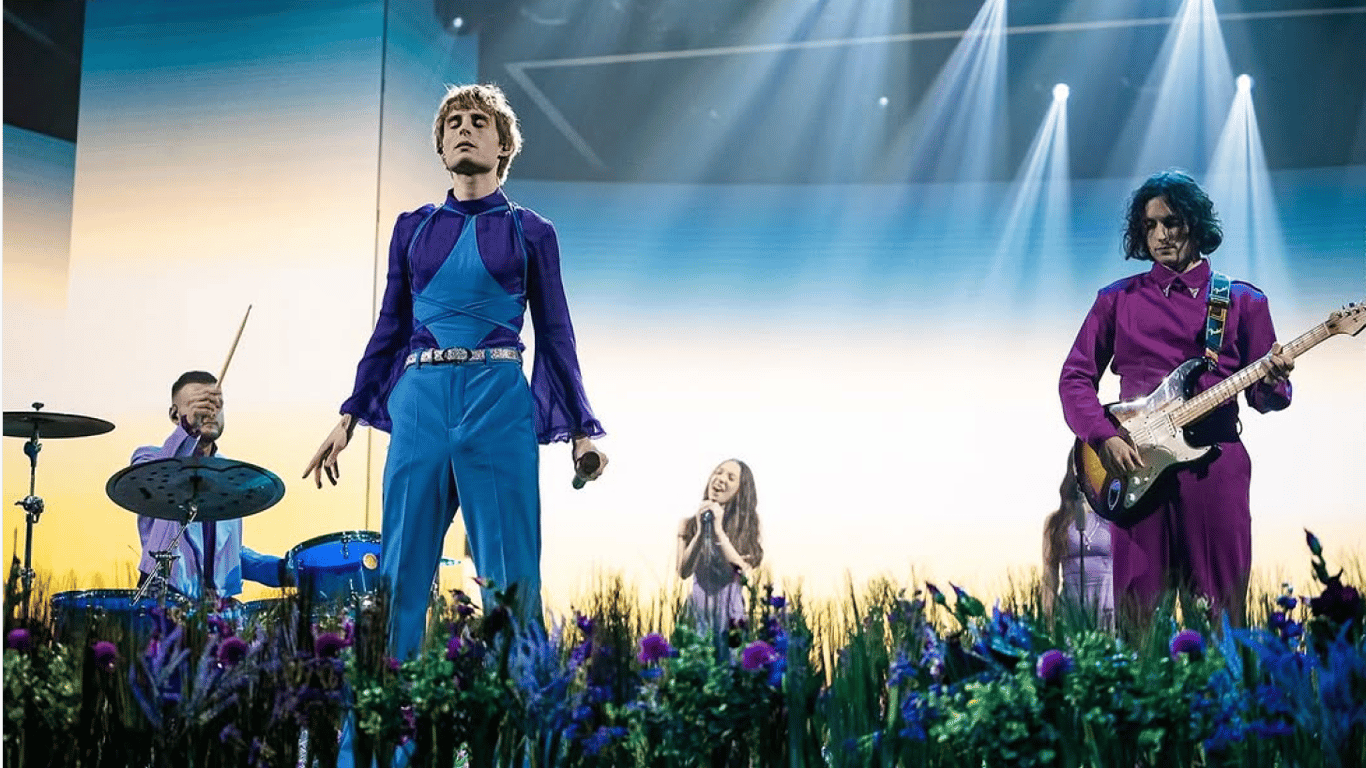

Yevrobachennya 2025 Prognoz Konchiti Vurst Na Chotirokh Peremozhtsiv

May 25, 2025

Yevrobachennya 2025 Prognoz Konchiti Vurst Na Chotirokh Peremozhtsiv

May 25, 2025 -

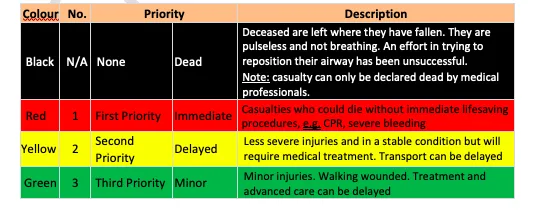

M56 Motorway Incident Car Rollover Casualty Receives Treatment

May 25, 2025

M56 Motorway Incident Car Rollover Casualty Receives Treatment

May 25, 2025 -

Thlyl Adae Daks 30 Tjawz Dhrwt Mars Lawl Mrt Fy Awrwba

May 25, 2025

Thlyl Adae Daks 30 Tjawz Dhrwt Mars Lawl Mrt Fy Awrwba

May 25, 2025 -

Analyzing The Net Asset Value Nav For Amundi Msci World Ii Ucits Etf Dist

May 25, 2025

Analyzing The Net Asset Value Nav For Amundi Msci World Ii Ucits Etf Dist

May 25, 2025 -

Hospodarsky Pokles V Nemecku H Nonline Sk Prinasa Prehlad O Prepustani

May 25, 2025

Hospodarsky Pokles V Nemecku H Nonline Sk Prinasa Prehlad O Prepustani

May 25, 2025

Latest Posts

-

Heinekens Q Quarter Results Revenue Beats Estimates Outlook Confirmed

May 25, 2025

Heinekens Q Quarter Results Revenue Beats Estimates Outlook Confirmed

May 25, 2025 -

Heineken Revenue Surpasses Projections Outlook Remains Strong Despite Tariff Challenges

May 25, 2025

Heineken Revenue Surpasses Projections Outlook Remains Strong Despite Tariff Challenges

May 25, 2025 -

Heineken Tops Revenue Expectations Reaffirms Outlook Despite Tariffs

May 25, 2025

Heineken Tops Revenue Expectations Reaffirms Outlook Despite Tariffs

May 25, 2025 -

7 Plunge Amsterdam Stock Market Hit Hard By Trade War Fears

May 25, 2025

7 Plunge Amsterdam Stock Market Hit Hard By Trade War Fears

May 25, 2025 -

Sharp Decline In Amsterdam Stock Market 7 Drop At Open Due To Trade War

May 25, 2025

Sharp Decline In Amsterdam Stock Market 7 Drop At Open Due To Trade War

May 25, 2025