Amundi Dow Jones Industrial Average UCITS ETF: Factors Affecting NAV

Table of Contents

Market Performance of Underlying Assets

The most significant driver of the Amundi Dow Jones Industrial Average UCITS ETF NAV is the performance of the 30 companies that constitute the DJIA. The ETF aims to replicate the index, meaning its value is directly tied to the collective performance of these underlying assets.

-

Individual Stock Price Movements: Fluctuations in the price of any single DJIA component will impact the overall NAV. A strong performance by a heavily weighted company like Apple will positively influence the ETF's NAV, while a decline in a significant company can have a negative effect.

-

Sector-Specific Performance: The DJIA comprises companies across various sectors, including technology, financials, industrials, and consumer goods. Strong performance in a particular sector will boost the ETF's NAV, while underperformance in a dominant sector can negatively impact it. For example, a downturn in the technology sector could significantly affect the ETF's NAV if technology companies hold a large weighting within the index.

-

Overall Market Trends: Broader market trends – bull markets (characterized by rising prices) and bear markets (characterized by falling prices) – have a substantial impact. During bull markets, the overall NAV tends to increase, and vice-versa. Understanding prevailing market sentiment and trends is therefore essential when analyzing the Amundi Dow Jones Industrial Average UCITS ETF NAV. Factors like inflation, interest rate changes, and geopolitical events contribute to these broader market trends, ultimately influencing the DJIA and, consequently, the ETF's NAV. Monitoring indicators like the VIX volatility index can provide insight into market sentiment and potential volatility affecting the DJIA components and therefore the ETF's NAV. The index weighting of each DJIA company plays a significant role in determining the sensitivity of the ETF's NAV to the performance of individual stocks. Companies with higher weightings will have a more pronounced effect.

Currency Exchange Rate Fluctuations

For investors whose base currency isn't the US dollar (USD), currency exchange rate fluctuations can significantly influence the NAV expressed in their local currency.

-

USD Strength/Weakness: A stronger US dollar relative to an investor's home currency will translate to a lower NAV when converted, while a weaker US dollar will result in a higher NAV (all else being equal).

-

Hedging Strategies: The ETF provider might employ hedging strategies to mitigate currency risk. However, these strategies are not always fully effective, and some residual currency risk may remain. Understanding the ETF provider’s hedging policy is crucial for investors sensitive to currency fluctuations.

-

Currency Risk Management: Investors should carefully consider the currency risk associated with investing in a USD-denominated ETF if their base currency is different. Diversification and hedging strategies can help manage this risk.

Expense Ratio and Management Fees

The ETF's expense ratio, which covers management fees and other operational costs, directly impacts the NAV over time.

-

Impact on Long-Term Returns: The annual expense ratio erodes returns gradually. A higher expense ratio will result in a lower NAV compared to an ETF with a lower expense ratio, all other things being equal. Therefore, comparing expense ratios with similar ETFs is crucial before investing.

-

Other Fees: While the expense ratio is the most prominent fee, it's essential to check the ETF's prospectus for any additional fees that might apply, as these could also affect the NAV.

Dividend Distributions

Dividend payments from the underlying DJIA companies directly affect the ETF's NAV.

-

Ex-Dividend Date: The ex-dividend date is when the price of the ETF adjusts to reflect the upcoming dividend payment. Understanding the ex-dividend date allows investors to make informed decisions about buying or selling the ETF to capture or avoid the dividend.

-

Dividend Reinvestment: Whether the ETF reinvests dividends or distributes them to shareholders impacts the NAV. Reinvestment generally leads to gradual growth in NAV over time.

-

Tax Implications: Dividend distributions are often subject to taxation. Investors need to be aware of the tax implications in their jurisdiction when considering dividend payments from the ETF.

Supply and Demand Dynamics

Trading activity and investor sentiment can influence the market price of the Amundi Dow Jones Industrial Average UCITS ETF, which may temporarily deviate from the NAV.

-

Trading Volume: High trading volume can lead to price fluctuations independent of the underlying assets' performance.

-

NAV Premium/Discount: The market price of the ETF may trade at a premium or discount to its NAV, driven by supply and demand forces. These discrepancies are usually temporary and tend to correct themselves over time.

-

Arbitrage Opportunities: These temporary price discrepancies between the market price and NAV create potential arbitrage opportunities for sophisticated investors.

Conclusion: Making Informed Decisions about the Amundi Dow Jones Industrial Average UCITS ETF

The Amundi Dow Jones Industrial Average UCITS ETF NAV is influenced by a multitude of factors, including the performance of the underlying DJIA companies, currency fluctuations, expense ratios, dividend distributions, and supply and demand dynamics. Understanding these factors is crucial for making informed investment decisions. While the NAV is a vital metric, it's important to remember it's only one piece of the puzzle when assessing the ETF's overall performance and suitability for your portfolio. Before investing in the Amundi Dow Jones Industrial Average UCITS ETF or similar ETFs tracking the DJIA, we strongly encourage you to conduct thorough research, considering all the factors discussed above, and seek professional financial advice if needed.

Featured Posts

-

Best Of Bangladesh Europe 2024 Focus On Collaboration And Growth

May 24, 2025

Best Of Bangladesh Europe 2024 Focus On Collaboration And Growth

May 24, 2025 -

Apples Resilience Assessing The Impact Of Past And Future Tariffs

May 24, 2025

Apples Resilience Assessing The Impact Of Past And Future Tariffs

May 24, 2025 -

Is An Escape To The Country Right For You A Realistic Look

May 24, 2025

Is An Escape To The Country Right For You A Realistic Look

May 24, 2025 -

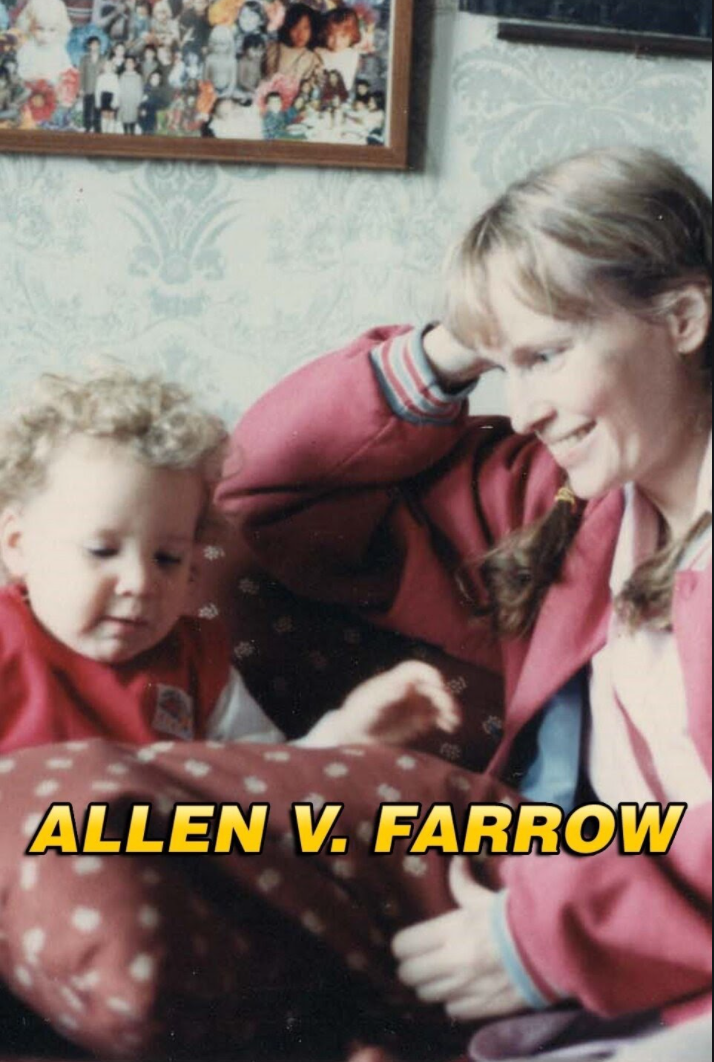

Broadway Buzz Mia Farrow And Sadie Sink Photo 5162787 Captures A Special Moment

May 24, 2025

Broadway Buzz Mia Farrow And Sadie Sink Photo 5162787 Captures A Special Moment

May 24, 2025 -

Dokumentalniy Film K Yubileyu Smoktunovskogo Menya Vela Kakaya To Sila

May 24, 2025

Dokumentalniy Film K Yubileyu Smoktunovskogo Menya Vela Kakaya To Sila

May 24, 2025

Latest Posts

-

Dispute Over Dylan Farrows Accusations Sean Penns Perspective

May 24, 2025

Dispute Over Dylan Farrows Accusations Sean Penns Perspective

May 24, 2025 -

Dylan Farrow And Woody Allen Sean Penn Weighs In

May 24, 2025

Dylan Farrow And Woody Allen Sean Penn Weighs In

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Case

May 24, 2025 -

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025 -

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 24, 2025

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 24, 2025