Amundi Dow Jones Industrial Average UCITS ETF: NAV Analysis And Implications

Table of Contents

Exchange-Traded Funds (ETFs) tracking the Dow Jones Industrial Average are incredibly popular, offering investors a simple way to gain exposure to some of the world's largest and most influential companies. The Amundi Dow Jones Industrial Average UCITS ETF is a prime example, providing efficient access to this iconic index. However, understanding the intricacies of this investment, particularly its Net Asset Value (NAV), is crucial for making informed investment decisions. This article aims to analyze the ETF's NAV and its implications for investors, equipping you with the knowledge to navigate this popular investment vehicle.

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets. Simply put, it's the total value of all the stocks held within the ETF, minus any liabilities, divided by the number of outstanding shares. For ETFs like the Amundi Dow Jones Industrial Average UCITS ETF, the NAV is calculated daily by summing the market value of each company in the Dow Jones Industrial Average weighted according to the ETF's holdings.

Understanding NAV is paramount for several reasons:

- NAV reflects the underlying asset value: It provides a true measure of the intrinsic worth of the ETF's holdings, independent of market fluctuations in the ETF's share price.

- NAV fluctuations indicate market movements: Changes in the NAV directly reflect the performance of the underlying Dow Jones Industrial Average. An increase in NAV suggests positive market movement, while a decrease signifies negative movement.

- Comparing NAV with market price helps identify arbitrage opportunities: While ideally, the ETF's market price should closely track its NAV, temporary discrepancies might arise, creating potential arbitrage opportunities for savvy traders.

- Monitoring NAV trends provides insights into investment performance: Tracking NAV over time allows investors to assess the long-term performance of their investment and compare it against the benchmark index.

Amundi Dow Jones Industrial Average UCITS ETF: A Detailed NAV Analysis

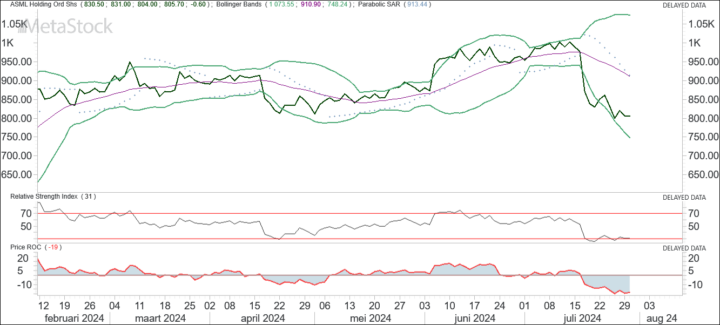

Analyzing the historical NAV of the Amundi Dow Jones Industrial Average UCITS ETF reveals valuable insights into its performance. (Insert a chart or graph here showing historical NAV data over a suitable period, e.g., 5 years). This visual representation will clearly illustrate the NAV trends over short-term, medium-term, and long-term periods.

Several factors influence NAV fluctuations:

-

Market conditions: Broad market trends, such as bull or bear markets, significantly impact the NAV.

-

Economic indicators: Macroeconomic factors like interest rates, inflation, and GDP growth can influence the performance of the underlying companies and thus the NAV.

-

Individual stock performance within the DJIA: The performance of individual companies within the Dow Jones Industrial Average directly affects the overall NAV of the ETF.

-

Key NAV statistics: (Include key statistics like average NAV, median NAV, and standard deviation of NAV over the period shown in the chart.) These figures provide a quantitative overview of the ETF's NAV behavior.

-

Significant NAV changes: (Highlight specific periods of significant NAV increase or decrease and analyze the contributing factors, referencing relevant news events or economic conditions.)

-

Benchmark comparison: (Compare the NAV performance against the Dow Jones Industrial Average itself. How closely does the ETF track the index?)

-

Dividend impact: (Discuss the effect of dividend payouts from the underlying companies on the NAV. Do dividends increase or decrease the NAV, and by how much?)

Impact of Expense Ratio on NAV

The ETF's expense ratio, which represents the annual cost of managing the fund, directly impacts NAV growth. A higher expense ratio means a larger deduction from the NAV over time, reducing the overall return for investors. (If possible, provide calculations showing the impact of the expense ratio on NAV growth over a given period. Compare the Amundi ETF's expense ratio to similar ETFs tracking the Dow Jones Industrial Average to highlight its competitiveness.)

Implications for Investors: Strategies Based on NAV Analysis

Understanding NAV is a powerful tool for developing effective investment strategies. Investors can use NAV analysis to make informed decisions:

- Buy low, sell high: While not foolproof, identifying periods of relatively low NAV compared to the market price might present attractive buying opportunities, while periods of high NAV might suggest suitable selling points.

- Dollar-cost averaging: Regular investments at consistent intervals, regardless of NAV fluctuations, can mitigate the risk associated with market timing.

However, it's crucial to remember:

- Strategies for utilizing NAV data for buy/sell decisions: (Provide practical examples of how investors might use NAV data to support their investment choices. Explain how to combine NAV analysis with other market indicators for more informed decisions.)

- Potential risks associated with relying solely on NAV: (Stress the importance of not basing investment decisions solely on NAV. Highlight other crucial factors that should be considered.)

- Importance of considering other factors beyond NAV: Market sentiment, future economic forecasts, and geopolitical events are all crucial considerations that complement NAV analysis.

Conclusion

Analyzing the Net Asset Value of the Amundi Dow Jones Industrial Average UCITS ETF offers valuable insights into its performance and provides a robust tool for investment decision-making. Understanding NAV fluctuations, the influence of expense ratios, and utilizing this information alongside other market indicators are vital for maximizing returns and mitigating risk. Stay informed about the Amundi Dow Jones Industrial Average UCITS ETF's NAV and make smarter investment decisions. Conduct thorough research and continue monitoring the ETF's NAV to adapt your investment strategy as market conditions evolve.

Featured Posts

-

880 Cv De Potencia Hibrida Conheca O Novo Ferrari 296 Speciale

May 25, 2025

880 Cv De Potencia Hibrida Conheca O Novo Ferrari 296 Speciale

May 25, 2025 -

Legal Action In Amsterdam Residents Blame Tik Tok For Snack Bar Overcrowding

May 25, 2025

Legal Action In Amsterdam Residents Blame Tik Tok For Snack Bar Overcrowding

May 25, 2025 -

Konchita Vurst O Evrovidenii 2025 Ee Predskazanie Chetyrekh Pobediteley

May 25, 2025

Konchita Vurst O Evrovidenii 2025 Ee Predskazanie Chetyrekh Pobediteley

May 25, 2025 -

Borse Crollano La Minaccia Di Dazi Ue Senza Limiti

May 25, 2025

Borse Crollano La Minaccia Di Dazi Ue Senza Limiti

May 25, 2025 -

Planning Your Memorial Day Trip Avoid These Busy Travel Days In 2025

May 25, 2025

Planning Your Memorial Day Trip Avoid These Busy Travel Days In 2025

May 25, 2025

Latest Posts

-

Kapitaalmarkt Rentestijging En De Euro Dollar Wisselkoers

May 25, 2025

Kapitaalmarkt Rentestijging En De Euro Dollar Wisselkoers

May 25, 2025 -

Relx Trotseert Economische Zwakte Met Ai Voorspellingen Voor Sterke Groei Tot 2025

May 25, 2025

Relx Trotseert Economische Zwakte Met Ai Voorspellingen Voor Sterke Groei Tot 2025

May 25, 2025 -

Stocks Trading 8 Higher On Euronext Amsterdam Analysis Of Trumps Tariff Impact

May 25, 2025

Stocks Trading 8 Higher On Euronext Amsterdam Analysis Of Trumps Tariff Impact

May 25, 2025 -

Verdere Stijging Kapitaalmarktrentes Euro Dollar Koersanalyse

May 25, 2025

Verdere Stijging Kapitaalmarktrentes Euro Dollar Koersanalyse

May 25, 2025 -

Datavorser Relx Sterke Groei Ondanks Economische Tegenwind Dankzij Ai

May 25, 2025

Datavorser Relx Sterke Groei Ondanks Economische Tegenwind Dankzij Ai

May 25, 2025