Amundi MSCI All Country World UCITS ETF USD Acc: Daily NAV Updates And Analysis

Table of Contents

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc

The Amundi MSCI All Country World UCITS ETF USD Acc is a passively managed exchange-traded fund designed to track the performance of the MSCI All Country World Index. Its primary investment objective is to provide investors with broad exposure to a diverse range of global equities, mirroring the composition of the index. Key features that make it attractive include:

- Global Diversification: The ETF offers exposure to companies across developed and emerging markets, spanning numerous sectors and geographies. This broad diversification helps mitigate risk associated with investing in a single country or region.

- USD-Denominated: The fund's currency is the US dollar, reducing currency risk for investors holding USD-based portfolios. This simplifies investment management and eliminates the complexities associated with currency fluctuations.

- UCITS Compliant: As a UCITS (Undertakings for Collective Investment in Transferable Securities) compliant ETF, it adheres to the stringent regulatory standards of the European Union, providing investors with a higher level of regulatory protection.

- Low Expense Ratio: The ETF boasts a competitive expense ratio (check and insert actual ratio here), making it a cost-effective option for long-term investors. This lower cost translates directly into higher returns over time.

The MSCI All Country World Index tracking methodology ensures the ETF's portfolio closely mirrors the index's composition through a representative sampling of its constituent securities.

Daily NAV Updates and Their Significance

The Net Asset Value (NAV) represents the market value of the ETF's assets per share. Daily NAV updates provide a snapshot of the ETF's performance on a daily basis. This information is crucial for several reasons:

- Tracking Investment Growth: Monitoring daily NAV changes allows investors to track their investment growth, both in the short-term and over the long-term. You can easily see daily fluctuations and identify overall trends.

- Identifying Potential Buying/Selling Opportunities: By observing changes in the daily NAV in conjunction with market movements, investors can identify potential opportunities to buy low and sell high.

- Assessing Risk: Analyzing the daily fluctuations in the NAV provides insights into the ETF's volatility and helps investors assess the level of risk associated with their investment.

Reliable daily NAV updates for the Amundi MSCI All Country World UCITS ETF USD Acc can be found on the Amundi website, major financial news portals, and through your brokerage account.

Analyzing the Amundi MSCI All Country World UCITS ETF USD Acc Performance

The performance of the Amundi MSCI All Country World UCITS ETF USD Acc is influenced by several key factors:

- Global Market Trends: The performance of major global indices like the S&P 500, FTSE 100, and Nikkei 225 significantly impacts the ETF's NAV.

- Economic Indicators: Macroeconomic factors such as interest rates, inflation rates, and GDP growth in various countries directly influence the performance of the ETF.

- Geopolitical Events: Significant geopolitical events, such as wars, political instability, and trade disputes, can cause considerable fluctuations in the ETF's NAV.

Interpreting NAV changes requires considering:

- Short-term Fluctuations vs. Long-term Trends: Short-term fluctuations are common, but long-term trends provide a more accurate picture of the ETF's performance. A long-term perspective is crucial.

- Comparing Performance to Benchmarks: Comparing the ETF's performance against its benchmark index (MSCI All Country World Index) and other similar global ETFs allows for a comprehensive performance evaluation.

Tools like financial charting software and investment platforms provide resources for in-depth analysis of the ETF's historical performance and future projections.

Risk Management Considerations

Investing in the Amundi MSCI All Country World UCITS ETF USD Acc, like any investment, carries inherent risks. These include:

- Market Risk: The value of the ETF can fluctuate significantly depending on overall market conditions.

- Currency Risk: While USD-denominated, changes in exchange rates between the USD and other currencies can still indirectly affect the performance of underlying holdings.

- Other Risks: These include issuer risk, counterparty risk, and liquidity risk.

It's important to remember that this ETF should be part of a well-diversified investment portfolio to mitigate overall risk.

Conclusion

The Amundi MSCI All Country World UCITS ETF USD Acc offers a valuable tool for achieving global diversification within an investment portfolio. Regular monitoring of its daily NAV updates is crucial for effective investment management. By understanding the factors influencing its performance and carefully considering the associated risks, investors can make informed decisions regarding their investment in this global ETF. Start your global diversification journey with the Amundi MSCI All Country World UCITS ETF USD Acc today! Visit the Amundi website for more details on the Amundi MSCI All Country World UCITS ETF USD Acc and to access daily NAV updates.

Featured Posts

-

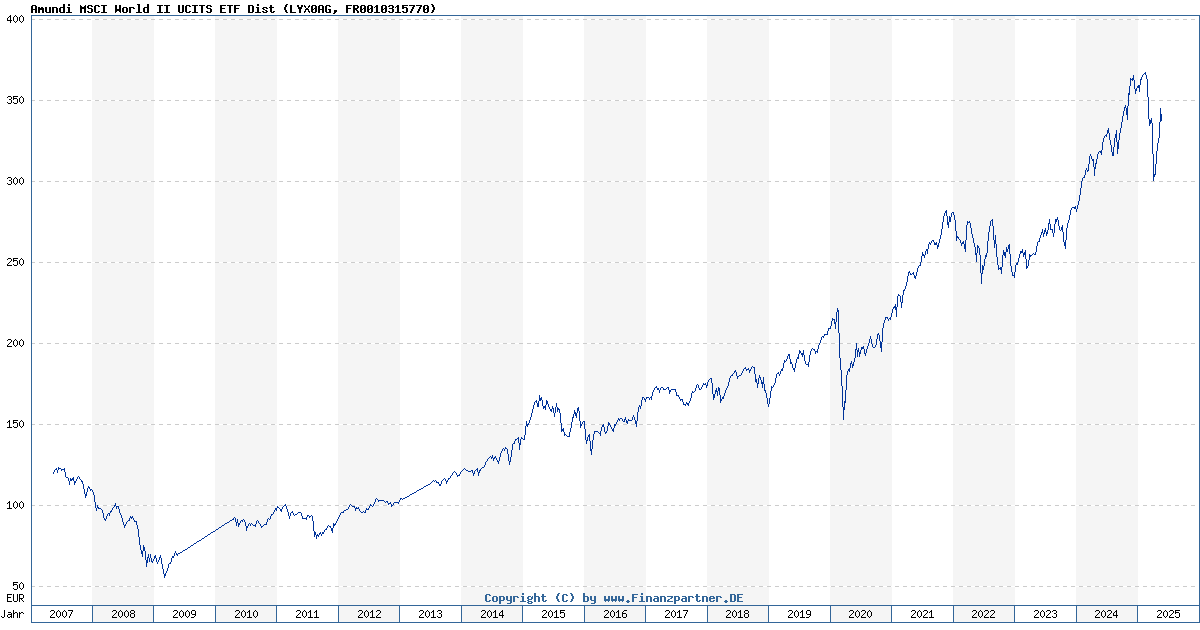

Amundi Msci World Ii Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

Affordable Country Escapes Properties Under 1 Million

May 24, 2025

Affordable Country Escapes Properties Under 1 Million

May 24, 2025 -

Escape To The Country Top Destinations For A Country Lifestyle

May 24, 2025

Escape To The Country Top Destinations For A Country Lifestyle

May 24, 2025 -

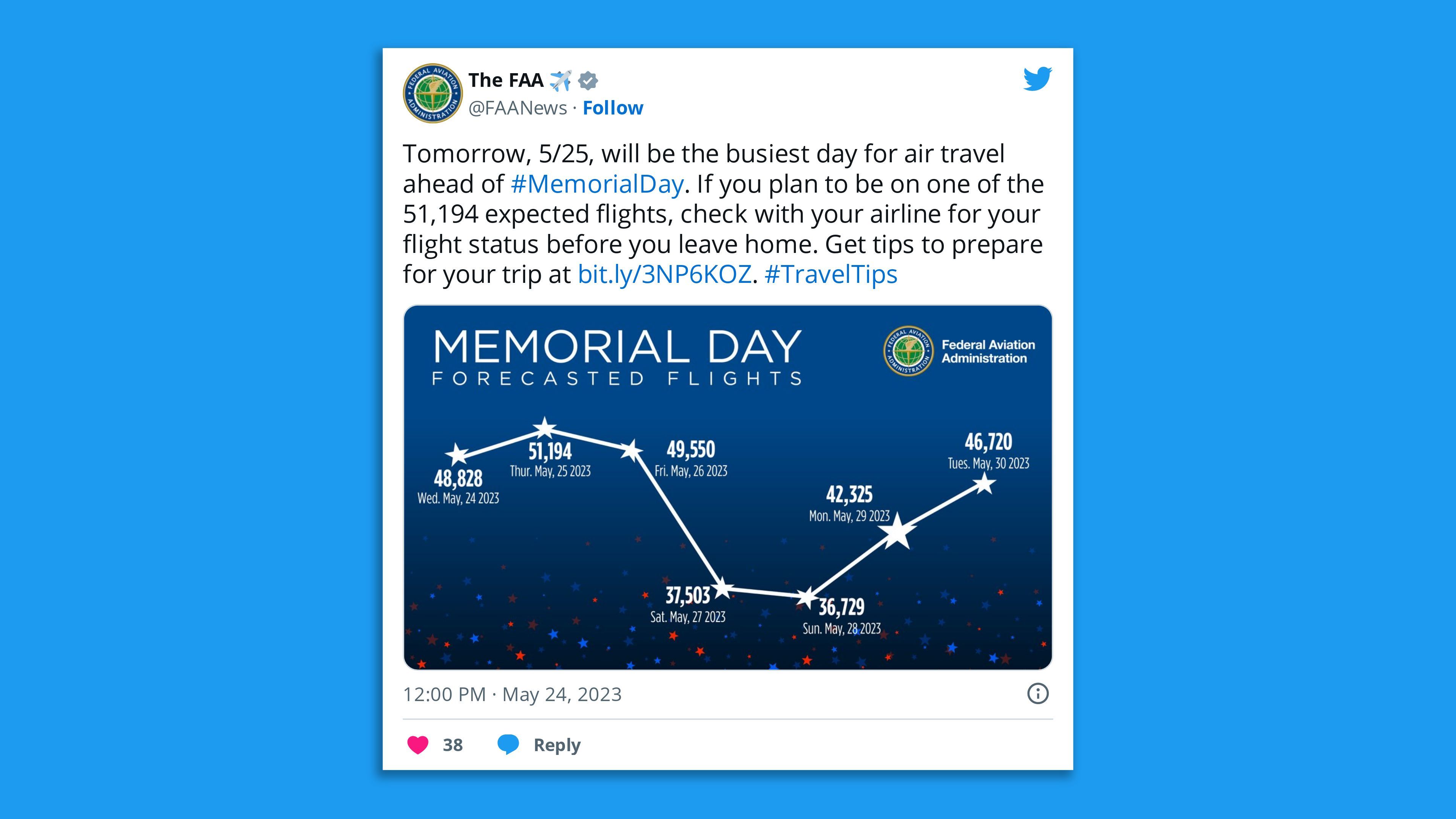

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025 -

A Successful Escape To The Country Tips And Advice For A Smooth Transition

May 24, 2025

A Successful Escape To The Country Tips And Advice For A Smooth Transition

May 24, 2025

Latest Posts

-

M6 Southbound Crash Causes 60 Minute Delays For Drivers

May 24, 2025

M6 Southbound Crash Causes 60 Minute Delays For Drivers

May 24, 2025 -

Dramatic Refueling During 90mph Police Chase Astonishing Footage

May 24, 2025

Dramatic Refueling During 90mph Police Chase Astonishing Footage

May 24, 2025 -

90mph Refuel The Extraordinary Escape During A Police Helicopter Pursuit

May 24, 2025

90mph Refuel The Extraordinary Escape During A Police Helicopter Pursuit

May 24, 2025 -

High Speed Police Chase Astonishing Refueling Moment At 90mph

May 24, 2025

High Speed Police Chase Astonishing Refueling Moment At 90mph

May 24, 2025 -

M56 Motorway Incident Car Accident Results In Casualty Paramedic Treatment

May 24, 2025

M56 Motorway Incident Car Accident Results In Casualty Paramedic Treatment

May 24, 2025