Amundi MSCI All Country World UCITS ETF USD Acc: NAV Analysis And Implications

Table of Contents

Amundi MSCI All Country World UCITS ETF USD Acc: NAV Performance Analysis

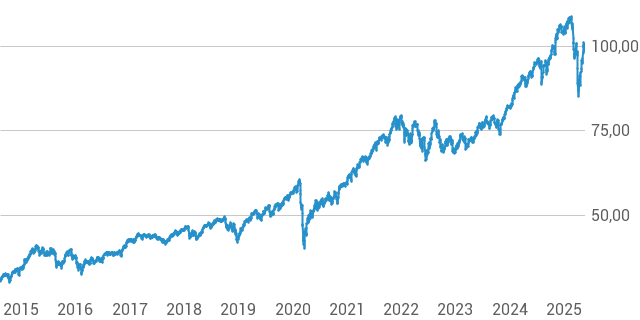

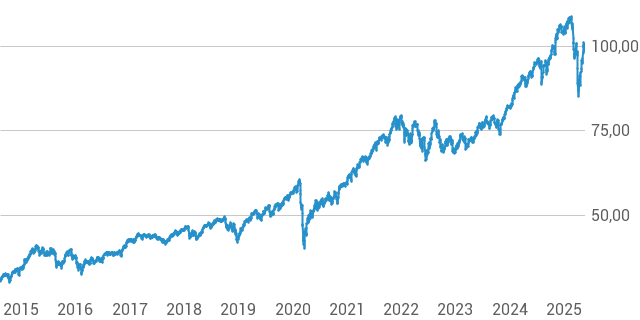

Historical NAV Performance

Analyzing the historical NAV performance of the Amundi MSCI All Country World UCITS ETF USD Acc provides valuable insights into its potential for growth and risk. (Insert chart/graph showing historical NAV performance here). This visual representation clearly illustrates periods of both growth and decline.

- Average Annual Return: (Insert data, e.g., "Over the past five years, the ETF has shown an average annual return of X%." Be sure to cite your source.) This figure provides a benchmark for understanding long-term performance.

- Volatility: (Insert data and explanation, e.g., "The ETF exhibits a volatility level of Y%, indicating [high/moderate/low] risk." Explain what this volatility means in terms of potential fluctuations.) Understanding volatility is key to assessing risk tolerance.

- Benchmark Comparison: The Amundi MSCI All Country World UCITS ETF USD Acc aims to track the MSCI All Country World Index. (Insert data comparing ETF performance to the benchmark index, highlighting periods of outperformance or underperformance and potential reasons for the divergence.) This comparison helps assess the ETF's tracking efficiency.

Specific periods of strong or weak performance can often be attributed to external factors. For example, periods of global economic uncertainty or geopolitical events may significantly impact the ETF's NAV. Analyzing these periods helps to understand the ETF's resilience.

Factors Influencing NAV Fluctuations

Several factors contribute to the fluctuations in the Amundi MSCI All Country World UCITS ETF USD Acc's NAV:

- Global Economic Conditions: Recessions, economic growth spurts, and shifts in monetary policy in major economies directly influence market performance and, consequently, the ETF's NAV.

- Market Sentiment: Investor confidence and overall market sentiment significantly impact asset prices, including the ETF's NAV. Periods of high optimism tend to drive prices up, while pessimism can lead to declines.

- Currency Exchange Rates (USD): As the ETF is denominated in USD, fluctuations in exchange rates against other currencies can affect the NAV for investors holding the ETF in different currencies.

- Performance of Individual Holdings: The ETF's NAV is a reflection of the collective performance of its underlying holdings. Strong performance by individual companies within the index contributes to a higher NAV, while underperformance has the opposite effect.

These factors are interconnected and often influence each other. For example, global economic uncertainty can lead to negative market sentiment, resulting in a decline in the ETF's NAV.

Understanding the ETF's Composition and its Impact on NAV

Geographic and Sectoral Allocation

The Amundi MSCI All Country World UCITS ETF USD Acc's composition is a crucial factor influencing its NAV. Its holdings are diversified across various countries and sectors.

- Geographic Distribution: (Insert data showing percentage allocation to different regions, e.g., "North America: 55%, Europe: 25%, Asia: 15%, etc.") This diversified geographic exposure aims to reduce risk by not concentrating investments in any single region.

- Sectoral Breakdown: (Insert data showing percentage allocation to different sectors, e.g., "Technology: 20%, Financials: 15%, Healthcare: 12%, etc.") Understanding the sector allocation helps investors assess their exposure to specific industry trends.

- Top Holdings: (List the top 5-10 holdings of the ETF and their respective weightings.) Knowing the top holdings allows investors to understand the major contributors to the ETF's performance.

This diverse allocation strategy aims to minimize the impact of any single company or sector underperforming.

Weighting Methodology

The Amundi MSCI All Country World UCITS ETF USD Acc uses the MSCI All Country World Index as its benchmark. Understanding MSCI's methodology is critical:

- Market Capitalization Weighting: The index is weighted based on the market capitalization of each company, meaning larger companies have a greater influence on the index's performance.

- Free-Float Adjustments: The index considers only the freely tradable shares of each company, excluding shares held by controlling shareholders or governments.

- Reconstitution Frequency: The index is regularly reviewed and rebalanced to reflect changes in the market capitalization of its constituent companies.

This weighting methodology influences the ETF's exposure to different markets and sectors, impacting its overall performance and NAV.

Implications for Investors: Strategies and Considerations

Risk Assessment

Investing in the Amundi MSCI All Country World UCITS ETF USD Acc involves a level of risk:

- Volatility: While diversification helps reduce risk, the ETF is still subject to market volatility, especially during periods of global economic uncertainty.

- Diversification Benefits: The ETF's broad diversification across countries and sectors can mitigate the risk associated with investing in individual stocks or sectors.

- Downsides of Global Market Exposure: Negative events in any part of the world can impact the ETF's NAV.

Investors need to carefully assess their risk tolerance before investing.

Investment Strategies

The Amundi MSCI All Country World UCITS ETF USD Acc can fit various investment strategies:

- Long-Term Investment: The ETF is suitable for long-term investors seeking global diversification and potential long-term growth.

- Portfolio Diversification: It can be a core holding in a diversified portfolio to reduce overall risk.

- Dollar-Cost Averaging: Investors can mitigate risk by investing a fixed amount regularly, regardless of market fluctuations.

Comparison to Alternative Investments

Investors should compare the Amundi MSCI All Country World UCITS ETF USD Acc to other global equity ETFs:

- Expense Ratios: Compare the ETF's expense ratio to those of competitors to ensure it's cost-effective.

- Tracking Error: Assess how closely the ETF tracks its benchmark index.

- Other Key Performance Indicators: Consider factors like dividend yield and historical performance to make informed comparisons.

Conclusion: Investing Wisely with the Amundi MSCI All Country World UCITS ETF USD Acc

Understanding the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc, its composition, and the factors influencing its performance is crucial for investors. While it offers significant diversification benefits, it's important to acknowledge the inherent risks associated with global market exposure. Consider your risk tolerance, investment goals, and the ETF's expense ratio and historical performance before investing. Conduct thorough research and compare it to other global equity ETFs like other world ETFs or global equity ETFs before making an investment decision. The Amundi MSCI All Country World ETF, with its focus on global diversification, can be a valuable component of a well-structured portfolio, but only after careful consideration of your individual circumstances.

Featured Posts

-

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 25, 2025

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 25, 2025 -

Annie Kilners Posts Following Kyle Walker Night Out Allegations Of Poisoning

May 25, 2025

Annie Kilners Posts Following Kyle Walker Night Out Allegations Of Poisoning

May 25, 2025 -

Escape To The Country Homes Activities And More

May 25, 2025

Escape To The Country Homes Activities And More

May 25, 2025 -

Amira Al Zuhair A Paris Fashion Week Highlight For Zimmermann

May 25, 2025

Amira Al Zuhair A Paris Fashion Week Highlight For Zimmermann

May 25, 2025 -

Dax Falls Below 24 000 Frankfurt Stock Market Losses

May 25, 2025

Dax Falls Below 24 000 Frankfurt Stock Market Losses

May 25, 2025

Latest Posts

-

Frances National Rally Sundays Demonstration And Its Implications For Le Pen

May 25, 2025

Frances National Rally Sundays Demonstration And Its Implications For Le Pen

May 25, 2025 -

Assessing The Success Of Le Pens National Rally Demonstration

May 25, 2025

Assessing The Success Of Le Pens National Rally Demonstration

May 25, 2025 -

Sundays Demonstration Assessing The National Rallys Support For Le Pen

May 25, 2025

Sundays Demonstration Assessing The National Rallys Support For Le Pen

May 25, 2025 -

The National Rallys Sunday Demonstration A Lower Than Anticipated Turnout For Le Pen

May 25, 2025

The National Rallys Sunday Demonstration A Lower Than Anticipated Turnout For Le Pen

May 25, 2025 -

Analysis Le Pens National Rally Demonstration And Its Political Significance

May 25, 2025

Analysis Le Pens National Rally Demonstration And Its Political Significance

May 25, 2025