Amundi MSCI World Ex-US UCITS ETF Acc: NAV Calculation And Importance

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the net value of an ETF's assets per share. It's a crucial indicator of the ETF's intrinsic worth, calculated by subtracting liabilities from the total asset value and then dividing by the number of outstanding shares. Unlike the market price, which fluctuates throughout the trading day based on supply and demand, the NAV reflects the actual underlying value of the ETF's holdings. Discrepancies between the market price and the NAV can arise due to factors like trading volume and market sentiment.

NAV is paramount for various investment decisions:

-

Buying and Selling: Investors often use the NAV as a benchmark to assess whether an ETF is undervalued or overvalued.

-

Performance Evaluation: Tracking NAV changes over time provides a clear picture of the ETF's performance, allowing investors to gauge its growth.

-

Comparison: NAV allows for direct comparisons between different ETFs, facilitating informed choices.

-

Fund Manager Efficiency: Consistent tracking of NAV helps investors assess the efficiency of the fund manager in managing assets.

-

NAV reflects the underlying asset value, providing a true measure of the ETF's worth.

-

Daily NAV calculations ensure transparency and accountability for investors.

-

Investors use NAV to compare the performance of different ETFs and make informed investment decisions.

-

NAV helps assess the efficiency of the fund manager in maximizing returns.

How is the NAV of Amundi MSCI World ex-US UCITS ETF Acc Calculated?

The Amundi MSCI World ex-US UCITS ETF Acc, being an index-tracking ETF, aims to mirror the performance of the MSCI World ex-US index. Its NAV calculation reflects this core objective. The process typically involves these steps:

- Determining Market Values: The market values of all constituent securities within the ETF's portfolio are obtained at the end of each trading day.

- Currency Adjustments: Exchange rate adjustments are applied to convert the values of holdings denominated in foreign currencies into the base currency of the ETF (likely EUR). This is crucial, especially considering the ETF's focus on non-US markets.

- Expense Deduction: The fund's operating expenses, including management fees, are deducted from the total asset value.

- Shares Outstanding: The net asset value is then divided by the total number of outstanding shares of the ETF.

- NAV per Share: The result represents the NAV per share, providing a snapshot of the ETF's net asset value.

The custodian bank plays a crucial role in verifying the accuracy of the asset values reported to ensure transparency and reliability.

- Daily market values of constituent securities are obtained from reliable sources.

- Exchange rate adjustments are applied to account for currency fluctuations impacting the value of international holdings.

- Fund expenses, such as management fees, are deducted to reflect the true net asset value.

- The total net asset value is divided by the number of outstanding shares to arrive at the NAV per share.

- The NAV per share is typically published daily on the Amundi website and other financial data providers.

Understanding the Impact of Currency Fluctuations on NAV

Since the Amundi MSCI World ex-US UCITS ETF Acc invests in non-US markets, it’s inherently exposed to multiple currencies. Fluctuations in exchange rates can significantly impact the NAV, impacting investor returns expressed in their local currency. A strengthening of the Euro (or the base currency) against the currencies of the underlying assets would increase the NAV, while a weakening would decrease it, even if the underlying asset values remain unchanged.

This highlights the importance of understanding and managing currency risk. Strategies for mitigating this risk include:

-

Currency Hedging: Employing hedging strategies can help offset some of the effects of currency fluctuations.

-

Diversification: Diversifying investments across different currencies can help reduce the overall impact of currency movements.

-

Monitoring: Closely monitoring currency movements and their potential impact on the ETF's performance is essential.

-

Exposure to multiple currencies increases the complexity of NAV calculations and exposes investors to currency risk.

-

Currency hedging strategies may be used to mitigate the risk of unfavorable exchange rate movements.

-

Investors should actively monitor currency markets and their potential impact on the ETF's performance.

-

Understand that returns, expressed in your base currency, can be affected by currency movements regardless of the performance of the underlying assets.

Accessing and Interpreting Amundi MSCI World ex-US UCITS ETF Acc NAV Data

Investors can typically find the daily NAV data for the Amundi MSCI World ex-US UCITS ETF Acc on Amundi's official website, major financial news websites (like Bloomberg or Yahoo Finance), and through their brokerage accounts.

Interpreting NAV data effectively involves:

-

Regularly checking the official sources for the most up-to-date NAV figures.

-

Comparing NAV changes over time to assess the ETF's performance and growth trajectory.

-

Utilizing charts and graphs to visualize NAV trends and identify patterns.

-

Consulting financial advisors for professional insights and interpretation of the data in the context of your overall investment portfolio.

-

Regularly check the official Amundi website and other reputable financial sources for updated NAV information.

-

Compare NAV changes over time to assess the ETF's performance and identify growth or decline trends.

-

Use charts and graphs to visualize NAV data for a clearer understanding of performance.

-

Consult with financial advisors for professional guidance on interpreting NAV data and incorporating it into your investment strategy.

Conclusion: The Importance of NAV in Your Investment Strategy with Amundi MSCI World ex-US UCITS ETF Acc

Understanding the Net Asset Value (NAV) calculation and its implications is crucial for making informed investment decisions regarding the Amundi MSCI World ex-US UCITS ETF Acc. NAV provides a transparent and reliable measure of the ETF's underlying value, allowing investors to assess its performance, manage risk, and compare it with other investment options. By regularly monitoring NAV data and understanding its relationship to market price and currency fluctuations, investors can effectively track their investments and make informed adjustments to their portfolio. Understanding the NAV of the Amundi MSCI World ex-US UCITS ETF Acc is crucial for making informed investment choices. Learn more about this ETF and incorporate it into your investment strategy today!

Featured Posts

-

Shop Owner Stabbed To Death Previously Bailed Teenager Arrested

May 25, 2025

Shop Owner Stabbed To Death Previously Bailed Teenager Arrested

May 25, 2025 -

Carmen Joy Crookes New Single

May 25, 2025

Carmen Joy Crookes New Single

May 25, 2025 -

Bbc Radio 1 Big Weekend Confirmed Artists Include Jorja Smith Biffy Clyro And Blossoms

May 25, 2025

Bbc Radio 1 Big Weekend Confirmed Artists Include Jorja Smith Biffy Clyro And Blossoms

May 25, 2025 -

Experience The Ferrari Challenge Racing Days In South Florida

May 25, 2025

Experience The Ferrari Challenge Racing Days In South Florida

May 25, 2025 -

Memorial Day 2025 Flight Prices When To Book For The Best Deals

May 25, 2025

Memorial Day 2025 Flight Prices When To Book For The Best Deals

May 25, 2025

Latest Posts

-

Matt Malteses Sixth Album Her In Deep A Conversation On Intimacy And Growth

May 25, 2025

Matt Malteses Sixth Album Her In Deep A Conversation On Intimacy And Growth

May 25, 2025 -

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025 -

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025 -

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025 -

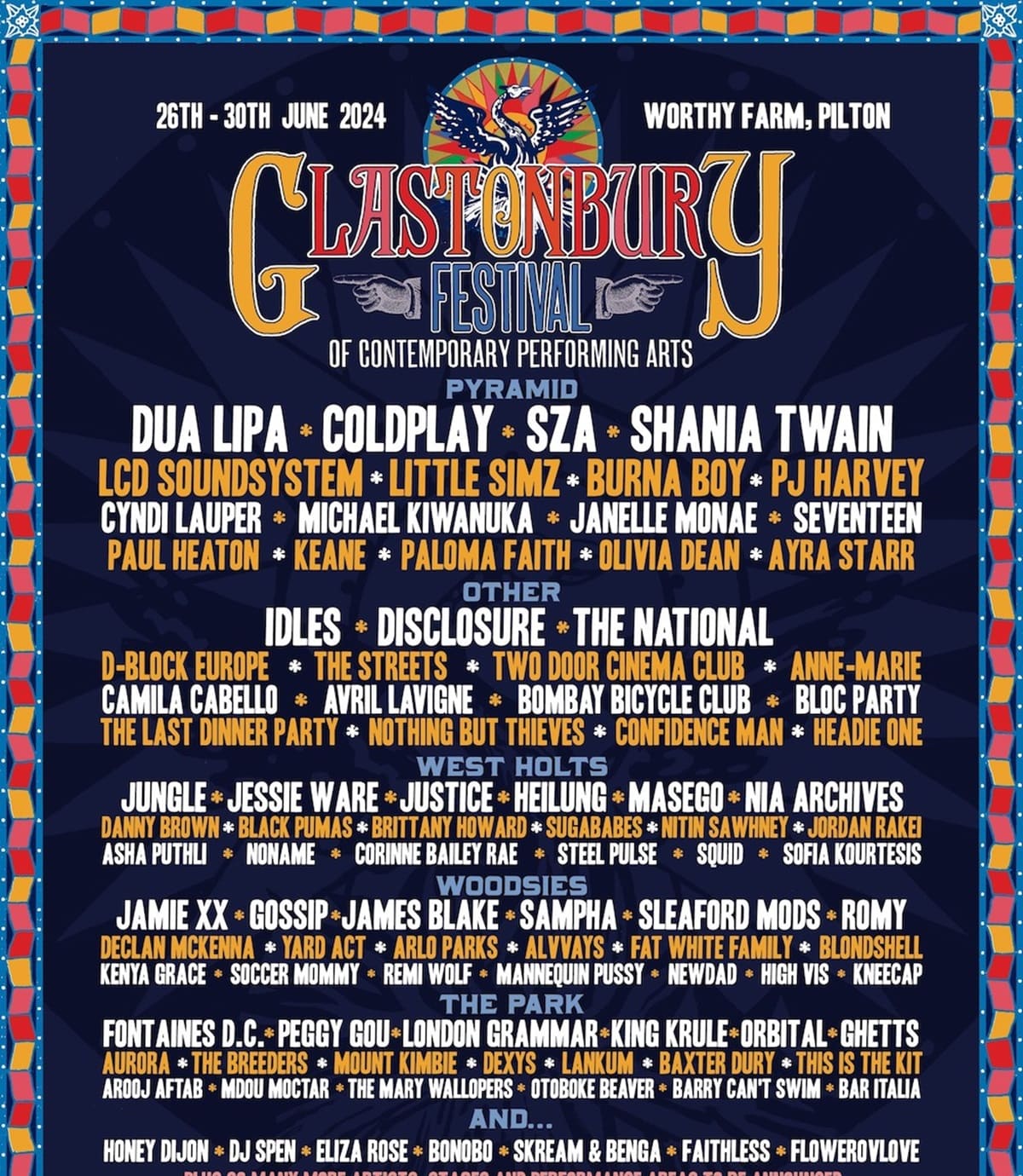

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025