Amundi MSCI World II UCITS ETF Dist: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Defining NAV:

The Net Asset Value (NAV) represents the true underlying value of each share in an ETF. It's calculated by subtracting the fund's liabilities from its total assets. For the Amundi MSCI World II UCITS ETF Dist, this means totaling the market value of all the stocks and other assets it holds, then subtracting any expenses or liabilities the fund incurs. This provides a snapshot of the fair market value of the ETF's holdings. Understanding NAV is vital for several reasons:

- NAV reflects the true underlying value: It gives you a clear picture of what your investment is actually worth, independent of market fluctuations in the ETF's share price.

- Daily NAV calculations provide transparency: The daily calculation of the NAV ensures transparency and allows investors to track the fund's performance accurately.

- Understanding NAV helps compare ETF performance: By tracking the NAV over time, you can easily compare the ETF's performance against its benchmark index (in this case, the MSCI World Index) and other similar ETFs.

- NAV changes impact the ETF's share price: While the market price may fluctuate, the NAV serves as a fundamental benchmark against which to assess these fluctuations.

How is the NAV of Amundi MSCI World II UCITS ETF Dist Calculated?

The Calculation Process:

The NAV of the Amundi MSCI World II UCITS ETF Dist is calculated daily by Amundi, the fund manager. The process involves:

- Valuation of underlying assets: Each asset held within the ETF (primarily stocks from developed markets worldwide) is valued using its closing market price on the relevant exchange.

- Currency conversions: Since the ETF holds assets in various currencies, these are converted into the base currency of the fund (likely Euros, given it's a UCITS ETF) using the prevailing exchange rates.

- Subtraction of expenses and liabilities: The fund's operating expenses, management fees, and other liabilities are deducted from the total asset value.

- Fund manager's role: Amundi, as the fund manager, is responsible for overseeing the accurate and timely calculation of the NAV.

This rigorous process ensures the NAV accurately reflects the net value of the ETF's holdings.

Where to Find the NAV of Amundi MSCI World II UCITS ETF Dist?

Accessing NAV Information:

Finding the daily NAV of your Amundi MSCI World II UCITS ETF Dist investment is straightforward. You can access this crucial information from several sources:

- Amundi Website: The official Amundi website is the primary source for this data. Look for the fund's fact sheet or dedicated page. [Insert a hypothetical link here - replace with actual link if available: e.g., www.amundi.com/amundi-msci-world-ii-nav]

- Financial News Websites: Reputable financial news sources and data providers (e.g., Bloomberg, Yahoo Finance, Google Finance) typically list the NAV for major ETFs like the Amundi MSCI World II UCITS ETF Dist.

- Brokerage Platforms: If you hold the ETF through a brokerage account, your platform will likely display the NAV alongside the current market price.

NAV vs. Market Price: Understanding the Difference

The Relationship Between NAV and Market Price:

While the NAV is the theoretical value of a single ETF share, the market price is the actual price at which the ETF is currently trading on the exchange. These two values may differ slightly due to several factors:

- Bid-ask spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) creates a small discrepancy.

- Trading volume: High trading volume generally leads to a market price closer to the NAV, while low volume can cause temporary deviations.

Understanding this difference is vital for informed trading. Arbitrage opportunities may exist for sophisticated investors who can exploit temporary discrepancies between the NAV and market price, but this requires advanced knowledge and expertise.

Conclusion:

Understanding the Net Asset Value (NAV) is critical for successfully managing your investment in the Amundi MSCI World II UCITS ETF Dist. We've explored how the NAV is calculated, where to find it, and its relationship to the market price. By regularly monitoring the NAV, you gain valuable insights into your ETF's performance and can make more informed investment decisions. Stay informed about your Amundi MSCI World II UCITS ETF Dist investment by regularly checking its NAV and conducting further research on its holdings and performance using the NAV as a key indicator.

Featured Posts

-

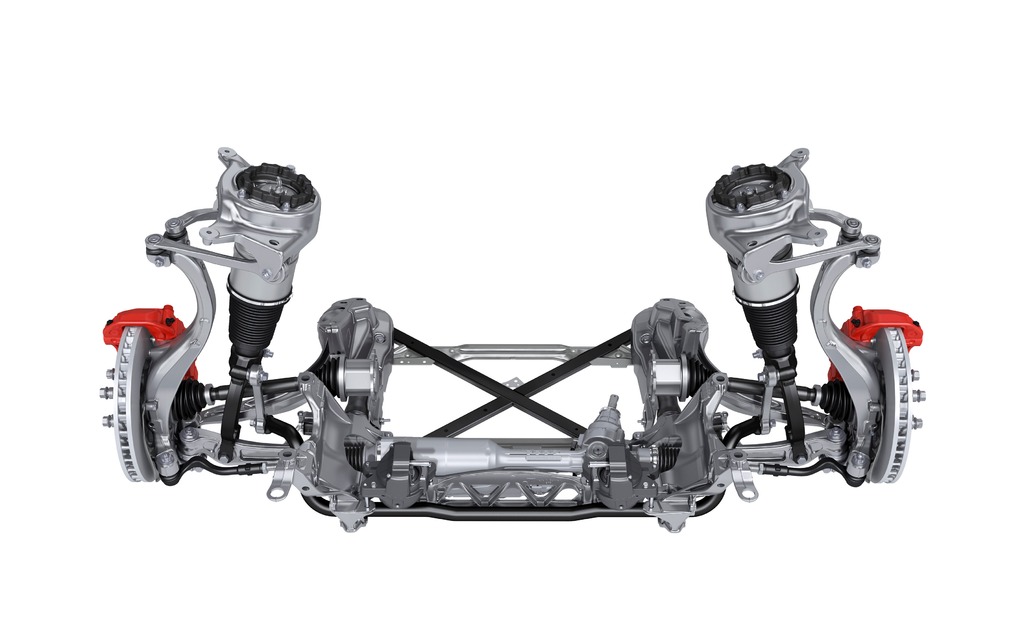

Upcoming 2026 Porsche Cayenne Ev Analysis Of Recent Spy Images

May 24, 2025

Upcoming 2026 Porsche Cayenne Ev Analysis Of Recent Spy Images

May 24, 2025 -

Choosing The Right Porsche Macan A Detailed Buyers Guide

May 24, 2025

Choosing The Right Porsche Macan A Detailed Buyers Guide

May 24, 2025 -

Beruehrende Momente In Der Naehe Des Uniklinikums Essen

May 24, 2025

Beruehrende Momente In Der Naehe Des Uniklinikums Essen

May 24, 2025 -

Escape To The Countryside Making The Move To Rural Life

May 24, 2025

Escape To The Countryside Making The Move To Rural Life

May 24, 2025 -

Bail Revoked Teen Rearrested Following Shop Owners Stabbing Death

May 24, 2025

Bail Revoked Teen Rearrested Following Shop Owners Stabbing Death

May 24, 2025

Latest Posts

-

The Kyle Walker Annie Kilner Situation New Developments In Milan

May 24, 2025

The Kyle Walker Annie Kilner Situation New Developments In Milan

May 24, 2025 -

Kyle Vs Teddi Details Of Their Dog Walker Argument

May 24, 2025

Kyle Vs Teddi Details Of Their Dog Walker Argument

May 24, 2025 -

What Happened Between Kyle Walker Mystery Women And Annie Kilner

May 24, 2025

What Happened Between Kyle Walker Mystery Women And Annie Kilner

May 24, 2025 -

Kyle Walkers Milan Party Details Emerge Following Wifes Uk Flight

May 24, 2025

Kyle Walkers Milan Party Details Emerge Following Wifes Uk Flight

May 24, 2025 -

The Kyle Walker Situation Party Pictures And Relationship Fallout

May 24, 2025

The Kyle Walker Situation Party Pictures And Relationship Fallout

May 24, 2025