Amundi MSCI World II UCITS ETF Dist: Net Asset Value (NAV) Explained

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the value of a single share in an ETF. It's calculated by subtracting the fund's liabilities from its assets and then dividing by the number of outstanding shares. Understanding NAV is fundamental to evaluating your investment's performance and making informed decisions.

-

NAV Calculation: (Total Assets - Total Liabilities) / Number of Shares Outstanding

-

Components of Assets: This includes the market value of all the underlying securities held by the ETF, such as stocks, bonds, and cash. The asset valuation is crucial for accurate NAV calculation.

-

Components of Liabilities: Liabilities encompass expenses such as management fees, operating costs, and any outstanding payable amounts.

-

Daily Fluctuations: The NAV fluctuates daily, reflecting changes in the market value of the underlying assets. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV. This daily change directly impacts the share price, though not always proportionally. Key terms related to this calculation include "asset valuation," "liability," and "share price."

NAV vs. Market Price of Amundi MSCI World II UCITS ETF Dist

While the NAV provides the intrinsic value of the ETF, the market price is the actual price at which the ETF is traded on the exchange. There's often a difference between these two values.

-

Bid-Ask Spread: The market price reflects the bid price (what buyers are willing to pay) and the ask price (what sellers are willing to accept). The difference between these two is the bid-ask spread.

-

Deviations from NAV: Several factors can cause the market price to deviate from the NAV, including trading volume, supply and demand dynamics, and market sentiment. High trading volume typically leads to a market price closer to the NAV.

-

Premium and Discount: When the market price trades above the NAV, it's said to be trading at a premium. Conversely, when the market price is below the NAV, it's trading at a discount. This can be influenced by investor expectations and market liquidity.

Importance of Monitoring NAV for Amundi MSCI World II UCITS ETF Dist Investors

Regularly monitoring the NAV of your Amundi MSCI World II UCITS ETF Dist is essential for effective investment management.

-

Evaluating ETF Performance: Tracking the NAV over time allows you to assess the ETF's performance. You can see the growth or decline in your investment's value.

-

Benchmarking: Compare the ETF's NAV performance against relevant benchmarks (like the MSCI World Index) to gauge its relative success.

-

Investment Decision-Making: The NAV helps in making informed investment decisions. A consistent upward trend in NAV might suggest holding onto the investment, while a prolonged decline could signal considering a sale.

-

Distribution Payments (Dist): The Amundi MSCI World II UCITS ETF Dist makes distribution payments. These payments, typically dividends, will affect the NAV. The NAV will usually decrease by the amount of the distribution on the ex-dividend date.

Where to Find the NAV of Amundi MSCI World II UCITS ETF Dist

Reliable sources for accessing up-to-date NAV information include:

-

Amundi's Website: The ETF provider's official website is the most accurate source for NAV data.

-

Financial News Websites: Reputable financial news sources often provide real-time or delayed NAV information for various ETFs.

-

Brokerage Platforms: Your brokerage account will usually show the current NAV of your holdings.

It’s crucial to understand that the reporting time for NAV data can vary between sources. Always check the timestamp to ensure you are using the most current information.

Conclusion: Mastering Amundi MSCI World II UCITS ETF Dist: Net Asset Value

Understanding the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF Dist is paramount for making informed investment decisions. By consistently monitoring the NAV, comparing it to the market price, and understanding its impact on your overall portfolio, you can effectively manage your investment and track its performance against relevant benchmarks. Regularly checking the NAV and understanding its calculation allows you to optimize your investment strategy and potentially maximize returns. Learn more about Amundi MSCI World II UCITS ETF Dist and its NAV to optimize your investment strategy. Regularly check the NAV and make informed decisions based on the net asset value of your portfolio.

Featured Posts

-

Jejak Sejarah Porsche 356 Di Pabrik Zuffenhausen Jerman

May 25, 2025

Jejak Sejarah Porsche 356 Di Pabrik Zuffenhausen Jerman

May 25, 2025 -

Konchita Vurst Peredbachennya Peremozhtsiv Yevrobachennya 2025 Unian

May 25, 2025

Konchita Vurst Peredbachennya Peremozhtsiv Yevrobachennya 2025 Unian

May 25, 2025 -

Allt Um Nyja Rafmagnsutgafuna Af Porsche Macan

May 25, 2025

Allt Um Nyja Rafmagnsutgafuna Af Porsche Macan

May 25, 2025 -

Mamma Mia Ferrari Hot Wheels New Sets Revealed

May 25, 2025

Mamma Mia Ferrari Hot Wheels New Sets Revealed

May 25, 2025 -

Is A Country Escape Right For You Weighing The Pros And Cons

May 25, 2025

Is A Country Escape Right For You Weighing The Pros And Cons

May 25, 2025

Latest Posts

-

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025 -

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025 -

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025 -

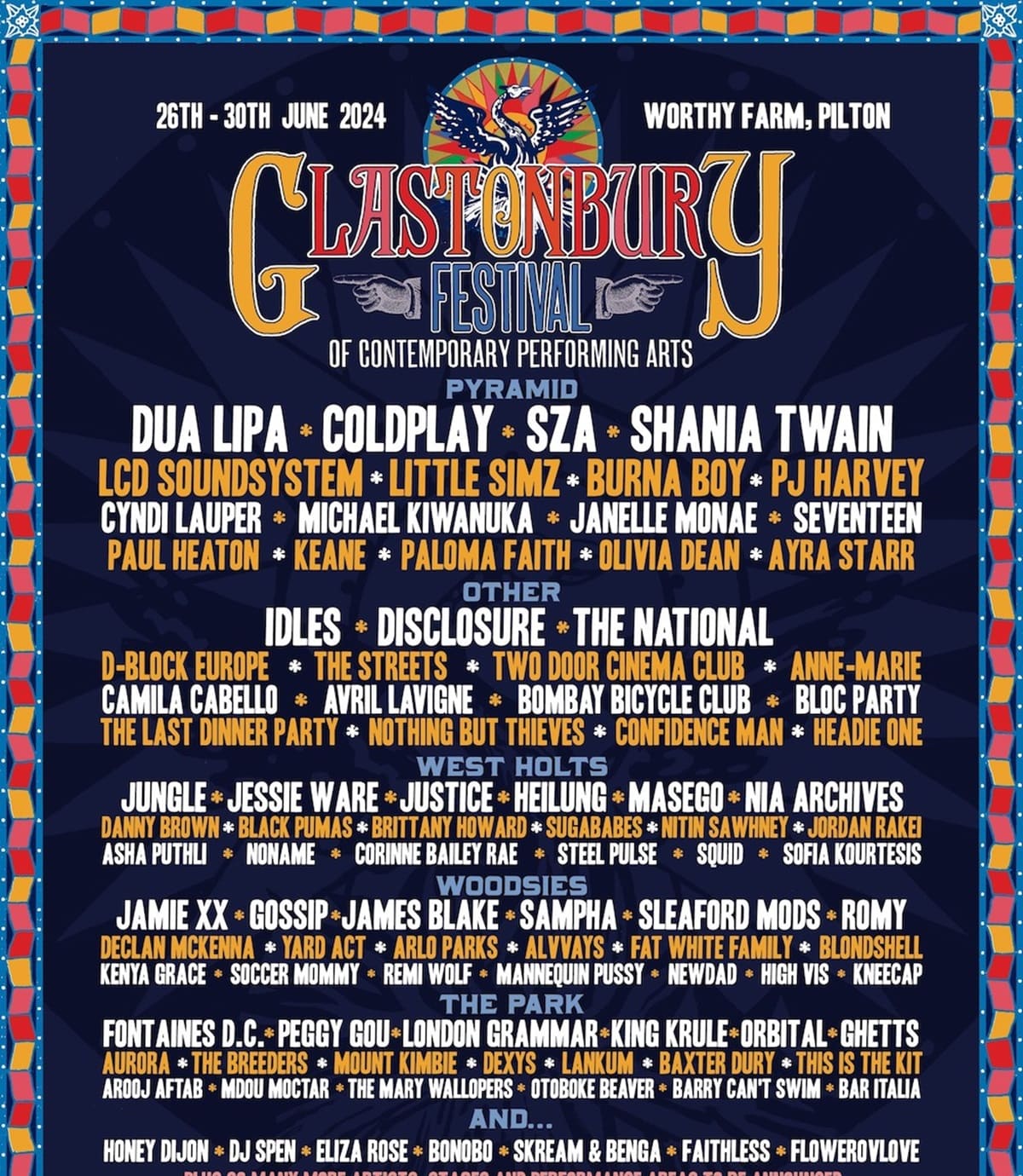

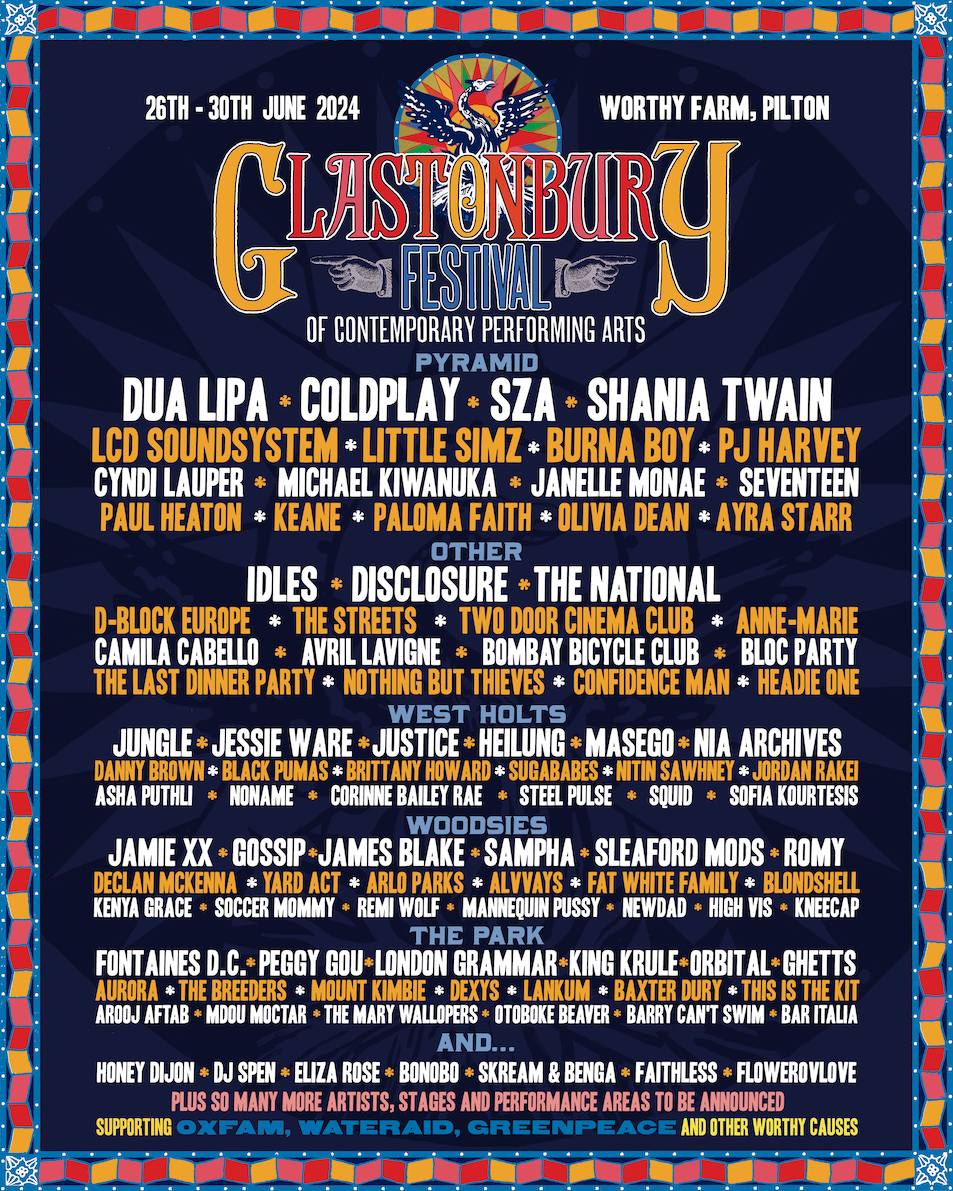

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025 -

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025