Amundi MSCI World II UCITS ETF USD Hedged Dist: NAV Performance And Analysis

Table of Contents

Amundi MSCI World II UCITS ETF USD Hedged Dist: A Deep Dive into the Investment Strategy

The Amundi MSCI World II UCITS ETF USD Hedged Dist aims to track the performance of the MSCI World Index, providing investors with broad exposure to large and mid-cap companies across developed markets worldwide. This comprehensive index covers a diverse range of sectors and geographies, offering significant diversification benefits.

The "USD Hedged" aspect is a critical feature. This means the ETF employs currency hedging strategies to minimize the impact of fluctuations between the investor's base currency and the US dollar. This is particularly beneficial for investors outside the US, protecting their investments from adverse currency movements and providing greater stability in their returns.

The "Dist" in the ETF's name signifies a distribution policy. The ETF distributes dividends to its shareholders periodically, reflecting the dividend payouts from the underlying companies within the MSCI World Index. These distributions can impact the NAV performance, as the payment reduces the ETF's overall asset value. However, they provide a regular income stream for investors.

- Underlying index: MSCI World Index

- Currency hedging: USD Hedged

- Distribution policy: Dividend payouts

- Expense ratio: [Insert Data - e.g., 0.20%]

- Investment style: Passive replication (tracking the MSCI World Index)

Analyzing NAV Performance: Historical Trends and Key Factors

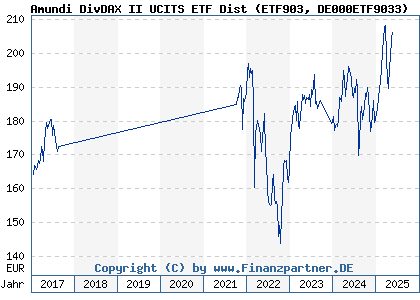

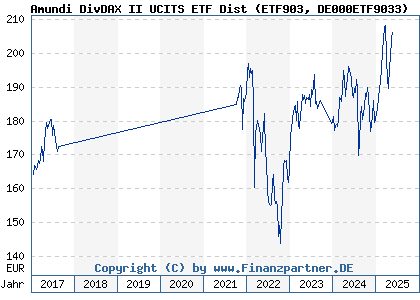

Analyzing the historical NAV performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist provides valuable insights into its long-term potential and risk profile. [Insert Chart/Graph Here showing historical NAV performance – ideally yearly or quarterly returns]. This visual representation allows for a clear understanding of trends and volatility.

Several key factors influence the ETF's NAV fluctuations:

-

Global market conditions: Economic growth, interest rate changes, geopolitical events, and overall market sentiment significantly impact the performance of global equities and, consequently, the ETF's NAV. Recessions, for instance, typically lead to lower NAVs, while periods of strong economic growth often correlate with higher NAVs.

-

Currency fluctuations: Even with the USD hedge, residual currency risk can still affect returns. While the hedge aims to mitigate fluctuations, unexpected sharp movements in exchange rates can still cause some minor impact on the NAV.

-

Performance of the underlying MSCI World Index: The ETF's NAV is directly linked to the performance of the MSCI World Index. Any significant upward or downward movement in the index will be reflected in the ETF's NAV.

-

Illustrative Data: [Include specific examples of periods of high and low performance, linking them to specific global events or market trends. For example: "In Q1 2020, the NAV experienced a significant downturn due to the initial market reaction to the COVID-19 pandemic. However, a strong recovery followed in subsequent quarters."]

-

Benchmark Comparison: [Include a comparison with relevant benchmark indices like the S&P 500 or other global market indices, highlighting relative performance.]

Risk Assessment and Considerations for Investors

Investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist, like any investment, carries inherent risks:

-

Market risk: The value of the ETF can fluctuate significantly due to changes in global market conditions. This is the primary risk associated with equity investments.

-

Currency risk: Despite the USD hedge, some residual currency risk remains. Unexpected movements in exchange rates could still slightly impact returns.

-

Counterparty risk: This risk relates to the potential failure of the ETF issuer to meet its obligations. However, this risk is generally low for reputable ETF providers like Amundi.

Diversification is crucial. This ETF should be considered as part of a broader, well-diversified investment portfolio tailored to an investor's individual risk tolerance and financial goals. Investors with a higher risk tolerance and longer time horizons may find this ETF suitable. Conversely, more risk-averse investors with shorter time horizons might consider allocating a smaller portion of their portfolio to this ETF.

Comparison with Similar ETFs

Several other ETFs offer global market exposure. Comparing the Amundi MSCI World II UCITS ETF USD Hedged Dist to its competitors is essential for making informed decisions.

[Insert Table Here comparing key features of at least 3 competing ETFs. Include columns for Expense Ratio, Performance Data (if available, perhaps average annual return over the last 3-5 years), and any key strategic differences].

Conclusion: Making Informed Decisions with the Amundi MSCI World II UCITS ETF USD Hedged Dist

This analysis of the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV performance highlights its potential for long-term growth and diversification benefits. However, it's crucial to remember that investment decisions should align with individual risk tolerance and investment objectives.

While the ETF offers exposure to a wide range of global markets and benefits from USD hedging, understanding the associated market and currency risks remains paramount.

Learn more about the Amundi MSCI World II UCITS ETF USD Hedged Dist and explore its potential to enhance your investment strategy. Consider it as a component within a carefully diversified portfolio, always taking into account your personal financial goals and risk profile. Remember to conduct thorough research and, if necessary, seek professional financial advice before making any investment decisions.

Featured Posts

-

Dax Rises Again Frankfurt Equities Market Update

May 24, 2025

Dax Rises Again Frankfurt Equities Market Update

May 24, 2025 -

Hmlt Mdahmat Waset Alntaq Llshrtt Alalmanyt Dd Mshjeyn

May 24, 2025

Hmlt Mdahmat Waset Alntaq Llshrtt Alalmanyt Dd Mshjeyn

May 24, 2025 -

Kynning A Nyju Porsche Macan Rafbil

May 24, 2025

Kynning A Nyju Porsche Macan Rafbil

May 24, 2025 -

Jymypaukku Muhii Tuukka Taponen F1 Autoon Jo Taenae Vuonna

May 24, 2025

Jymypaukku Muhii Tuukka Taponen F1 Autoon Jo Taenae Vuonna

May 24, 2025 -

Escape To The Country Choosing The Right Location For You

May 24, 2025

Escape To The Country Choosing The Right Location For You

May 24, 2025

Latest Posts

-

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025 -

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025 -

Annie Kilner Addresses Allegations Public Statement And Social Media

May 24, 2025

Annie Kilner Addresses Allegations Public Statement And Social Media

May 24, 2025 -

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025