Amundi MSCI World II UCITS ETF USD Hedged Dist: NAV Tracking And Analysis

Table of Contents

Understanding NAV and its Calculation for the Amundi MSCI World II UCITS ETF USD Hedged Dist

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. Understanding NAV is crucial for evaluating an ETF's performance and its alignment with the underlying index. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV calculation is a complex process. It considers:

- The market value of the underlying assets: This includes the value of all the stocks comprising the MSCI World index held by the ETF.

- Currency hedging costs: The ETF employs a USD hedging strategy to minimize exposure to currency fluctuations between the underlying assets (denominated in various currencies) and the USD. The costs associated with this hedging strategy are factored into the NAV calculation.

- Expenses: The Total Expense Ratio (TER) represents the annual cost of managing the ETF. This includes management fees, administrative expenses, and other operational costs. The TER directly impacts the NAV, reducing the overall value.

The NAV is typically calculated daily, and the information is publicly available, usually at the end of the trading day. A lower TER generally leads to a higher NAV, all else being equal.

Analyzing the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV Tracking Performance

Analyzing the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV tracking performance requires examining its historical data. (Note: In a published article, this section would include charts and graphs illustrating historical NAV data and tracking error.) We'd look at the tracking difference – the deviation between the ETF's price and the underlying MSCI World index. A smaller tracking difference indicates better performance.

Key factors influencing NAV tracking include:

- Market Volatility: During periods of high market volatility, the ETF's price might deviate more significantly from the index.

- Trading Volume: High trading volume generally leads to tighter tracking.

- Management Strategy: The ETF's management strategy plays a crucial role in minimizing tracking error.

A comparative analysis against similar ETFs, such as other MSCI World index-tracking ETFs, provides valuable insights into its relative performance. We'd consider metrics like the MSCI World index tracking error and expense ratio comparison to evaluate its competitiveness.

The Impact of Currency Hedging on NAV

The USD hedging in the Amundi MSCI World II UCITS ETF USD Hedged Dist aims to mitigate currency risk for investors. It reduces the impact of exchange rate fluctuations between the USD and other currencies represented in the underlying index.

- Benefits: Reduced volatility for USD-based investors, providing greater stability in returns.

- Drawbacks: Hedging strategies aren't perfect. They incur costs, which might slightly reduce the ETF's NAV compared to an unhedged version. Furthermore, the effectiveness of hedging depends on the accuracy of the hedging strategy used. During extreme currency fluctuations, hedging may not completely neutralize the risk.

Analyzing how the hedging strategy influences the ETF's NAV, particularly during periods of significant exchange rate fluctuations, is essential for understanding its overall performance.

Dividend Distribution and its Effect on NAV

The Amundi MSCI World II UCITS ETF USD Hedged Dist distributes dividends, which impact the NAV.

- Dividend Policy: The ETF's dividend distribution policy outlines the frequency and amount of dividend payouts.

- NAV Impact: When dividends are paid, the NAV decreases by the amount of the dividend per share.

- Historical Analysis: Examining the historical dividend yield and its consistency helps investors assess the ETF's income potential. The dividend payout ratio, and the distribution frequency also provide valuable insights for income-focused investors.

Risk Factors and Considerations for Investors

Investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist, like any investment, carries risks:

- Market Risk: Fluctuations in the global stock market can impact the ETF's NAV.

- Currency Risk: Despite the hedging, residual currency risk may still exist.

- Counterparty Risk: This refers to the risk of the ETF's counterparties failing to fulfill their obligations.

Portfolio diversification is crucial to mitigate these risks. The suitability of this ETF depends on individual investor risk tolerance and investment goals. Careful consideration of your own investment risk profile and ETF risk management strategies is essential before making an investment decision.

Conclusion: Investing Wisely with the Amundi MSCI World II UCITS ETF USD Hedged Dist

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV tracking performance, the influence of its USD hedging strategy, and its dividend distribution policy is vital for informed investment decisions. While the ETF offers diversification and currency risk mitigation, potential investors should carefully consider associated risks. Effective NAV tracking is a key indicator of an ETF’s success in replicating its benchmark index. This detailed analysis of the Amundi MSCI World II UCITS ETF USD Hedged Dist allows you to assess its suitability for your portfolio. We encourage you to conduct further research, considering your individual circumstances, before making any investment decisions. Remember to carefully evaluate the ETF's NAV tracking and other critical factors before investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist.

Featured Posts

-

Mamma Mia The Hottest New Ferrari Hot Wheels Sets Unveiled

May 24, 2025

Mamma Mia The Hottest New Ferrari Hot Wheels Sets Unveiled

May 24, 2025 -

Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025

Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025 -

Konchita Vurst Zhivott Sled Pobedata Na Evroviziya

May 24, 2025

Konchita Vurst Zhivott Sled Pobedata Na Evroviziya

May 24, 2025 -

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School

May 24, 2025

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School

May 24, 2025 -

First Official Ferrari Service Centre Opens In Bengaluru A Comprehensive Overview

May 24, 2025

First Official Ferrari Service Centre Opens In Bengaluru A Comprehensive Overview

May 24, 2025

Latest Posts

-

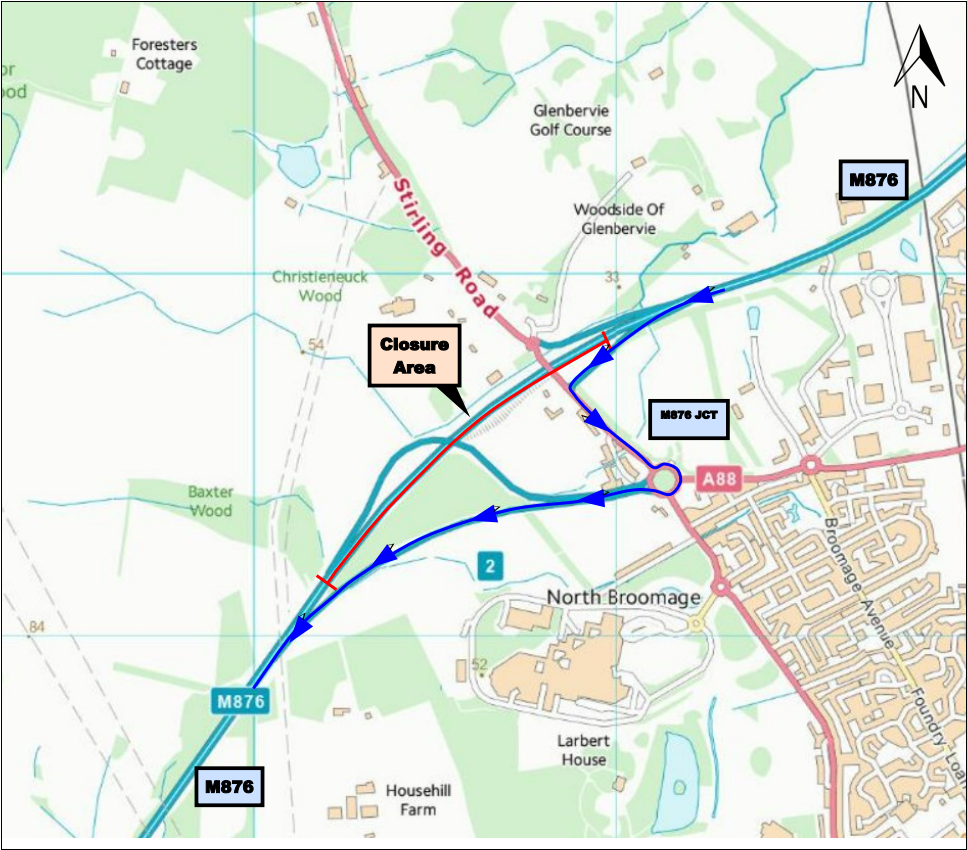

M62 Manchester To Warrington Westbound Resurfacing Works And Road Closure Details

May 24, 2025

M62 Manchester To Warrington Westbound Resurfacing Works And Road Closure Details

May 24, 2025 -

Planned M62 Westbound Closure For Resurfacing Impact On Drivers From Manchester To Warrington

May 24, 2025

Planned M62 Westbound Closure For Resurfacing Impact On Drivers From Manchester To Warrington

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Collision

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Collision

May 24, 2025 -

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025 -

M56 Motorway Closure Serious Crash Causes Major Delays Live Updates

May 24, 2025

M56 Motorway Closure Serious Crash Causes Major Delays Live Updates

May 24, 2025