Analysis: China's Monetary Policy Shift Amidst Rising Tariffs

Table of Contents

The Impact of Rising Tariffs on the Chinese Economy

Rising tariffs have directly impacted the Chinese economy, primarily by affecting exports and GDP growth. The increased costs associated with exporting goods to major markets, particularly the United States, have led to several significant consequences:

-

Decreased export demand leading to factory closures and job losses: Tariffs make Chinese goods more expensive, reducing their competitiveness in international markets. This decreased demand has forced many factories to scale back production, leading to job losses and economic hardship in affected regions. The manufacturing sector, a cornerstone of the Chinese economy, has been particularly hard hit.

-

Reduced foreign investment due to uncertainty in the global market: The trade war has created significant uncertainty for foreign investors, making China a less attractive destination for investment. This uncertainty stems from the unpredictable nature of tariff increases and retaliatory measures.

-

Increased inflationary pressure from import costs: While exports are suffering, the cost of imports has risen due to retaliatory tariffs and disruptions in global supply chains. This increased cost of imported goods contributes to inflationary pressures within the Chinese economy.

-

Weakening of the Chinese Yuan (CNY) against the US dollar: The trade war and economic slowdown have put downward pressure on the Chinese Yuan, making imports more expensive and potentially fueling inflation further. This weakening of the currency is a direct consequence of the decreased demand for Chinese goods.

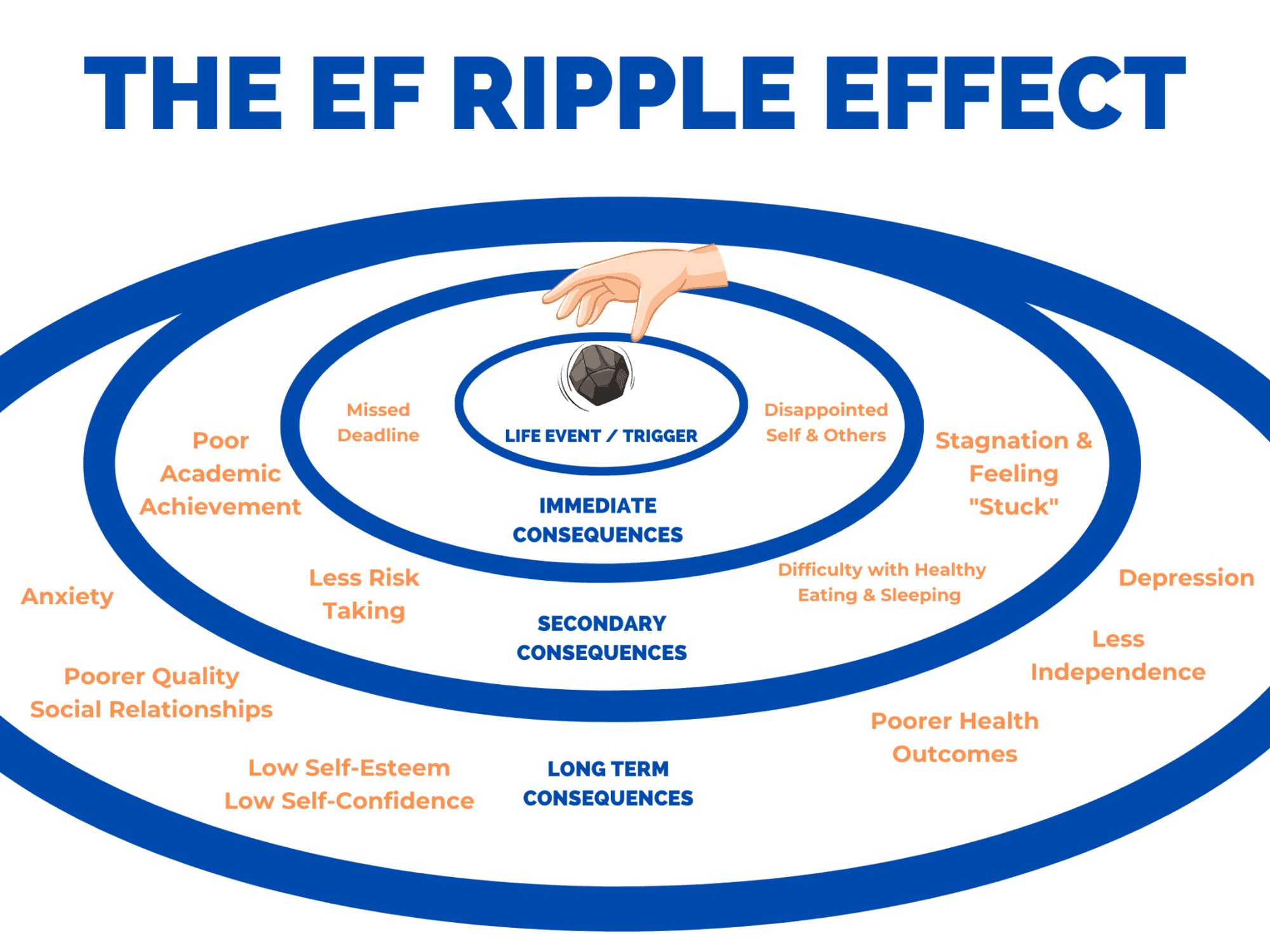

The ripple effect extends beyond these direct impacts, affecting related sectors such as technology and agriculture, creating a complex web of economic challenges. For example, the tech sector faces difficulties in accessing crucial components from abroad, while agricultural exports have also suffered from reduced demand. The overall impact necessitates a comprehensive response from the Chinese government.

China's Monetary Policy Response: A Shift Towards Ease

In response to these challenges, the PBOC has implemented a series of monetary policy adjustments aimed at easing the economic strain. These measures include:

-

Reduction in reserve requirement ratio (RRR) for commercial banks: Lowering the RRR frees up more capital for banks to lend, stimulating borrowing and investment within the economy.

-

Lowering of interest rates on loans: Lower interest rates make borrowing cheaper for businesses and consumers, encouraging investment and spending. This is a classic tool for stimulating economic activity.

-

Increased liquidity injections into the money market: The PBOC has injected more liquidity into the money market to ensure sufficient funds are available for lending and to prevent a credit crunch.

-

Government stimulus packages targeting infrastructure and consumption: Beyond monetary policy, significant government stimulus packages have focused on boosting infrastructure projects and encouraging consumer spending to bolster economic growth.

These measures are designed to counteract the negative effects of tariffs by boosting domestic demand and stimulating economic activity. However, such policies also carry potential risks. For example, excessive liquidity injections could contribute to inflation or the creation of asset bubbles.

Effectiveness of the Implemented Measures

Assessing the effectiveness of the PBOC's response is complex and requires analyzing various economic indicators. While some positive signs exist:

-

Evidence of increased lending and investment following policy adjustments: Data suggests an increase in lending and investment activity following the implementation of the eased monetary policy.

-

Indicators of improved economic activity (e.g., industrial production, consumer spending): Certain economic indicators, such as industrial production and consumer spending, have shown signs of improvement, though the recovery remains uneven.

-

Assessment of the effectiveness of government stimulus packages: The effectiveness of government stimulus packages remains a subject of ongoing debate and analysis, with varying assessments depending on the specific sectors and regions considered.

However, the limitations are also apparent:

- Evaluation of the impact on inflation and exchange rates: The impact on inflation and exchange rates has been mixed, with inflationary pressures remaining a concern.

Further analysis is needed to determine the long-term effectiveness of these measures in mitigating the negative impacts of the tariffs. The use of graphs and charts visualizing key economic data would greatly enhance this analysis.

The Role of Fiscal Policy in Supporting Monetary Policy

China's response to the tariffs has involved a coordinated approach between monetary and fiscal policies. The government's fiscal policies, such as increased infrastructure spending and targeted tax cuts, play a crucial role in complementing the PBOC's monetary easing. This coordinated approach aims to stimulate aggregate demand and support economic growth. The success of this coordinated strategy is still being assessed.

Future Outlook for China's Monetary Policy

Predicting the future trajectory of China's monetary policy is challenging, given the ongoing uncertainties surrounding the trade war and the global economic climate. Potential future adjustments could include:

-

Predictions for interest rates and RRR changes: Further adjustments to interest rates and the RRR are possible, depending on the pace of economic recovery and inflationary pressures.

-

Forecast for future government spending and stimulus measures: Continued government spending and stimulus measures are likely, particularly if the economic recovery remains slow.

-

Anticipated impacts of ongoing trade negotiations: The outcome of ongoing trade negotiations will significantly influence the future direction of China's monetary policy.

-

Analysis of potential risks and challenges facing the Chinese economy: Risks such as rising debt levels and potential asset bubbles need to be carefully managed.

Both optimistic and pessimistic scenarios are possible. A sustained economic recovery could lead to a gradual normalization of monetary policy, while a prolonged slowdown could necessitate further easing.

Conclusion: Rising tariffs have significantly impacted China's monetary policy, forcing the PBOC to implement substantial easing measures. While these measures, combined with coordinated fiscal policies, have shown some positive effects, the overall effectiveness remains a subject of ongoing assessment. The future trajectory of China's monetary policy depends heavily on the resolution of trade disputes and the overall global economic climate. Stay informed about the evolving dynamics of China's monetary policy by following our updates and analyses on the subject. Understanding China's monetary policy is crucial for navigating the complexities of the global economy.

Featured Posts

-

Shifting Sands Taiwanese Investors Reduce Exposure To Us Bond Etfs

May 08, 2025

Shifting Sands Taiwanese Investors Reduce Exposure To Us Bond Etfs

May 08, 2025 -

Exploring The Unique Double Performances In Okc Thunder History

May 08, 2025

Exploring The Unique Double Performances In Okc Thunder History

May 08, 2025 -

Lahwr Ky Edlyh Ke Jjz Ke Lye Nyy Tby Bymh Askym Ka Aelan

May 08, 2025

Lahwr Ky Edlyh Ke Jjz Ke Lye Nyy Tby Bymh Askym Ka Aelan

May 08, 2025 -

The Ripple Effect Understanding Xrps 400 Surge And Future Trajectory

May 08, 2025

The Ripple Effect Understanding Xrps 400 Surge And Future Trajectory

May 08, 2025 -

Shkelje E Rregulloreve Arsenali Nen Hetim Nga Uefa Pas Ndeshjes Me Psg

May 08, 2025

Shkelje E Rregulloreve Arsenali Nen Hetim Nga Uefa Pas Ndeshjes Me Psg

May 08, 2025