Analysis: Chinese Stock Market's Response To Recent US Discussions And Data

Table of Contents

Impact of US-China Trade Discussions on Chinese Stocks

The ongoing dialogue and occasional tensions between the US and China significantly influence the Chinese stock market. Fluctuations in trade policy directly impact investor confidence and market volatility.

Trade War Uncertainty and Volatility

- Increased tariffs: Imposition of tariffs on goods traded between the US and China creates uncertainty and directly affects specific sectors like manufacturing and agriculture.

- Market uncertainty: The unpredictable nature of trade negotiations leads to increased market volatility, making it challenging for investors to predict short-term trends.

- Investor hesitation: Uncertainty discourages foreign investment and leads to domestic investors adopting a wait-and-see approach.

- Flight to safety: Investors often move their funds to safer assets during periods of heightened trade tensions, leading to capital outflow from the Chinese market.

- Sector-specific impacts: The technology and manufacturing sectors, heavily involved in US-China trade, experience disproportionately larger impacts than other sectors.

For instance, during the initial stages of the trade war in 2018, the Shanghai Composite Index experienced significant drops as uncertainty grew. The subsequent implementation of tariffs led to further volatility and a period of investor apprehension.

Easing Trade Tensions and Market Recovery

- Positive impacts of de-escalation: Periods of decreased trade tension and positive dialogue between the US and China usually lead to increased investor confidence and market recovery.

- Renewed investor confidence: When trade uncertainties lessen, investors become more willing to invest in Chinese assets, leading to capital inflows.

- Capital inflows: Easing tensions attract both domestic and foreign investment, boosting market liquidity and driving up stock prices.

- Sector-specific rebounds: Sectors most negatively affected by trade tensions (like technology and manufacturing) tend to show stronger rebounds during periods of de-escalation.

For example, announcements of "phase one" trade deals between the US and China often resulted in a noticeable upswing in the Shanghai and Shenzhen stock indices, reflecting renewed investor optimism. Government interventions and policy responses aimed at stabilizing the market also contribute to these recoveries.

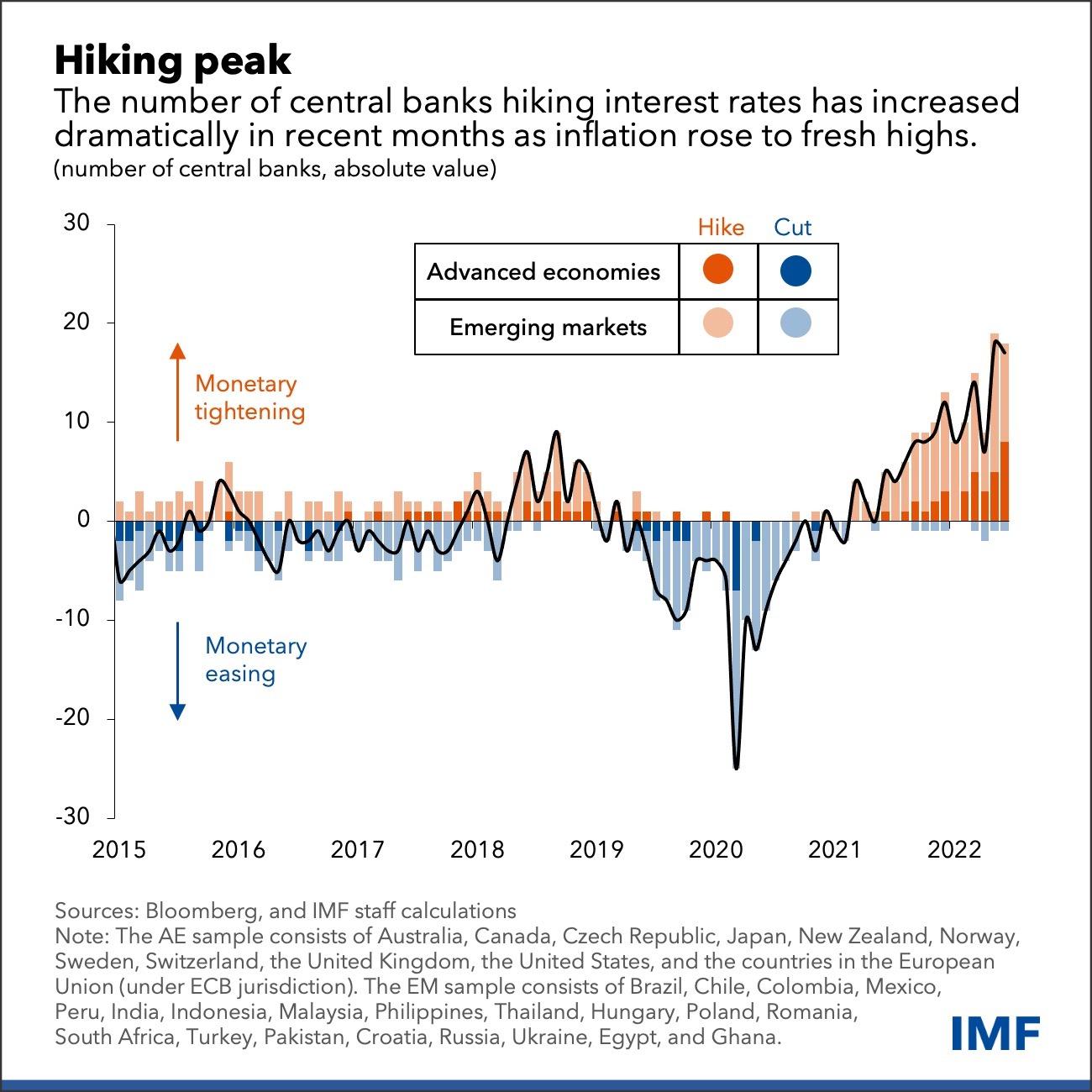

Influence of US Economic Data on the Chinese Stock Market

US economic data, particularly interest rates and inflation figures, exert significant influence on the Chinese stock market. These factors impact global capital flows and investor sentiment.

US Interest Rate Hikes and their Ripple Effects

- Impact on capital flows: Higher US interest rates often attract global capital away from emerging markets like China, reducing investment in Chinese stocks.

- Yuan valuation: Increased US interest rates can strengthen the US dollar relative to the yuan, potentially impacting Chinese exports and investor confidence.

- Foreign investment in China: Higher US yields make dollar-denominated assets more attractive, reducing foreign direct investment (FDI) into China.

- Impact on Chinese companies with US debt: Chinese companies with significant US dollar-denominated debt face increased borrowing costs when US interest rates rise.

The correlation between US interest rate hikes and capital outflows from the Chinese market is a crucial factor to consider when analyzing market performance. Data illustrating this correlation can be readily found through various financial news sources and economic databases.

US Inflation Data and its Implications

- Impact on global demand: High US inflation can dampen global demand, negatively affecting Chinese export-oriented sectors.

- Commodity prices: US inflation often affects global commodity prices, impacting the profitability of Chinese companies reliant on raw materials.

- Chinese export-oriented sectors: Sectors heavily reliant on exports to the US, such as manufacturing and consumer goods, are particularly vulnerable to fluctuations in US inflation.

- Investor expectations: High US inflation can fuel expectations of further interest rate hikes, impacting investor sentiment towards the Chinese market.

For example, periods of high US inflation often correlate with decreased demand for Chinese-manufactured goods, leading to slower growth in related sectors and impacting their stock prices.

Sector-Specific Analysis of Market Response

The impact of US developments on the Chinese stock market varies significantly across different sectors.

Technology Sector Sensitivity

- Impact of US tech sanctions: US sanctions on Chinese technology companies create significant uncertainty and negatively impact their stock prices.

- Regulatory changes in China: Domestic regulatory changes, often in response to US actions, further add to the volatility of the Chinese tech sector.

- Investor concerns regarding intellectual property: Concerns surrounding intellectual property rights and technological espionage contribute to investor apprehension.

The Chinese technology sector, given its close ties to global technology markets and its frequent involvement in US-China trade disputes, shows heightened sensitivity to US actions. The performance of individual companies within the sector reflects these external pressures.

Performance of other key sectors (e.g., Real Estate, Consumer Goods)

The real estate and consumer goods sectors in China also show varying responses to US developments, though often less dramatic than the tech sector. For instance, consumer goods may be affected indirectly through changes in global demand and trade relationships. The real estate sector, while significantly influenced by domestic policy, is also affected by changes in global capital flows related to US economic data. Data illustrating the performance of these sectors relative to the technology sector provides valuable insights into the nuanced impact of US-China dynamics on the Chinese stock market.

Conclusion

This analysis demonstrates a complex relationship between the Chinese stock market and recent US discussions and data releases. Trade tensions, US interest rate adjustments, and inflation figures significantly influence investor sentiment and market performance across various sectors. The technology sector, in particular, displays heightened sensitivity to US actions. Understanding this interplay is vital for successful investment strategies.

Call to Action: Understanding the intricate interplay between US and Chinese economic factors is crucial for navigating the Chinese stock market. Stay informed on US-China relations and key economic indicators to make well-informed investment decisions regarding the Chinese stock market. Continue monitoring the Chinese Stock Market for further insights and analysis. Understanding the nuances of the Chinese stock market, in relation to US developments, is crucial for making informed investment choices.

Featured Posts

-

Mnozica Na Trgu Sv Petra Papezev Tradicionalni Blagoslov

May 07, 2025

Mnozica Na Trgu Sv Petra Papezev Tradicionalni Blagoslov

May 07, 2025 -

The Timberwolves Appreciation Of Randles Physical Presence

May 07, 2025

The Timberwolves Appreciation Of Randles Physical Presence

May 07, 2025 -

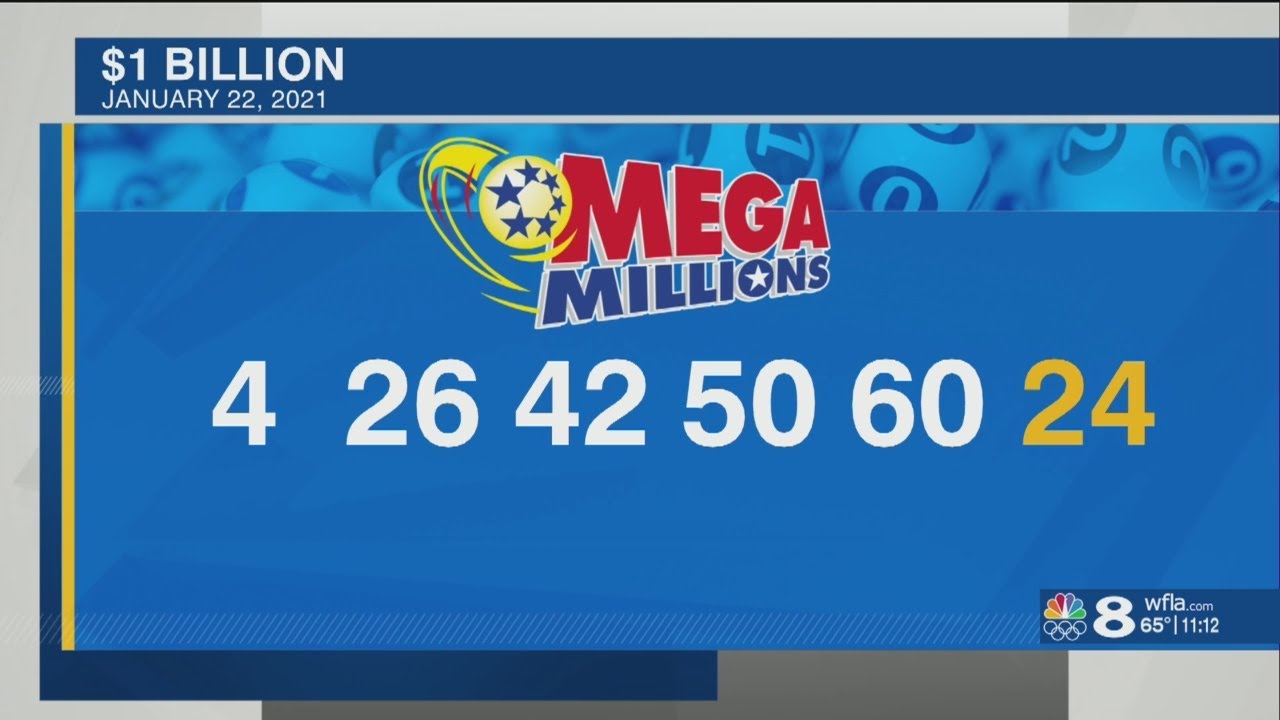

April 16 2025 Lottery Results Check Winning Numbers

May 07, 2025

April 16 2025 Lottery Results Check Winning Numbers

May 07, 2025 -

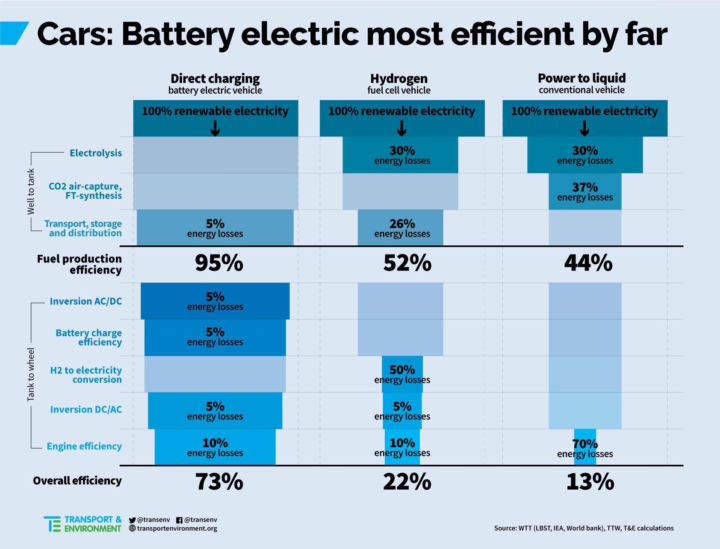

Hydrogen Vs Battery Buses A European Transit Comparison

May 07, 2025

Hydrogen Vs Battery Buses A European Transit Comparison

May 07, 2025 -

Simone Biles From Gymnastics Champion To What

May 07, 2025

Simone Biles From Gymnastics Champion To What

May 07, 2025

Latest Posts

-

50 Years Of Tension Indias Bold Military Action Against Pakistan

May 08, 2025

50 Years Of Tension Indias Bold Military Action Against Pakistan

May 08, 2025 -

China Eases Monetary Policy To Counter Tariff Impacts

May 08, 2025

China Eases Monetary Policy To Counter Tariff Impacts

May 08, 2025 -

Lab Owners Guilty Plea Falsified Covid 19 Test Results

May 08, 2025

Lab Owners Guilty Plea Falsified Covid 19 Test Results

May 08, 2025 -

Chinas Rate Cuts And Easier Bank Lending A Response To Tariffs

May 08, 2025

Chinas Rate Cuts And Easier Bank Lending A Response To Tariffs

May 08, 2025 -

Cadillac Celestiq First Drive Review Exploring The Ultra Luxury Electric Vehicle

May 08, 2025

Cadillac Celestiq First Drive Review Exploring The Ultra Luxury Electric Vehicle

May 08, 2025