Analysis: Gold Suffers First Double-Week Loss Of 2025

Table of Contents

Key Factors Contributing to Gold's Decline

Several interconnected factors contributed to gold's recent double-week loss. Understanding these factors is crucial for navigating the current market uncertainty and making informed decisions about your gold holdings.

Strengthening US Dollar

The US dollar's recent strength against other major currencies has played a significant role in gold's price decline. Gold is priced in US dollars, so a stronger dollar makes gold more expensive for investors holding other currencies. This reduces demand, leading to lower prices.

- Inverse Relationship: There's an inverse relationship between the US dollar index (DXY) and gold prices. As the DXY rises, gold prices tend to fall, and vice versa.

- DXY Data: During the period of gold's decline, the DXY showed a notable increase, reaching [insert specific DXY data here], indicating a strengthening dollar. This data clearly demonstrates the impact of the dollar's strength on gold.

- Reasons for Dollar Strength: Several factors contributed to the US dollar's strength, including positive economic data, expectations of continued interest rate hikes by the Federal Reserve, and a flight to safety amid global uncertainties.

Rising Interest Rates

Increased interest rates globally make non-yielding assets like gold less attractive compared to interest-bearing investments. Higher interest rates boost the returns on bonds and savings accounts, diverting investor funds away from gold.

- Investor Preference Shift: Higher interest rates incentivize investors to shift their capital towards higher-yielding alternatives. This reduced demand for gold directly impacts its price.

- Interest Rate Changes: The recent increase in interest rates by [mention specific central banks and percentage changes] significantly contributed to the decreased appeal of gold as an investment.

- Central Bank Policies: Central bank policies play a crucial role in influencing interest rates and consequently, gold prices. Aggressive monetary tightening measures generally exert downward pressure on gold.

Profit-Taking and Market Corrections

After a period of relative stability or growth, market corrections are a natural part of the investment cycle. Profit-taking by some investors, who had previously held onto gold, contributed to the recent decline. This sell-off amplified the downward price trend.

- Profit-Taking Explained: Profit-taking involves selling an asset to realize gains. When many investors simultaneously take profits from their gold investments, it can create significant selling pressure.

- Technical Analysis: Technical analysis might have indicated potential corrections, prompting some investors to sell before prices fell further. This adds to the overall selling pressure.

- Trading Volume: High trading volumes during the decline suggest significant activity in the market, further emphasizing the impact of profit-taking and market corrections.

Geopolitical Factors

Geopolitical instability often boosts gold's appeal as a safe-haven asset. However, unexpected shifts or reduced investor confidence in certain regions can impact gold prices negatively.

- Geopolitical Events: [Analyze any relevant geopolitical events that occurred during the gold price decline and explain their impact].

- Investor Sentiment: Investor sentiment towards geopolitical risk significantly influences gold prices. Reduced fear or increased confidence can lead to selling pressure on gold.

- News and Events: Negative news or events related to geopolitical stability can lead to a sell-off in gold even if it's considered a safe-haven asset.

Implications for Gold Investors

The recent decline in gold prices presents both challenges and opportunities for investors. It's important to assess the implications for your investment strategy.

Short-Term vs. Long-Term Outlook

The recent double-week loss is a short-term market fluctuation. While concerning, it shouldn't necessarily dictate long-term investment decisions.

- Short-Term Trends: Short-term trends are inherently volatile and can be influenced by various factors. Analyzing these trends helps in understanding the current market sentiment.

- Long-Term Outlook: The long-term outlook for gold remains a subject of ongoing debate among analysts. Some believe in its continued role as a safe-haven asset, while others are more cautious.

- Long-Term Investment Strategies: Investors with a long-term perspective might view this decline as a buying opportunity, adopting a "buy-the-dip" strategy. Dollar-cost averaging is another suitable strategy.

Diversification and Risk Management

Gold's price volatility underscores the importance of diversification. Holding only gold can expose investors to significant risks.

- Portfolio Diversification: Diversification across various asset classes is crucial for mitigating risk. A diversified portfolio cushions against losses in any single asset class.

- Other Asset Classes: Consider diversifying into assets such as stocks, bonds, real estate, or other commodities to reduce overall portfolio risk.

- Risk Management Strategies: Employing risk management strategies like stop-loss orders can help limit potential losses during market corrections.

Conclusion

The first double-week loss for gold in 2025 is a significant event influenced by a confluence of factors including a strengthening US dollar, rising interest rates, profit-taking, and potential geopolitical uncertainties. While the short-term outlook might appear uncertain, investors should maintain a long-term perspective and consider diversifying their portfolios to mitigate risk. The price fluctuations of gold emphasize the need for careful monitoring and a well-defined investment strategy. Stay informed on market developments and continue your analysis of gold prices to make informed decisions about your investment strategy. Consider consulting a financial advisor before making significant changes to your gold investments. Remember, understanding the factors influencing gold prices is key to successful long-term gold investment.

Featured Posts

-

Watch Fox For Free Alternatives To Cable Tv For Live Content

May 05, 2025

Watch Fox For Free Alternatives To Cable Tv For Live Content

May 05, 2025 -

Federal Judge Rejects Trump Administrations Action Against Perkins Coie

May 05, 2025

Federal Judge Rejects Trump Administrations Action Against Perkins Coie

May 05, 2025 -

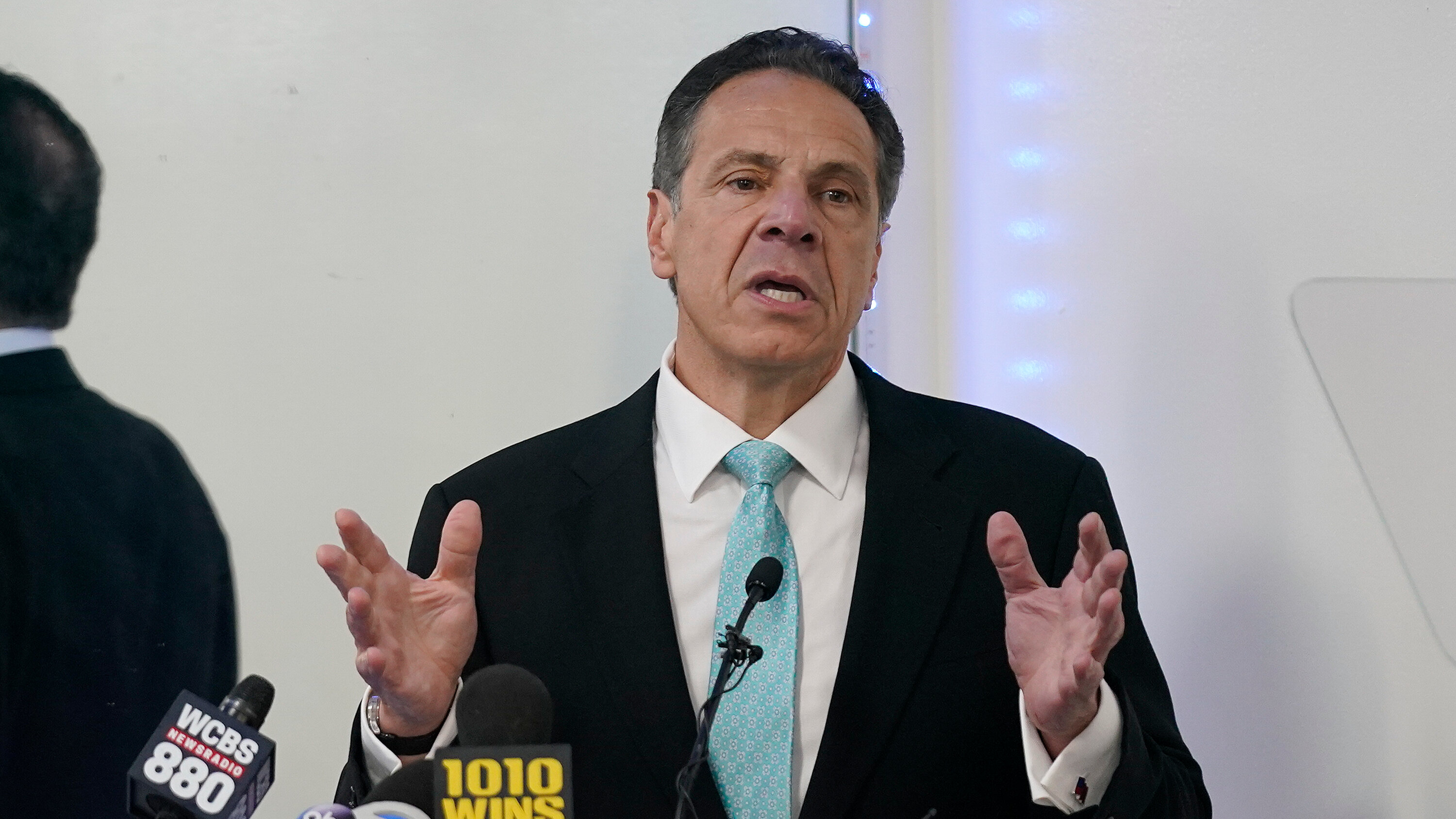

Investigation Andrew Cuomos 3 Million Nuclear Stock Holdings

May 05, 2025

Investigation Andrew Cuomos 3 Million Nuclear Stock Holdings

May 05, 2025 -

Verstappens First Interview Since Becoming A Father

May 05, 2025

Verstappens First Interview Since Becoming A Father

May 05, 2025 -

Unexpected Spring Snow 1 2 Inches Possible In Some Nyc Suburbs

May 05, 2025

Unexpected Spring Snow 1 2 Inches Possible In Some Nyc Suburbs

May 05, 2025

Latest Posts

-

Chicago Med Season 10 Episode 14 Features Brian Tees Return

May 05, 2025

Chicago Med Season 10 Episode 14 Features Brian Tees Return

May 05, 2025 -

Brian Tees Highly Anticipated Return In Chicago Med Season 10 Episode 14

May 05, 2025

Brian Tees Highly Anticipated Return In Chicago Med Season 10 Episode 14

May 05, 2025 -

Brian Tee Returns To Chicago Med Season 10 Episode 14

May 05, 2025

Brian Tee Returns To Chicago Med Season 10 Episode 14

May 05, 2025 -

A 390 000 Win For Nelson Dong In Apo Main Event

May 05, 2025

A 390 000 Win For Nelson Dong In Apo Main Event

May 05, 2025 -

Convicted Paedophile Receives Significant Prison Term

May 05, 2025

Convicted Paedophile Receives Significant Prison Term

May 05, 2025