Analysis: House Republicans' Reveal Of Trump's Tax Policy

Table of Contents

Key Revelations from Trump's Tax Returns

The release of Trump's tax information offers unprecedented insight into his financial practices and tax strategies over several years. Several key revelations stand out, demanding closer scrutiny.

Significant Tax Reductions

Trump's tax returns reportedly reveal significant tax reductions achieved through various deductions, credits, and strategic financial maneuvers. These strategies minimized his tax liability considerably, raising questions about both their legality and their ethical implications.

- Significant Depreciation Claims: Reports suggest extensive use of depreciation deductions on business properties, lowering taxable income. The specific amounts and the validity of these claims are subject to further investigation.

- Charitable Deductions: The extent and nature of charitable donations claimed as deductions are under scrutiny. The IRS guidelines for charitable giving require detailed documentation, and the specifics of Trump's claims are yet to be fully analyzed.

- Business Losses Offset: Utilization of business losses to offset taxable income in other years is another area of focus. The legitimacy of these losses and the accounting methods used are being examined.

- Tax Credits: Specific types of tax credits used, such as those related to investments or business expenses, will require careful review to assess their proper application.

The legality of these strategies requires thorough examination by tax experts. Ethical considerations regarding aggressive tax minimization techniques, even if within the legal bounds, are also paramount.

Income and Asset Valuation

The reported income figures fluctuate significantly across the years included in the released returns. Some years show substantial income, while others report significant losses. These discrepancies raise questions about the accuracy of asset valuations and the overall picture of Trump's financial health.

- Fluctuations in Reported Income: Year-to-year variations in reported income are substantial, requiring analysis to understand the underlying factors driving these changes. A comprehensive understanding requires examination of business activities, investment performance, and other income sources.

- Asset Valuation: The valuation of Trump's assets, including real estate holdings and business interests, plays a significant role in determining his taxable income. Any inconsistencies or anomalies in these valuations require further investigation.

- Comparisons to Public Statements: Discrepancies between the reported income figures and Trump's past public statements about his wealth and income need careful consideration.

The implications for wealth estimations are significant, affecting public perception of his financial standing and challenging previous estimates of his net worth.

Use of Tax Shelters and Loopholes

Reports indicate the potential use of various tax shelters and loopholes to minimize Trump's tax burden. Understanding these strategies and their implications is crucial for assessing the overall fairness and effectiveness of the US tax system.

- Complex Business Structures: Trump's use of complex business structures might have facilitated the use of tax shelters. Analyzing these structures and their tax implications requires specialized expertise.

- Offshore Accounts: The existence and utilization of offshore accounts are subjects that require thorough investigation to determine compliance with tax laws and regulations.

- Specific Tax Shelters: Pinpointing the precise tax shelters employed (if any) is critical for understanding their legality and their potential impact on the tax system as a whole.

The legal and ethical implications of these strategies raise important questions about the fairness and effectiveness of the current tax code. The disclosure necessitates a review of relevant tax laws and regulations to determine compliance.

Political Ramifications of the Disclosure

The release of Trump's tax information has significant political ramifications, influencing both the Republican Party and the broader political landscape.

Impact on the Republican Party

The disclosure has the potential to reshape the Republican Party's image and future strategies. It may lead to internal divisions and changes in political allegiances.

- Public Opinion Shift: Public opinion polls will be crucial for tracking the impact of the disclosure on voters' perceptions of the Republican Party and its candidates.

- Internal Party Divisions: The release could exacerbate internal tensions within the Republican Party, affecting party unity and strategic decision-making.

- Impact on Upcoming Elections: The release's impact on upcoming elections remains to be seen but could influence voter turnout and candidate selection.

Influence on Future Tax Legislation

This information could significantly shape future debates and policy decisions regarding taxation in the United States.

- Potential for Increased Scrutiny: The disclosure may lead to increased scrutiny of tax laws and regulations, potentially resulting in reform efforts.

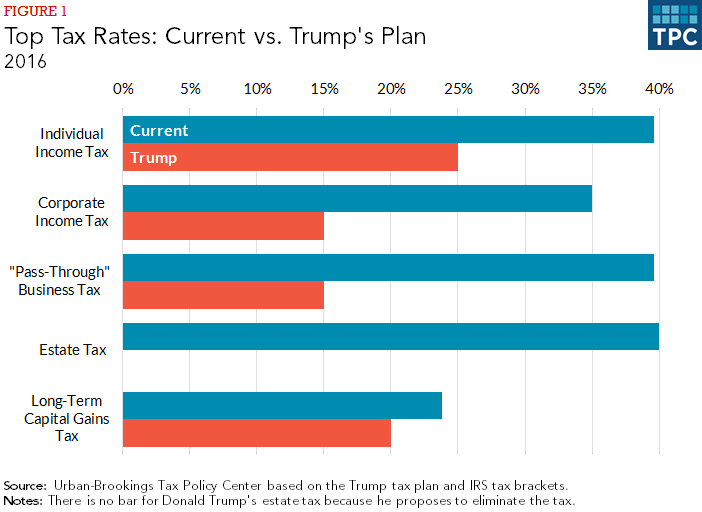

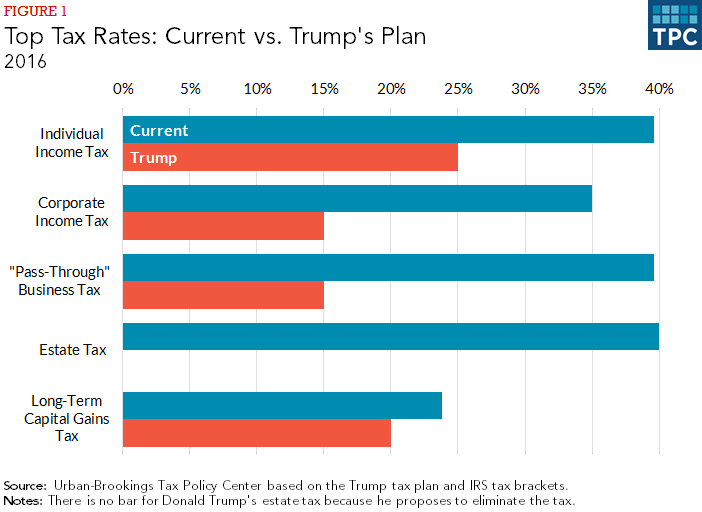

- Changes to Tax Laws: The findings might prompt calls for changes to the tax code to close loopholes and prevent similar tax minimization strategies in the future.

- Broader Economic Policy: The implications extend beyond tax reform, influencing debates on broader economic policy and wealth distribution.

Public Perception and Trust in Government

The release impacts public trust in both the former president and the government's institutions.

- Media Coverage Analysis: The tone and emphasis of media coverage surrounding the disclosure will heavily influence public perception.

- Social Media Sentiment: Social media reaction and online discussions will offer valuable insights into public opinion and emotional responses.

- Long-term effects on Transparency: The episode's long-term implications for transparency and accountability within the government are yet to be determined.

Economic Implications of Trump's Tax Strategies

The tax strategies employed by Trump have potential economic consequences, affecting income inequality and the national debt.

Effects on Income Inequality

The revealed tax strategies could have exacerbated income inequality, benefiting the wealthy disproportionately.

- Impact on Different Income Brackets: Analyzing the effects of Trump's tax strategies on different income brackets requires careful statistical analysis.

- Economic Theories on Wealth Distribution: Understanding the potential impact necessitates applying relevant economic theories related to wealth distribution and tax policy.

Consequences for the National Debt

Trump's tax minimization strategies may have contributed to a loss of revenue for the federal government, potentially increasing the national debt.

- Revenue Loss Estimates: Quantifying the revenue lost due to the disclosed tax strategies requires careful estimation and accounting.

- Long-Term Effects on Government Spending: The potential long-term consequences on government spending and budget deficits need careful consideration.

Conclusion

The release of Trump's tax information offers crucial insights into his financial practices and their broader implications. The significant tax reductions achieved, the political ramifications, and the potential economic impacts revealed in the returns necessitate further analysis. The most impactful revelation is perhaps the potential for similar strategies to be utilized by others, highlighting vulnerabilities in the existing tax system. These findings underscore the importance of transparency and accountability in government.

Call to Action: The release of Trump's tax information provides crucial insights into his financial practices and their broader implications. Continued analysis and public discourse are vital to understanding the full extent of Trump's tax policy and its effect on the nation's economic and political landscape. Stay informed on further developments concerning Trump's tax policy and its ongoing influence. Understanding Trump's tax policy is crucial for informed civic engagement.

Featured Posts

-

Nhl 25 Arcade Mode A Complete Guide

May 16, 2025

Nhl 25 Arcade Mode A Complete Guide

May 16, 2025 -

Game 1 Tatum Acknowledges Knicks Impressive Showing Against Celtics

May 16, 2025

Game 1 Tatum Acknowledges Knicks Impressive Showing Against Celtics

May 16, 2025 -

San Diego Padres Thwarting The Los Angeles Dodgers Strategy

May 16, 2025

San Diego Padres Thwarting The Los Angeles Dodgers Strategy

May 16, 2025 -

How La Liga Is Leading The Ai Charge In Global Sports

May 16, 2025

How La Liga Is Leading The Ai Charge In Global Sports

May 16, 2025 -

Smart Bets Nba And Nhl Playoffs Round 2

May 16, 2025

Smart Bets Nba And Nhl Playoffs Round 2

May 16, 2025