Analysis Of A 20M XRP Transaction: Whale Activity And Market Predictions

Table of Contents

Deconstructing the 20M XRP Transaction

Understanding the nuances of this significant transaction is crucial to assessing its market impact. Let's break down the key details and contextualize it within the broader XRP market landscape.

Transaction Details

Pinpointing the exact details requires accessing blockchain explorers. However, hypothetical data for illustrative purposes could look like this:

- Source Exchange: Unknown (potentially a large, centralized exchange or OTC trading desk)

- Destination Wallet: A previously inactive wallet, suggesting potential accumulation.

- Transaction Time: October 26, 2023, 14:37 UTC (example)

- Transaction Hash (link to explorer): [Insert a hypothetical transaction hash link here, ideally to a real explorer]

- Transaction Fee: Relatively low, indicating potentially planned and pre-mediated activity.

Identifying the Whale

Unmasking the entity behind such a large transaction is challenging. Blockchain technology, while transparent, offers a level of anonymity. Several scenarios are possible:

-

Possible Scenarios:

- Large Exchange: A major exchange might be repositioning its XRP holdings.

- Institutional Investor: A significant institutional investor could be accumulating XRP for long-term investment or trading purposes.

- High-Net-Worth Individual (Accumulator): A wealthy individual might be strategically accumulating XRP, anticipating future price appreciation.

-

Data Limitations and Anonymity: The inherent privacy features of cryptocurrency transactions make definitively identifying the actor extremely difficult. Often, only inferences can be made based on transaction patterns and known wallet addresses.

Transaction Timing and Market Context

The timing of this 20M XRP transaction is equally important. Analyzing it in the context of recent market events provides valuable insights:

- Recent XRP News and Price Trends: (Insert details about recent XRP news, price movements, and relevant market sentiment at the time of the transaction) Was there positive news about Ripple's ongoing legal battle or other developments affecting market sentiment?

- Correlation with Market Sentiment: Did the transaction coincide with a period of high volatility, indicating a potential attempt to capitalize on market fluctuations?

- Potential Motivations: Was the large transaction an attempt at accumulation (buying low), distribution (selling high), or a strategic maneuver intended to influence market manipulation? All these are possibilities that need to be examined given the surrounding context.

Impact on XRP Price and Volatility

The 20M XRP transaction's effect on XRP's price and volatility requires a close examination of both immediate and long-term impacts.

Immediate Market Reaction

The immediate aftermath of such a large transaction can manifest as a price spike or dip, depending on the perceived buying or selling pressure.

- Price before the transaction: (Insert price data)

- Price immediately after: (Insert price data)

- Percentage change: (Calculate and insert percentage change)

- Volume spikes: Did the transaction lead to a noticeable surge in trading volume, indicative of heightened market activity? (Insert relevant data)

Long-Term Implications

Predicting the long-term implications is complex and speculative. Different scenarios can be envisioned based on the identified (or speculated) actor.

- Bullish scenarios (accumulation): If the transaction represents accumulation by a major player, it could signal positive sentiment and potentially drive future price increases.

- Bearish scenarios (distribution): Conversely, if it signifies a large sell-off, it might exert downward pressure on the price, impacting market confidence.

- Neutral scenarios (normal trading activity): The transaction might simply reflect ordinary trading activity within the market, with little lasting impact on the long-term price trend.

Market Predictions and Future Outlook

Combining technical and fundamental analysis can offer a more holistic view of the future XRP outlook post-transaction.

Technical Analysis

Technical indicators provide insights into price patterns and potential future movements.

- Relevant technical indicators: Mentioning specific technical indicators (moving averages, RSI, MACD) and how they reacted to this specific event.

- Support and resistance levels: Did the transaction break through any significant support or resistance levels?

- Potential price targets: Based on technical analysis, what are potential short-term and long-term price targets for XRP? (Provide data and charts where possible).

Fundamental Analysis

Fundamental analysis considers factors beyond technical indicators. For XRP, key considerations include:

- Ripple's legal battles: The ongoing legal battle between Ripple and the SEC significantly impacts XRP's price and market sentiment.

- Adoption by financial institutions: Increased adoption of XRP by financial institutions could positively influence its price.

- Technological advancements in the XRP Ledger: Updates and improvements to the XRP Ledger's technology and efficiency can also impact market sentiment and price.

Conclusion

The 20M XRP transaction serves as a case study highlighting the influence of whale activity on the cryptocurrency market. Analyzing such significant transactions is crucial for understanding market dynamics and forming more informed predictions. While definitively identifying the actor behind this specific transaction remains challenging, the analysis reveals potential impacts on XRP's price and volatility, both in the short term and long term. By examining the transaction's details, market context, and utilizing both technical and fundamental analysis, we can gain valuable insights into future market movements.

Call to Action: Continue monitoring the XRP market, staying informed about significant transactions like this 20M XRP transaction and other large XRP transactions, and always conduct your own thorough research before making any investment decisions. Understanding whale activity in XRP and analyzing XRP market movements is key to navigating the complexities of the cryptocurrency landscape.

Featured Posts

-

Uber Auto Service Goes Cash Only Impact And Implications

May 08, 2025

Uber Auto Service Goes Cash Only Impact And Implications

May 08, 2025 -

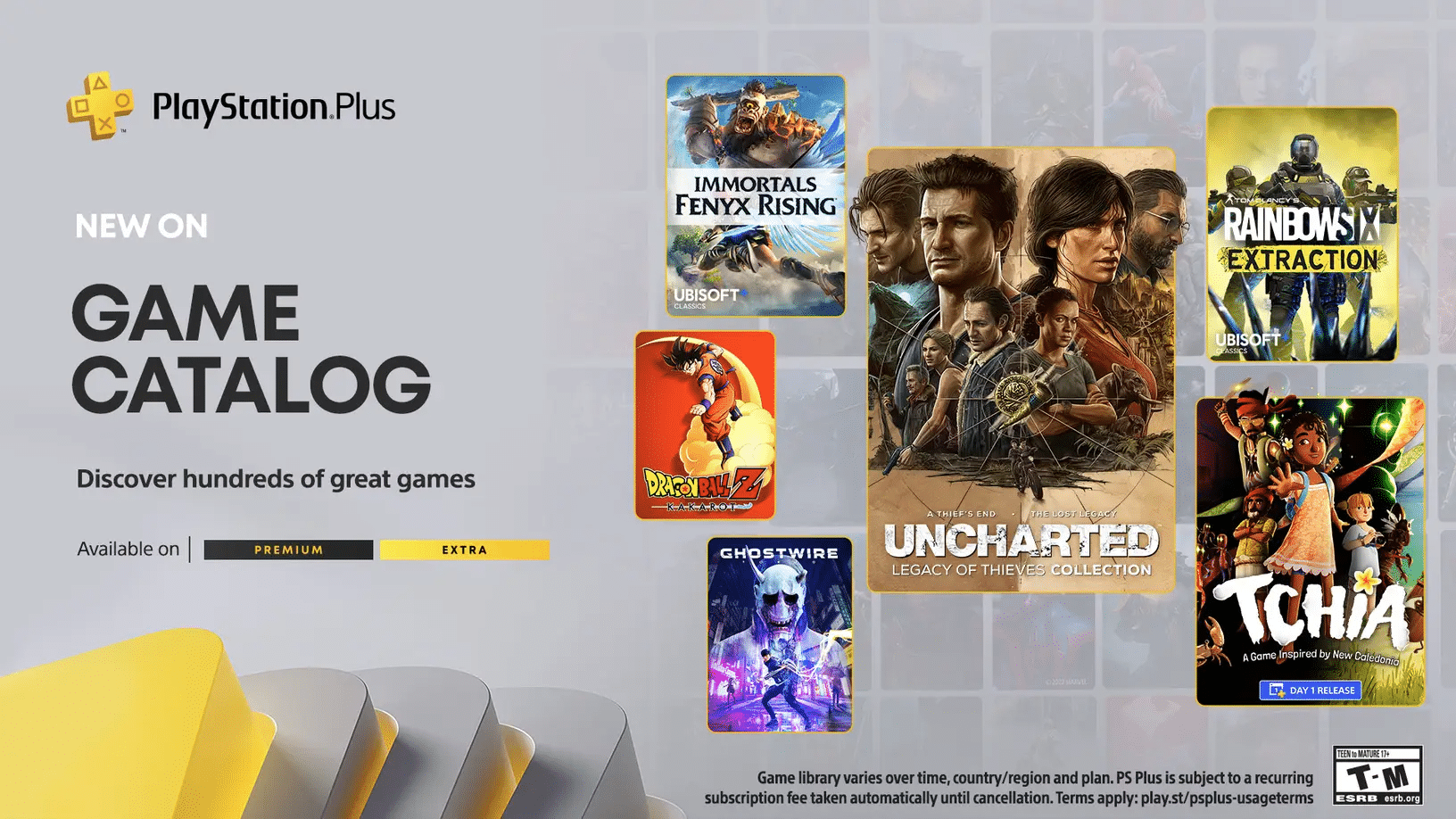

Ps Plus Premium And Extra New Games For March 2024 Full Details

May 08, 2025

Ps Plus Premium And Extra New Games For March 2024 Full Details

May 08, 2025 -

Should You Invest In Uber Technologies Uber A Detailed Look

May 08, 2025

Should You Invest In Uber Technologies Uber A Detailed Look

May 08, 2025 -

Ubers Cash Only Auto Service A Comprehensive Guide

May 08, 2025

Ubers Cash Only Auto Service A Comprehensive Guide

May 08, 2025 -

Jhl Privatization Ghas Strong Condemnation

May 08, 2025

Jhl Privatization Ghas Strong Condemnation

May 08, 2025