Analysis Of Australia's Opposition's $9 Billion Budget Improvement Proposal

Table of Contents

Key Areas Targeted for Improvement

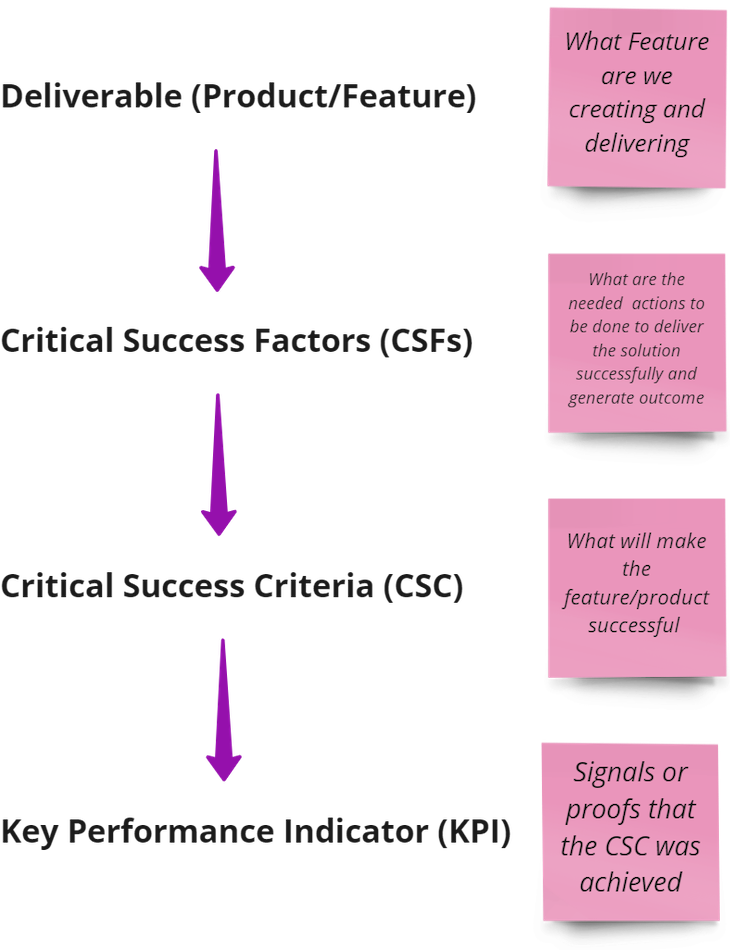

The opposition's plan focuses on several key areas to achieve its ambitious $9 billion target. These include significant tax reforms, strategic spending cuts, enhanced efficiency measures, and targeted investments in crucial infrastructure projects.

-

Taxation Reform: The proposal outlines several tax policy changes aimed at boosting revenue generation and promoting fiscal responsibility. This might involve adjustments to company tax rates, potentially offering incentives for investment while increasing the tax burden on high-profit corporations. Changes to capital gains tax, such as altering the discount rate or broadening the definition of capital assets, are also under consideration. Finally, adjustments to individual income tax brackets could also contribute to increased revenue. These changes, if implemented, are projected to generate a significant portion of the $9 billion target.

-

Spending Cuts: To enhance budget efficiency and fiscal sustainability, the opposition suggests targeted spending cuts across various government departments. While specifics remain limited at this stage, potential areas under review include streamlining administrative processes, reducing redundancies within government agencies, and potentially re-evaluating the funding of certain less impactful programs. This strategy is intended to free up resources for more impactful initiatives.

-

Increased Efficiency and Productivity Measures: The proposal emphasizes improving the efficiency of public sector operations. This includes reforms aimed at streamlining bureaucratic processes, improving procurement practices to secure better value for money, and investing in technology to enhance productivity across government departments. Such public sector reform is vital to ensure that taxpayer money is used effectively and efficiently.

-

Investment in Key Infrastructure Projects: A key component of the proposal involves substantial infrastructure investment, focusing on areas with high economic growth potential. This includes significant investment in renewable energy sources to support a transition to a cleaner energy future, modernizing transport infrastructure to improve connectivity and efficiency, and boosting investment in digital infrastructure to support technological advancement and economic competitiveness. These investments are expected to generate jobs and stimulate economic growth.

Feasibility and Potential Impact of the Proposal

The feasibility and ultimate impact of the opposition's proposal hinge on several factors, requiring a thorough analysis.

-

Economic Modeling and Forecasts: Independent economic modeling and government projections will be crucial in assessing the proposal's impact on key economic indicators. Analyzing projected GDP growth, employment rates, and inflation levels will be essential in understanding the true economic consequences of the proposed changes. A comprehensive fiscal impact assessment will be needed to validate the $9 billion target.

-

Political Considerations and Potential Challenges: The political landscape will play a significant role in determining the proposal's fate. Securing parliamentary support and navigating potential opposition from within the government or other parties will be critical for implementation. The parliamentary process itself, including the required legislative changes, could pose considerable challenges.

-

Social and Environmental Impacts: A thorough social impact assessment and consideration of environmental sustainability are crucial. Any potential negative consequences for specific demographics or the environment must be carefully weighed against the projected economic benefits. Equity considerations and the potential for unintended negative social impacts need to be rigorously addressed.

Comparison with the Government's Budget

To fully evaluate the opposition's proposal, a detailed comparison with the government's existing budget is necessary.

-

Direct Comparison of Key Figures and Policy Approaches: A direct comparison of key figures such as total government expenditure, revenue projections, and spending priorities will highlight significant differences in their fiscal strategies. This will include a side-by-side analysis of the proposed tax changes, spending cuts, and investment plans, to expose similarities and differences in their overall economic approach.

-

Analysis of Differing Approaches and Philosophies: Examining the underlying economic philosophies guiding each budget proposal is crucial. This analysis will delve into the differing views on the role of government intervention, the balance between fiscal stimulus and austerity, and the long-term vision for the Australian economy. Understanding these fundamental differences is essential for a comprehensive evaluation.

Analyzing Australia's Opposition's $9 Billion Budget Improvement Proposal – A Summary and Call to Action

In summary, Australia's Opposition's $9 billion budget improvement proposal presents a comprehensive plan addressing several key economic challenges. While the proposal outlines ambitious targets through tax reform, spending cuts, efficiency improvements, and strategic investments, its ultimate success hinges on its feasibility, political viability, and broader social and environmental impacts. A thorough and independent assessment is crucial to fully understand its potential implications. The $9 billion figure represents a significant potential shift in Australia's economic trajectory.

To gain a deeper understanding of the specifics of this proposal, and its potential ramifications for the Australian economy, we encourage you to further analyze Australia's Opposition's budget proposal by exploring relevant government documents and independent analyses. Learn more about the proposed $9 billion budget improvements and contribute to the informed discussion surrounding this crucial policy debate.

Featured Posts

-

Ghanas Mental Healthcare Gap The Need For Investment And Reform

May 03, 2025

Ghanas Mental Healthcare Gap The Need For Investment And Reform

May 03, 2025 -

Syracuse Hazing Scandal 11 Lacrosse Players Face Charges

May 03, 2025

Syracuse Hazing Scandal 11 Lacrosse Players Face Charges

May 03, 2025 -

Open Ai Facing Ftc Investigation Concerns Over Chat Gpts Data Practices And Ai Safety

May 03, 2025

Open Ai Facing Ftc Investigation Concerns Over Chat Gpts Data Practices And Ai Safety

May 03, 2025 -

Boris Johnson Comeback Could He Save The Conservative Party

May 03, 2025

Boris Johnson Comeback Could He Save The Conservative Party

May 03, 2025 -

Will Ow Subsidies Return To Encourage Bidding In The Netherlands

May 03, 2025

Will Ow Subsidies Return To Encourage Bidding In The Netherlands

May 03, 2025

Latest Posts

-

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025 -

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025 -

The Power Of Middle Management Fostering Collaboration And Driving Results

May 04, 2025

The Power Of Middle Management Fostering Collaboration And Driving Results

May 04, 2025 -

Investing In Middle Management A Strategic Approach To Business Growth

May 04, 2025

Investing In Middle Management A Strategic Approach To Business Growth

May 04, 2025 -

Middle Management A Critical Link In The Chain Of Success

May 04, 2025

Middle Management A Critical Link In The Chain Of Success

May 04, 2025