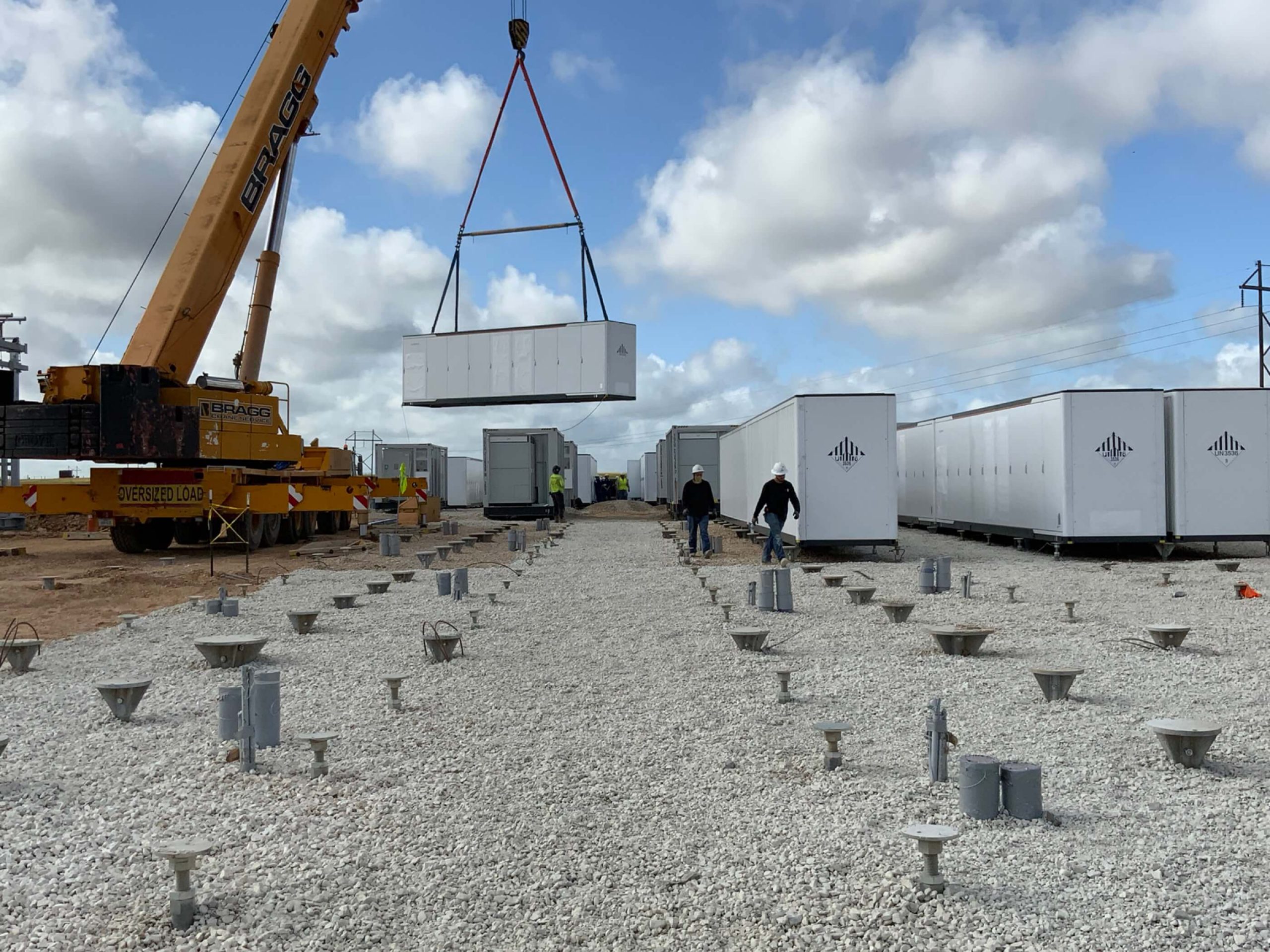

Analysis Of Financing Strategies For A 270MWh BESS Project In The Belgian Merchant Market

Table of Contents

Understanding the Belgian Energy Market and its Impact on BESS Financing

The regulatory landscape in Belgium significantly influences the financing options available for BESS projects. The government actively promotes renewable energy integration through various incentives and subsidies, creating a favorable environment for energy storage solutions. However, navigating these incentives requires a deep understanding of the specific regulations and eligibility criteria. Furthermore, the fluctuating market prices for electricity in Belgium directly impact the profitability of BESS projects. Accurate forecasting and effective risk management are crucial for securing financing.

- Impact of renewable energy integration on grid stability and BESS demand: The intermittent nature of solar and wind power necessitates flexible energy storage solutions like BESS to maintain grid stability and reliability. This growing demand drives investment in BESS projects.

- Belgian capacity market mechanisms and their relevance to BESS financing: Participation in the capacity market can provide a stable revenue stream for BESS projects, enhancing their attractiveness to lenders and investors. Understanding these mechanisms is vital for successful financing.

- Analysis of potential revenue streams from frequency regulation and ancillary services: BESS can provide ancillary services, generating additional revenue streams beyond energy arbitrage. These services enhance the financial viability of the project and improve its creditworthiness.

Exploring Different Financing Options for the 270MWh BESS Project

Securing funding for a 270MWh BESS project requires a strategic approach to financing. Several options exist, each with its own advantages and disadvantages.

Equity Financing

Equity financing involves attracting investors who receive an ownership stake in the project in exchange for their capital contribution. This can include private equity firms, venture capital funds, and strategic investors with expertise in the energy sector.

- Advantages: Reduces debt burden, provides access to expertise and networks.

- Disadvantages: Dilution of ownership, potential for disagreements among investors.

- Illustrative examples: Several successful BESS projects in Europe have secured significant equity investment from leading players in the renewable energy sector.

Debt Financing

Debt financing involves borrowing funds from financial institutions, such as banks or through the issuance of green bonds. Project finance, a specialized form of debt financing tailored to large-scale infrastructure projects, is particularly relevant for BESS projects.

- Role of financial institutions and lenders in the Belgian market: Belgian banks and specialized financial institutions are increasingly active in financing renewable energy projects, including BESS. Understanding their lending criteria is crucial.

- Structuring of debt financing: Careful structuring of the debt, including repayment schedules and covenants, is critical for ensuring the project's financial sustainability.

- Importance of credit ratings and risk assessment: A strong credit rating and a comprehensive risk assessment are essential for attracting favorable financing terms.

Hybrid Financing

Combining equity and debt financing can create an optimal capital structure, balancing risk and return. Mezzanine financing and other hybrid instruments can be used to bridge the gap between equity and debt.

- Use of mezzanine financing: Mezzanine financing offers a blend of debt and equity, providing flexibility in capital structure.

- Impact of different financing mixes: Different financing mixes can significantly influence project returns, requiring careful analysis to optimize the capital structure.

Public Funding and Grants

Various public funding programs and grants are available in Belgium for renewable energy projects, including BESS. These can significantly reduce the project's upfront capital costs.

- Application process and eligibility criteria: Understanding the application process and eligibility requirements for these programs is essential for accessing public funding.

- Examples of successful BESS projects: Several BESS projects in Belgium have successfully secured public funding, demonstrating the availability of these resources.

Assessing the Financial Viability and Risk Mitigation Strategies

A robust financial model is essential for evaluating the project's financial viability and attracting investors and lenders.

Detailed Financial Modeling

A comprehensive financial model should incorporate:

- Key financial metrics: Internal Rate of Return (IRR), Net Present Value (NPV), and Payback Period are crucial metrics for assessing project viability.

- Sensitivity analysis: This analysis evaluates the impact of key variables such as electricity prices, interest rates, and operational costs on the project's profitability.

Risk Assessment and Mitigation

Several risks can impact the project's success:

- Technology risk: Risks associated with the BESS technology itself, including equipment failure and performance degradation.

- Regulatory risk: Changes in government regulations or policies that could negatively affect the project's profitability.

- Market risk: Fluctuations in electricity prices and demand.

Mitigation strategies include:

- Insurance: Purchasing insurance policies to cover potential losses from equipment failure or other unforeseen events.

- Hedging: Using financial instruments to hedge against price volatility in the electricity market.

- Power Purchase Agreements (PPAs): Securing long-term PPAs to guarantee a stable revenue stream.

Conclusion: Securing Financing for Your Belgian BESS Project

Financing a 270MWh BESS project in the Belgian merchant market requires a comprehensive understanding of the regulatory environment, market dynamics, and available financing options. A well-structured financial model incorporating robust risk mitigation strategies is crucial for attracting investors and lenders. By carefully considering the various equity, debt, and hybrid financing options, and leveraging available public funding opportunities, developers can significantly enhance the chances of securing funding and optimizing their BESS project financing. To maximize the return on your Belgian BESS project and secure funding for your BESS investment, contact experienced project finance experts today to develop a comprehensive financing strategy tailored to your specific needs. Optimize your BESS project financing and unlock the full potential of your investment in the dynamic Belgian energy market.

Featured Posts

-

6aus49 Lottozahlen Ziehung Vom 12 April 2025

May 03, 2025

6aus49 Lottozahlen Ziehung Vom 12 April 2025

May 03, 2025 -

Planifier Votre Visite A La Seine Musicale 2025 2026

May 03, 2025

Planifier Votre Visite A La Seine Musicale 2025 2026

May 03, 2025 -

Play Station Portal And Cloud Gaming Access To A Wider Library Of Classics

May 03, 2025

Play Station Portal And Cloud Gaming Access To A Wider Library Of Classics

May 03, 2025 -

Winning Lotto Numbers Wednesday April 30th 2025

May 03, 2025

Winning Lotto Numbers Wednesday April 30th 2025

May 03, 2025 -

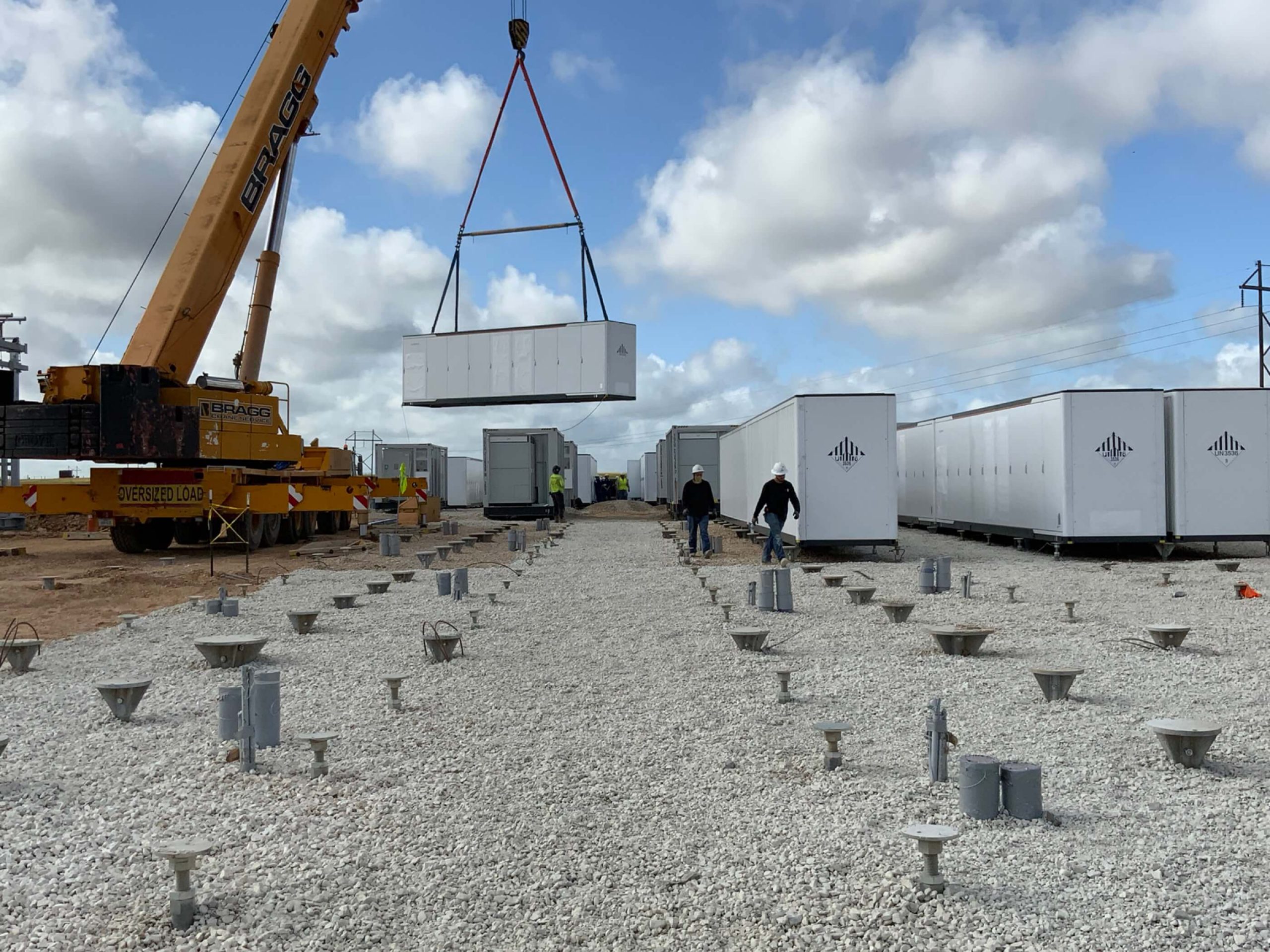

Severe Weather Alert Near Blizzard Conditions In Tulsa Nws

May 03, 2025

Severe Weather Alert Near Blizzard Conditions In Tulsa Nws

May 03, 2025

Latest Posts

-

Familys Poignant Tribute To Devoted Manchester United Supporter Poppy

May 03, 2025

Familys Poignant Tribute To Devoted Manchester United Supporter Poppy

May 03, 2025 -

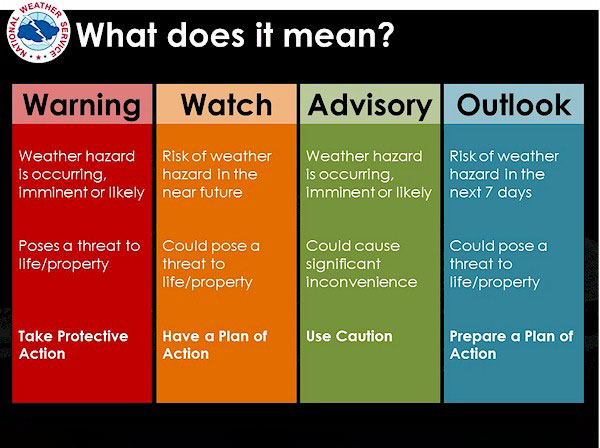

Planuojamas Hario Poterio Parkas Sanchajuje 2027 M

May 03, 2025

Planuojamas Hario Poterio Parkas Sanchajuje 2027 M

May 03, 2025 -

Loyle Carners New Album Everything We Know So Far

May 03, 2025

Loyle Carners New Album Everything We Know So Far

May 03, 2025 -

Manchester United Community Mourns Familys Tribute To Poppy

May 03, 2025

Manchester United Community Mourns Familys Tribute To Poppy

May 03, 2025 -

Naujas Hario Poterio Parkas Sanchajus 2027 Metai

May 03, 2025

Naujas Hario Poterio Parkas Sanchajus 2027 Metai

May 03, 2025