Analysis Of PwC's Pullout From Sub-Saharan Africa: Impact And Future Outlook

Table of Contents

Reasons Behind PwC's Restructuring in Sub-Saharan Africa

Economic Challenges and Market Volatility

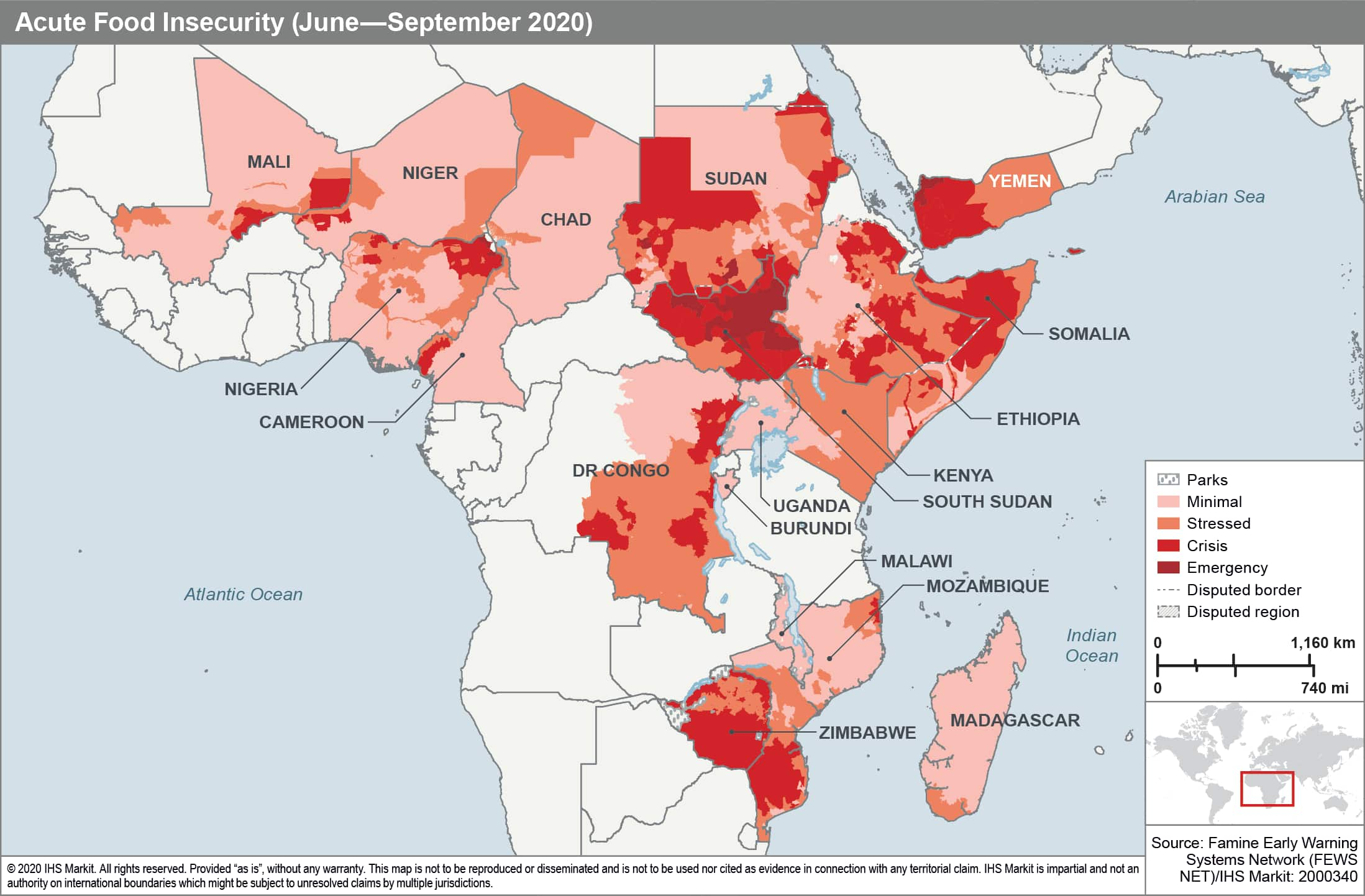

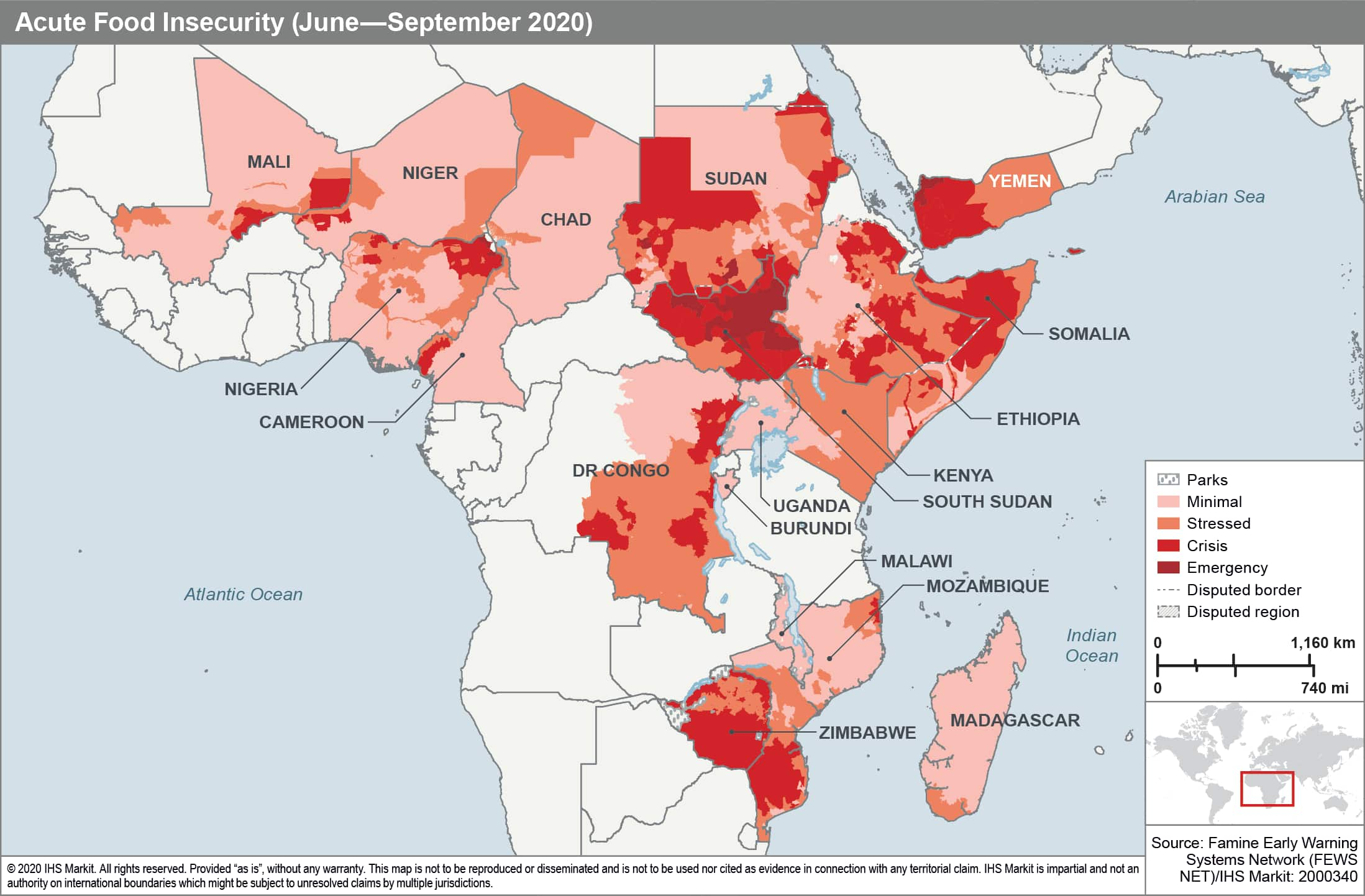

Sub-Saharan Africa faces significant economic headwinds impacting investment decisions. Several countries within the region experience considerable economic instability and volatility. Currency fluctuations are frequent, impacting profitability and making long-term financial planning difficult. High inflation rates erode purchasing power and increase operational costs for businesses. Political risks, including regime changes and civil unrest, create uncertainty and deter investment. Finally, inadequate infrastructure, particularly in areas such as transportation and communication, adds to operational challenges.

- Currency fluctuations: The Nigerian Naira, for example, has experienced significant volatility in recent years, impacting the profitability of businesses operating in the country.

- Inflation: Hyperinflation in some countries makes it challenging to maintain consistent pricing and profitability.

- Political risks: Political instability can lead to disruptions in business operations and investor confidence.

- Infrastructure limitations: Poor infrastructure increases transportation and communication costs, hindering business efficiency.

These challenges directly impact the viability and profitability of operating within the region, contributing to PwC's decision to restructure.

Competitive Landscape and Market Saturation

The professional services sector in Sub-Saharan Africa is becoming increasingly competitive. Both local and international firms are vying for market share, leading to price wars and making it harder to achieve sustainable profit margins. PwC's decision to restructure may also reflect a need to differentiate its services and target high-value clients in a saturated market.

- Increased competition: Deloitte, EY, and KPMG are major competitors, each vying for a larger share of the market. Local firms are also gaining traction.

- Price wars: The intense competition leads to downward pressure on pricing, eroding profitability for all players.

- Need for differentiation: To stand out, firms need to offer specialized services and build strong client relationships.

This competitive pressure, alongside economic instability, makes maintaining a broad presence across all Sub-Saharan African markets less strategically advantageous.

Operational Efficiency and Cost Optimization

PwC's restructuring likely reflects a broader global strategic review focused on operational efficiency and cost optimization. Streamlining operations and centralizing certain functions are common strategies used by large multinational corporations to improve profitability. Reducing overhead costs, including office space and personnel, is a key element in this process.

- Streamlining operations: Focusing on core competencies and shedding less profitable areas improves overall efficiency.

- Centralizing functions: Consolidation of certain administrative or support functions lowers operational costs.

- Reducing overhead costs: This involves a critical assessment of operational expenditure across all facets of the business.

The decision aligns with PwC's global strategy of focusing resources on higher-growth areas and markets with better stability.

Impact of PwC's Pullout on Sub-Saharan Africa

Impact on Businesses

Businesses relying on PwC's services, including auditing, consulting, and tax advice, face disruptions. Finding alternative providers with equivalent expertise may be difficult, potentially leading to delays in operations and increased costs. The loss of PwC's extensive regional network and institutional knowledge represents a substantial blow.

- Loss of expertise: PwC possesses specialized knowledge of the region's unique regulatory environments.

- Difficulty in finding alternative providers: The pool of firms capable of providing the same level of service may be limited.

- Potential disruption to operations: This disruption can impact business continuity and financial reporting.

The impact will vary significantly based on the size and specific needs of individual businesses.

Impact on Investors

PwC's restructuring could negatively impact investor confidence in the region. The pullout might be perceived as an increased risk, potentially leading to a reduction in foreign direct investment (FDI). This could hamper economic growth and development efforts in affected countries.

- Perceived increased risk: The departure of a major international firm can signal perceived instability.

- Potential for reduced investment: Reduced investor confidence might lead to fewer investment projects.

- Impact on economic growth: Decreased FDI can significantly impede economic development.

This potential reduction in FDI could have wide-reaching consequences for Sub-Saharan Africa's economic growth trajectory.

Impact on the Accounting and Professional Services Sector

The ripple effect within the accounting and professional services sector will be substantial. Competitors will likely experience increased workloads as they absorb PwC's former clients. Job losses among PwC's employees are inevitable, creating challenges for individuals and the labor market. The long-term impact on the development of local talent and the growth of local firms remains to be seen.

- Job losses: The restructuring will likely lead to redundancies within PwC's workforce.

- Increased workload for competitors: Existing firms will have to cope with the increased demand for services.

- Potential for market consolidation: The shakeup might trigger further mergers and acquisitions in the sector.

Future Outlook and Predictions

PwC's Future Strategy in Sub-Saharan Africa

PwC's future engagement in Sub-Saharan Africa may involve a reduced presence, focusing on specific high-growth markets or strategic partnerships with local firms. A complete withdrawal is unlikely, given the region's long-term growth potential. A shift towards a more selective, targeted approach appears more plausible.

- Reduced presence: A scaled-down operation focusing on key markets is a probable outcome.

- Focus on specific high-growth markets: PwC might concentrate on countries with stronger economic prospects.

- Strategic partnerships: Collaborations with local firms could provide access to regional expertise.

The possibility of future re-entry into markets currently being exited remains a possibility, dependent on future economic and political developments.

Opportunities for Competitors

PwC's restructuring creates significant opportunities for competitors. They can gain market share by attracting PwC's former clients and expanding their services in the region. Aggressive recruitment strategies and targeted marketing campaigns will be key to capitalizing on this shift.

- Market share gains: Competitors stand to benefit from increased market share and client acquisition.

- Expansion opportunities: The pullout opens up opportunities for geographical expansion and service diversification.

- Attracting PwC's former clients: Competitors will actively pursue these clients through targeted outreach.

This creates a dynamic competitive landscape with significant potential for disruption and growth.

The Long-Term Implications for Sub-Saharan Africa

The long-term implications require a nuanced understanding of the region's developmental challenges. Building local capacity and attracting other international firms to fill the void left by PwC is crucial. A stable investment climate, fostered through supportive government policies and strong regulatory frameworks, is essential to attract and retain investment.

- Need for local capacity building: Investing in education and training to develop local talent is paramount.

- Importance of attracting other international firms: Maintaining a competitive professional services sector requires attracting alternative firms.

- Promoting a stable investment climate: Clear regulations, consistent policies, and transparent governance are crucial.

Conclusion

PwC's restructuring in Sub-Saharan Africa is a complex issue with multifaceted impacts. The reasons behind the pullout are a combination of economic challenges, competitive pressures, and strategic internal decisions. The impact on businesses, investors, and the professional services sector will be significant, requiring careful consideration of both short-term disruptions and long-term developmental implications. Understanding the implications of the PwC Sub-Saharan Africa pullout is crucial for businesses, investors, and policymakers. Further research and proactive strategies are necessary to navigate this changing landscape and ensure sustainable economic development in the region. Continue exploring the complexities of the PwC Sub-Saharan Africa pullout and its implications for informed decision-making.

Featured Posts

-

Adhd Aging And Brain Iron Understanding Attention And Cognitive Decline

Apr 29, 2025

Adhd Aging And Brain Iron Understanding Attention And Cognitive Decline

Apr 29, 2025 -

Nyt Strands March 15 2025 Solving The Daily Puzzle

Apr 29, 2025

Nyt Strands March 15 2025 Solving The Daily Puzzle

Apr 29, 2025 -

Suspect Adult Adhd Your Guide To Next Steps

Apr 29, 2025

Suspect Adult Adhd Your Guide To Next Steps

Apr 29, 2025 -

The Pete Rose Pardon Debate Trump Baseball And The Legacy Of A Betting Ban

Apr 29, 2025

The Pete Rose Pardon Debate Trump Baseball And The Legacy Of A Betting Ban

Apr 29, 2025 -

Dynasty Star Linda Evans 82 Celebrates Valentines Day With A Heartfelt Message

Apr 29, 2025

Dynasty Star Linda Evans 82 Celebrates Valentines Day With A Heartfelt Message

Apr 29, 2025

Latest Posts

-

Stream Ru Pauls Drag Race Season 17 Episode 6 Free No Cable Needed

Apr 30, 2025

Stream Ru Pauls Drag Race Season 17 Episode 6 Free No Cable Needed

Apr 30, 2025 -

Where To Watch Ru Pauls Drag Race Season 17 Episode 6 For Free Without Cable

Apr 30, 2025

Where To Watch Ru Pauls Drag Race Season 17 Episode 6 For Free Without Cable

Apr 30, 2025 -

How To Stream Ru Pauls Drag Race Season 17 Episode 9 Without Paying

Apr 30, 2025

How To Stream Ru Pauls Drag Race Season 17 Episode 9 Without Paying

Apr 30, 2025 -

A Day In The Life Amanda Owens 9 Children And Their Rural Family Life

Apr 30, 2025

A Day In The Life Amanda Owens 9 Children And Their Rural Family Life

Apr 30, 2025 -

Amanda Owen And Our Yorkshire Farm Facing Backlash After Channel 4 Decision

Apr 30, 2025

Amanda Owen And Our Yorkshire Farm Facing Backlash After Channel 4 Decision

Apr 30, 2025