Analysis Of The Proposed Trump Tax Cuts From House Republicans

Table of Contents

Individual Income Tax Changes Under the Proposed Plan

The proposed plan significantly alters individual income tax rates and deductions. Understanding these changes is crucial for assessing their impact on household budgets.

Changes to Tax Brackets

The House Republican tax plan proposed adjustments to individual income tax brackets. While specifics varied depending on the iteration of the plan, a common thread was a reduction in the number of brackets and a lowering of the rates for several brackets.

- Example: A hypothetical plan might reduce the number of brackets from seven to three, with rates of 12%, 25%, and 35%. This could lead to significant tax savings for high-income earners.

- Standard Deduction: Many proposals also included increases to the standard deduction, potentially benefiting lower- and middle-income taxpayers who don't itemize. This increase could offset some of the tax cuts for higher earners. These changes in individual tax rates and the standard deduction would impact income tax reform in a significant way.

Impact on Itemized Deductions

The proposed plan often included significant modifications to itemized deductions. This is a critical area because it affects how many taxpayers calculate their taxes.

- SALT Deduction: A major point of contention was the potential limitation or elimination of the state and local tax (SALT) deduction. This disproportionately impacts taxpayers in high-tax states.

- Mortgage Interest Deduction: While the mortgage interest deduction might have been retained, its limits could have been altered, impacting those with large mortgages.

- Other Itemized Deductions: Other itemized deductions could also be affected, leading to increased tax burdens for some taxpayers who currently rely on these deductions to reduce their tax liabilities. These changes would impact the overall effectiveness of income tax reform.

Child Tax Credit Modifications

The child tax credit (CTC) was another area targeted for reform. The proposed modifications aimed to make the credit more generous.

- Increased Credit Amount: Many proposals suggested increasing the amount of the CTC.

- Enhanced Refundability: Some plans proposed making the credit fully refundable, meaning taxpayers could receive the entire credit amount even if it exceeds their tax liability. This would benefit lower-income families significantly.

- Eligibility Requirements: Changes to eligibility requirements could have broadened or narrowed access to the CTC. These modifications to the CTC were a major component of the proposed plan's individual income tax changes.

Corporate Tax Rate Reductions and Their Implications

The proposed Trump Tax Cuts from House Republicans included significant reductions in corporate tax rates.

Proposed Corporate Tax Rate

A central feature of the plan was a substantial reduction in the corporate tax rate. Proposals typically aimed for a rate significantly lower than the existing rate.

- Economic Effects: Proponents argued that a lower corporate tax rate would stimulate economic growth, attract foreign investment, boost corporate profits, and lead to job creation.

- Increased Competitiveness: A lower rate was believed to enhance the competitiveness of US businesses on the global stage. However, critics pointed out potential downsides such as increased budget deficits.

Impact on Small Businesses

The impact of the corporate tax rate reduction on small businesses was complex and depended heavily on the business structure.

- Pass-Through Entities: Small business owners operating as pass-through entities (like sole proprietorships, partnerships, and S corporations) might have received tax relief, but the details varied significantly across different versions of the plan.

- Small Business Tax Cuts: While small business tax cuts were often touted as a benefit, their actual effect depended on the specifics of the proposal and the individual business structure.

Potential Economic Effects of the Trump Tax Cuts from House Republicans

The proposed tax cuts had significant potential implications for the US economy, sparking considerable debate among economists.

Impact on the National Debt

One major concern was the potential for a substantial increase in the national debt. Tax cuts, particularly large ones, tend to reduce government revenue.

- Fiscal Deficit: The plan’s reduced tax revenue could significantly widen the fiscal deficit, leading to an increase in the national debt.

- Economic Forecasts: Economic forecasts regarding the impact varied significantly, depending on the underlying economic assumptions and models used.

Impact on Economic Growth

Proponents argued that the tax cuts would stimulate economic growth through increased investment and consumption.

- GDP Growth: Estimates of the impact on GDP growth ranged widely, with some models projecting significant increases and others showing smaller or even negative effects.

- Job Creation: The impact on job creation was also debated, with some economists predicting job growth and others expressing skepticism.

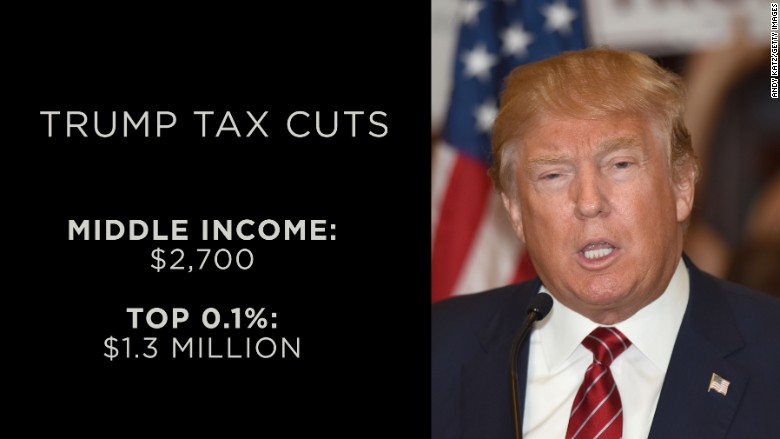

Income Inequality

The distributional effects of the tax cuts were a major area of concern. Critics argued that they would exacerbate income inequality.

- Tax Fairness: Many argued the cuts disproportionately benefited high-income earners and corporations at the expense of lower- and middle-income families.

- Wealth Distribution: The potential for the tax cuts to widen the gap between the rich and the poor was a significant point of contention.

Conclusion: Understanding the Trump Tax Cuts from House Republicans – A Call to Action

The proposed Trump Tax Cuts from House Republicans represent a significant attempt at comprehensive tax reform. The plan included substantial changes to individual income tax brackets, itemized deductions, the child tax credit, and the corporate tax rate. Potential economic effects include impacts on the national debt, economic growth, and income inequality, all of which remain subjects of intense debate. Understanding these intricate details is crucial for informed participation in the ongoing policy discussion. Stay informed about the ongoing debate surrounding the Trump Tax Cuts from House Republicans and voice your opinion on these crucial policy changes. Further research into the specifics of the House Republican tax bill impact and a deeper dive into Trump tax plan analysis is encouraged.

Featured Posts

-

Elsbeth Season 2 Episode 15 Missed Potential And Narrative Flaws

May 13, 2025

Elsbeth Season 2 Episode 15 Missed Potential And Narrative Flaws

May 13, 2025 -

The Pay Gap Between Colin Jost And Scarlett Johansson Examining The Details

May 13, 2025

The Pay Gap Between Colin Jost And Scarlett Johansson Examining The Details

May 13, 2025 -

The Enduring Legacy Of The Da Vinci Code

May 13, 2025

The Enduring Legacy Of The Da Vinci Code

May 13, 2025 -

Sicherheitsalarm Braunschweiger Schule Gebaeude Geraeumt Kinder In Sicherheit

May 13, 2025

Sicherheitsalarm Braunschweiger Schule Gebaeude Geraeumt Kinder In Sicherheit

May 13, 2025 -

2025 Chicago Cubs Deconstructing Game 16s Wins And Losses

May 13, 2025

2025 Chicago Cubs Deconstructing Game 16s Wins And Losses

May 13, 2025