Analysis Of The Securities Lawsuit Filed Against BigBear.ai Holdings, Inc.

Table of Contents

Allegations in the BigBear.ai Securities Lawsuit

The core of the securities lawsuit against BigBear.ai centers around allegations of misleading statements and misrepresentations made to investors, constituting potential securities fraud. The plaintiff(s) – [Insert Plaintiff Information if available; otherwise, state "the details of the plaintiff(s) are currently unavailable" ] – have filed a [class action/individual] lawsuit alleging that BigBear.ai knowingly made false and/or misleading statements regarding its financial performance and business prospects.

Key claims against BigBear.ai and its executives include:

- Inflated Revenue Figures: Plaintiffs allege that BigBear.ai artificially inflated its revenue figures through improper accounting practices or the inclusion of non-recurring revenue streams.

- Misleading Statements Regarding Contract Wins: The lawsuit claims that BigBear.ai issued press releases and public statements that misrepresented the size, scope, and value of certain contract wins.

- Failure to Disclose Material Risks: Plaintiffs contend that BigBear.ai failed to adequately disclose material risks associated with its business operations, particularly concerning its dependence on government contracts and the competitive landscape.

[Insert links to relevant court documents or news articles here, if available. Example: "See the complaint filed in [Court Name]: [Link to Document]"]

BigBear.ai's Response to the Lawsuit

BigBear.ai has responded to the lawsuit by [Insert BigBear.ai's official statement; if no public statement is available, replace with "releasing a statement denying all allegations and asserting its commitment to a vigorous defense."]. The company has denied all wrongdoing and claims to have adhered to all applicable accounting standards and regulations. Key points of their response include:

- Denial of Wrongdoing: BigBear.ai strongly denies all allegations of fraud and misrepresentation.

- Claim of Adherence to Accounting Standards: The company insists its financial reporting practices comply with generally accepted accounting principles (GAAP).

- Commitment to a Full and Fair Investigation: BigBear.ai has pledged to conduct a thorough internal investigation to address the allegations raised in the lawsuit.

Impact on BigBear.ai's Stock Price and Investor Sentiment

The securities lawsuit has had a significant negative impact on BigBear.ai's stock price. [Insert details on stock price fluctuations, including percentage drops and dates, if available. Include a chart or graph visualizing the stock price changes if possible.] Investor sentiment has soured considerably since the filing of the lawsuit, evidenced by [Insert evidence of negative investor sentiment, e.g., reduced trading volume, negative analyst reports].

- Stock Price Drop: The stock price experienced a [percentage]% drop immediately following the lawsuit announcement.

- Trading Volume Changes: Trading volume has [increased/decreased] significantly since the lawsuit.

- Investor Confidence: Investor confidence in BigBear.ai has demonstrably decreased, as reflected in [Insert quantifiable data if available; otherwise, use qualitative descriptions].

Potential Outcomes and Legal Implications

The potential outcomes of the BigBear.ai securities lawsuit range from a settlement to dismissal to a full trial. The legal precedents surrounding similar cases of alleged securities fraud will heavily influence the outcome. A favorable ruling for the plaintiffs could result in substantial financial penalties for BigBear.ai, along with significant reputational damage.

Potential scenarios include:

- Settlement: A settlement is possible, though the terms would depend on various factors.

- Financial Penalties: If found liable, BigBear.ai could face significant financial penalties, including fines and restitution to investors.

- Impact on Future Business Prospects: A negative outcome could severely impact BigBear.ai's ability to secure future contracts and funding.

Conclusion: Understanding the Future of the BigBear.ai Securities Lawsuit

This analysis reveals a complex situation involving serious allegations of securities fraud against BigBear.ai. While the company denies all wrongdoing, the lawsuit’s impact on its stock price and investor sentiment is undeniable. The potential outcomes hold significant consequences for BigBear.ai, its investors, and the broader investment landscape. To stay informed about the progress and developments of this BigBear.ai securities lawsuit, regularly check reputable financial news sources for updates. Before making any investment decisions related to BigBear.ai, it is advisable to consult with a qualified financial advisor.

Featured Posts

-

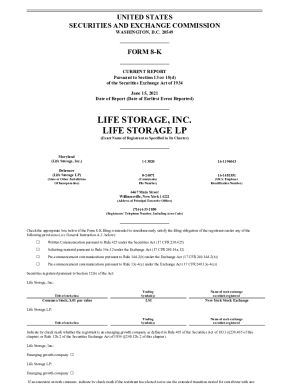

Nyt Mini Crossword Answers March 13 2025 Full Solution

May 21, 2025

Nyt Mini Crossword Answers March 13 2025 Full Solution

May 21, 2025 -

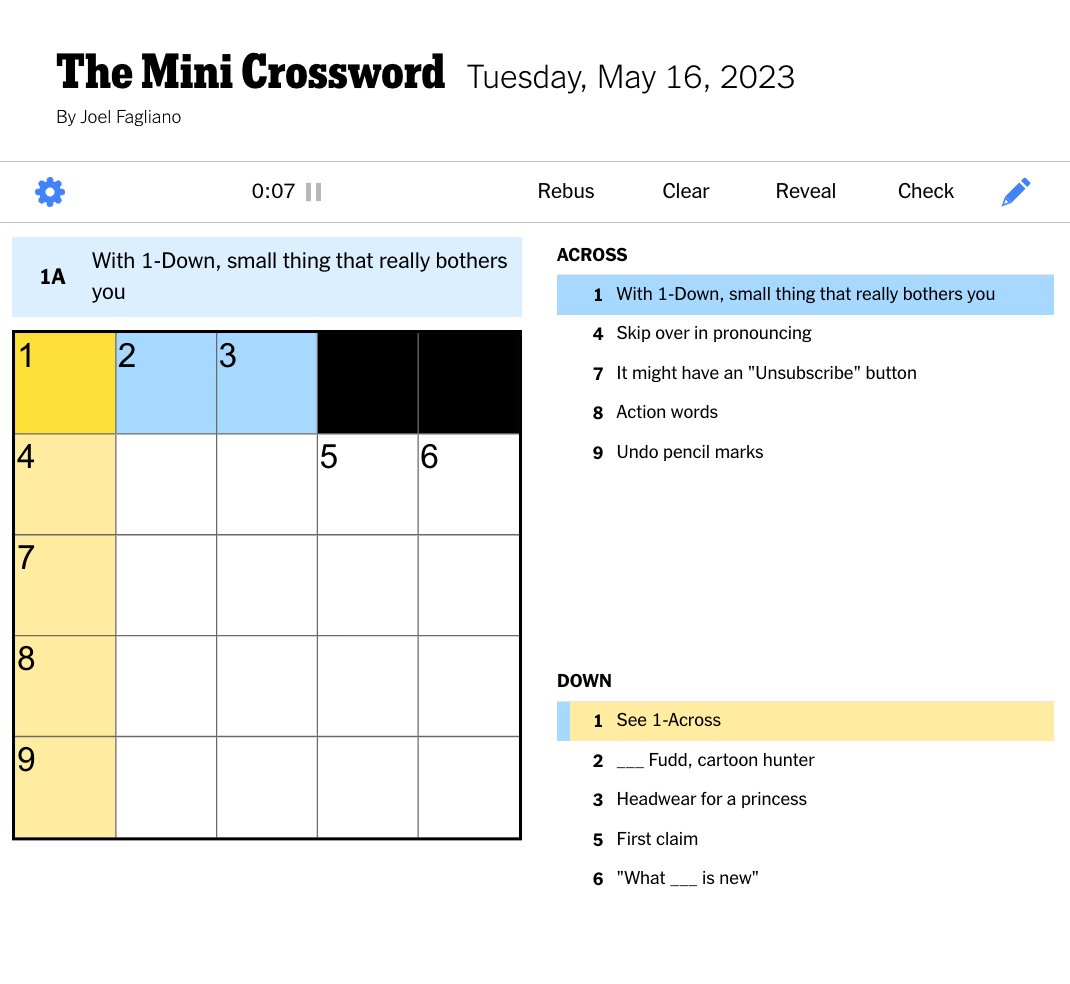

From Underdogs To Champions Charting Liverpools Rise Under Juergen Klopp

May 21, 2025

From Underdogs To Champions Charting Liverpools Rise Under Juergen Klopp

May 21, 2025 -

Big Bear Ai Bbai Defense Sector Investment Boosts Buy Rating

May 21, 2025

Big Bear Ai Bbai Defense Sector Investment Boosts Buy Rating

May 21, 2025 -

Nagelsmann Names Goretzka To Germanys Nations League Team

May 21, 2025

Nagelsmann Names Goretzka To Germanys Nations League Team

May 21, 2025 -

Understanding The D Wave Quantum Qbts Stock Drop In 2025

May 21, 2025

Understanding The D Wave Quantum Qbts Stock Drop In 2025

May 21, 2025

Latest Posts

-

Trinidad Defence Minister Weighs Age Limit And Song Ban For Kartel Concert

May 22, 2025

Trinidad Defence Minister Weighs Age Limit And Song Ban For Kartel Concert

May 22, 2025 -

The Goldbergs Every Season Ranked And Reviewed

May 22, 2025

The Goldbergs Every Season Ranked And Reviewed

May 22, 2025 -

Exploring The Humor And Heart Of The Goldbergs

May 22, 2025

Exploring The Humor And Heart Of The Goldbergs

May 22, 2025 -

The Goldbergs Characters Relationships And Lasting Impact

May 22, 2025

The Goldbergs Characters Relationships And Lasting Impact

May 22, 2025 -

The Goldbergs Behind The Scenes And Production Insights

May 22, 2025

The Goldbergs Behind The Scenes And Production Insights

May 22, 2025