Analysis: ProShares' XRP ETF Launch And Its Effect On Cryptocurrency Prices

Table of Contents

Potential Price Surge and Increased Volatility

The approval of an XRP ETF would likely be a watershed moment for XRP, potentially triggering significant price movements.

Increased Institutional Investment

A ProShares XRP ETF would open the doors for institutional investors – hedge funds, pension funds, and others – to easily invest in XRP. This influx of capital would significantly increase demand:

- Increased demand from large investors: Large-scale buying pressure could drive up XRP's price significantly.

- Greater liquidity in the XRP market: Increased trading volume would make it easier to buy and sell XRP, reducing price slippage.

- Potential for price manipulation reduced: Higher trading volume typically makes it harder for any single entity to manipulate XRP's price.

Short-Term Volatility

While a price surge is anticipated, the initial launch period is likely to be volatile:

- Potential for rapid price increases followed by corrections: Initial exuberance might lead to overbought conditions, resulting in price corrections.

- Increased trading volume could exacerbate short-term price swings: High trading volume amplifies both upward and downward price movements.

- Importance of risk management for investors: Investors need to be prepared for significant short-term fluctuations and implement appropriate risk management strategies.

Impact on the Broader Cryptocurrency Market

The launch of an XRP ETF wouldn't just affect XRP; it could have broader ramifications for the cryptocurrency market.

Positive Sentiment and Spillover Effects

A successful XRP ETF launch could act as a catalyst for broader crypto market growth:

- Increased institutional interest in the broader crypto space: The success of an XRP ETF could encourage institutional investment in other cryptocurrencies.

- Potential for other cryptocurrencies to follow suit and launch their own ETFs: A successful XRP ETF could pave the way for other crypto ETFs, boosting the entire sector.

- Improved overall perception of cryptocurrencies among traditional investors: It could help legitimize cryptocurrencies in the eyes of mainstream investors.

Regulatory Uncertainty and its Influence

The SEC's lawsuit against Ripple Labs casts a long shadow:

- Potential delays or rejection due to ongoing legal battles: The SEC's decision could significantly delay or even prevent the launch of the ProShares XRP ETF.

- Impact of the SEC ruling on the acceptance and adoption of the ETF: A favorable ruling would boost confidence, while an unfavorable ruling could severely dampen market enthusiasm.

- Investor concerns regarding regulatory risks in the crypto market: Regulatory uncertainty remains a significant risk factor for the entire cryptocurrency market.

Trading Volume and Market Liquidity

The ProShares XRP ETF is expected to drastically alter XRP's trading dynamics.

Increased Trading Volume

The ETF is projected to dramatically increase XRP trading volume:

- Easier buying and selling of XRP for institutional and retail investors: The ETF provides a convenient and regulated vehicle for investing in XRP.

- Reduced price slippage and improved execution of trades: Higher liquidity leads to better price execution for traders.

- Potential for the creation of new trading strategies around the ETF: The ETF could enable new trading strategies, including arbitrage and hedging opportunities.

Impact on Existing XRP Exchanges

The surge in trading activity would necessitate significant upgrades to existing XRP exchanges:

- Need for increased server capacity and improved trading platforms: Exchanges will need to upgrade their infrastructure to handle the increased volume.

- Attracting new users to exchanges through XRP ETF-related trading: The ETF could drive significant new user acquisition for exchanges.

- Potential consolidation or mergers within the XRP exchange market: The increased competition could lead to consolidation within the exchange industry.

Conclusion

The potential launch of a ProShares XRP ETF presents both significant opportunities and considerable challenges for the cryptocurrency market. While a successful launch could trigger substantial price increases, increased trading volume, and a positive shift in market sentiment, the ongoing regulatory uncertainty surrounding Ripple and XRP introduces a significant element of risk. Careful consideration of these factors is crucial for investors. Stay informed about the ProShares XRP ETF and its impact on XRP price and the broader crypto market to make informed investment decisions. Monitor developments related to the ProShares XRP ETF and other potential cryptocurrency ETFs for the latest insights into this evolving landscape. Understanding the potential impact of the ProShares XRP ETF is vital for navigating the complexities of the cryptocurrency market.

Featured Posts

-

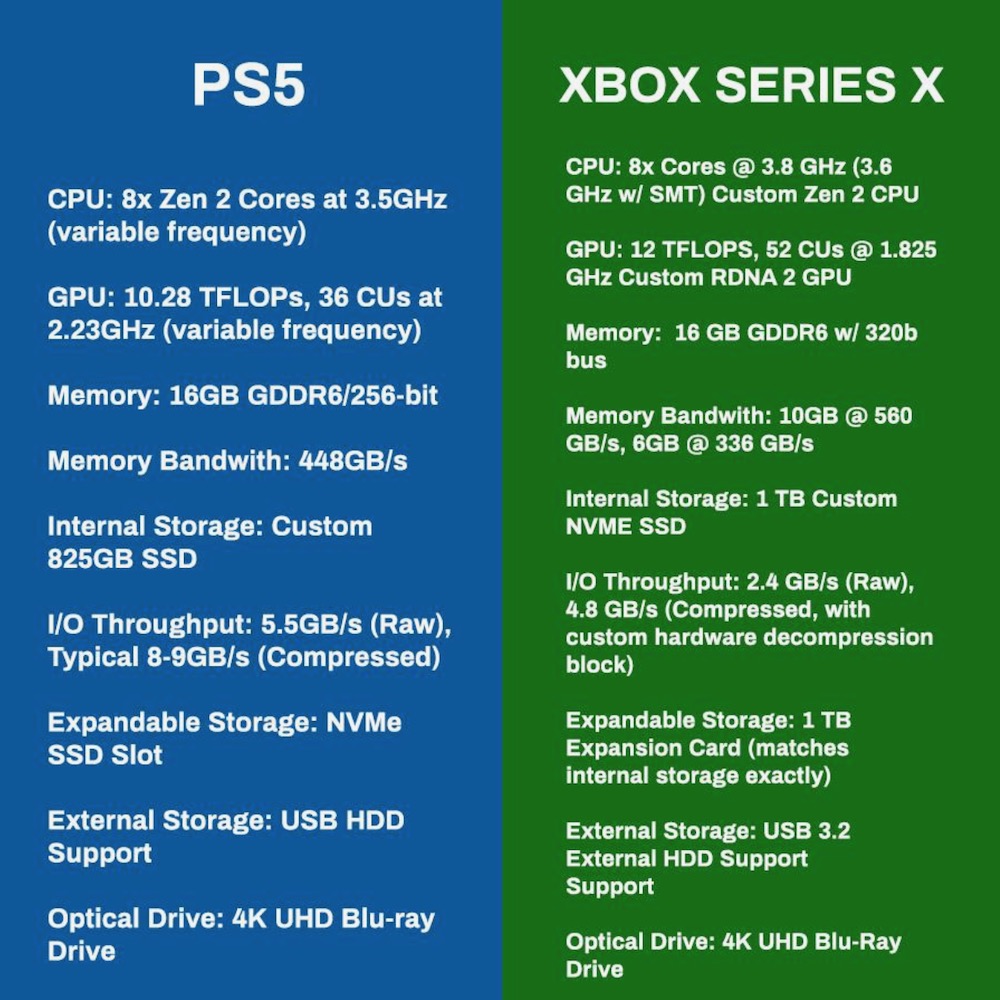

Choosing Between Ps 5 And Xbox Series S A Comprehensive Guide

May 08, 2025

Choosing Between Ps 5 And Xbox Series S A Comprehensive Guide

May 08, 2025 -

Lab Owners Guilty Plea Falsified Covid 19 Test Results

May 08, 2025

Lab Owners Guilty Plea Falsified Covid 19 Test Results

May 08, 2025 -

Cowherd On Tatums Performance Celtics Game 1 Post Game Analysis

May 08, 2025

Cowherd On Tatums Performance Celtics Game 1 Post Game Analysis

May 08, 2025 -

Wildfire Betting A Reflection Of Our Times The Los Angeles Case Study

May 08, 2025

Wildfire Betting A Reflection Of Our Times The Los Angeles Case Study

May 08, 2025 -

Dwp Benefit Stoppage Four Word Letters Warning Uk Households

May 08, 2025

Dwp Benefit Stoppage Four Word Letters Warning Uk Households

May 08, 2025