Analysis: The House-Passed Trump Tax Bill And What It Means

Table of Contents

Individual Tax Changes Under the Trump Tax Bill

The Trump tax bill brought sweeping changes to the individual income tax system. These alterations impacted tax brackets, deductions, and exemptions, affecting taxpayers across all income levels.

- Changes to Tax Brackets: The bill reduced the number of individual income tax brackets, resulting in lower rates for some. However, the impact varied considerably depending on income level.

- Increased Standard Deduction: A significant increase in the standard deduction provided tax relief to many, particularly those with lower incomes. This simplified tax filing for many individuals and families.

- Elimination of Personal Exemptions: The bill eliminated personal exemptions, offsetting some of the benefits of the increased standard deduction, especially for larger families.

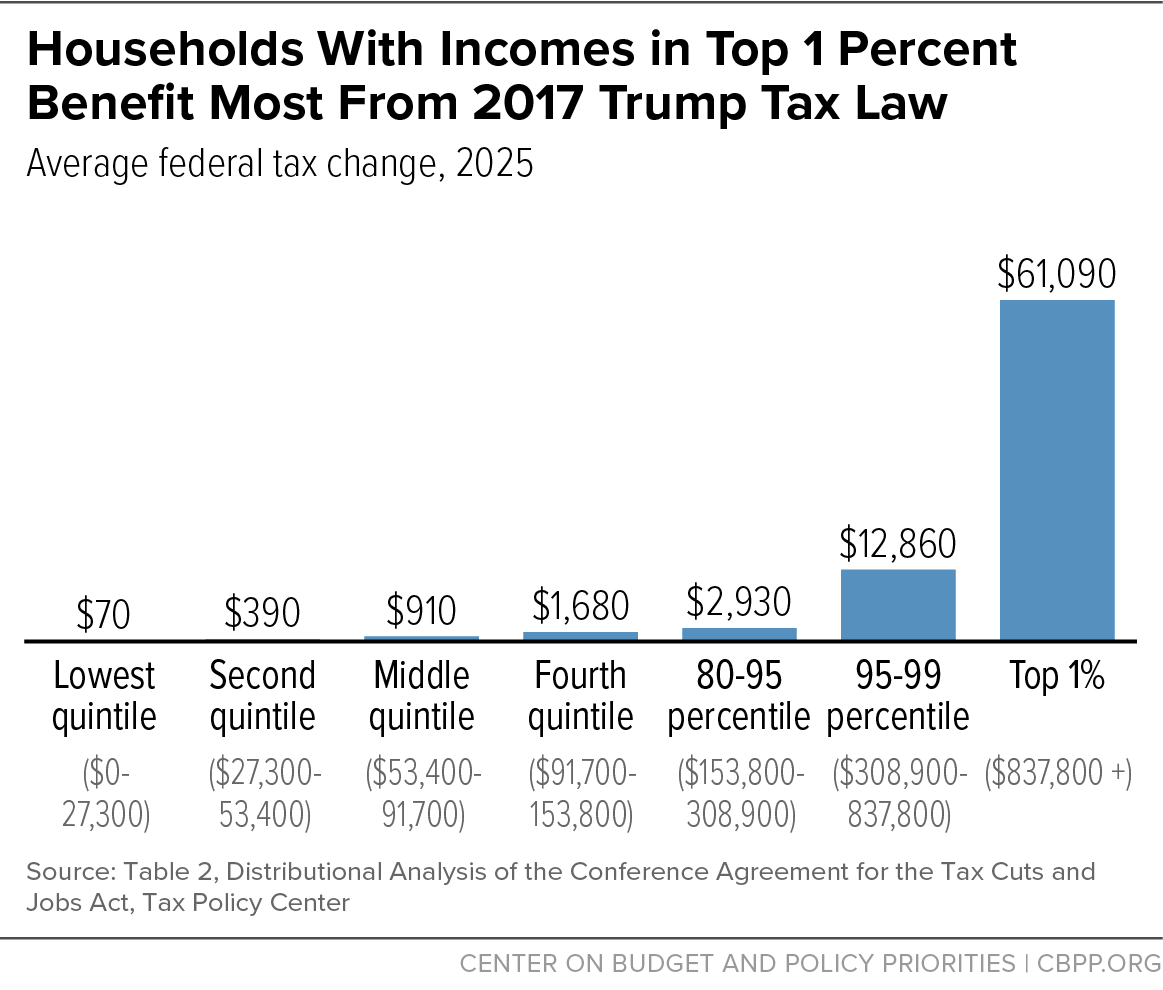

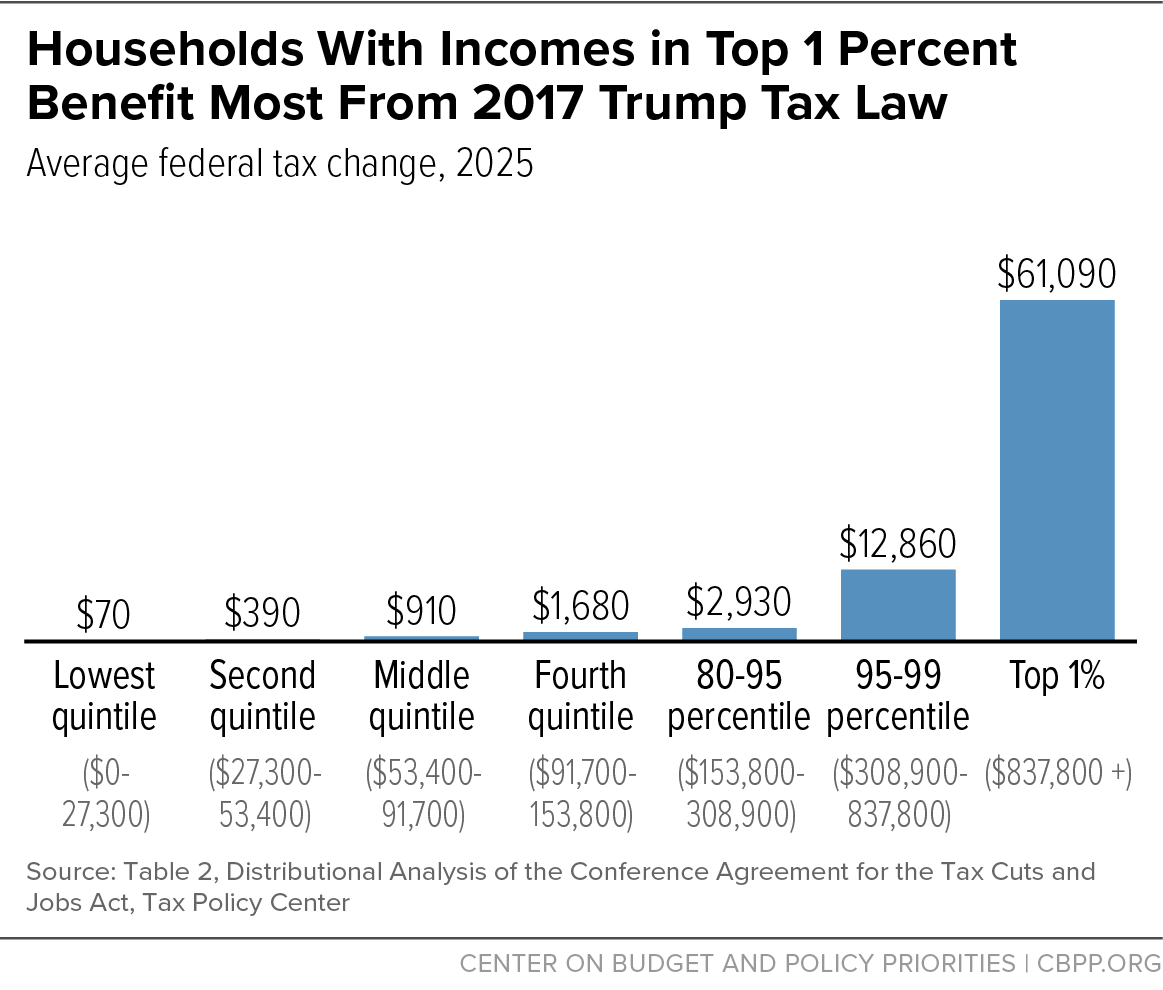

The impact on different income groups was varied:

- High-Income Earners: While some high-income earners saw lower tax rates, the elimination of personal exemptions partially offset these benefits.

- Middle Class: The increased standard deduction generally benefited the middle class, leading to lower tax burdens for many.

- Low-Income Earners: Low-income earners often benefited most from the increased standard deduction, as it pushed many below the taxable threshold.

Keywords related to this section include: "individual income tax," "tax brackets," "standard deduction," "personal exemption," "tax burden," "tax relief."

Corporate Tax Rate Reductions and Their Effects

A cornerstone of the Trump tax bill was the dramatic reduction in the corporate tax rate. This cut, from 35% to 21%, aimed to boost economic growth through increased investment and job creation.

- Reduced Corporate Tax Rate: The lower rate was intended to make US corporations more competitive globally and encourage domestic investment.

- Potential Economic Effects: Proponents argued that this would lead to increased investment, higher wages, and a surge in job creation.

- Potential Drawbacks: Critics raised concerns about the potential for increased corporate profits without corresponding increases in wages or investment, widening income inequality and exacerbating the national debt.

Keywords for this section: "corporate tax rate," "corporate tax reform," "business tax," "economic growth," "investment," "job creation," "income inequality."

Impact on Specific Sectors and Industries

The Trump tax bill's impact varied significantly across different sectors. Some experienced significant benefits, while others faced less favorable outcomes.

- Real Estate: The changes to depreciation rules and the elimination of certain deductions affected the real estate industry, impacting investment and development. Keywords: "Real Estate Tax Implications," "Real Estate Investment," "Depreciation Rules."

- Manufacturing: The lower corporate tax rate potentially benefited manufacturing companies, although the effects varied depending on individual business structures and global competitiveness. Keywords: "Manufacturing Tax Reform," "Manufacturing Competitiveness," "Corporate Tax Benefits."

- Technology: The technology sector, with its generally high profitability, also saw benefits from the lower corporate tax rate, although the impact was less dramatic than in some other sectors. Keywords: "Technology Tax Implications," "Tech Industry Tax Reform," "Corporate Tax Cuts."

Analyzing winners and losers required a detailed sector-specific analysis considering numerous factors beyond just the headline corporate tax rate change.

Long-Term Fiscal Implications and National Debt

The significant tax cuts included in the Trump tax bill raised substantial concerns about their long-term fiscal impact.

- Projected Revenue Losses: The Congressional Budget Office (CBO) projected substantial revenue losses over the following decade due to the tax cuts.

- Increased National Debt: This led to concerns about a widening budget deficit and a growing national debt.

- Long-Term Economic Consequences: The long-term economic consequences of these projected revenue shortfalls remained a subject of ongoing debate among economists.

Keywords: "national debt," "fiscal policy," "budget deficit," "long-term economic impact," "CBO," "revenue losses."

Political and Social Ramifications of the Trump Tax Bill

The Trump tax bill sparked significant political debate and controversy.

- Political Polarization: The bill further deepened the existing political divides in the United States, with strong opposition from Democrats.

- Social Impact: The bill's impact on income inequality and its potential effect on social programs were subjects of intense public debate and discussion.

- Public Opinion: Public opinion polls showed mixed reactions to the bill, with varying levels of support across different demographic groups.

Keywords: "political impact," "social consequences," "tax debate," "public opinion," "political polarization."

Conclusion: Understanding the Implications of the House-Passed Trump Tax Bill

The 2017 Tax Cuts and Jobs Act, or Trump tax bill, fundamentally altered the US tax landscape. Its impact, while initially stimulating some sectors and benefiting certain income groups, raised long-term concerns regarding the national debt and income inequality. Understanding the complexities of this legislation requires careful consideration of its effects on individual tax burdens, corporate profitability, and national fiscal health. For a complete understanding of how the Trump tax bill affects you, explore the official government resources and continue your research on Trump tax reform. Further research into the specific implications of the Trump tax cuts on your personal finances and business is strongly recommended.

Featured Posts

-

Shop Owner Stabbing Previously Bailed Teen Faces New Arrest

May 24, 2025

Shop Owner Stabbing Previously Bailed Teen Faces New Arrest

May 24, 2025 -

Dr Beachs Top 10 Best Us Beaches Of 2025

May 24, 2025

Dr Beachs Top 10 Best Us Beaches Of 2025

May 24, 2025 -

Konchita Vurst Zhizn Posle Pobedy Na Evrovidenii 2014

May 24, 2025

Konchita Vurst Zhizn Posle Pobedy Na Evrovidenii 2014

May 24, 2025 -

Ces Unveiled Europe Rendez Vous A Amsterdam Pour Les Innovations Technologiques

May 24, 2025

Ces Unveiled Europe Rendez Vous A Amsterdam Pour Les Innovations Technologiques

May 24, 2025 -

Sejarah Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda

May 24, 2025

Sejarah Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda

May 24, 2025

Latest Posts

-

Joe Jonas Addresses Couples Argument About Him

May 24, 2025

Joe Jonas Addresses Couples Argument About Him

May 24, 2025 -

Joe Jonas Responds To Couples Dispute The Full Story

May 24, 2025

Joe Jonas Responds To Couples Dispute The Full Story

May 24, 2025 -

Your Guide To The Top Memorial Day Sales And Deals In 2025

May 24, 2025

Your Guide To The Top Memorial Day Sales And Deals In 2025

May 24, 2025 -

Where To Find The Best Memorial Day Sales And Deals In 2025

May 24, 2025

Where To Find The Best Memorial Day Sales And Deals In 2025

May 24, 2025 -

2025 Memorial Day Find The Best Sales And Deals Here

May 24, 2025

2025 Memorial Day Find The Best Sales And Deals Here

May 24, 2025