Analyzing CoreWeave Inc.'s (CRWV) Stock Performance: Tuesday's Decline Explained

Table of Contents

Broader Market Influences on CRWV Stock

Several macroeconomic factors and broader market trends likely contributed to Tuesday's decline in CRWV stock.

Overall Market Sentiment

Tuesday's market performance wasn't entirely rosy. A general air of uncertainty seemed to permeate the investment landscape.

- Market Indices Performance: The Nasdaq Composite, a key indicator for technology stocks, experienced a [insert percentage]% decline on Tuesday. The S&P 500, a broader market index, also saw a [insert percentage]% decrease, reflecting a negative overall market sentiment.

- Economic News Impact: [Mention any significant economic news, such as interest rate hikes, inflation reports, or geopolitical events, that might have negatively impacted investor confidence on Tuesday. For example: "The release of unexpectedly high inflation figures fueled concerns about further interest rate increases by the Federal Reserve, impacting investor risk appetite across sectors."]

Sector-Specific Trends

The downturn in CRWV wasn't isolated. The cloud computing and AI infrastructure sector, as a whole, experienced some pressure.

- Competitor Stock Performance: Competitors such as [mention competitor stock tickers and their percentage changes on Tuesday]. This suggests that the decline in CRWV may be partly attributable to broader sector-specific headwinds.

- Industry News and Reports: [Mention any negative industry reports or news items released around Tuesday that may have negatively affected investor perception of the cloud computing and AI sector. For example: "Concerns surrounding increased competition in the AI infrastructure space and the potential for slower-than-expected growth in cloud adoption contributed to the sector's overall weakness."]

CoreWeave-Specific News and Factors

While broader market forces played a role, let's examine any CoreWeave-specific news or factors that may have influenced Tuesday's decline.

Absence of Positive Catalysts

The lack of positive news or announcements from CoreWeave itself could have contributed to the stock price dip.

- Anticipated Announcements: Were there any expected product launches, partnerships, or earnings reports that didn't materialize? The absence of such positive catalysts might have disappointed investors.

- Impact on Investor Confidence: The absence of positive news, especially in a market already showing some weakness, can lead to a sell-off as investors look for more promising opportunities.

Potential Negative News or Speculation

While no significant negative news was publicly reported concerning CoreWeave on Tuesday, market rumor and speculation can also impact stock prices.

- Sources of Negative Speculation: [If any rumors or speculation circulated, mention their source and nature, but carefully assess their credibility. Be cautious and avoid spreading unsubstantiated claims.]

- Impact Assessment: [Analyze the potential impact of any negative speculation. For example: "Even unsubstantiated rumors can create uncertainty and trigger selling pressure, especially in a volatile market."]

Technical Analysis of CRWV Stock

A technical analysis of CRWV's stock chart offers additional insights into Tuesday's decline.

Chart Patterns and Indicators

Several technical indicators might help explain the downturn.

- Key Technical Indicators: [Mention specific technical indicators like moving averages (e.g., 50-day and 200-day), RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) and their readings on Tuesday. For example: "The 50-day moving average crossed below the 200-day moving average, a bearish signal indicating a potential trend reversal."]

- Chart Patterns: [Discuss any relevant chart patterns observed on Tuesday, such as head and shoulders, double top, or other formations that may suggest a price decline. For example: "The chart showed signs of a potential 'head and shoulders' pattern, a bearish reversal pattern that often precedes a price drop."]

Trading Volume and Volatility

Analyzing trading volume provides further context.

- Trading Volume Data: [Present data on CRWV's trading volume on Tuesday. Was it unusually high (suggesting increased selling pressure) or low (indicating lower investor participation)?]

- Volatility Implications: High volume coupled with a price drop suggests strong selling pressure. Low volume might indicate a lack of conviction behind the price movement, potentially suggesting a temporary dip.

Conclusion

CoreWeave Inc.'s (CRWV) stock decline on Tuesday was likely a confluence of factors. Broader market weakness, sector-specific concerns in the cloud computing and AI infrastructure space, the absence of positive catalysts for CRWV, and potentially some technical indicators all contributed to the downturn. While the immediate outlook might seem uncertain, it's crucial to remember that the long-term prospects of CoreWeave, a key player in the rapidly growing AI infrastructure market, remain promising.

Outlook: The future performance of CRWV stock will depend on several factors, including the overall market sentiment, the company's execution of its business strategy, and the continued growth of the cloud computing and AI sectors. Positive announcements, such as new partnerships or successful product launches, could act as significant catalysts for future price appreciation. Conversely, any negative news or increased competition could put downward pressure on the stock.

Call to Action: Continuously monitor CoreWeave Inc.'s (CRWV) stock performance, paying close attention to market trends, company news, and relevant technical indicators. Conduct thorough research and consider your own risk tolerance before making any investment decisions regarding CoreWeave stock or any other investment. Understanding the various factors impacting CRWV stock price is key to successful CoreWeave stock investing.

Featured Posts

-

Wordle 1366 Hints Answer And How To Solve Todays Puzzle March 16th

May 22, 2025

Wordle 1366 Hints Answer And How To Solve Todays Puzzle March 16th

May 22, 2025 -

Whats Driving Core Weave Stocks Current Price

May 22, 2025

Whats Driving Core Weave Stocks Current Price

May 22, 2025 -

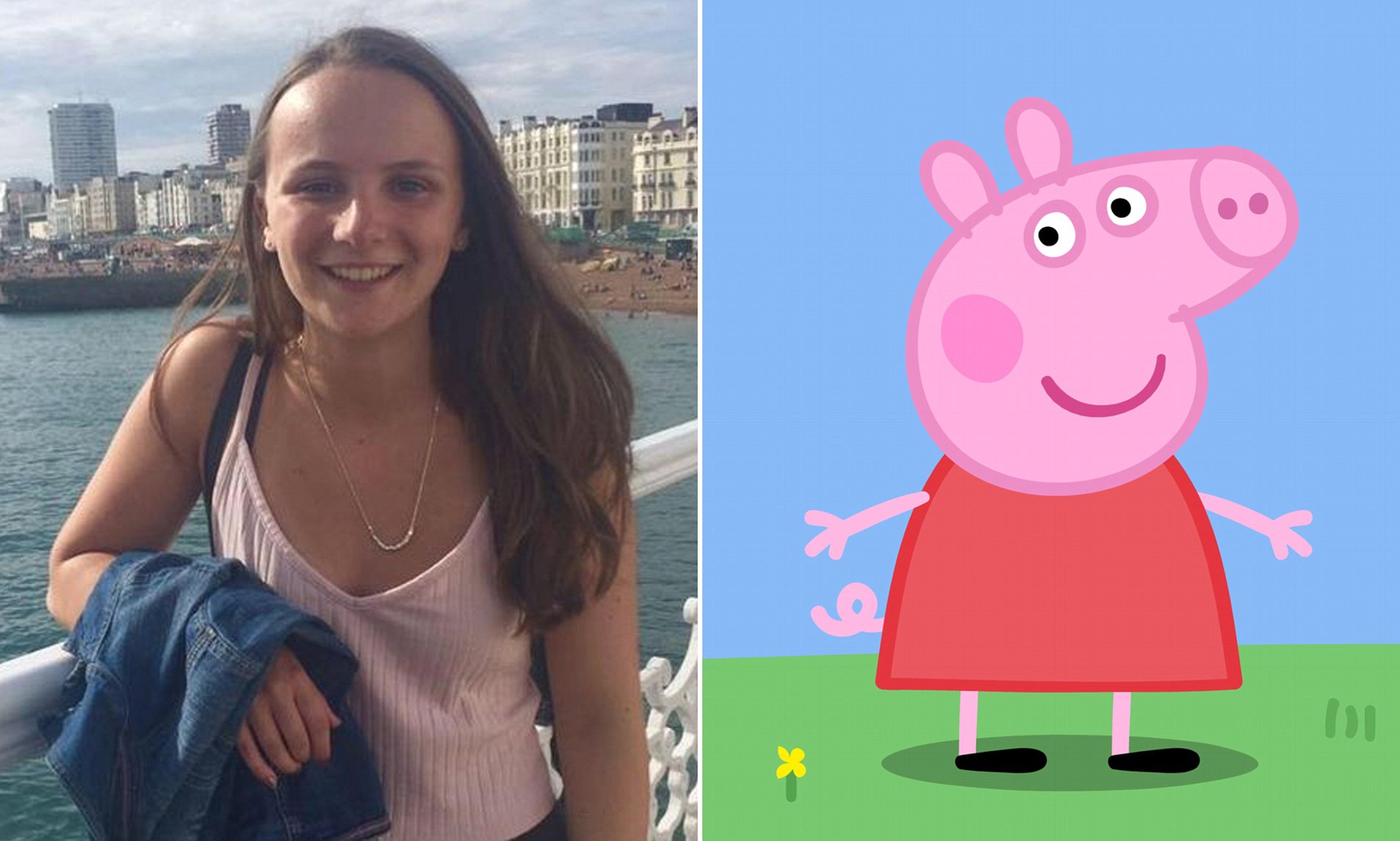

Peppa Pigs Real Name A Surprise For Longtime Fans

May 22, 2025

Peppa Pigs Real Name A Surprise For Longtime Fans

May 22, 2025 -

2025 Nfl Draft Kipers Bold Prediction Impacts Steelers Strategy

May 22, 2025

2025 Nfl Draft Kipers Bold Prediction Impacts Steelers Strategy

May 22, 2025 -

Funbox Mesa Arizonas First Permanent Indoor Bounce Park

May 22, 2025

Funbox Mesa Arizonas First Permanent Indoor Bounce Park

May 22, 2025

Latest Posts

-

Oscar Winner And White Lotus Star In Netflixs Upcoming Sexy Darkly Funny Series

May 22, 2025

Oscar Winner And White Lotus Star In Netflixs Upcoming Sexy Darkly Funny Series

May 22, 2025 -

Siren Trailer Julianne Moore Clarifies Character Portrayal

May 22, 2025

Siren Trailer Julianne Moore Clarifies Character Portrayal

May 22, 2025 -

Un Nou Serial Netflix Cu O Distributie Care Impresioneaza

May 22, 2025

Un Nou Serial Netflix Cu O Distributie Care Impresioneaza

May 22, 2025 -

White Lotus Star And Oscar Winner Headline Netflixs New Darkly Funny Drama

May 22, 2025

White Lotus Star And Oscar Winner Headline Netflixs New Darkly Funny Drama

May 22, 2025 -

New Siren Trailer Julianne Moore Addresses Monster Rumors

May 22, 2025

New Siren Trailer Julianne Moore Addresses Monster Rumors

May 22, 2025