Analyzing Elon Musk's Net Worth: A Correlation With US Economic Power?

Table of Contents

Musk's Net Worth: A Product of Innovation and Market Forces

Elon Musk's staggering net worth is undeniably tied to the success of his ventures, primarily Tesla and SpaceX. Understanding its trajectory requires examining both the innovative nature of these companies and the powerful forces of the stock market.

The Role of Tesla and SpaceX

-

Tesla's impact on the electric vehicle (EV) market: Tesla's pioneering role in making EVs mainstream has significantly impacted the automotive industry and contributed to US technological leadership in this rapidly growing sector. The company's innovative battery technology and charging infrastructure have accelerated the transition to sustainable transportation, attracting substantial investment and creating numerous jobs.

-

SpaceX's influence on the space exploration industry: SpaceX has revolutionized space travel through reusable rockets and cost-effective launch systems. This innovation not only advances space exploration but also has significant economic spin-offs, including new technologies and job creation in related industries. Its success has sparked renewed interest and investment in the US space sector.

-

Broader economic impact: The innovations stemming from Musk's companies have a ripple effect across the US economy. They attract foreign investment, create high-skilled jobs, and stimulate innovation in related fields like artificial intelligence, renewable energy, and materials science.

-

Data Points: Tesla's market capitalization frequently ranks among the highest in the world, reflecting investor confidence in its future growth. Similarly, SpaceX's valuation, although privately held, is estimated to be in the tens of billions of dollars, highlighting its significant economic impact. These valuations directly contribute to Musk's overall net worth.

The Influence of Stock Market Performance

Elon Musk's net worth is heavily reliant on the performance of Tesla's stock price. His substantial ownership stake means even small fluctuations in the share price translate to significant changes in his overall wealth.

-

Direct impact of stock market fluctuations: The volatile nature of the stock market directly influences Musk's net worth. Positive market sentiment and strong investor confidence boost Tesla's stock price, consequently increasing his wealth. Conversely, negative market trends or controversies surrounding Tesla can lead to substantial decreases.

-

Correlation with overall market performance: While Tesla's stock performance is a major driver, the overall health of the US stock market (e.g., the S&P 500 index) also plays a role. A strong, bullish market generally supports the valuations of all publicly traded companies, including Tesla.

-

Role of investor sentiment and market speculation: Market speculation and investor sentiment heavily impact Tesla's stock price, and consequently Musk's net worth. Positive news, technological breakthroughs, or successful product launches tend to drive up the stock price, while negative news or setbacks can trigger sharp declines.

-

Illustrative Charts: A simple chart depicting the correlation between Tesla's stock price and Musk's net worth over time would visually demonstrate this direct relationship.

US Economic Power: Key Indicators and Their Relationship to Musk's Wealth

Analyzing the relationship between Elon Musk's wealth and US economic power requires examining key economic indicators and the intricate connections between them.

Technological Innovation and Economic Growth

The US economy's strength is significantly linked to its technological prowess, and Musk's success reflects this strength.

-

Connection between US technological leadership and Musk's success: Musk's success in the EV and space exploration sectors is intrinsically linked to the US's historical strength in technological innovation and its capacity for supporting ambitious entrepreneurial ventures.

-

Contribution to US technological leadership: Tesla and SpaceX are at the forefront of technological innovation, pushing the boundaries of electric vehicle technology and space exploration, thereby strengthening the US's position as a global leader.

-

Impact of government policies: Government policies, such as tax incentives for green technology, play a crucial role in both the success of companies like Tesla and the broader strength of the US economy. These policies encourage investment in key sectors and foster innovation.

-

Data on US GDP Growth: Data showing the correlation between US GDP growth and technological advancements would highlight the importance of innovation for overall economic strength.

Global Economic Factors and Their Influence

Global economic trends significantly impact Musk's net worth and, by extension, the US economy.

-

Influence of global market trends: Global demand for EVs and increased interest in space exploration significantly influence the valuation of Tesla and SpaceX, impacting Musk's wealth. The global reach of these markets underlines the interconnectedness of the US economy with the global landscape.

-

Impact of global economic shifts: Global economic downturns or shifts in consumer preferences can impact the demand for Tesla's vehicles and SpaceX's services, indirectly affecting Musk's net worth.

-

Interplay between US economic policies and global conditions: US economic policies, such as trade agreements and regulations, influence the global competitive landscape, which in turn can affect the success of Musk's companies.

-

Data on Global EV Market Growth: Including data on the growth of the global EV market and its impact on Tesla's valuation further illustrates the interconnectedness of national and global economies.

Causality vs. Correlation: Unpacking the Relationship

While a correlation exists between Elon Musk's net worth and certain aspects of the US economy, establishing a direct causal link is complex.

-

Differentiating correlation and causality: It's crucial to distinguish between Musk's net worth moving in tandem with specific economic indicators (correlation) and whether his actions directly cause changes in the US economy (causality).

-

Potential confounding factors: Several confounding factors, such as overall market trends, investor sentiment, global economic conditions, and government policies, influence both Musk's net worth and US economic indicators, making it difficult to isolate a direct causal relationship.

-

Limitations of relying on correlation: Correlation doesn't equal causation. Observing a simultaneous rise in Musk's net worth and a certain economic indicator doesn't automatically imply a direct causal relationship.

-

Examples and Counterarguments: Providing examples and counterarguments demonstrates the complexities of determining causality. For instance, while Tesla's success contributes to the growth of the EV sector, the sector's growth is also influenced by various other factors, including government regulations and consumer preferences.

Conclusion

This analysis reveals a strong correlation between Elon Musk's net worth and specific aspects of US economic power, particularly in the technological sector. However, establishing direct causality requires further research, as numerous economic and market factors influence both. Musk's success undeniably reflects, to some extent, the strengths of the US economy's innovation capacity and its leading role in emerging technological fields.

Call to Action: Further research into the complex interplay between Elon Musk's net worth and US economic power is crucial for understanding the dynamics of innovation, wealth creation, and national economic strength. Continue the conversation by exploring additional perspectives on analyzing Elon Musk's net worth and its connection to US economic power.

Featured Posts

-

Melanie Griffith And Family Attend Dakota Johnsons Materialist Screening

May 10, 2025

Melanie Griffith And Family Attend Dakota Johnsons Materialist Screening

May 10, 2025 -

Brobbeys Power A Potential Europa League Decisive Factor

May 10, 2025

Brobbeys Power A Potential Europa League Decisive Factor

May 10, 2025 -

Celebrity Antiques Road Trip A Guide To The Show And Its Treasures

May 10, 2025

Celebrity Antiques Road Trip A Guide To The Show And Its Treasures

May 10, 2025 -

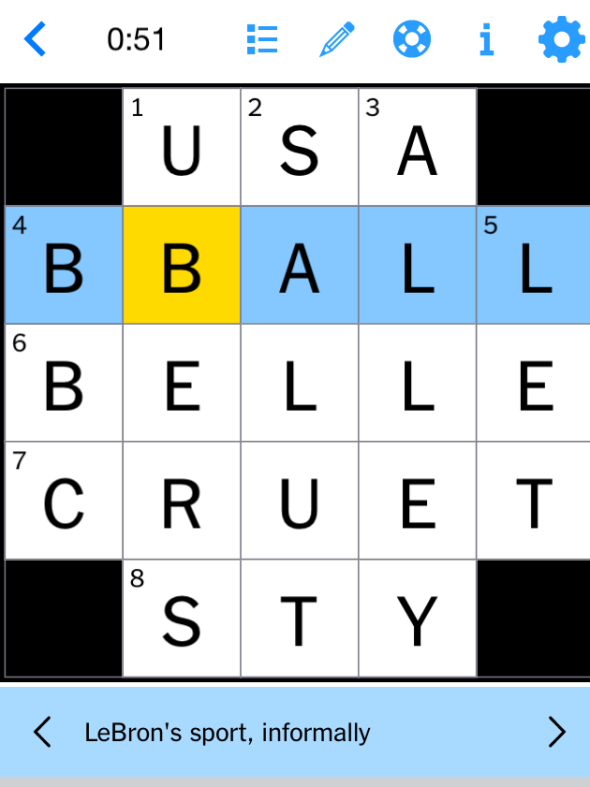

Nyt Strands Crossword April 6 2025 Complete Guide To Solving

May 10, 2025

Nyt Strands Crossword April 6 2025 Complete Guide To Solving

May 10, 2025 -

These 4 Randall Flagg Theories Will Change Your View Of Stephen Kings Work

May 10, 2025

These 4 Randall Flagg Theories Will Change Your View Of Stephen Kings Work

May 10, 2025