Analyzing Market Reactions: Professional Vs. Individual Investor Strategies

Table of Contents

Professional Investor Strategies for Analyzing Market Reactions

Professional investors employ sophisticated methods to analyze market reactions, leveraging advanced tools and a long-term perspective. Their strategies are built on rigorous research and a deep understanding of market dynamics.

Sophisticated Analytical Tools & Data

Professional investors utilize a range of advanced tools and data sources to gain a comprehensive understanding of market reactions. This allows them to identify trends, predict potential shifts, and make informed investment decisions.

- Advanced Software and Algorithms: They employ cutting-edge software and algorithms for real-time market analysis, providing insights into price movements, trading volume, and other key indicators. This allows for rapid identification of opportunities and risks.

- Proprietary Data Feeds and Research Reports: Access to exclusive research, economic forecasts, and proprietary data feeds gives them a significant informational advantage over individual investors. This privileged information can inform trading strategies and risk assessment.

- Quantitative and Qualitative Analysis: Professional investors combine quantitative analysis (using statistical models and data) with qualitative analysis (considering economic factors, geopolitical events, and company-specific news) to build a holistic view of market conditions and forecast future market reactions. This multifaceted approach leads to more nuanced investment decisions.

- Examples: Bloomberg Terminal and Refinitiv Eikon are prime examples of the sophisticated platforms utilized by professionals to access real-time market data, news, and analytical tools.

Diversification & Risk Management

Risk management is paramount in professional investing. Their strategies prioritize diversification and hedging to mitigate potential losses and protect capital.

- Sophisticated Hedging Strategies: Professional investors employ complex hedging techniques using derivatives and other financial instruments to protect their portfolios from adverse market reactions. This minimizes the impact of unexpected events.

- Diversification Across Asset Classes and Geographies: They spread their investments across different asset classes (stocks, bonds, real estate, commodities) and geographies to reduce risk. This minimizes the impact of losses in any single asset class or region.

- Options and Futures Contracts: These derivatives are used for hedging and speculation, allowing professional investors to fine-tune their exposure to market risks and capitalize on anticipated movements.

- Strict Risk Tolerance Parameters and Stop-Loss Orders: Professional investors set clear risk tolerance limits and use stop-loss orders to automatically sell assets when they reach a predetermined price, limiting potential losses.

Long-Term Investment Horizons

Professional investors typically take a long-term perspective, focusing on sustainable growth rather than short-term gains. This approach minimizes the impact of short-term market volatility.

- Long-Term Growth Strategies: Their investment decisions are guided by long-term growth potential, rather than short-term price fluctuations. This results in a more stable and potentially more profitable investment portfolio.

- Insensitivity to Short-Term Volatility: They are less prone to emotional decision-making triggered by short-term market volatility. This steady approach helps avoid impulsive trades based on fear or greed.

- Buy-and-Hold Strategies: Core portfolio holdings are often managed using buy-and-hold strategies, minimizing trading costs and capital gains taxes.

- Regular Portfolio Rebalancing: They regularly rebalance their portfolios to maintain the desired asset allocation and risk profile, ensuring alignment with long-term financial objectives.

Individual Investor Strategies for Analyzing Market Reactions

Individual investors often lack the resources and expertise of professionals, leading to different approaches to analyzing market reactions. Their strategies are often more reactive and influenced by readily available information.

Reliance on News & Sentiment

Individual investors frequently rely on easily accessible news and market sentiment to make investment decisions, leading to susceptibility to emotional biases.

- Influence of Media Headlines and Market Sentiment: They often react to news headlines and overall market sentiment, sometimes leading to impulsive buying or selling. This can result in poor investment outcomes.

- Impulsive Reactions to Short-Term Fluctuations: Short-term price movements can trigger emotional responses, leading to rash investment decisions. This reactive behavior can be detrimental to long-term goals.

- Emotional Decision-Making (Fear and Greed): Fear and greed significantly influence investment decisions, leading to poor risk management and potentially substantial losses.

- Limited Access to Sophisticated Tools: They generally lack access to the advanced analytical tools and data available to professional investors.

Limited Diversification & Risk Tolerance

Individual investors often demonstrate less diversification and sometimes higher risk tolerance compared to their professional counterparts.

- Concentration of Investments: They may concentrate their investments in a limited number of assets, increasing their exposure to risk. This lack of diversification magnifies the impact of negative market reactions.

- Higher Risk Tolerance (Sometimes Excessive): Some individual investors take on excessive risk in pursuit of quick gains, neglecting proper risk management. This can lead to significant losses.

- Lack of Sophisticated Risk Management: They are less likely to use sophisticated risk management tools and strategies, increasing their vulnerability to market downturns.

- Lack of Understanding of Diversification: Many individual investors don't fully grasp the benefits of diversification, leading to concentrated portfolios.

Short-Term Focus & Active Trading

Individual investors frequently engage in active trading, often driven by short-term market trends, which can lead to higher transaction costs and inconsistent results.

- Active Trading Based on Short-Term Trends: They frequently buy and sell assets based on perceived short-term trends, often resulting in higher transaction costs.

- Higher Transaction Costs: Frequent buying and selling increases brokerage fees and capital gains taxes, eroding potential profits.

- Susceptibility to Market Manipulation and Misinformation: They are more susceptible to manipulation and misinformation due to their reliance on readily available information without thorough verification.

- Difficulty Achieving Long-Term Goals: Inconsistent trading strategies and emotional decision-making hinder their ability to achieve long-term financial objectives.

Key Differences in Market Reaction Analysis

The contrasting approaches of professional and individual investors to analyzing market reactions are significant.

- Objective vs. Subjective Analysis: Professionals employ data-driven, objective analysis, whereas individuals often rely on subjective interpretations and emotional responses.

- Long-Term vs. Short-Term Focus: Professionals prioritize long-term strategies and risk management, while individuals may focus on short-term gains and speculation.

- Resource Advantage: Professionals have access to superior resources and technology, giving them a considerable advantage in analyzing market reactions.

- Informed Decision-Making: Understanding these differences is crucial for making informed investment decisions, regardless of your investor profile.

Conclusion

Analyzing market reactions effectively is vital for successful investing. While professional investors leverage sophisticated tools and strategies to navigate market fluctuations, individual investors often rely on readily available information and can be more susceptible to emotional biases. By understanding the key differences in approach, both professional and individual investors can refine their strategies and improve their chances of achieving long-term financial success. To further enhance your understanding of market reactions, explore additional resources on risk management and investment strategies. Mastering the art of analyzing market reactions is a journey, not a destination.

Featured Posts

-

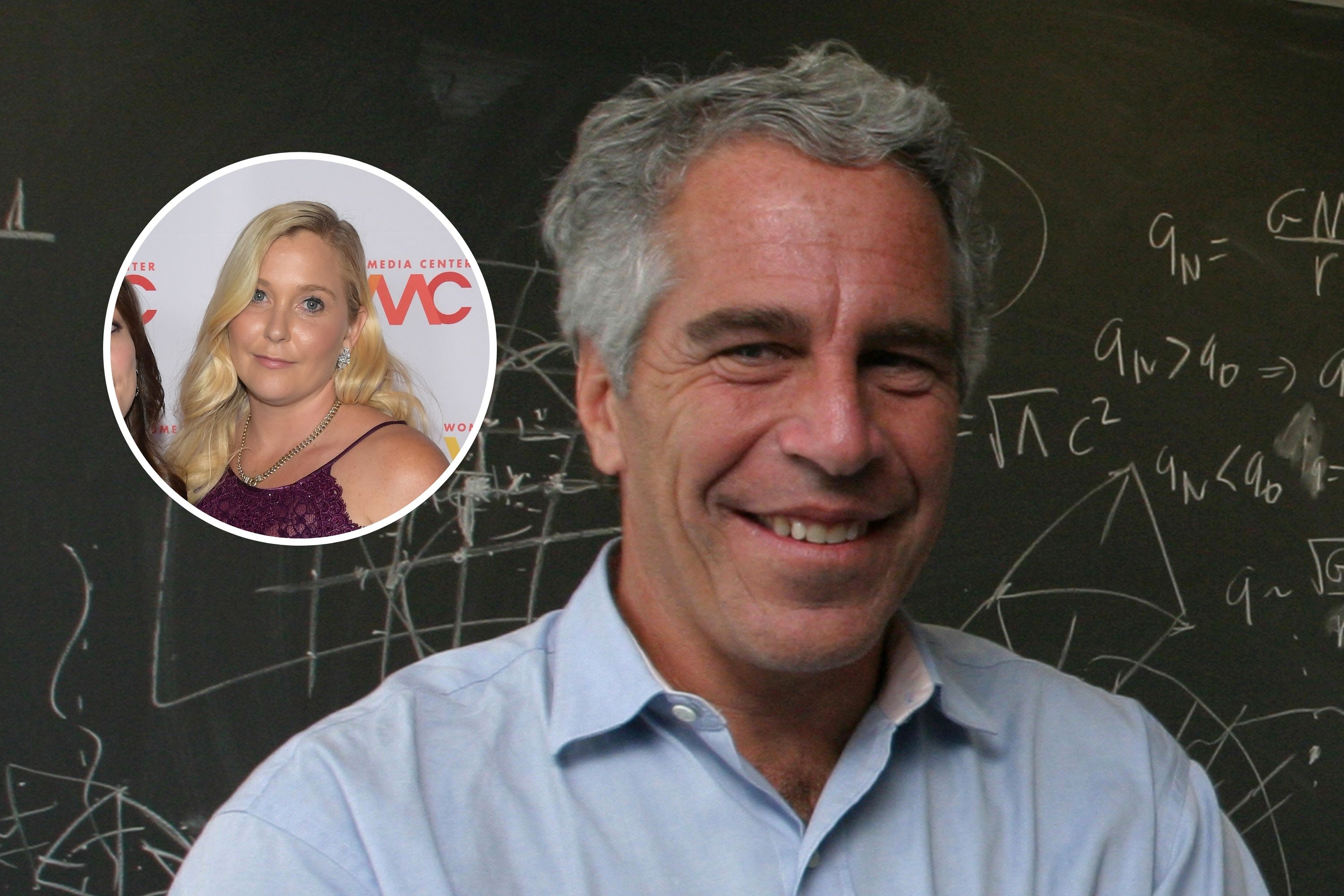

Death Of Virginia Giuffre Remembering The Epstein Survivor

Apr 28, 2025

Death Of Virginia Giuffre Remembering The Epstein Survivor

Apr 28, 2025 -

Yankees 2000 Season A Diary Entry Royals Game Recap

Apr 28, 2025

Yankees 2000 Season A Diary Entry Royals Game Recap

Apr 28, 2025 -

Perplexity Ceo The Fight For Ai Search Dominance Against Google

Apr 28, 2025

Perplexity Ceo The Fight For Ai Search Dominance Against Google

Apr 28, 2025 -

Aaron Judge Paul Goldschmidt Propel Yankees To Hard Fought Victory

Apr 28, 2025

Aaron Judge Paul Goldschmidt Propel Yankees To Hard Fought Victory

Apr 28, 2025 -

Decoding Musks X Debt Sale A Financial Deep Dive

Apr 28, 2025

Decoding Musks X Debt Sale A Financial Deep Dive

Apr 28, 2025

Latest Posts

-

E Ink Spectra

Apr 28, 2025

E Ink Spectra

Apr 28, 2025 -

75

Apr 28, 2025

75

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Coras Subtle Red Sox Lineup Changes For Doubleheader

Apr 28, 2025

Coras Subtle Red Sox Lineup Changes For Doubleheader

Apr 28, 2025 -

Could Espns Red Sox Outfield Prediction For 2025 Come True

Apr 28, 2025

Could Espns Red Sox Outfield Prediction For 2025 Come True

Apr 28, 2025