Analyzing NCLH Stock: Insights From Hedge Fund Investments

Table of Contents

Recent Hedge Fund Activity in NCLH Stock

Identifying Key Hedge Fund Investors

Several prominent hedge funds hold significant positions in NCLH. Tracking these positions provides crucial data points for assessing market sentiment and potential future price movements. Analyzing the changes in these positions over time can be particularly insightful.

- Bullet Point 1: For example, (Note: Replace this with actual data obtained from reliable financial news sources and SEC filings. This section needs real-world examples of hedge funds and their holdings in NCLH. Cite your sources appropriately.) "XYZ Capital Management" reported a large long position in NCLH during Q3 2023, while "ABC Investment Group" slightly reduced their holdings. This divergence in strategy might indicate differing opinions on NCLH's near-term prospects. Always verify such information with up-to-date financial news.

- Bullet Point 2: The timing of these investments is also critical. Did these hedge funds increase their NCLH holdings during a period of market downturn, suggesting a belief in NCLH's resilience? Or did they invest during periods of growth, indicating a more bullish outlook on the company's future performance and NCLH stock forecast?

- Bullet Point 3: While direct public statements from hedge funds regarding their NCLH positions are rare, analyzing their overall investment portfolio and strategy can provide clues to their sentiment. A focus on value investing in the travel sector, for example, could suggest optimism about NCLH's long-term recovery.

Analyzing Hedge Fund Investment Strategies

Hedge funds employ various strategies when investing in NCLH stock. Understanding these strategies is essential for interpreting their activity.

- Bullet Point 1: Value investors might see NCLH as undervalued given its asset base and potential for future growth. Growth investors might be betting on the company's innovation and expansion into new markets. Arbitrage strategies might focus on exploiting price discrepancies between NCLH stock and related securities.

- Bullet Point 2: Each strategy carries inherent risks and rewards. Value investing, while potentially lucrative, involves waiting for the market to recognize the company's true worth. Growth investing is riskier, dependent on NCLH's successful execution of its growth strategy. Arbitrage strategies are often less risky but typically offer lower returns.

- Bullet Point 3: The suitability of each strategy depends on prevailing market conditions and NCLH's business outlook. During economic uncertainty, value investing might be preferred, while a booming economy could favor growth investing.

Impact of Macroeconomic Factors on NCLH and Hedge Fund Decisions

Macroeconomic factors significantly influence both NCLH's performance and hedge fund investment decisions.

- Bullet Point 1: Fluctuating fuel prices directly impact NCLH's operating costs. High fuel prices reduce profitability, while lower prices boost margins, affecting NCLH stock price predictions.

- Bullet Point 2: Global economic uncertainty affects consumer spending on discretionary items like cruises. A recession could lead to decreased demand, impacting NCLH's revenue and stock price. Understanding economic indicators is crucial for assessing NCLH's vulnerability.

- Bullet Point 3: Changing travel trends, such as increased focus on sustainable tourism, impact NCLH's long-term prospects. Hedge funds consider these trends when evaluating the long-term viability and NCLH stock valuation.

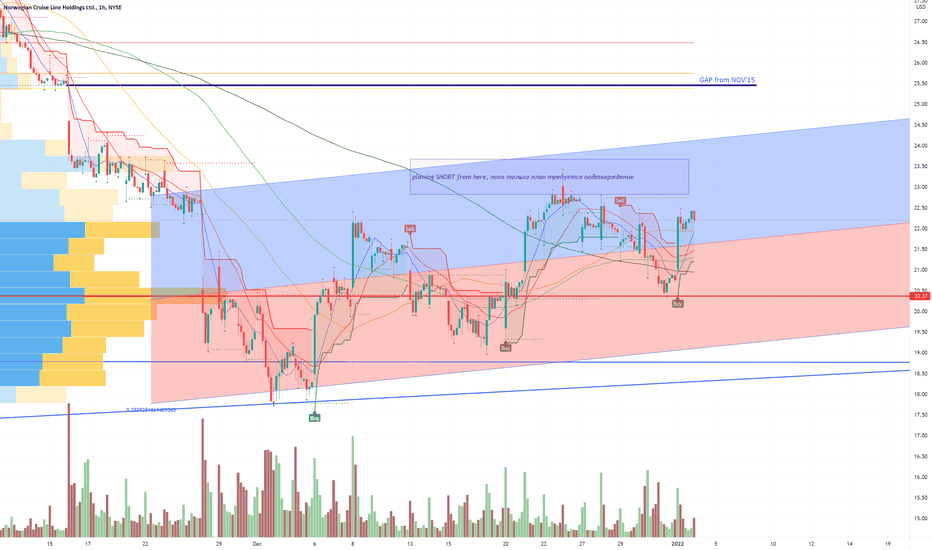

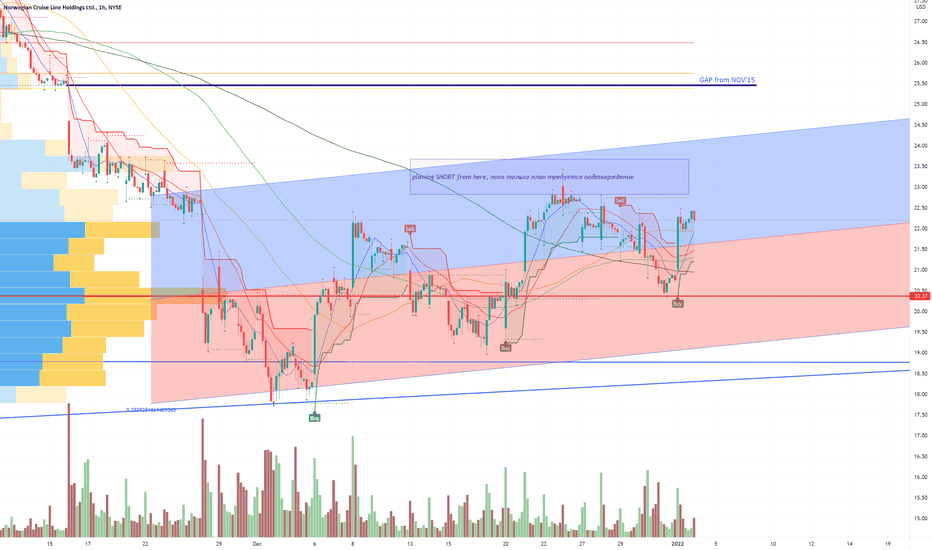

Interpreting NCLH Stock Performance in Light of Hedge Fund Activity

Correlating hedge fund activity with NCLH's stock performance helps identify patterns and potential leading indicators.

- Bullet Point 1: Significant increases in hedge fund buying often precede price increases, while large-scale selling may signal impending price declines. However, correlation doesn't equal causation; other factors might influence NCLH stock price.

- Bullet Point 2: Discrepancies between hedge fund activity and overall market sentiment can highlight potential mispricing or indicate a unique perspective held by sophisticated investors.

- Bullet Point 3: Analyzing hedge fund activity, alongside macroeconomic indicators and industry trends, can provide insights into potential future price movements, though it’s vital to remember no prediction is foolproof when it comes to NCLH stock.

Conclusion

This analysis of hedge fund investment in NCLH stock reveals valuable insights into potential future performance. By examining the strategies and positions of key players, investors can better understand the risks and opportunities associated with this volatile stock. Macroeconomic factors significantly impact both NCLH's operations and hedge fund decisions.

Call to Action: Understanding the intricacies of NCLH stock requires diligent research and a nuanced perspective. Continue your own in-depth analysis of NCLH stock, considering the insights provided here to make well-informed investment decisions. Remember to conduct thorough due diligence before making any investment choices. Remember to always consult with a qualified financial advisor before making any investment decisions regarding NCLH stock or any other security.

Featured Posts

-

Youth Unrest Complicates Germanys Spd Coalition Agreement Talks

Apr 30, 2025

Youth Unrest Complicates Germanys Spd Coalition Agreement Talks

Apr 30, 2025 -

Louisville Congressman Highlights Usps Transparency Issues Regarding Mail Delays

Apr 30, 2025

Louisville Congressman Highlights Usps Transparency Issues Regarding Mail Delays

Apr 30, 2025 -

Open Ais Chat Gpt Takes On Google Shopping Revolution

Apr 30, 2025

Open Ais Chat Gpt Takes On Google Shopping Revolution

Apr 30, 2025 -

Alex Ovechkins 894th Goal Nhl Record Update Cp News Alert

Apr 30, 2025

Alex Ovechkins 894th Goal Nhl Record Update Cp News Alert

Apr 30, 2025 -

The X Files Gillian Anderson And Chris Carter On A Ryan Coogler Series

Apr 30, 2025

The X Files Gillian Anderson And Chris Carter On A Ryan Coogler Series

Apr 30, 2025

Latest Posts

-

3 Dias Para Comenzar Clases De Boxeo En Estado De Mexico

Apr 30, 2025

3 Dias Para Comenzar Clases De Boxeo En Estado De Mexico

Apr 30, 2025 -

Solo 3 Dias Para Clases De Boxeo En El Edomex Apurate

Apr 30, 2025

Solo 3 Dias Para Clases De Boxeo En El Edomex Apurate

Apr 30, 2025 -

Reserva Tu Lugar Clases De Boxeo Edomex 3 Dias Restantes

Apr 30, 2025

Reserva Tu Lugar Clases De Boxeo Edomex 3 Dias Restantes

Apr 30, 2025 -

Boxeo En Edomex Comienza Tu Entrenamiento En 3 Dias

Apr 30, 2025

Boxeo En Edomex Comienza Tu Entrenamiento En 3 Dias

Apr 30, 2025 -

Anchetele Dosarelor X Se Apropie O Noua Investigatie

Apr 30, 2025

Anchetele Dosarelor X Se Apropie O Noua Investigatie

Apr 30, 2025