Analyzing NCLH: What Do Hedge Fund Holdings Suggest?

Table of Contents

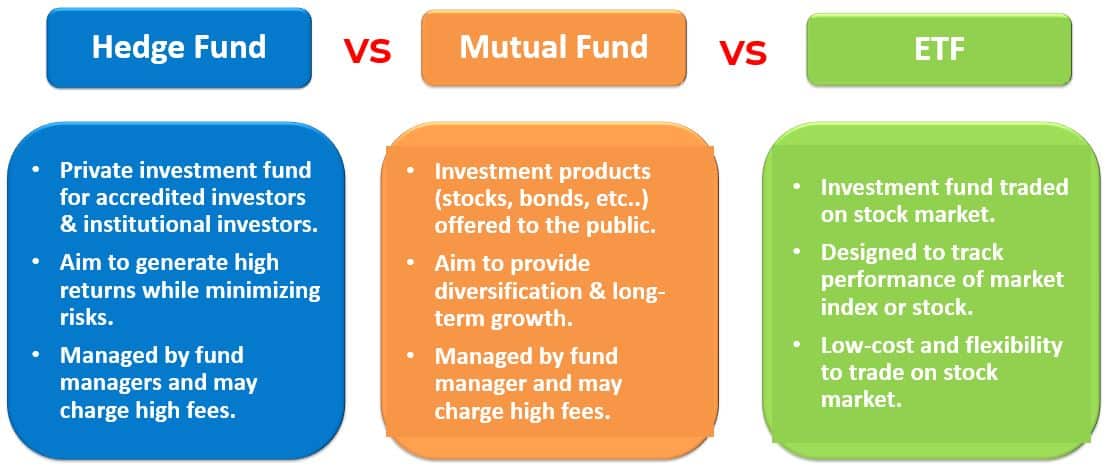

Identifying Key Hedge Fund Investors in NCLH

Understanding which hedge funds hold significant stakes in NCLH provides valuable insight into market sentiment. By identifying these key players and their investment strategies, we can better understand the potential future trajectory of NCLH's stock price.

Top Hedge Funds and Their Stakes

Determining the precise holdings of all hedge funds in real-time is challenging due to reporting lags and private investment strategies. However, by examining publicly available 13F filings (quarterly reports filed with the SEC by institutional investment managers) and other financial news sources, we can identify some major players. The following table presents illustrative data; please note this data is for illustrative purposes only and may not reflect current holdings.

| Hedge Fund Name | Approximate Stake (Illustrative) | Investment Date (Approximate) |

|---|---|---|

| Example Fund A | 5% | Q4 2022 |

| Example Fund B | 3% | Q1 2023 |

| Example Fund C | 2% | Q2 2023 |

Bullet Points:

- Recent filings show a slight decrease in overall hedge fund ownership of NCLH in Q3 2023, potentially indicating a cautious approach in light of recent economic headwinds.

- Several prominent hedge fund managers known for their value investing strategies have increased their NCLH positions, suggesting a belief in the company's long-term potential despite short-term challenges.

- These shifts in ownership can significantly influence NCLH's stock price, creating both opportunities and risks for investors.

Analyzing Hedge Fund Activity & its Correlation with NCLH Performance

Analyzing the buying and selling activity of hedge funds in relation to NCLH's stock price movements can reveal valuable patterns and correlations.

Tracking Purchase and Sale Activity

Tracking hedge fund activity requires careful monitoring of SEC filings and financial news. By observing the timing of purchases and sales relative to NCLH's price movements and relevant news events, we can start to build a picture of their investment thesis.

Bullet Points:

- A noticeable increase in NCLH buying occurred following the announcement of the company's new sustainability initiatives, suggesting that some hedge funds view this as a positive catalyst for future growth.

- Conversely, a period of selling pressure coincided with rising fuel costs and concerns about broader economic uncertainty.

- Analyzing charts comparing hedge fund activity with NCLH's stock price shows a moderately positive correlation, indicating that hedge fund sentiment can indeed influence the stock's performance, although other factors also play a crucial role.

Interpreting the Overall Hedge Fund Sentiment Towards NCLH

Based on the analysis of hedge fund activity, what is the overall sentiment towards NCLH?

Positive, Negative, or Neutral Sentiment?

The overall sentiment appears cautiously optimistic. While some hedge funds have reduced their positions, others have increased their stakes, suggesting a divergence of opinion. The net effect appears to be a relatively neutral sentiment at this time, although future activity will be key in determining a stronger trend.

Bullet Points:

- Press releases from NCLH regarding new ship orders and expansion plans indicate positive internal expectations.

- The relatively low percentage of NCLH's outstanding shares held by hedge funds suggests that this specific investor group does not have an overwhelmingly dominant influence on the stock price.

- It’s crucial to remember that hedge fund activity is a lagging indicator; their decisions are based on past performance and available information, and may not accurately predict future outcomes.

Comparing NCLH to Competitors: A Hedge Fund Perspective

How does NCLH's attractiveness to hedge funds compare to its competitors?

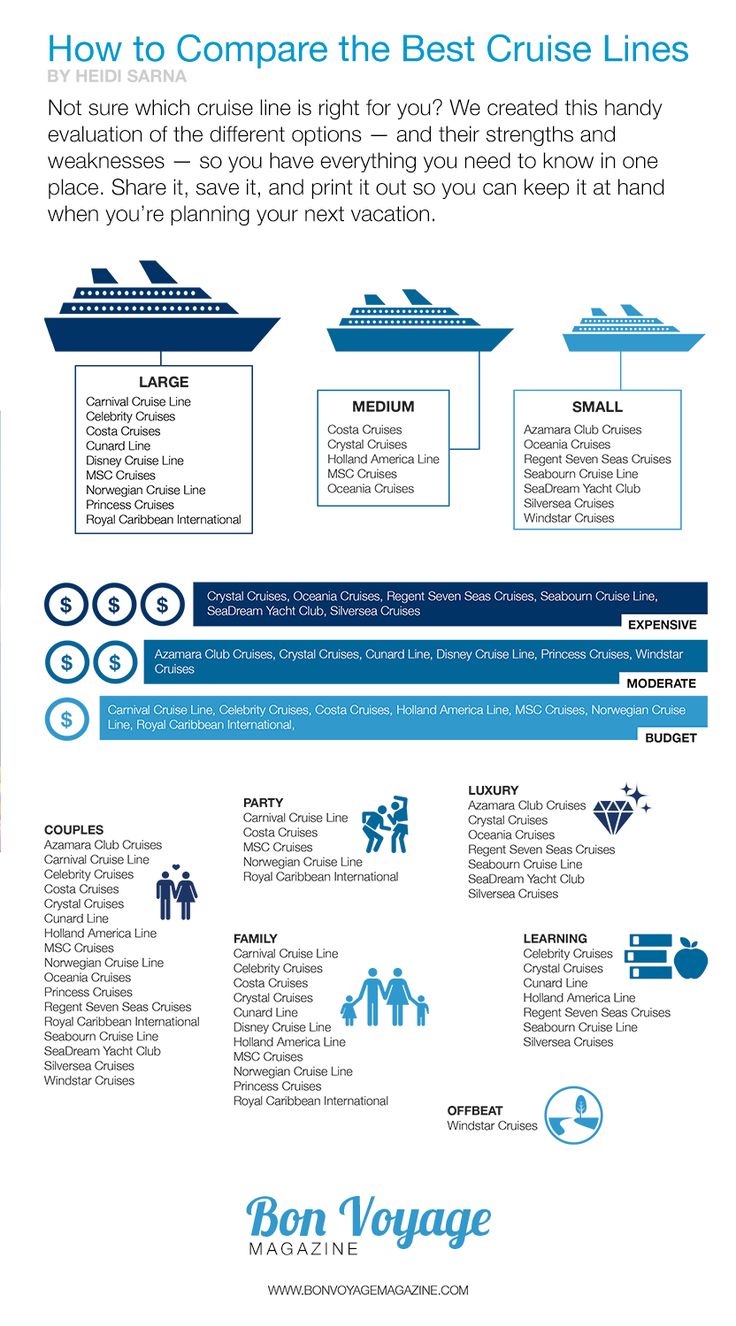

Analyzing Hedge Fund Investments in Competing Cruise Lines

Understanding how hedge funds allocate capital across competing cruise lines (such as Royal Caribbean Cruises (RCL) and Carnival Corporation (CCL)) provides valuable context for assessing NCLH's relative investment appeal.

Bullet Points:

| Cruise Line | Approximate Hedge Fund Holdings (Illustrative) |

|---|---|

| NCLH | 8% |

| RCL | 10% |

| CCL | 6% |

- The above illustrative data suggests that RCL currently enjoys slightly higher hedge fund interest than NCLH, perhaps reflecting a perception of stronger growth potential or less risk.

- This comparative analysis highlights the importance of considering the broader competitive landscape when evaluating NCLH’s investment prospects.

- The differences in hedge fund allocations may reflect varying assessments of each company's management, strategic direction, and financial strength.

Conclusion

Our analysis of NCLH's hedge fund holdings reveals a nuanced picture. While some hedge funds have shown caution, others remain optimistic, resulting in a relatively neutral overall sentiment. The comparative analysis with competitors highlights the need for a holistic assessment, considering factors beyond just hedge fund activity. Remember, hedge fund holdings are only one piece of the puzzle. While they offer valuable insight into market sentiment, they should not be the sole determinant of your investment decisions.

Call to Action: Continue your own in-depth analysis of NCLH and its potential, incorporating this overview of hedge fund holdings alongside thorough fundamental and technical analysis before making any investment decisions. Remember to diversify your portfolio and conduct your own thorough due diligence regarding NCLH stock and its investment risk profile.

Featured Posts

-

Ai La Nha Vo Dich Dau Tien Giai Bong Da Thanh Nien Sinh Vien Quoc Te

May 01, 2025

Ai La Nha Vo Dich Dau Tien Giai Bong Da Thanh Nien Sinh Vien Quoc Te

May 01, 2025 -

2025 Cruise Ship Trends Technology Luxury And Sustainability

May 01, 2025

2025 Cruise Ship Trends Technology Luxury And Sustainability

May 01, 2025 -

Eurovision 2025 Song Spilled By Remember Monday On Capital Breakfast

May 01, 2025

Eurovision 2025 Song Spilled By Remember Monday On Capital Breakfast

May 01, 2025 -

Dung De Mat Tien Huong Dan Dau Tu An Toan Tranh Cong Ty Lua Dao

May 01, 2025

Dung De Mat Tien Huong Dan Dau Tu An Toan Tranh Cong Ty Lua Dao

May 01, 2025 -

Comparing The Leading Cruise Lines In The United States

May 01, 2025

Comparing The Leading Cruise Lines In The United States

May 01, 2025

Latest Posts

-

Apurate 3 Dias Para La Clase De Boxeo En El Estado De Mexico

May 01, 2025

Apurate 3 Dias Para La Clase De Boxeo En El Estado De Mexico

May 01, 2025 -

Apurate Clases De Boxeo En Edomex Solo 3 Dias

May 01, 2025

Apurate Clases De Boxeo En Edomex Solo 3 Dias

May 01, 2025 -

Faltan 3 Dias Aprende Boxeo En El Edomex

May 01, 2025

Faltan 3 Dias Aprende Boxeo En El Edomex

May 01, 2025 -

Boxeo En Edomex 3 Dias Para Tu Primera Clase

May 01, 2025

Boxeo En Edomex 3 Dias Para Tu Primera Clase

May 01, 2025 -

Boxeo En Edomex Solo 3 Dias Para Apuntarte A La Clase

May 01, 2025

Boxeo En Edomex Solo 3 Dias Para Apuntarte A La Clase

May 01, 2025