Analyzing Nicolai Tangen's Investment Strategy During The Trump Tariff Era

Table of Contents

The Trump administration's imposition of tariffs from 2018 onwards created a period of significant upheaval in global markets. This article analyzes how Nicolai Tangen, CEO of Norges Bank Investment Management (NBIM), the manager of Norway's sovereign wealth fund, navigated this turbulent period, adjusting his investment strategy to mitigate risks and capitalize on opportunities presented by the changing trade landscape. We will explore his approach to managing the massive portfolio during this period of economic uncertainty, focusing on key decisions and their outcomes, examining the impact of the Nicolai Tangen investment strategy and the Trump tariffs.

The Impact of Trump Tariffs on Global Markets

The Trump tariffs, primarily targeting China and other nations, significantly impacted global markets. These tariffs, designed to protect American industries, led to increased prices for imported goods and retaliatory tariffs from affected countries. This created a complex web of economic consequences across various sectors.

- Increased uncertainty for investors: The unpredictable nature of the tariff implementations made it difficult for investors to forecast future market trends and accurately price assets. This uncertainty led to increased volatility in stock markets worldwide.

- Supply chain disruptions: Tariffs disrupted global supply chains, forcing companies to re-evaluate sourcing strategies and leading to delays and increased costs. The technology and manufacturing sectors were particularly hard hit.

- Shift in global trade patterns: Countries sought alternative trading partners, leading to a reshaping of global trade relationships and a re-evaluation of international supply chains.

- Impact on inflation and currency exchange rates: Tariffs contributed to inflationary pressures as import costs increased. Currency exchange rates also fluctuated significantly due to the changing global economic landscape.

Data from the World Trade Organization (WTO) shows a significant decline in global trade growth during this period, directly attributable to the impact of trade wars and protectionist policies. The International Monetary Fund (IMF) also reported decreased global economic growth forecasts as a consequence of the trade tensions.

Nicolai Tangen's Pre-Tariff Investment Approach

Before the implementation of the Trump tariffs, NBIM, under Tangen's leadership, followed a broadly passive investment strategy, largely focused on global diversification across equities, fixed income, and real estate. His approach emphasized long-term value creation rather than short-term market timing.

- NBIM's overall investment mandate: NBIM's mandate is to manage the Government Pension Fund Global (GPFG), aiming for long-term returns that outpace inflation while adhering to strict ethical guidelines.

- Focus on passive vs. active management: NBIM primarily utilizes a passive investment strategy, with a small portion of the portfolio allocated to active management. This approach is intended to reduce costs and minimize exposure to active manager risk.

- Sector allocation prior to the tariff era: Prior to the tariffs, NBIM's portfolio was broadly diversified across various sectors, reflecting global market capitalization weights.

- Key performance indicators (KPIs) before the tariffs: NBIM's performance before the tariff era was generally in line with its benchmarks, demonstrating consistent long-term value creation.

While specific details of NBIM's pre-tariff portfolio allocation are not publicly available in granular detail due to confidentiality reasons, available information points towards a strong focus on broad diversification as a core tenet of their investment approach.

Adapting the Strategy: Navigating the Tariff Uncertainty

Tangen's response to the Trump tariffs involved a strategic recalibration of NBIM’s portfolio, not a dramatic overhaul. The focus remained on long-term value creation within a risk-managed framework.

- Changes in portfolio allocation: While precise figures are not publicly disclosed, it is reasonable to assume some adjustments were made to sector weightings. Increased volatility in certain sectors might have prompted some reallocations to less affected areas.

- Diversification strategies employed: Existing diversification was likely strengthened, spreading risk across geographies and asset classes.

- Risk management techniques implemented: NBIM likely enhanced its risk monitoring and stress testing procedures to better assess the impact of tariff-related uncertainties.

- Potential hedging strategies against tariff-related risks: Hedging strategies, possibly involving currency hedging or options, may have been deployed to mitigate certain risks.

Specific investment decisions made during this period remain confidential, but the overall strategy focused on maintaining a diversified portfolio and reacting to shifts in market fundamentals rather than attempting to time the market based on short-term tariff-related news.

Performance Evaluation: Assessing the Success of the Strategy

Assessing the success of NBIM's strategy during the Trump tariff era requires a comparison of its performance to relevant benchmarks. Unfortunately, precise breakdowns of sector-specific performance directly attributable to the tariff impact are not typically released publicly by NBIM due to confidentiality concerns.

- Return on investment (ROI) compared to benchmark indices: Analyzing the overall returns compared to major global indices provides a general measure of performance during the period.

- Analysis of sector-specific performance: This would require detailed data not publicly available, limiting our direct assessment of sector-specific impacts.

- Comparison with other major sovereign wealth funds: Comparing NBIM’s performance to other similar funds provides valuable context.

- Identification of successful and less successful investment decisions: Without access to detailed portfolio data, pinpointing specific successful or unsuccessful decisions is not feasible.

It's crucial to understand that isolating the direct impact of tariffs on NBIM's performance is challenging due to the simultaneous influence of other macroeconomic factors.

Lessons Learned and Future Implications

Tangen's experience during the Trump tariff era provides valuable lessons applicable to long-term investment strategies:

- Implications for long-term investment strategies: The importance of long-term diversification, robust risk management, and avoiding market timing based on short-term political events was highlighted.

- Adaptability and responsiveness to geopolitical events: The ability to adapt to changing market conditions and geopolitical uncertainties is paramount.

- Importance of robust risk management: A robust risk management framework is essential for navigating economic uncertainty.

- Future strategies for navigating similar economic uncertainties: The experience underscores the need for proactive monitoring of geopolitical risks and continuous portfolio re-evaluation.

These lessons are applicable not only to sovereign wealth funds but also to individual investors and portfolio managers worldwide. Understanding macroeconomic factors and their impact is crucial for building resilient investment strategies.

Conclusion

This analysis of Nicolai Tangen's investment strategy during the Trump tariff era reveals his emphasis on adapting to volatile market conditions through diversification and robust risk management. His responses highlight the importance of flexibility and proactive risk assessment in navigating periods of significant global economic uncertainty. The long-term approach, despite short-term market fluctuations, remains a key takeaway.

Call to Action: Understanding the complexities of global trade and their impact on investment strategies is crucial for all investors. Learn more about how to analyze macroeconomic factors and adapt your investment strategy by researching further into Nicolai Tangen's investment strategy and the Trump Tariffs. Developing a resilient investment portfolio requires a deep understanding of geopolitical risks and the ability to adapt to evolving global conditions.

Featured Posts

-

Celebrity Style Inspiration Anna Kendricks Must Have Shell Top

May 05, 2025

Celebrity Style Inspiration Anna Kendricks Must Have Shell Top

May 05, 2025 -

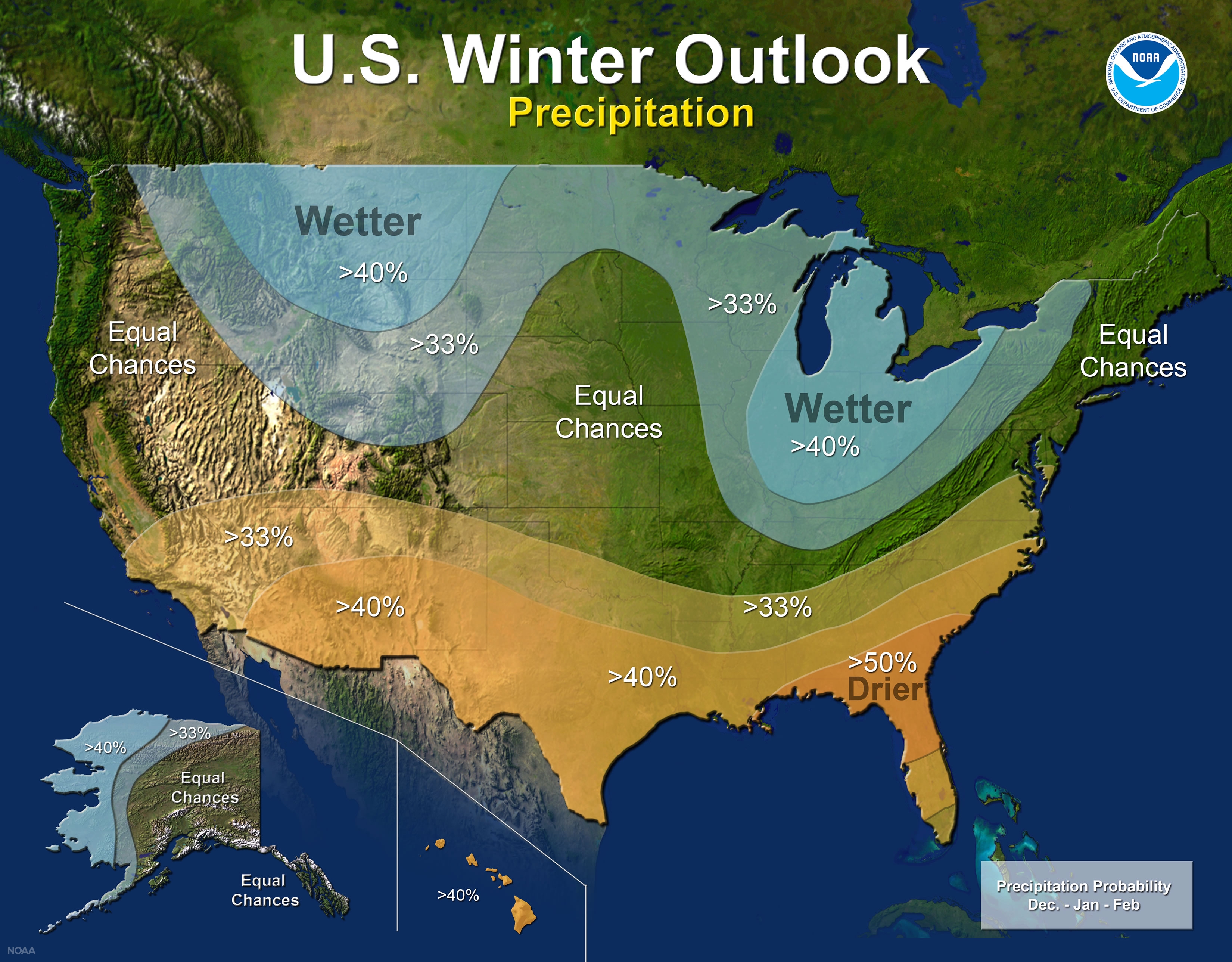

Kolkata To Sizzle March Temperature Forecast Exceeds 30 Degrees

May 05, 2025

Kolkata To Sizzle March Temperature Forecast Exceeds 30 Degrees

May 05, 2025 -

Morning Coffee Hockey Oilers Outlook Against The Canadiens

May 05, 2025

Morning Coffee Hockey Oilers Outlook Against The Canadiens

May 05, 2025 -

Churchill Downs Renovations Kentucky Derby Prep In Full Swing

May 05, 2025

Churchill Downs Renovations Kentucky Derby Prep In Full Swing

May 05, 2025 -

Lizzo In Real Life Tour Ticket Prices A Complete Guide

May 05, 2025

Lizzo In Real Life Tour Ticket Prices A Complete Guide

May 05, 2025

Latest Posts

-

Ufcs Poirier Retires Analysis Of Paddy Pimbletts Comments

May 05, 2025

Ufcs Poirier Retires Analysis Of Paddy Pimbletts Comments

May 05, 2025 -

Fox Appoints Peter Distad To Head Direct To Consumer Streaming

May 05, 2025

Fox Appoints Peter Distad To Head Direct To Consumer Streaming

May 05, 2025 -

Is Dustin Poiriers Retirement A Mistake Paddy Pimblett Weighs In

May 05, 2025

Is Dustin Poiriers Retirement A Mistake Paddy Pimblett Weighs In

May 05, 2025 -

The Paddy Pimblett Dustin Poirier Retirement Debate

May 05, 2025

The Paddy Pimblett Dustin Poirier Retirement Debate

May 05, 2025 -

Revised Fight Card Ufc 314 Pay Per View Event Updates

May 05, 2025

Revised Fight Card Ufc 314 Pay Per View Event Updates

May 05, 2025