Analyzing Nike's Q3: What It Means For Foot Locker's Immediate Future

Table of Contents

Nike's Q3 Performance: A Deep Dive

Nike's Q3 results offer a mixed bag, presenting both opportunities and challenges for its retail partners. A thorough examination of these results is vital for understanding their impact on Foot Locker.

Key Financial Highlights:

- Revenue: Nike reported a [Insert Actual Revenue Figure]% increase/decrease in revenue compared to Q3 of the previous year. This was driven primarily by [mention specific driver, e.g., strong performance in the basketball category, success of a new product line].

- Earnings Per Share (EPS): EPS stood at [Insert Actual EPS Figure], representing a [Insert Percentage Change]% increase/decrease compared to the same period last year. Factors contributing to this include [mention factors, e.g., increased marketing costs, changes in supply chain efficiency].

- Footwear Sales: This key segment showed a [Insert Percentage Change]% increase/decrease, reflecting [mention reason, e.g., strong demand for running shoes, weaker sales in basketball].

- Apparel Sales: Apparel sales experienced a [Insert Percentage Change]% increase/decrease, largely attributable to [mention reason, e.g., successful new apparel releases, changing fashion trends].

- Direct-to-Consumer (DTC) Revenue: DTC revenue, a crucial indicator of brand strength, saw a [Insert Percentage Change]% increase/decrease, indicating [mention reason, e.g., success of online sales strategies, impact of store closures].

Analysis: Nike's Q3 performance reveals [summarize overall performance - positive, negative, or mixed]. The success in [mention successful area] demonstrates strong consumer demand, while challenges in [mention area needing improvement] require further attention. These results will undoubtedly influence Foot Locker's bottom line.

Inventory Levels and Supply Chain:

- Inventory: Nike's inventory levels were [high/low/stable] compared to the previous quarter and to industry competitors.

- Supply Chain: Nike reported [mention any significant improvements or challenges in their supply chain]. This involved [mention specifics such as new logistics partnerships, improved manufacturing processes].

Analysis: Nike's inventory situation is [favorable/unfavorable] for Foot Locker. High inventory could lead to increased supply for Foot Locker, potentially lowering prices and affecting margins. Conversely, low inventory could limit the availability of popular Nike products, affecting sales.

Future Outlook and Guidance:

- Sales Growth Projection: Nike projected [Insert Projected Sales Growth]% sales growth for the coming quarters.

- Profitability: The company's forecast for profitability indicates [mention projected profit margins or other relevant metrics].

- Market Share: Nike anticipates maintaining/increasing its market share by [mention strategies].

Analysis: Nike's future outlook is [positive/negative/uncertain]. This projection impacts Foot Locker’s ability to predict future demand and manage its inventory effectively. A positive outlook suggests a more stable supply and potential for increased sales, whereas a negative outlook could necessitate adjustments in Foot Locker's strategy.

Foot Locker's Dependence on Nike

Foot Locker's significant reliance on Nike presents both opportunities and risks. Understanding this dependence is crucial for evaluating the impact of Nike's Q3 results.

Nike's Market Share in Foot Locker's Portfolio:

- Nike accounts for approximately [Insert Percentage]% of Foot Locker's total sales.

Analysis: This high dependence creates a significant vulnerability. Any negative fluctuation in Nike's performance directly affects Foot Locker's revenue and profitability.

Potential Impacts on Foot Locker's Sales and Profitability:

- Decreased Nike Supply: Reduced supply from Nike could lead to lost sales and decreased revenue for Foot Locker.

- Changes in Nike Pricing: Changes to Nike's wholesale pricing will directly impact Foot Locker's profit margins.

- Shift in Consumer Demand: If consumer demand shifts away from Nike products, Foot Locker will experience a direct impact.

Analysis: The potential range of impact on Foot Locker's financial performance is considerable, ranging from [mention potential range, e.g., a slight decrease to a significant decline] in revenue and profit.

Foot Locker's Diversification Strategies:

- Foot Locker is expanding its product offerings to include brands such as [list examples, e.g., Adidas, Puma, New Balance].

- They are also investing in their own private label brands and expanding their DTC capabilities.

Analysis: These diversification efforts are crucial for mitigating the risk associated with relying heavily on a single supplier. The success of these strategies will be critical for Foot Locker's long-term stability.

Competitive Landscape and Market Trends

The broader competitive landscape and overarching market trends also play significant roles in influencing both Nike and Foot Locker's performance.

Impact of Competitor Performance:

- Adidas and Under Armour, key competitors, have recently reported [mention their recent performance].

Analysis: The performance of these competitors could impact consumer preferences and Foot Locker's ability to attract and retain customers.

Overall Consumer Spending Trends:

- Current economic indicators suggest [mention current economic climate, e.g., inflation, recessionary fears].

- Consumer confidence in the athletic apparel market is [high/low/moderate].

Analysis: Broader economic trends and shifts in consumer spending patterns can significantly affect both Nike's and Foot Locker's performance. Economic downturns usually result in reduced discretionary spending, directly impacting sales in the athletic footwear sector.

Conclusion: Analyzing Nike's Q3 and Its Implications for Foot Locker's Future

Nike's Q3 performance offers a mixed outlook for Foot Locker's immediate future. While Nike's successes in certain product categories present opportunities, challenges in other areas, coupled with Foot Locker's significant dependence on Nike, introduce considerable risk. Foot Locker's diversification strategies are crucial for mitigating this risk. Monitoring consumer spending trends and the competitive landscape is equally important. Key takeaways include the critical need for Foot Locker to effectively manage its inventory and diversify its product offerings to ensure long-term stability. Stay informed on future quarterly reports to continue analyzing Nike's Q3 and its impact on Foot Locker's immediate future, and to make informed investment decisions.

Featured Posts

-

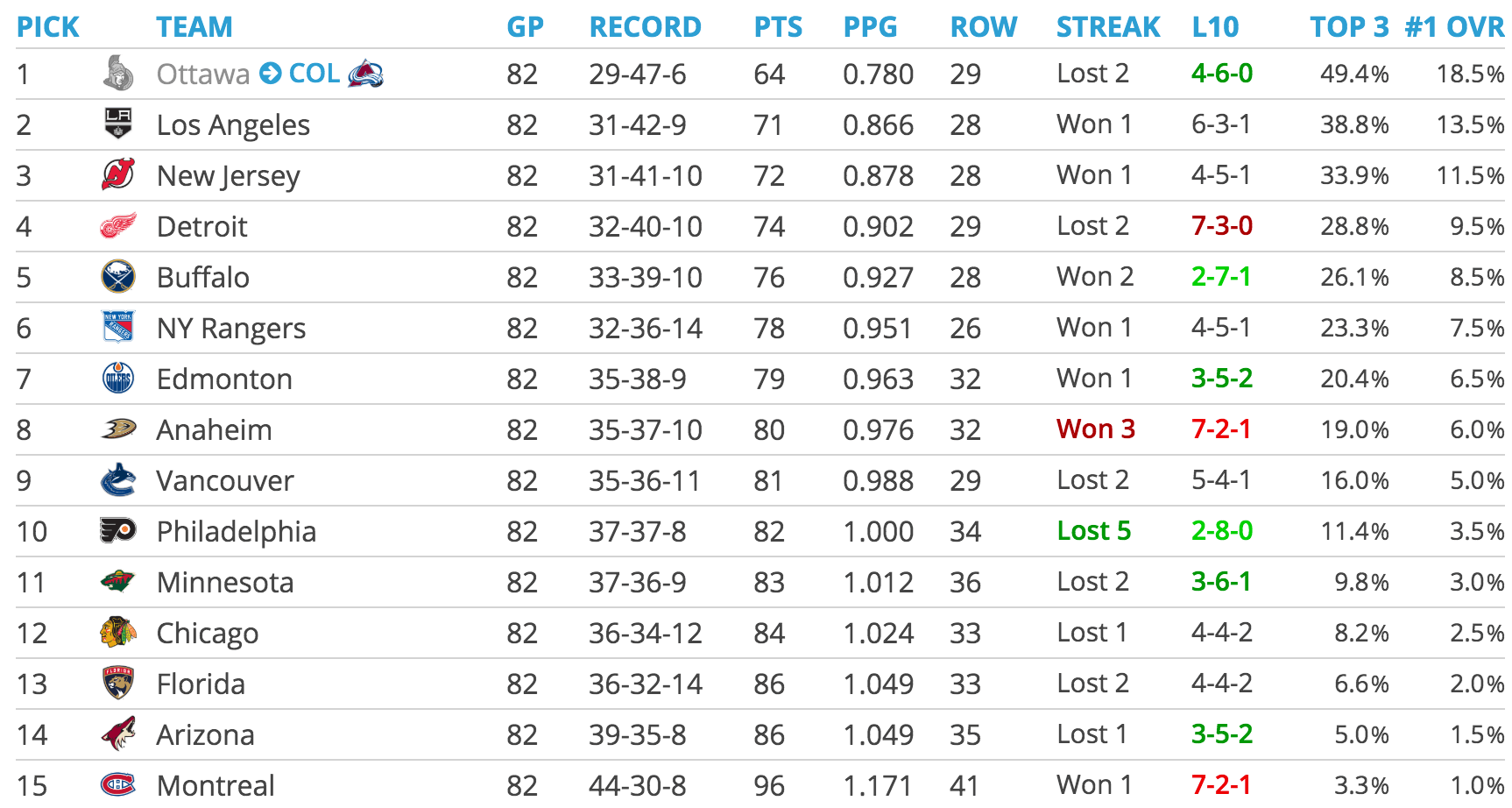

The Nhl Draft Lottery A Breakdown Of The Rules And The Fan Backlash

May 15, 2025

The Nhl Draft Lottery A Breakdown Of The Rules And The Fan Backlash

May 15, 2025 -

V Mware Costs To Skyrocket At And T Details A 1 050 Price Increase From Broadcom

May 15, 2025

V Mware Costs To Skyrocket At And T Details A 1 050 Price Increase From Broadcom

May 15, 2025 -

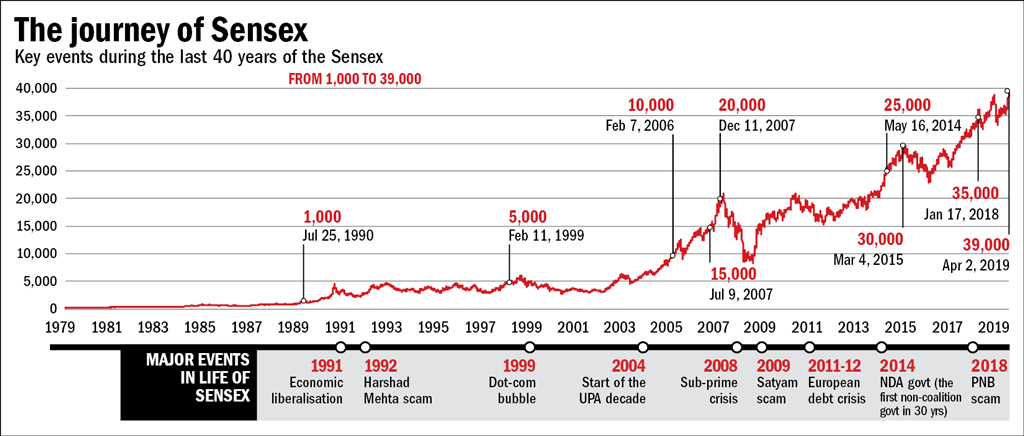

Sensex Soars Top Bse Stocks That Gained Over 10

May 15, 2025

Sensex Soars Top Bse Stocks That Gained Over 10

May 15, 2025 -

Giant Sea Wall Dukungan Dpr Untuk Visi Presiden Prabowo

May 15, 2025

Giant Sea Wall Dukungan Dpr Untuk Visi Presiden Prabowo

May 15, 2025 -

Napoles Vs Venezia Transmision En Vivo Online

May 15, 2025

Napoles Vs Venezia Transmision En Vivo Online

May 15, 2025