Analyzing Nvidia's Exposure: Geopolitical Challenges And Future Outlook

Table of Contents

US-China Relations and Their Impact on Nvidia's Operations

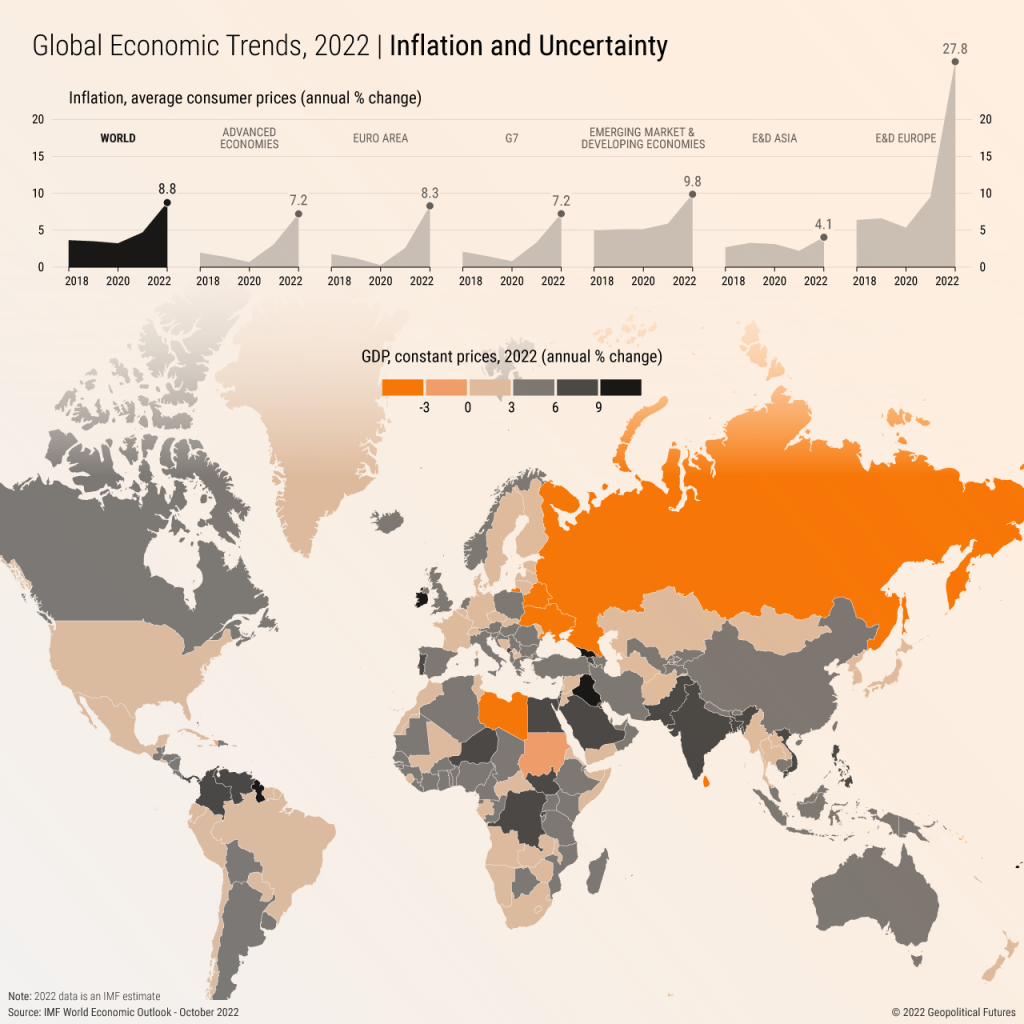

The escalating tensions between the US and China significantly impact Nvidia's operations. China represents a substantial revenue source for Nvidia, particularly for its high-performance GPUs used in data centers and AI applications. Keywords: US-China trade war, technology sanctions, export controls, China market, Nvidia sales, chip manufacturing.

- Impact on the Chinese Market: The ongoing US-China trade war and technology sanctions have created uncertainty in the Chinese market. Restrictions on the export of advanced GPUs to certain Chinese entities directly affect Nvidia's sales and revenue streams. This necessitates careful navigation of complex regulatory landscapes.

- Export Controls and Sanctions: US export controls and sanctions targeting specific Chinese companies and research institutions limit Nvidia's ability to supply its most advanced GPUs, impacting revenue and potentially hindering its market share growth in China. The evolving nature of these restrictions presents ongoing challenges.

- Supply Chain Diversification: To mitigate these risks, Nvidia is actively diversifying its manufacturing and supply chains. This includes exploring manufacturing options beyond Taiwan, seeking alternative suppliers, and investing in regions less susceptible to geopolitical tensions. This diversification is crucial for long-term resilience.

- Long-Term Impact on Revenue and Profitability: The combined effect of trade tensions, export controls, and supply chain disruptions presents a considerable challenge to Nvidia's long-term revenue and profitability. Successful mitigation strategies are vital for maintaining financial stability.

Global Supply Chain Disruptions and Their Effects on Nvidia

Nvidia's reliance on a global supply chain makes it vulnerable to geopolitical instability and unforeseen events. Keywords: supply chain resilience, semiconductor shortage, global logistics, manufacturing capacity, Taiwan, geopolitical instability.

- Geopolitical Instability and Natural Disasters: The concentration of semiconductor manufacturing in specific regions, such as Taiwan, exposes Nvidia to the risks of geopolitical instability and natural disasters. Any disruption in these regions can severely impact production and delivery timelines.

- Semiconductor Shortages: The ongoing semiconductor shortage underscores the fragility of the global supply chain. Nvidia, like other semiconductor companies, faces challenges in securing sufficient components to meet market demand, potentially impacting growth and profitability.

- Supply Chain Resilience Strategies: Nvidia is investing heavily in strategies to enhance supply chain resilience. This includes diversifying suppliers, expanding manufacturing capacity in multiple regions, and improving logistics and inventory management. Proactive measures are critical for mitigating future disruptions.

- Costs and Benefits of Diversification: While diversifying the supply chain reduces reliance on specific regions, it increases costs and complexity. Nvidia must carefully balance these factors to ensure long-term sustainability.

The Role of AI and the Future of Nvidia's Market Position

The burgeoning artificial intelligence (AI) market presents a significant growth opportunity for Nvidia. Keywords: Artificial intelligence, AI chip market, Nvidia data centers, machine learning, deep learning, competitive landscape, technological innovation.

- Growing Demand for GPUs in AI: Nvidia's GPUs are essential for training and deploying AI models, fueling demand in data centers, cloud computing, and autonomous vehicles. This rapidly growing market is a key driver of Nvidia's future growth.

- Competitive Position in the AI Chip Market: While Nvidia holds a dominant position in the AI chip market, competition is intensifying. The company must continually innovate and adapt to maintain its leadership position. Technological advancements are crucial for staying ahead.

- Technological Innovation: Nvidia's continued investment in research and development is vital for maintaining its competitive edge. Innovations in GPU architecture, software platforms, and AI algorithms are crucial for staying ahead of competitors.

- Long-Term Implications of AI Advancements: The continued expansion of the AI market and Nvidia's ability to capitalize on its opportunities will significantly impact the company's long-term growth trajectory. Innovation is key to continued market dominance.

Investment Implications and Strategic Considerations

Nvidia's exposure to geopolitical challenges presents both risks and opportunities for investors. Keywords: Nvidia stock, investment risk, long-term growth, market analysis, financial performance, portfolio diversification.

- Risks and Opportunities for Investors: Investing in Nvidia involves navigating geopolitical uncertainties. While the long-term growth potential is significant, investors must consider the impact of trade tensions, supply chain disruptions, and competition.

- Impact on Nvidia's Financial Performance: Geopolitical factors can significantly affect Nvidia's financial performance. Investors must carefully analyze these risks when making investment decisions. Thorough due diligence is crucial.

- Recommendations for Investors: Investors should diversify their portfolios, carefully assess Nvidia's risk profile, and monitor geopolitical developments closely. A long-term perspective is essential for successful investing.

- Impact on Investment Strategies: Geopolitical uncertainty necessitates a flexible investment strategy capable of adapting to changing conditions. Understanding and accounting for these variables is crucial for informed decisions.

Conclusion

Analyzing Nvidia's exposure to geopolitical challenges reveals a complex interplay of risks and opportunities. US-China relations and global supply chain vulnerabilities pose substantial threats, but the explosive growth of the AI market offers considerable potential. Nvidia's strategic response to these challenges, particularly its focus on supply chain diversification and technological innovation, will be pivotal in determining its future success. Understanding Nvidia's geopolitical exposure is crucial for investors and industry analysts. Continue to monitor these evolving factors and consider their impact on your investment strategies and future outlook on Nvidia and the broader semiconductor industry. Thorough analysis of Nvidia’s geopolitical exposure is essential for informed decision-making.

Featured Posts

-

Soi Noi Tran Mo Man Chung Ket Bong Da Sinh Vien

Apr 30, 2025

Soi Noi Tran Mo Man Chung Ket Bong Da Sinh Vien

Apr 30, 2025 -

Disneys Alaskan Adventure Double The Ships Double The Fun In 2026

Apr 30, 2025

Disneys Alaskan Adventure Double The Ships Double The Fun In 2026

Apr 30, 2025 -

Beyonces Grammy Win Blue Ivys Reaction Sets The Internet Ablaze

Apr 30, 2025

Beyonces Grammy Win Blue Ivys Reaction Sets The Internet Ablaze

Apr 30, 2025 -

Vozmozhnaya Vstrecha Trampa I Zelenskogo V Rime

Apr 30, 2025

Vozmozhnaya Vstrecha Trampa I Zelenskogo V Rime

Apr 30, 2025 -

Rqm Qyasy Jdyd Lwjbt Alraklyt Fy Mdynt Martyny Alswysryt

Apr 30, 2025

Rqm Qyasy Jdyd Lwjbt Alraklyt Fy Mdynt Martyny Alswysryt

Apr 30, 2025

Latest Posts

-

Kogda Ovechkin Pobet Rekord Grettski Prognoz N Kh L

Apr 30, 2025

Kogda Ovechkin Pobet Rekord Grettski Prognoz N Kh L

Apr 30, 2025 -

Rekord Grettski N Kh L Obnovila Prognoz Dlya Ovechkina

Apr 30, 2025

Rekord Grettski N Kh L Obnovila Prognoz Dlya Ovechkina

Apr 30, 2025 -

Obnovlenniy Prognoz N Kh L Kogda Ovechkin Prevzoydet Grettski

Apr 30, 2025

Obnovlenniy Prognoz N Kh L Kogda Ovechkin Prevzoydet Grettski

Apr 30, 2025 -

Tkachuk And Panthers Overpower Senators

Apr 30, 2025

Tkachuk And Panthers Overpower Senators

Apr 30, 2025 -

Ovechkin I Ego Rekord Reaktsiya Zakharovoy

Apr 30, 2025

Ovechkin I Ego Rekord Reaktsiya Zakharovoy

Apr 30, 2025